Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that Newcrest Mining Limited (ASX:NCM) does use debt in its business. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Newcrest Mining

What Is Newcrest Mining's Debt?

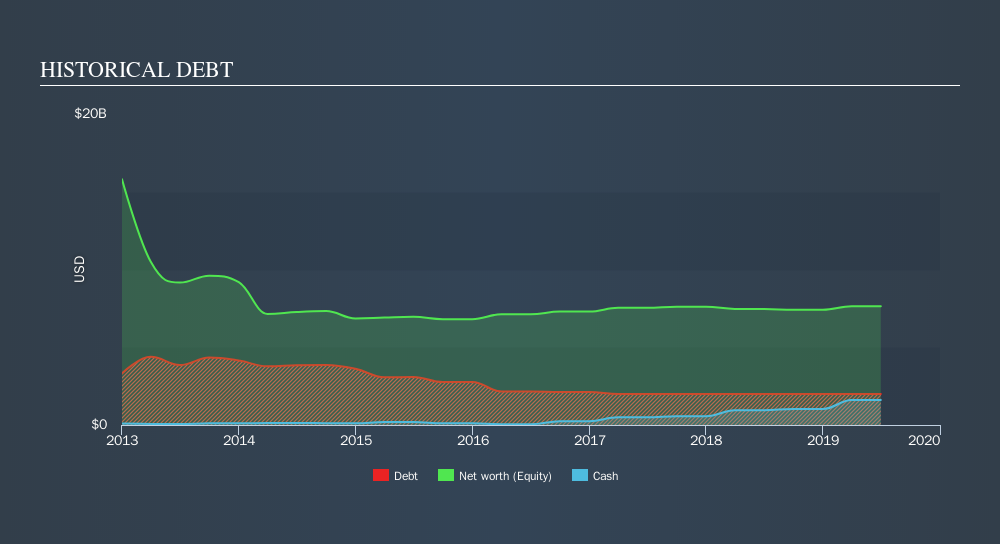

The chart below, which you can click on for greater detail, shows that Newcrest Mining had US$2.00b in debt in June 2019; about the same as the year before. However, it does have US$1.60b in cash offsetting this, leading to net debt of about US$395.0m.

A Look At Newcrest Mining's Liabilities

We can see from the most recent balance sheet that Newcrest Mining had liabilities of US$812.0m falling due within a year, and liabilities of US$3.39b due beyond that. Offsetting these obligations, it had cash of US$1.60b as well as receivables valued at US$167.0m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$2.44b.

Of course, Newcrest Mining has a titanic market capitalization of US$18.4b, so these liabilities are probably manageable. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Newcrest Mining's net debt is only 0.23 times its EBITDA. And its EBIT easily covers its interest expense, being 13.3 times the size. So we're pretty relaxed about its super-conservative use of debt. Even more impressive was the fact that Newcrest Mining grew its EBIT by 108% over twelve months. If maintained that growth will make the debt even more manageable in the years ahead. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Newcrest Mining's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we always check how much of that EBIT is translated into free cash flow. Over the last three years, Newcrest Mining actually produced more free cash flow than EBIT. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Our View

The good news is that Newcrest Mining's demonstrated ability to cover its interest expense with its EBIT delights us like a fluffy puppy does a toddler. And the good news does not stop there, as its conversion of EBIT to free cash flow also supports that impression! It looks Newcrest Mining has no trouble standing on its own two feet, and it has no reason to fear its lenders. To our minds it has a healthy happy balance sheet. We'd be very excited to see if Newcrest Mining insiders have been snapping up shares. If you are too, then click on this link right now to take a (free) peek at our list of reported insider transactions.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ASX:NCM

Newcrest Mining

Newcrest Mining Limited, together with its subsidiaries, engages in the exploration, mine development, mine operation, and sale of gold and gold/copper concentrates.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives