- Australia

- /

- Metals and Mining

- /

- ASX:MTM

Metallium (ASX:MTM) Moves to Advance Rare Earth Supply Independence With Ucore Collaboration

Reviewed by Simply Wall St

- On September 16, 2025, Metallium Ltd. announced a binding Technology Collaboration Agreement with Ucore Rare Metals Inc. to integrate their Flash Joule Heating upgrade platform with Ucore's RapidSX™ rare earth separation technology, advancing a collaborative feedstock-to-oxide refining process in North America.

- This partnership directly targets critical gaps in U.S. rare earth supply chains and leverages federal support aimed at achieving independent, scalable refining capabilities separate from China's dominant market position.

- We'll examine how this Ucore collaboration positions Metallium at the forefront of U.S. efforts to secure rare earth independence.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Metallium's Investment Narrative?

Owning Metallium shares is largely about belief in the company’s ability to unlock value from the U.S. rare earth supply chain at a time when independence from Chinese-dominated processing is a major federal priority. The latest binding agreement with Ucore aims to make Metallium’s technology part of a government-backed, scalable domestic refining pathway, potentially shifting the narrative from early-stage innovation to near-term commercial relevance. In the context of Metallium’s ongoing losses, dilution, and volatile share price, this announcement could accelerate progress toward real revenues if the collaboration yields measurable results, making it a more meaningful potential short-term catalyst than previous research or facility updates. Still, execution risk remains high, as the company’s financial position is unchanged and it is not yet generating revenue. Add to this a relatively inexperienced board and past insider selling, and it’s important not to lose sight of the fact that many hurdles remain. On the other hand, Metallium’s thin revenues and ongoing dilution are obstacles investors should be aware of.

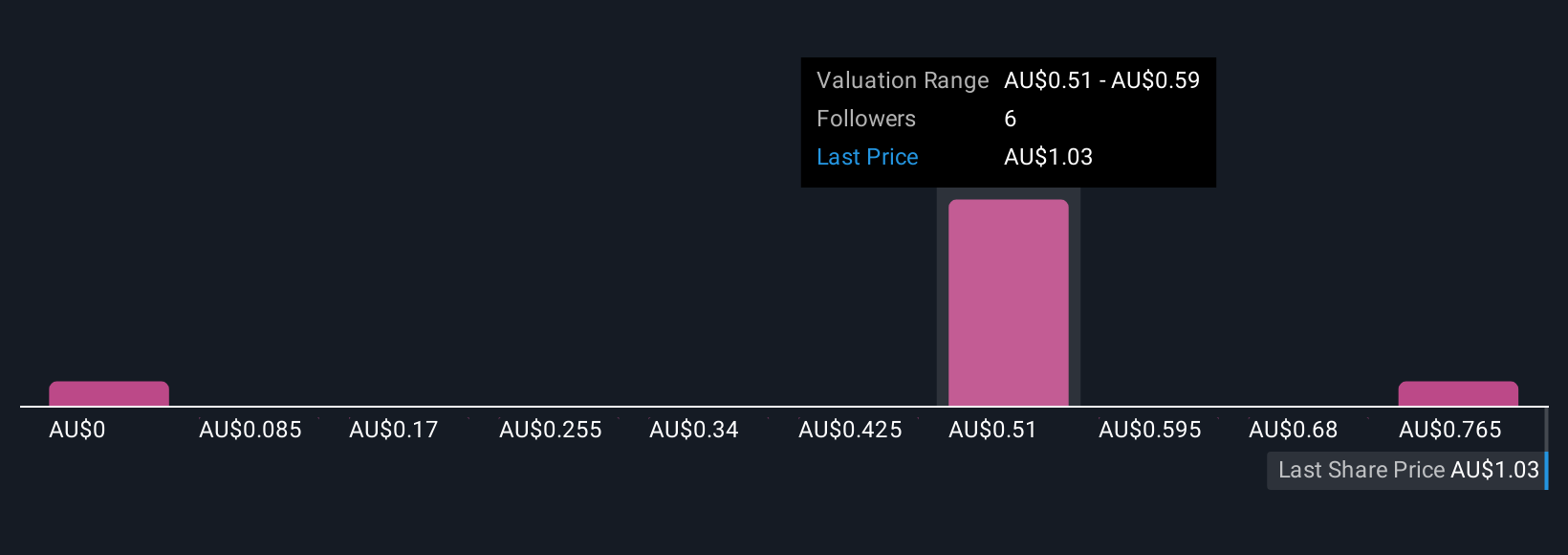

The valuation report we've compiled suggests that Metallium's current price could be inflated.Exploring Other Perspectives

Explore 3 other fair value estimates on Metallium - why the stock might be worth as much as A$0.85!

Build Your Own Metallium Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Metallium research is our analysis highlighting 5 important warning signs that could impact your investment decision.

- Our free Metallium research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Metallium's overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MTM

Metallium

Through its subsidiaries, explores for mineral tenements in Western Australia.

Excellent balance sheet with moderate risk.

Market Insights

Community Narratives