- Australia

- /

- Metals and Mining

- /

- ASX:MRC

A Quick Analysis On Mineral Commodities' (ASX:MRC) CEO Compensation

Mark Caruso became the CEO of Mineral Commodities Ltd (ASX:MRC) in 2014, and we think it's a good time to look at the executive's compensation against the backdrop of overall company performance. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for Mineral Commodities.

See our latest analysis for Mineral Commodities

How Does Total Compensation For Mark Caruso Compare With Other Companies In The Industry?

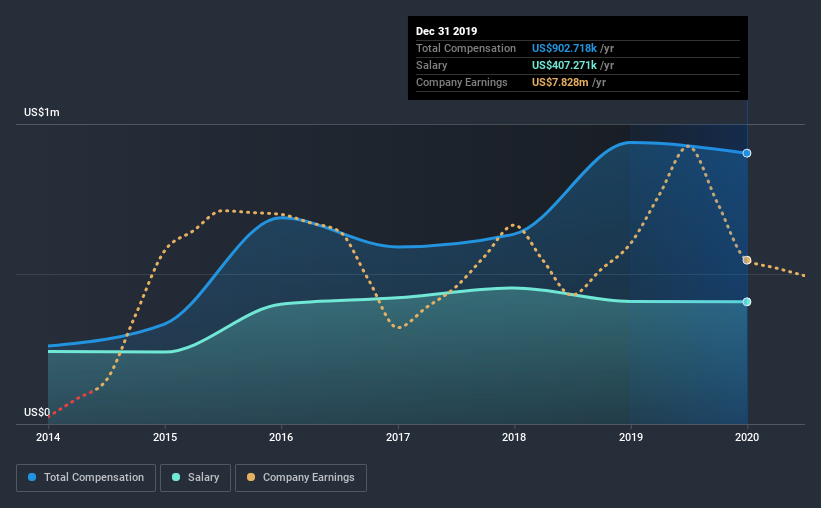

At the time of writing, our data shows that Mineral Commodities Ltd has a market capitalization of AU$160m, and reported total annual CEO compensation of AU$903k for the year to December 2019. We note that's a small decrease of 3.8% on last year. While we always look at total compensation first, our analysis shows that the salary component is less, at AU$407k.

For comparison, other companies in the industry with market capitalizations below AU$274m, reported a median total CEO compensation of AU$312k. This suggests that Mark Caruso is paid more than the median for the industry. Furthermore, Mark Caruso directly owns AU$735k worth of shares in the company.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | AU$407k | AU$409k | 45% |

| Other | AU$495k | AU$529k | 55% |

| Total Compensation | AU$903k | AU$938k | 100% |

On an industry level, roughly 70% of total compensation represents salary and 30% is other remuneration. It's interesting to note that Mineral Commodities allocates a smaller portion of compensation to salary in comparison to the broader industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

A Look at Mineral Commodities Ltd's Growth Numbers

Mineral Commodities Ltd has seen its earnings per share (EPS) increase by 2.1% a year over the past three years. In the last year, its revenue is down 15%.

We would prefer it if there was revenue growth, but it is good to see a modest EPS growth at least. These two metrics are moving in different directions, so while it's hard to be confident judging performance, we think the stock is worth watching. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Mineral Commodities Ltd Been A Good Investment?

Boasting a total shareholder return of 219% over three years, Mineral Commodities Ltd has done well by shareholders. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

To Conclude...

As we noted earlier, Mineral Commodities pays its CEO higher than the norm for similar-sized companies belonging to the same industry. Importantly though, shareholder returns for the last three years have been excellent. On the other hand, EPS growth — over the same period — is not as impressive. So, although we would've liked to see stronger EPS growth, positive investor returns lead us to believe CEO compensation is reasonable.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. We identified 5 warning signs for Mineral Commodities (2 are significant!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you’re looking to trade Mineral Commodities, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ASX:MRC

Mineral Commodities

Operates as a mining and development company with a primary focus on the development of mineral deposits within the industrial and battery minerals sectors.

Moderate with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026