- Australia

- /

- Metals and Mining

- /

- ASX:MIN

3 Stocks That May Be Trading Below Intrinsic Value By Up To 48.2%

Reviewed by Simply Wall St

With global markets reaching new highs following the Federal Reserve's recent rate cut, investors are eagerly seeking opportunities that may be trading below their intrinsic value. In this favorable market environment, identifying undervalued stocks can be particularly rewarding, as these investments have the potential to offer significant upside when their true worth is recognized.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Chengdu Guibao Science & TechnologyLtd (SZSE:300019) | CN¥12.42 | CN¥24.69 | 49.7% |

| VIOL (KOSDAQ:A335890) | ₩8880.00 | ₩17731.76 | 49.9% |

| Gerresheimer (XTRA:GXI) | €96.90 | €193.02 | 49.8% |

| Defence Tech Holding (BIT:DTH) | €3.52 | €7.01 | 49.8% |

| Exel Composites Oyj (HLSE:EXL1V) | €0.392 | €0.78 | 49.9% |

| Digital China Holdings (SEHK:861) | HK$2.95 | HK$5.88 | 49.9% |

| Ai-Media Technologies (ASX:AIM) | A$0.71 | A$1.42 | 49.9% |

| Akeso (SEHK:9926) | HK$67.40 | HK$134.17 | 49.8% |

| Ningbo Jifeng Auto Parts (SHSE:603997) | CN¥12.75 | CN¥25.33 | 49.7% |

| Sinch (OM:SINCH) | SEK32.26 | SEK64.22 | 49.8% |

We'll examine a selection from our screener results.

Mineral Resources (ASX:MIN)

Overview: Mineral Resources Limited, with a market cap of A$8.41 billion, operates as a mining services company in Australia, Asia, and internationally through its subsidiaries.

Operations: Revenue segments for Mineral Resources Limited include A$16 million from Energy, A$1.41 billion from Lithium, A$2.58 billion from Iron Ore, A$3.38 billion from Mining Services, and A$19 million from Other Commodities.

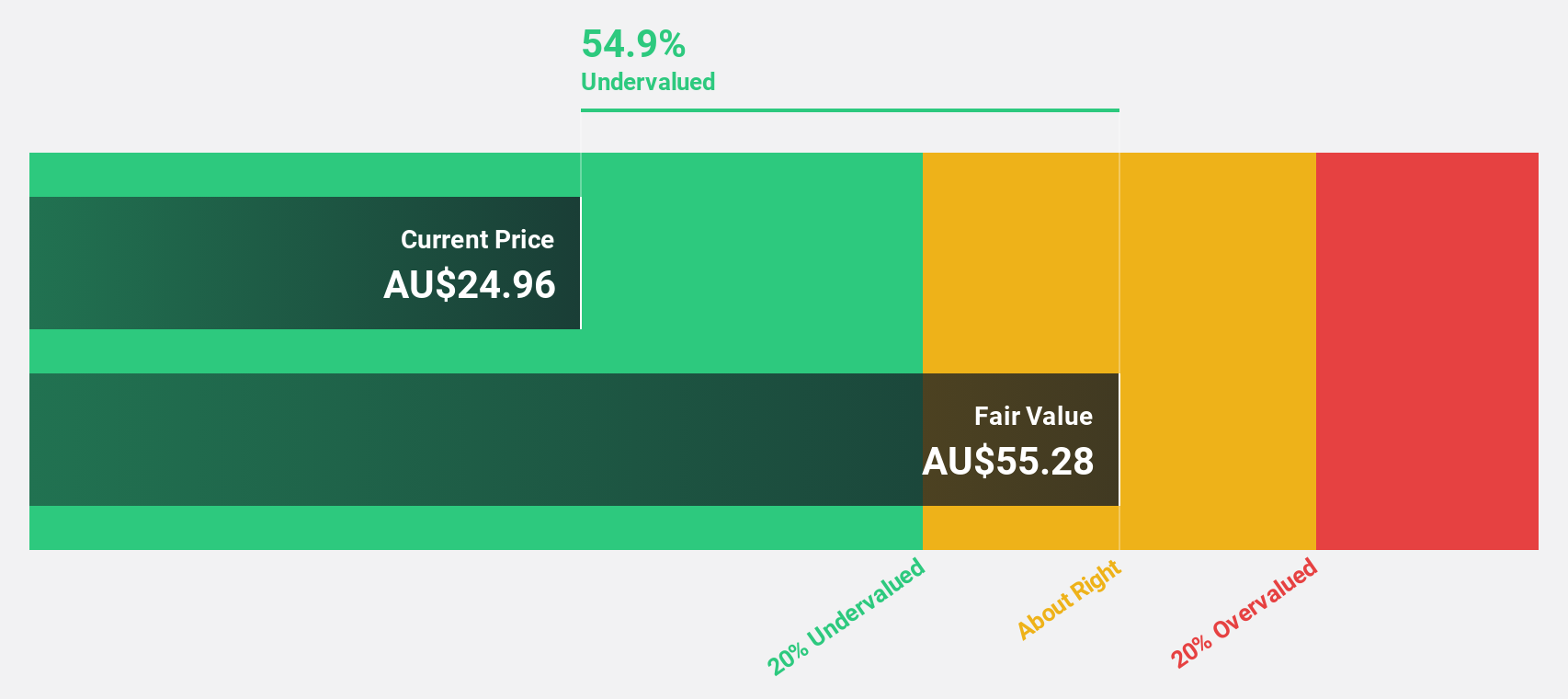

Estimated Discount To Fair Value: 46.6%

Mineral Resources (A$49.14) is trading significantly below its estimated fair value of A$91.97, presenting an undervaluation based on discounted cash flows. Despite a forecasted annual earnings growth of 38.3%, profit margins have declined from 5.1% to 2.4%. Recent earnings results show net income dropped to A$125 million from A$243 million the previous year, indicating potential financial challenges despite strong revenue growth and high future earnings expectations.

- Our growth report here indicates Mineral Resources may be poised for an improving outlook.

- Navigate through the intricacies of Mineral Resources with our comprehensive financial health report here.

BeiGene (NasdaqGS:BGNE)

Overview: BeiGene, Ltd. is an oncology company focused on discovering and developing cancer treatments globally, with a market cap of $21.98 billion.

Operations: Revenue from pharmaceutical products for BeiGene, Ltd. amounted to $3.10 billion.

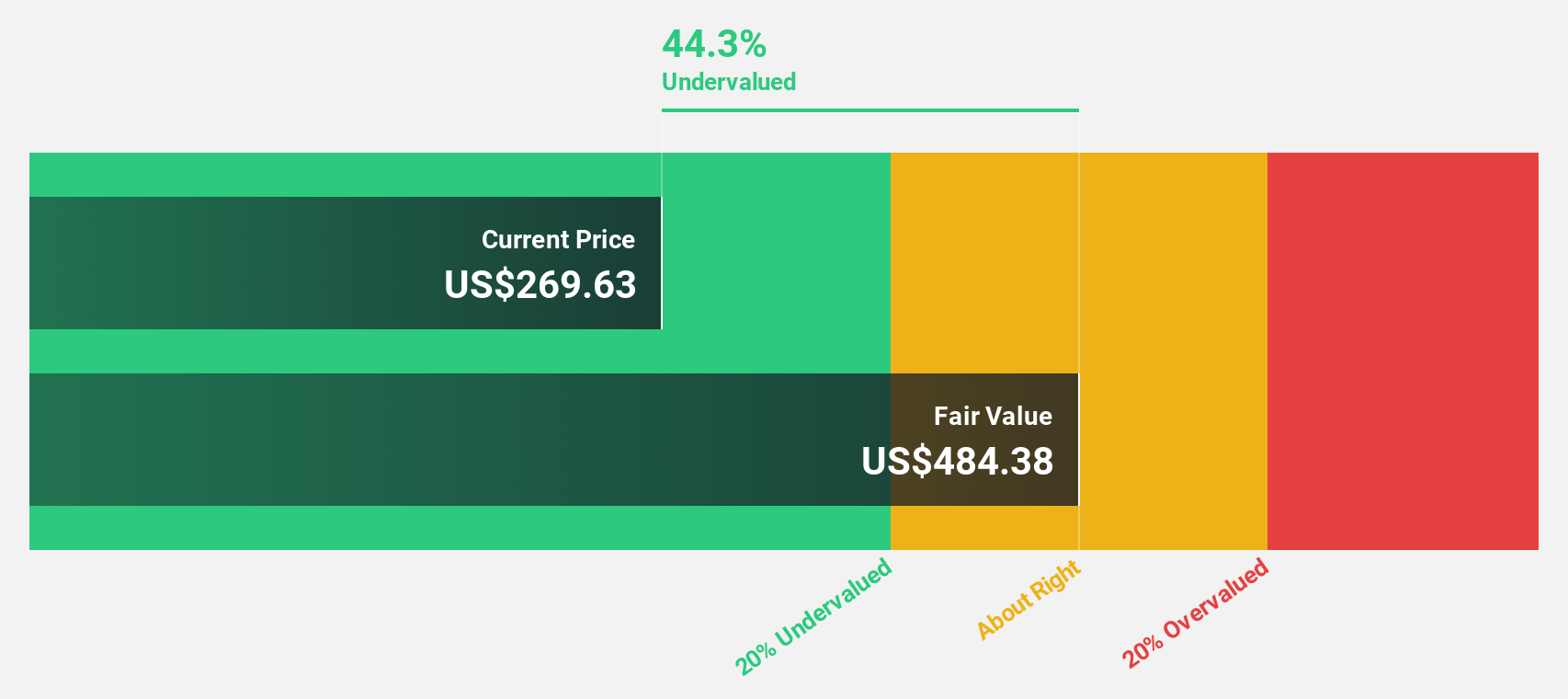

Estimated Discount To Fair Value: 20.5%

BeiGene (US$212.53) is trading well below its estimated fair value of US$267.28, indicating significant undervaluation based on discounted cash flows. Despite a net loss reduction to US$120.41 million from US$381.14 million year-over-year, revenue surged to US$929.17 million from US$595.26 million in the same period, reflecting robust financial performance and potential for profitability within three years due to high expected earnings growth of 64.15% annually.

- The analysis detailed in our BeiGene growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of BeiGene stock in this financial health report.

Kanzhun (NasdaqGS:BZ)

Overview: Kanzhun Limited, with a market cap of $7.06 billion, provides online recruitment services in the People’s Republic of China through its subsidiaries.

Operations: Kanzhun Limited generates CN¥6.81 billion from its Internet Information Providers segment in the People’s Republic of China.

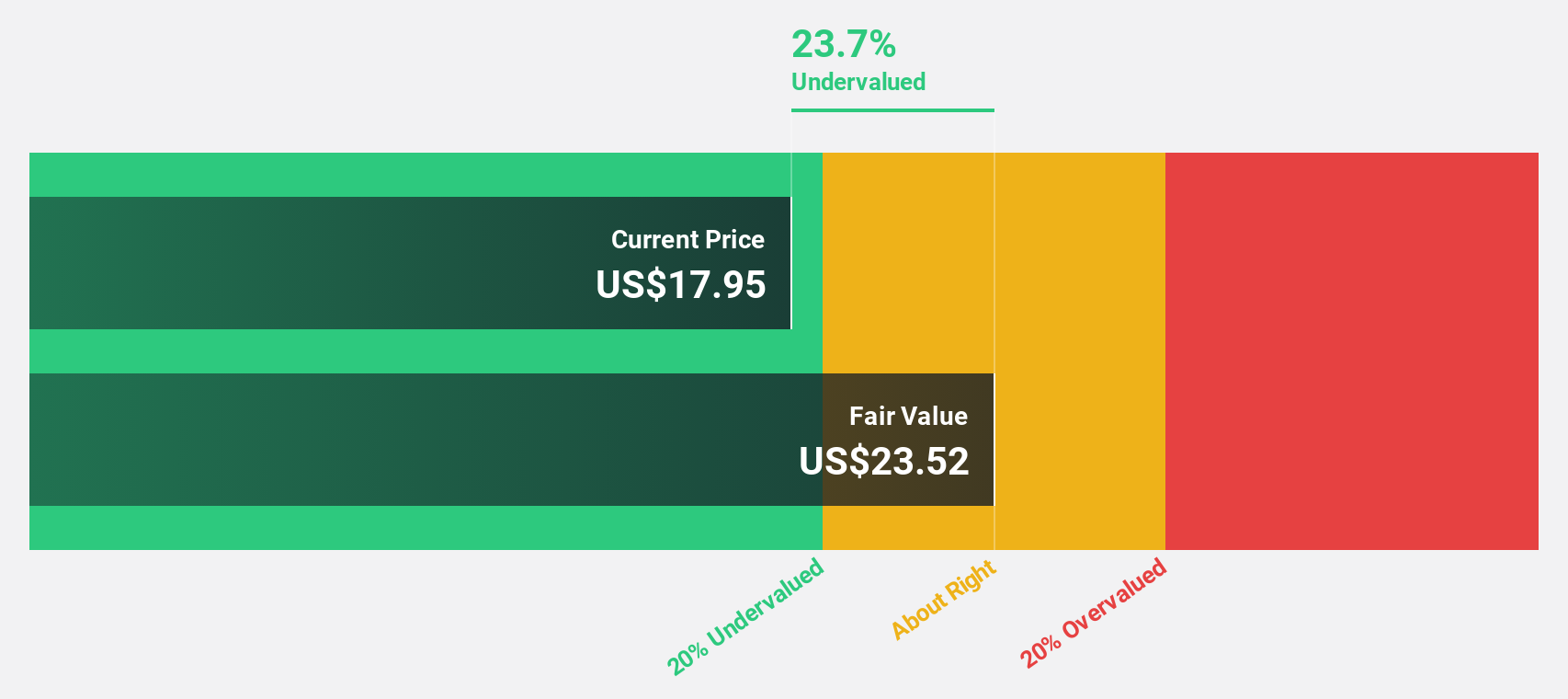

Estimated Discount To Fair Value: 48.2%

Kanzhun (US$16.12) is trading at 48.2% below its estimated fair value of US$31.12, highlighting significant undervaluation based on discounted cash flows. Recent earnings show robust growth, with net income rising to CNY 666.68 million from CNY 342.26 million year-over-year and revenue increasing to CNY 3,620.5 million from CNY 2,765.16 million in the same period. Earnings are projected to grow at an annual rate of 21%, outpacing the US market forecast of 15%.

- According our earnings growth report, there's an indication that Kanzhun might be ready to expand.

- Dive into the specifics of Kanzhun here with our thorough financial health report.

Make It Happen

- Click this link to deep-dive into the 953 companies within our Undervalued Stocks Based On Cash Flows screener.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MIN

Mineral Resources

Together with subsidiaries, operates as a mining services company in Australia, Asia, and internationally.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives