- Australia

- /

- Specialty Stores

- /

- ASX:TPW

3 ASX Growth Companies With Insider Ownership Up To 13%

Reviewed by Simply Wall St

The ASX200 has been flat at 8,141 points, with sectors showing mixed performance amid ongoing monetary policy discussions in the US. In this environment of uncertainty, growth companies with high insider ownership can offer a degree of confidence to investors, as significant insider stakes often signal strong belief in the company's future prospects.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 27.4% |

| Catalyst Metals (ASX:CYL) | 17% | 54.5% |

| Genmin (ASX:GEN) | 12% | 117.7% |

| Hillgrove Resources (ASX:HGO) | 10.4% | 70.9% |

| AVA Risk Group (ASX:AVA) | 15.7% | 118.8% |

| Pointerra (ASX:3DP) | 18.7% | 126.4% |

| Liontown Resources (ASX:LTR) | 16.4% | 69.4% |

| Acrux (ASX:ACR) | 17.4% | 91.6% |

| Adveritas (ASX:AV1) | 21.1% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

We'll examine a selection from our screener results.

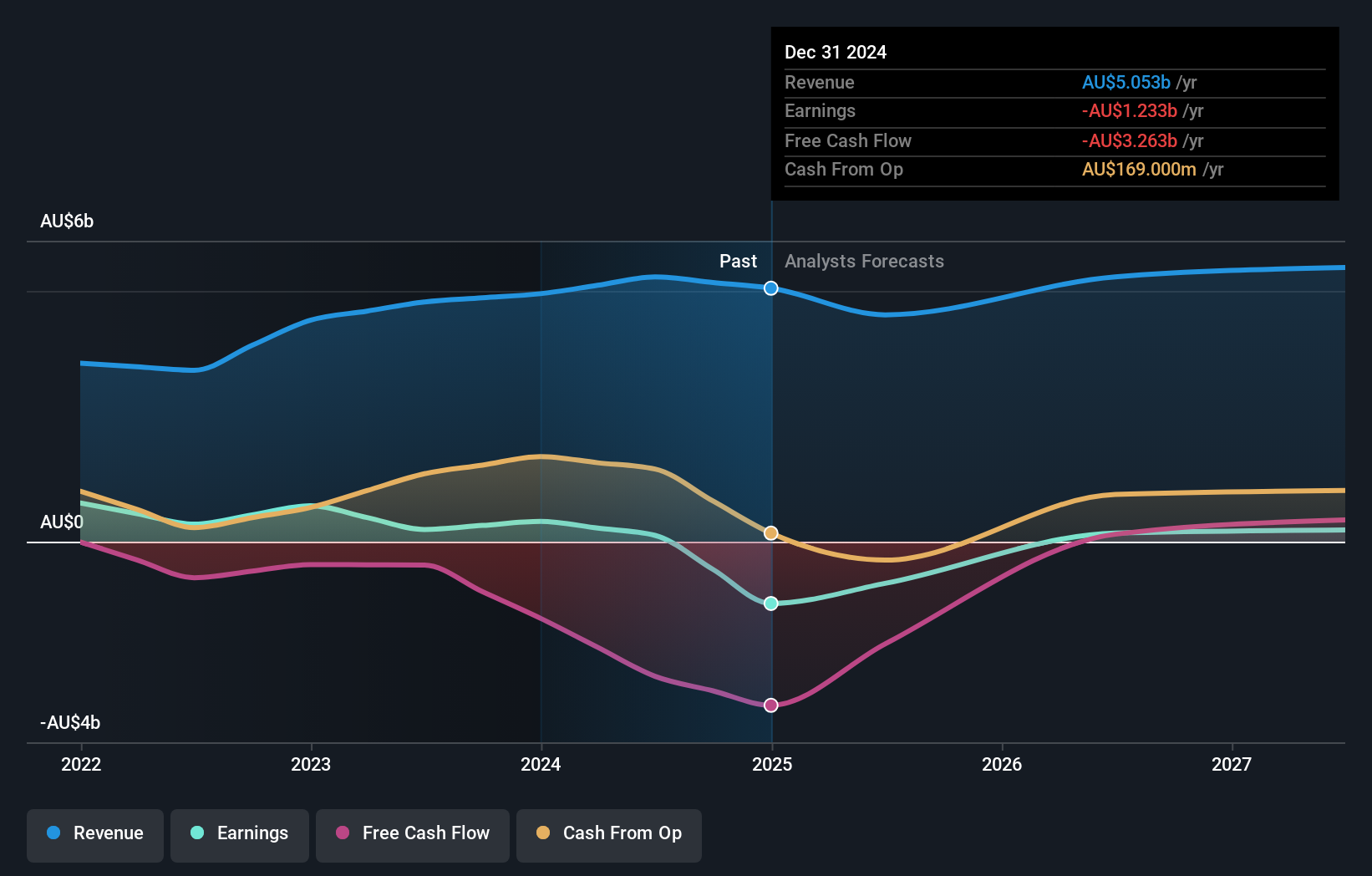

Mineral Resources (ASX:MIN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Mineral Resources Limited, with a market cap of A$7.38 billion, operates as a mining services company in Australia, Asia, and internationally through its subsidiaries.

Operations: Revenue segments for the company include Energy (A$16 million), Lithium (A$1.41 billion), Iron Ore (A$2.58 billion), Mining Services (A$3.38 billion), and Other Commodities (A$19 million).

Insider Ownership: 11.7%

Mineral Resources Limited, a growth company with high insider ownership in Australia, reported A$5.28 billion in sales for the year ended June 30, 2024, up from A$4.78 billion the previous year. However, net income fell to A$125 million from A$243 million. Despite lower profit margins and earnings per share compared to last year, its earnings are forecasted to grow significantly at 38.65% annually over the next three years. Insiders have been buying shares recently without substantial selling activity.

- Dive into the specifics of Mineral Resources here with our thorough growth forecast report.

- The analysis detailed in our Mineral Resources valuation report hints at an inflated share price compared to its estimated value.

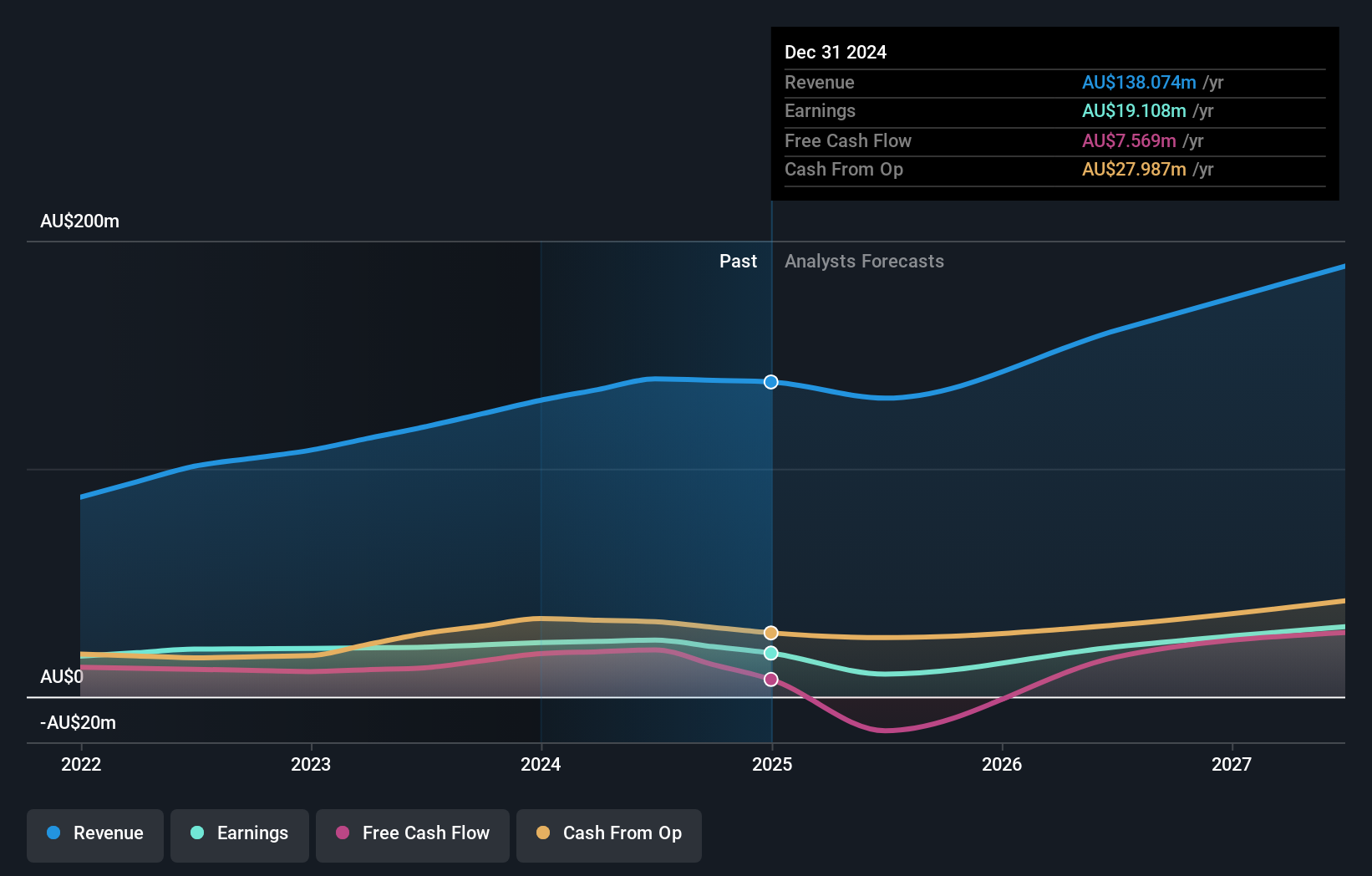

PWR Holdings (ASX:PWH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PWR Holdings Limited designs, prototypes, produces, tests, validates, and sells cooling products and solutions globally with a market cap of A$899.33 million.

Operations: PWR Holdings generates revenue from two main segments: PWR C&R (A$41.98 million) and PWR Performance Products (A$111.26 million).

Insider Ownership: 13.2%

PWR Holdings reported full-year 2024 sales of A$97.53 million, up from A$80.87 million in 2023, with net income rising to A$20.99 million from A$17.4 million. Earnings per share increased to A$0.2469 from A$0.2167 last year. The company is trading below its estimated fair value and forecasts suggest earnings will grow at 15% annually, outpacing the Australian market's growth rate of 12.3%. Recent board changes include Jeff Forbes' retirement and Jason Conroy's appointment as Chairman of the Audit, Risk and Sustainability Committee.

- Get an in-depth perspective on PWR Holdings' performance by reading our analyst estimates report here.

- Our valuation report unveils the possibility PWR Holdings' shares may be trading at a premium.

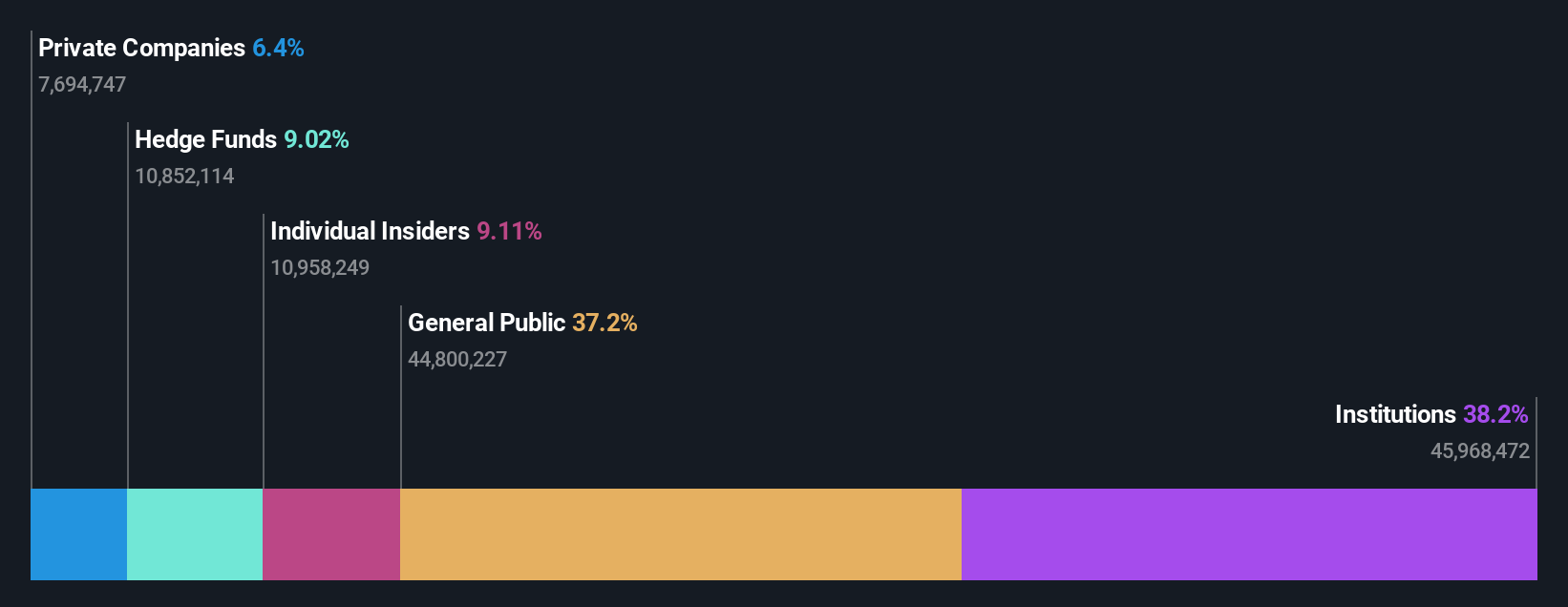

Temple & Webster Group (ASX:TPW)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Temple & Webster Group Ltd (ASX:TPW) operates as an online retailer of furniture, homewares, and home improvement products in Australia with a market cap of A$1.37 billion.

Operations: The company generates revenue primarily from the sale of furniture, homewares, and home improvement products, amounting to A$497.84 million.

Insider Ownership: 12%

Temple & Webster Group's earnings are forecast to grow significantly at 39.8% per year, outpacing the Australian market's 12.3%. Despite revenue growth of A$497.8 million for FY2024, up from A$395.5 million, net income dropped to A$1.8 million from A$8.3 million due to lower profit margins and large one-off items. The company recently appointed Cameron Barnsley as CFO, bringing extensive financial services experience from Morgan Stanley’s technology and ecommerce sectors globally.

- Take a closer look at Temple & Webster Group's potential here in our earnings growth report.

- Our comprehensive valuation report raises the possibility that Temple & Webster Group is priced higher than what may be justified by its financials.

Key Takeaways

- Dive into all 99 of the Fast Growing ASX Companies With High Insider Ownership we have identified here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Temple & Webster Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:TPW

Temple & Webster Group

Engages in the online retail of furniture, homewares, and home improvement products in Australia.

Flawless balance sheet with high growth potential.