- Australia

- /

- Metals and Mining

- /

- ASX:LYC

Lynas Rare Earths (ASX:LYC) Stock Surges 49% Over Last Quarter

Reviewed by Simply Wall St

Lynas Rare Earths (ASX:LYC) announced it will hold its Q4 2025 earnings call on July 24, alongside the results release, offering investors a comprehensive look at the company's performance and future strategies. The 49% price increase for Lynas over the last quarter comes amid a broader market landscape where stocks generally rose, fueled by a flurry of earnings reports and the impact of tariff news. While Lynas' events coincided with these broader positive market movements, they reinforced investor sentiment, pushing the stock's performance in tandem with the uplift seen across the S&P 500 and Nasdaq indices.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

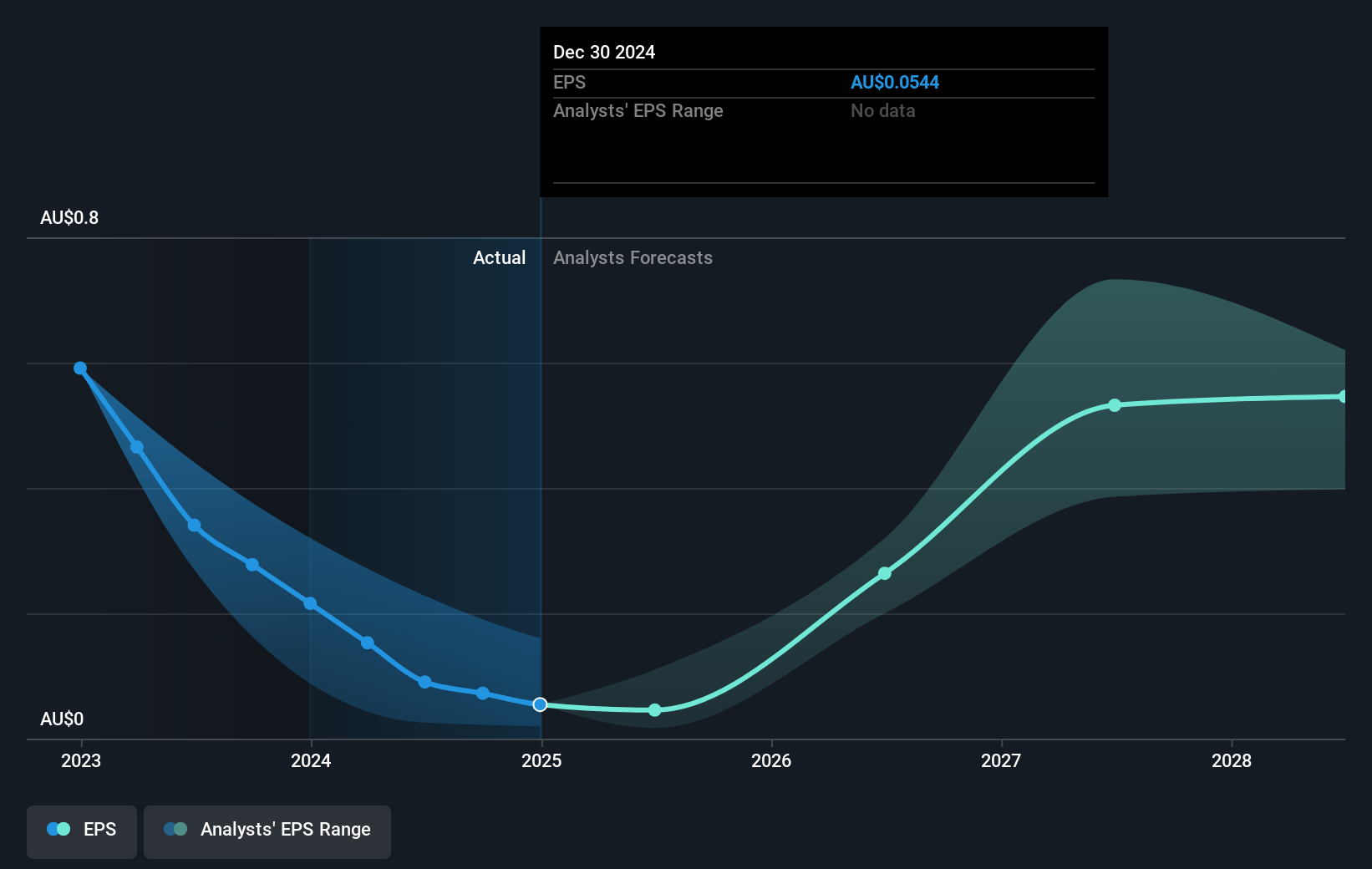

The announcement of Lynas Rare Earths' upcoming earnings call could significantly influence investor outlook, as it coincides with a recent 49% share price increase over the past quarter. This event provides an opportunity for Lynas to address its strategic expansion plans and partnerships aimed at enhancing revenue streams, potentially stabilizing net margins, and increasing production capacity. These initiatives position the company to tap into growing demand for heavy rare earths, which could influence both revenue and earnings forecasts favorably.

Over a longer five-year period, Lynas' total shareholder return, including share price and dividends, was an impressive 376.87%. Comparatively, in the past year, the company's performance exceeded the Australian Metals and Mining industry, which returned 7.4%. This robust historical performance underscores Lynas' capacity to generate substantial returns amid industry challenges.

However, the current A$11.90 share price represents a 14.29% premium over the consensus analyst price target of A$10.20, suggesting that market expectations may already be factoring in optimistic growth assumptions. Investors might consider whether current market conditions and future strategic initiatives can support these elevated valuations.

Review our growth performance report to gain insights into Lynas Rare Earths' future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:LYC

Lynas Rare Earths

Engages in the exploration, development, mining, extraction, and processing of rare earth minerals in Australia and Malaysia.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives