- Australia

- /

- Metals and Mining

- /

- ASX:LYC

Lynas (ASX:LYC): Valuation Insights Following Landmark Solidec Partnership for Greener Rare Earth Processing

Reviewed by Simply Wall St

Lynas Rare Earths (ASX:LYC) has entered into a landmark partnership with Solidec to pilot a first-of-its-kind hydrogen peroxide generator at its Australian facility. This move focuses on creating a more efficient and low-carbon approach to rare earth materials processing.

See our latest analysis for Lynas Rare Earths.

The latest collaboration adds to an eventful period for Lynas. The share price has soared by 117.15% year to date, though a sharp 34.47% drop over the past month reminds investors that rapid momentum can shift as excitement balances with caution. Over the past year, the company delivered an impressive 98.60% total shareholder return, reflecting strong long-term optimism despite recent volatility.

If this move toward greener processing sparks your curiosity about where industry innovation is headed, now could be the right moment to discover fast growing stocks with high insider ownership

But with such explosive returns in recent years, is Lynas trading at a discount or has the surge fully captured all future potential, leaving little room for upside? Is there still a buying opportunity, or is the market already pricing in the next wave of growth?

Most Popular Narrative: 11.1% Undervalued

Lynas Rare Earths’ most-followed valuation narrative points to a fair value of A$15.94, which is above the recent closing price of A$14.18. This perspective reflects broader optimism about future earnings and margin growth, shining a spotlight on the bold assumptions driving expectations higher.

Investors appear to expect sustained above-trend pricing and demand, largely based on the belief that Western governments' ongoing support for supply chain diversification and critical mineral security will continue to provide Lynas with long-term government-backed offtake agreements and pricing floors, driving higher future revenue and valuation multiples.

Want to see what’s fueling this bullish stance? The narrative is built around a forecast of rapid acceleration, not just in sales, but in future profit margins and valuation multiples that stretch past today’s levels. If you’re hungry to uncover which key financial levers underpin such a strong upside, the details will surprise you.

Result: Fair Value of $15.94 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing regulatory challenges in Malaysia or unexpected technological changes could quickly undermine the current growth outlook for Lynas Rare Earths.

Find out about the key risks to this Lynas Rare Earths narrative.

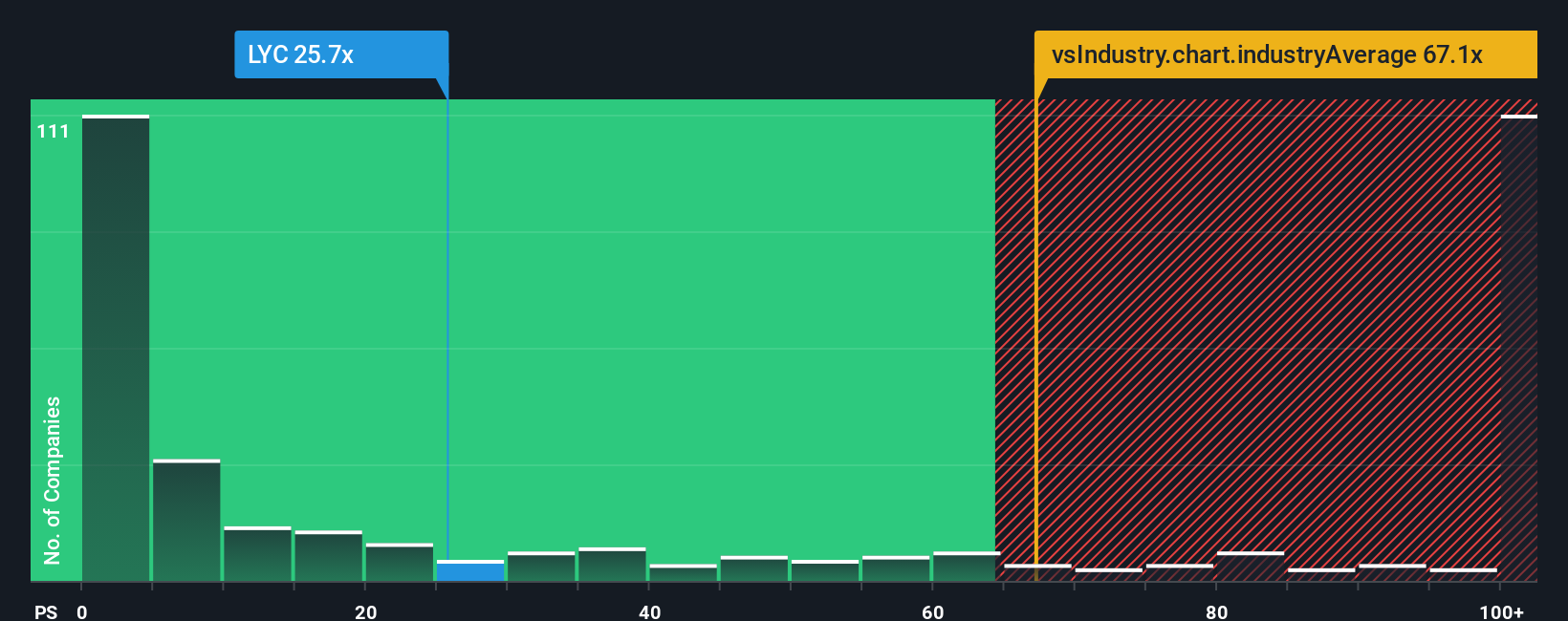

Another View: Multiples Tell a Very Different Story

While some see value based on growth forecasts, a look at Lynas’ price-to-sales ratio presents a caution flag. The company trades at 25.6x sales, far above the fair ratio of 4.4x and even higher than its peer average of 7.4x. This raises questions about how much future potential is already priced in and what risks this premium might carry.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Lynas Rare Earths Narrative

If you see things differently or want a more hands-on approach, you can review the data firsthand and form your own view in just a few minutes. Do it your way

A great starting point for your Lynas Rare Earths research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Winning Investment Ideas?

Don’t stop with Lynas Rare Earths. The smartest investors look beyond the obvious, using proven tools to spot where tomorrow’s outperformance may come from. Let Simply Wall Street’s powerful screener help you access trends others are just catching onto and make sure you’re at the forefront, not left behind.

- Profit from forward-thinking companies with cutting-edge breakthroughs by checking out these 25 AI penny stocks.

- Secure income and stability with attractive revenue streams by reviewing these 16 dividend stocks with yields > 3% now.

- Capitalize on real value before the market wakes up to it through these 879 undervalued stocks based on cash flows that meet strict cash flow criteria.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:LYC

Lynas Rare Earths

Engages in the exploration, development, mining, extraction, and processing of rare earth minerals in Australia and Malaysia.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives