- Australia

- /

- Metals and Mining

- /

- ASX:LTR

Liontown Resources (ASX:LTR) Completes Follow-On Equity Offering Raising A$56 Million

Reviewed by Simply Wall St

Liontown Resources (ASX:LTR) completed a follow-on equity offering raising AUD 56 million, which, alongside prior offering activities, aligns with the company's strategic expansion efforts. This equaled a significant share issuance and the recent executive changes, such as the departure of the CFO, which may have shaped investor sentiment. This 12% price move during a quarter in which broader markets, particularly the S&P 500 and Nasdaq, hit records reflects both company-specific catalysts and overall market undercurrents. While the recent offering and executive shake-up could have countered the general upward market trend, the broader market's strength likely also played a role.

The recent equity offering by Liontown Resources, raising A$56 million, aligns with its ongoing expansion drive and impacts some narratives around the company's operational momentum. This capital can potentially fund production and processing upgrades, possibly enhancing revenue and earnings forecasts. However, another factor in shaping the narrative is the recent executive shakeup, including the CFO's departure, which may inject some uncertainty into leadership stability.

In terms of longer-term performance, Liontown Resources has experienced significant total returns of 330.56% over the past five years, reflecting substantial market appreciation. However, over the past year, it underperformed the Australian Metals and Mining industry, which saw a 23.5% increase. This discrepancy highlights that recent challenges and market conditions may have affected its short-term performance compared to industry peers.

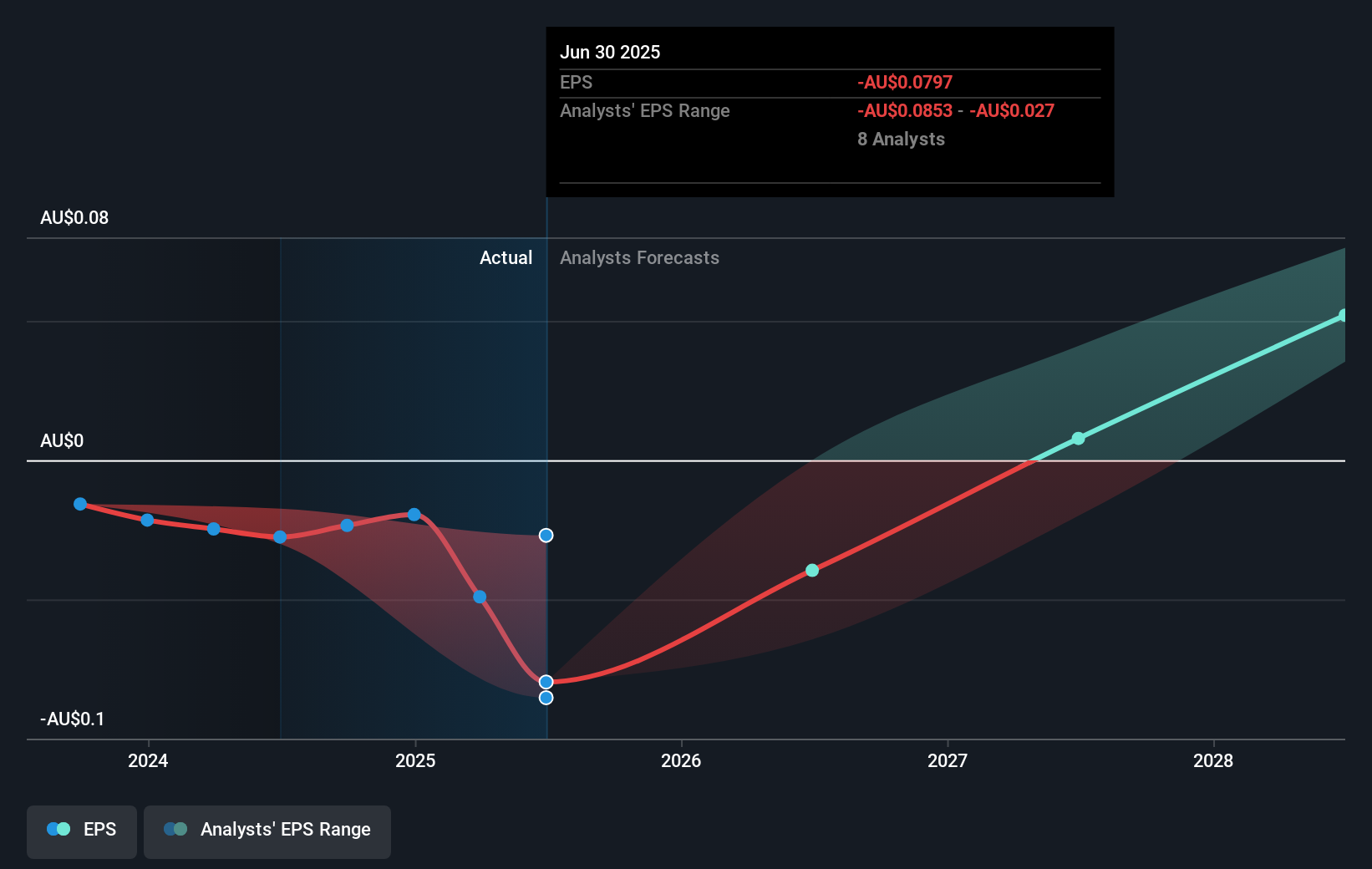

The current share price of A$0.77 is above the consensus analyst price target of A$0.63, indicating a possible overvaluation according to market analysts' forecasts. With revenue expected to grow at an average of 30% annually and anticipated margin improvements, there's optimism about potential operational efficiency gains. Still, these expectations need to be met with consistent execution. Analysts forecast a transition to profitability in the coming years. The ability to achieve expected targets will be crucial for aligning the share price with longer-term analyst valuations.

Learn about Liontown Resources' historical performance here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:LTR

Liontown Resources

Engages in the exploration, evaluation, and development of mineral properties in Australia.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives