- Australia

- /

- Metals and Mining

- /

- ASX:LTR

How Leadership Changes and Financial Results Have Altered Liontown Resources’ (ASX:LTR) Investment Narrative

Reviewed by Sasha Jovanovic

- In September 2025, Liontown Resources reported full-year sales of A$297.57 million and a net loss of A$193.28 million, while announcing the appointments of Greg Jason as Chief Financial Officer and Lisa Breen as Chief People Officer.

- These executive changes bring mining sector expertise as the company positions itself to become Australia’s only underground lithium mine operator amid ongoing operational and financial challenges.

- We’ll examine how Liontown’s new leadership appointments could shape its investment narrative as it pursues operational improvements and growth.

Find companies with promising cash flow potential yet trading below their fair value.

Liontown Resources Investment Narrative Recap

To be a shareholder in Liontown Resources, you need to believe in the company’s ability to capitalize on underground lithium production while managing current operational and financial challenges, including mounting losses. The recent executive appointments may support improvement over time, but they do not materially change the near-term catalyst of ramping up underground operations, nor do they offset the biggest risk: elevated costs combined with a prolonged period of unprofitability and cash burn.

Among the latest announcements, Liontown’s full-year earnings reveal a widening net loss to A$193.28 million despite sales of A$297.57 million, highlighting the urgent need to improve operating margins as the company scales up at Kathleen Valley. This operational focus is especially relevant as the company transitions to its next growth phase, where controlling costs and achieving production targets become critical to its outlook.

By contrast, it’s essential for investors to understand the potential consequences if production or cost efficiencies fall short in coming quarters, especially as...

Read the full narrative on Liontown Resources (it's free!)

Liontown Resources' narrative projects A$725.1 million revenue and A$62.7 million earnings by 2028. This requires 93.1% yearly revenue growth and an earnings increase of A$111.8 million from the current A$-49.1 million.

Uncover how Liontown Resources' forecasts yield a A$0.654 fair value, a 33% downside to its current price.

Exploring Other Perspectives

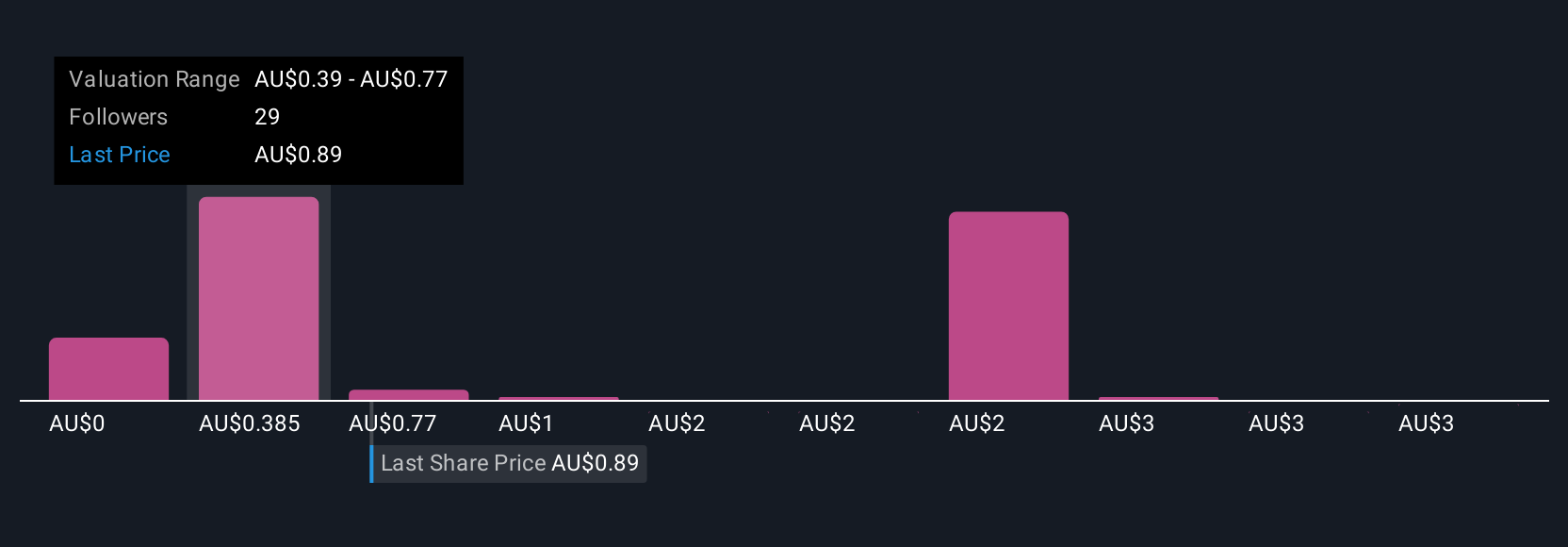

Nineteen members of the Simply Wall St Community estimate Liontown’s fair value ranges widely from A$0.39 to A$3.85 per share. While these opinions differ, it’s important to keep in mind that persistent cost pressures remain a major concern for short term performance, and you may want to compare several viewpoints.

Explore 19 other fair value estimates on Liontown Resources - why the stock might be worth less than half the current price!

Build Your Own Liontown Resources Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Liontown Resources research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Liontown Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Liontown Resources' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 32 best rare earth metal stocks of the very few that mine this essential strategic resource.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:LTR

Liontown Resources

Engages in the exploration, evaluation, and development of mineral properties in Australia.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives