- Australia

- /

- Metals and Mining

- /

- ASX:LTR

ASX Growth Companies With High Insider Ownership To Watch

Reviewed by Simply Wall St

As the Australian market faces a potential dip of around 0.5% amid global economic concerns and a turbulent week, investors are keenly observing how local indices respond to external pressures like high US job cuts and fluctuating commodity prices. In such uncertain times, stocks with strong insider ownership can offer some reassurance, as they often indicate confidence from those closest to the company's operations and future prospects.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Wisr (ASX:WZR) | 12.6% | 90.7% |

| Titomic (ASX:TTT) | 11.2% | 74.9% |

| Polymetals Resources (ASX:POL) | 37.7% | 108% |

| Pointerra (ASX:3DP) | 19.8% | 110.3% |

| Newfield Resources (ASX:NWF) | 31.5% | 72.1% |

| IRIS Metals (ASX:IR1) | 21.6% | 144.4% |

| Elsight (ASX:ELS) | 17.4% | 77% |

| Echo IQ (ASX:EIQ) | 19.1% | 49.9% |

| BlinkLab (ASX:BB1) | 35.4% | 101.4% |

| Adveritas (ASX:AV1) | 18.4% | 96.8% |

Below we spotlight a couple of our favorites from our exclusive screener.

Guzman y Gomez (ASX:GYG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Guzman y Gomez Limited operates quick service restaurants in Australia, Singapore, Japan, and the United States with a market cap of A$2.57 billion.

Operations: The company's revenue primarily comes from its quick service restaurant operations, generating A$465.04 million.

Insider Ownership: 15.2%

Guzman y Gomez demonstrates strong growth potential, with revenue expected to grow at 15.5% annually, surpassing the Australian market's 5.7%. Earnings are projected to increase significantly by 32.5% per year over the next three years. Despite trading below estimated fair value, insider buying indicates confidence in its prospects. Recent announcements include a A$100 million share buyback and plans to open 32 new restaurants in FY26, supporting its growth trajectory while enhancing shareholder returns.

- Dive into the specifics of Guzman y Gomez here with our thorough growth forecast report.

- Our comprehensive valuation report raises the possibility that Guzman y Gomez is priced higher than what may be justified by its financials.

Liontown Resources (ASX:LTR)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Liontown Resources Limited focuses on the exploration, evaluation, and development of mineral properties in Australia with a market cap of A$2.99 billion.

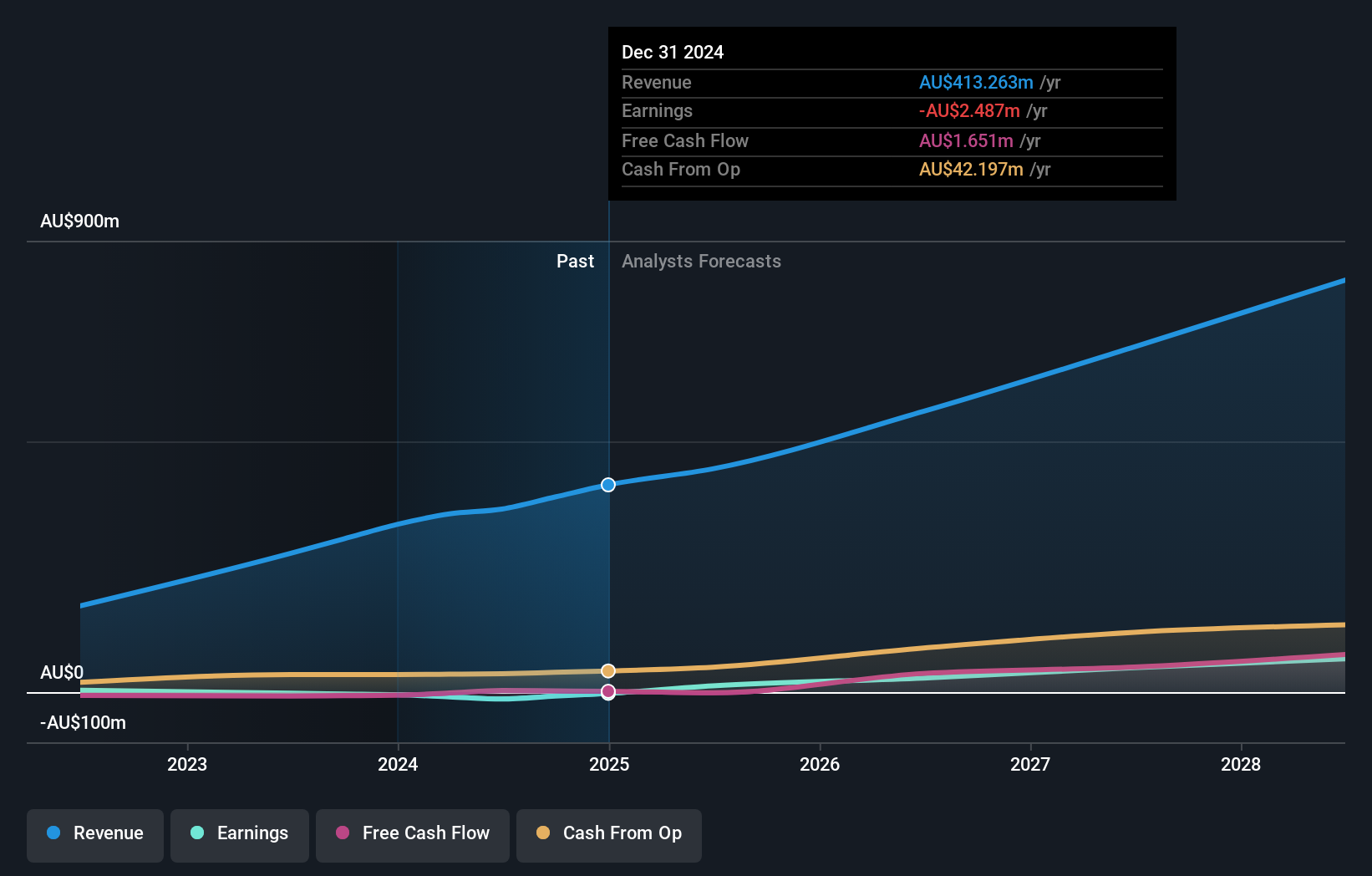

Operations: The company's revenue segment is derived from the exploration and development of minerals, amounting to A$297.57 million.

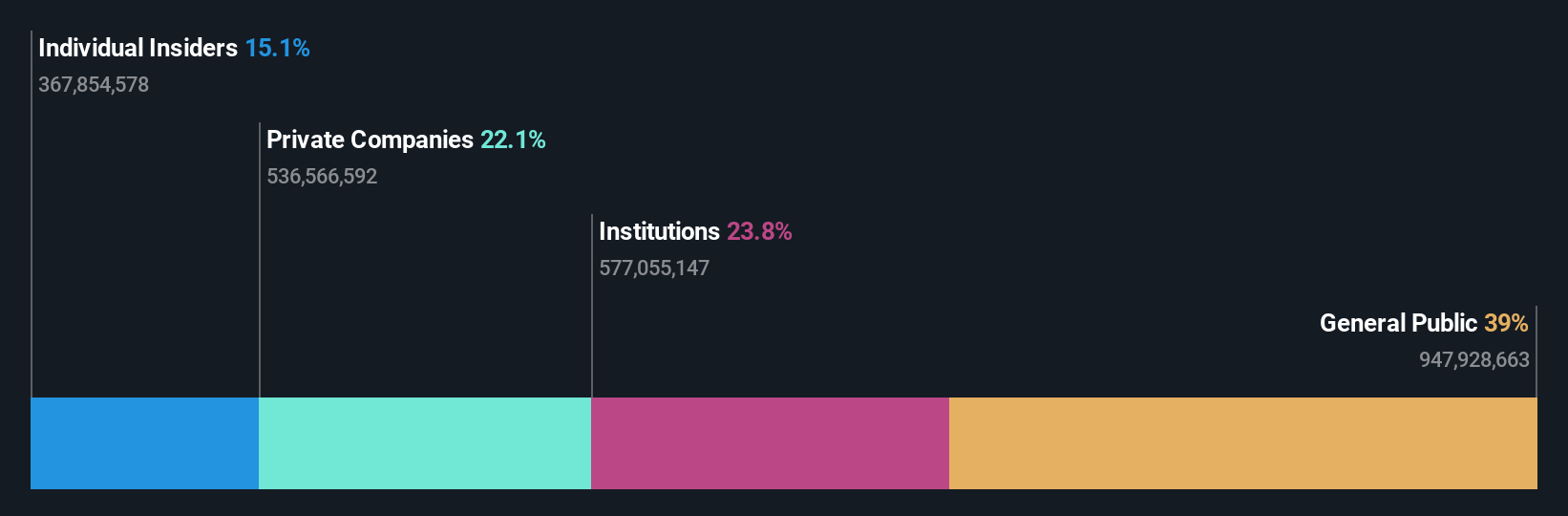

Insider Ownership: 12.1%

Liontown Resources is positioned for substantial growth, with revenue expected to increase by 24.1% annually, outpacing the Australian market. Although the company has faced shareholder dilution and reported a net loss of A$193.28 million in FY25, it is forecast to become profitable within three years. The stock trades significantly below its estimated fair value, suggesting potential upside. Recent executive appointments aim to strengthen leadership as the company navigates its growth trajectory.

- Unlock comprehensive insights into our analysis of Liontown Resources stock in this growth report.

- According our valuation report, there's an indication that Liontown Resources' share price might be on the cheaper side.

Technology One (ASX:TNE)

Simply Wall St Growth Rating: ★★★★☆☆

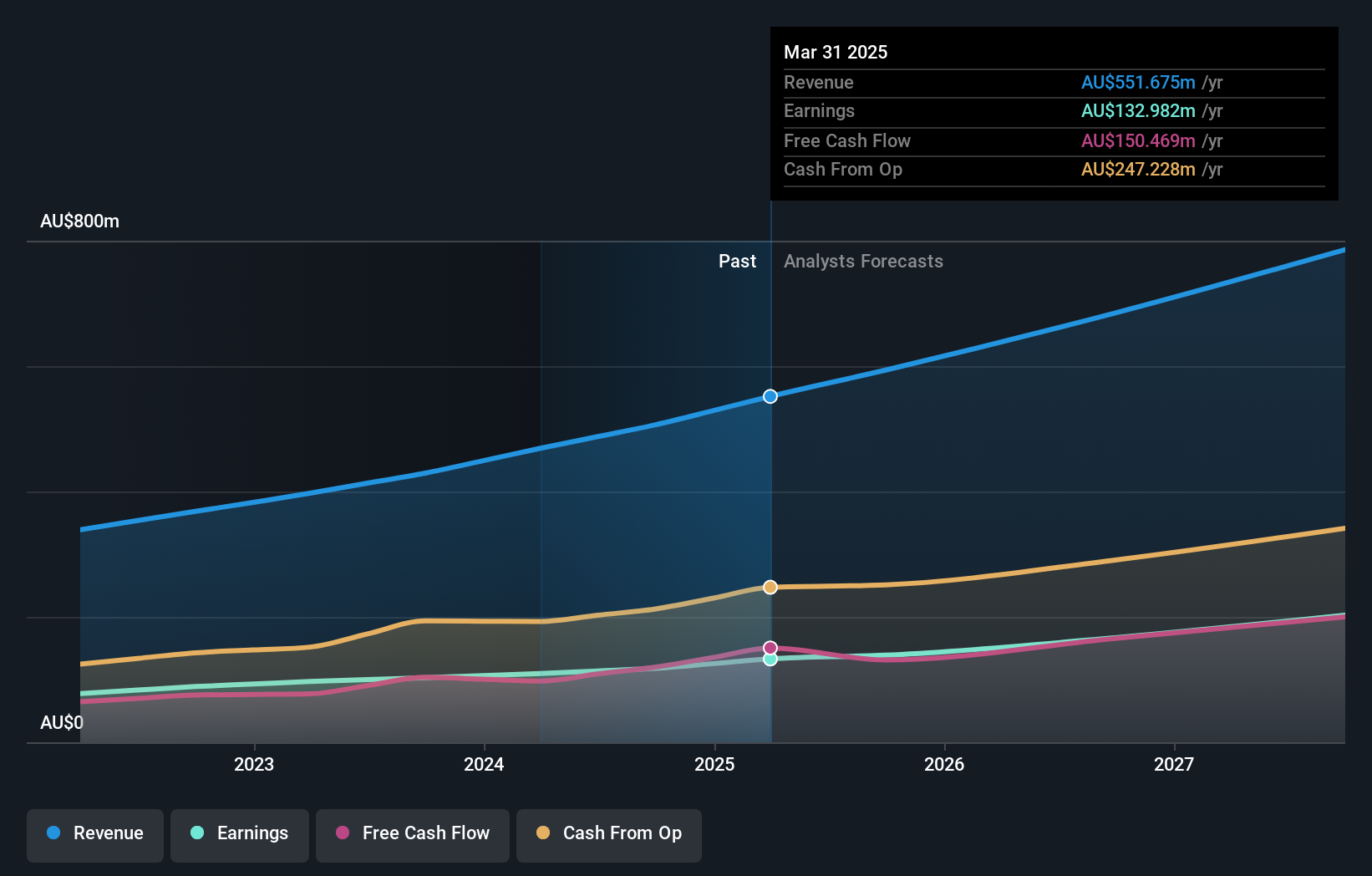

Overview: Technology One Limited develops, markets, sells, implements, and supports integrated enterprise business software solutions in Australia and internationally with a market cap of A$11.71 billion.

Operations: The company's revenue is derived from its Software segment, which generated A$378.25 million, followed by the Corporate segment with A$90.55 million and the Consulting segment contributing A$82.87 million.

Insider Ownership: 10.4%

Technology One is experiencing steady growth, with earnings forecasted to rise by 15.65% annually, surpassing the Australian market's average. Revenue growth of 12.7% per year also exceeds the market rate. The company's recent inclusion in major indices like S&P Global 1200 and S&P/ASX 50 highlights its expanding influence. Recent board appointments bring expertise in scaling SaaS and cloud businesses, potentially enhancing strategic direction while maintaining strong insider ownership stability without significant recent trading activity.

- Click here to discover the nuances of Technology One with our detailed analytical future growth report.

- Our valuation report here indicates Technology One may be overvalued.

Summing It All Up

- Unlock our comprehensive list of 108 Fast Growing ASX Companies With High Insider Ownership by clicking here.

- Interested In Other Possibilities? We've found 16 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:LTR

Liontown Resources

Engages in the exploration, evaluation, and development of mineral properties in Australia.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives