- Australia

- /

- Medical Equipment

- /

- ASX:NAN

ASX Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

In recent times, the Australian stock market has experienced fluctuations influenced by global trade policies and geopolitical developments, with notable movements in commodity-linked stocks and healthcare sectors. In this environment, growth companies with high insider ownership can be particularly appealing as they often signal strong confidence from those who know the business best, potentially offering resilience amidst market volatility.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Alfabs Australia (ASX:AAL) | 10.8% | 41.3% |

| Acrux (ASX:ACR) | 15.5% | 106.9% |

| Cyclopharm (ASX:CYC) | 11.3% | 97.8% |

| Fenix Resources (ASX:FEX) | 21.1% | 53.4% |

| Newfield Resources (ASX:NWF) | 31.5% | 72.1% |

| Brightstar Resources (ASX:BTR) | 11.6% | 105.2% |

| Echo IQ (ASX:EIQ) | 19.8% | 65.9% |

| Plenti Group (ASX:PLT) | 12.7% | 89.6% |

| Image Resources (ASX:IMA) | 20.6% | 79.9% |

| BETR Entertainment (ASX:BBT) | 38.6% | 121.8% |

Underneath we present a selection of stocks filtered out by our screen.

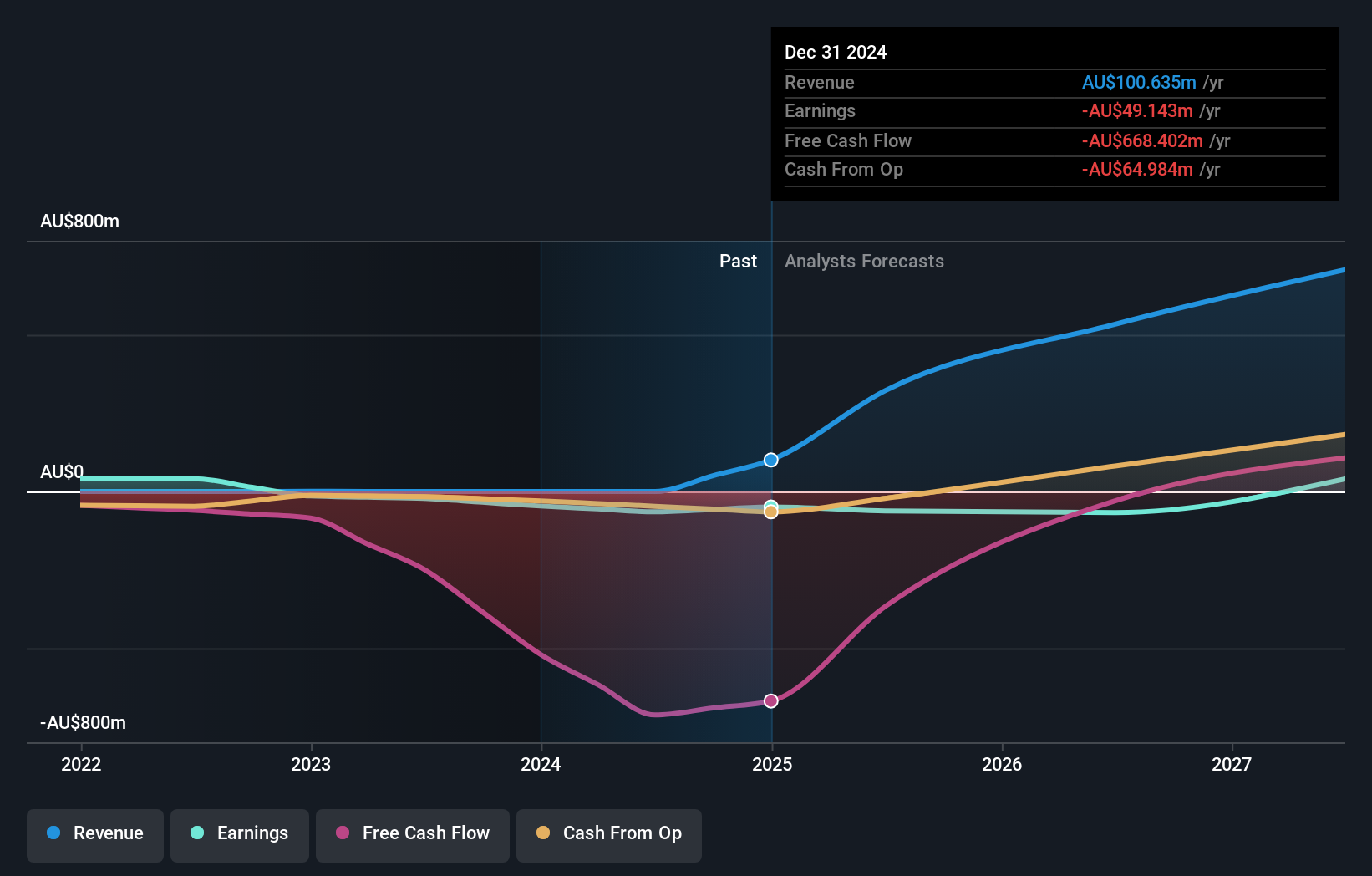

Liontown Resources (ASX:LTR)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Liontown Resources Limited focuses on the exploration, evaluation, and development of mineral properties in Australia with a market cap of A$1.80 billion.

Operations: Liontown Resources Limited does not currently report any revenue segments.

Insider Ownership: 15.2%

Liontown Resources is poised for significant growth, with revenue expected to increase by 36.4% annually, outpacing the Australian market. The company is transitioning to underground operations at its Kathleen Valley Lithium Operation, aiming for higher lithia recoveries and improved throughput. Despite a recent net loss of A$15.24 million, profitability is anticipated within three years. However, Liontown was recently removed from the FTSE All-World Index and faces financial constraints with less than one year of cash runway.

- Unlock comprehensive insights into our analysis of Liontown Resources stock in this growth report.

- Our comprehensive valuation report raises the possibility that Liontown Resources is priced lower than what may be justified by its financials.

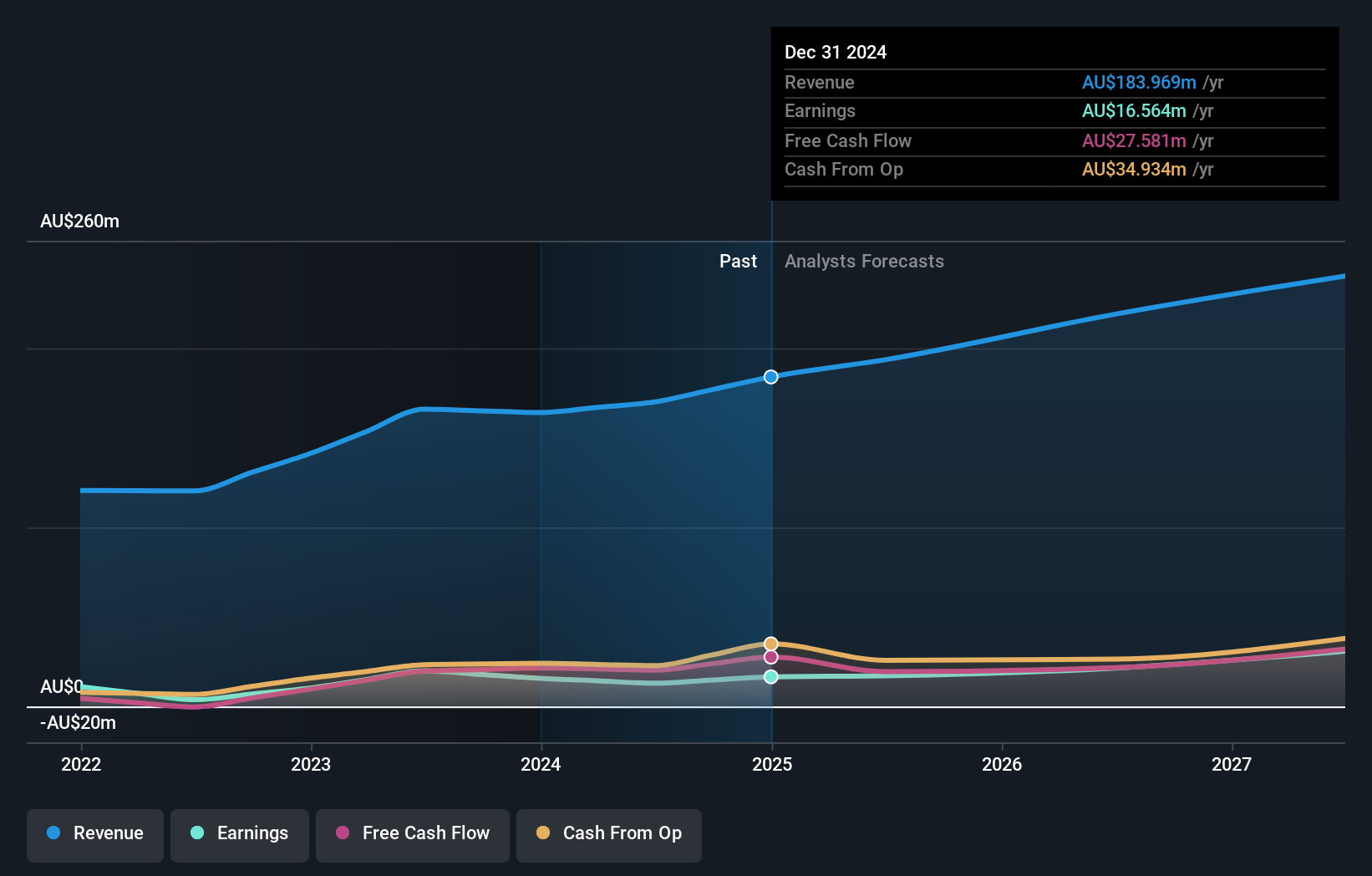

Nanosonics (ASX:NAN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Nanosonics Limited is an infection prevention company with global operations and a market cap of A$1.49 billion.

Operations: The company's revenue is primarily derived from its Healthcare Equipment segment, which generated A$183.97 million.

Insider Ownership: 15.4%

Nanosonics demonstrates robust growth potential with insider confidence, as insiders have been buying more shares recently. The company revised its revenue guidance upwards for the first half of 2025, expecting growth between 11% and 14%. Sales increased to A$93.6 million from A$79.64 million year-on-year, while net income rose to A$9.76 million from A$6.17 million. Forecasts indicate earnings will grow significantly at 24.3% annually, outpacing the broader Australian market's growth rate.

- Click here and access our complete growth analysis report to understand the dynamics of Nanosonics.

- According our valuation report, there's an indication that Nanosonics' share price might be on the cheaper side.

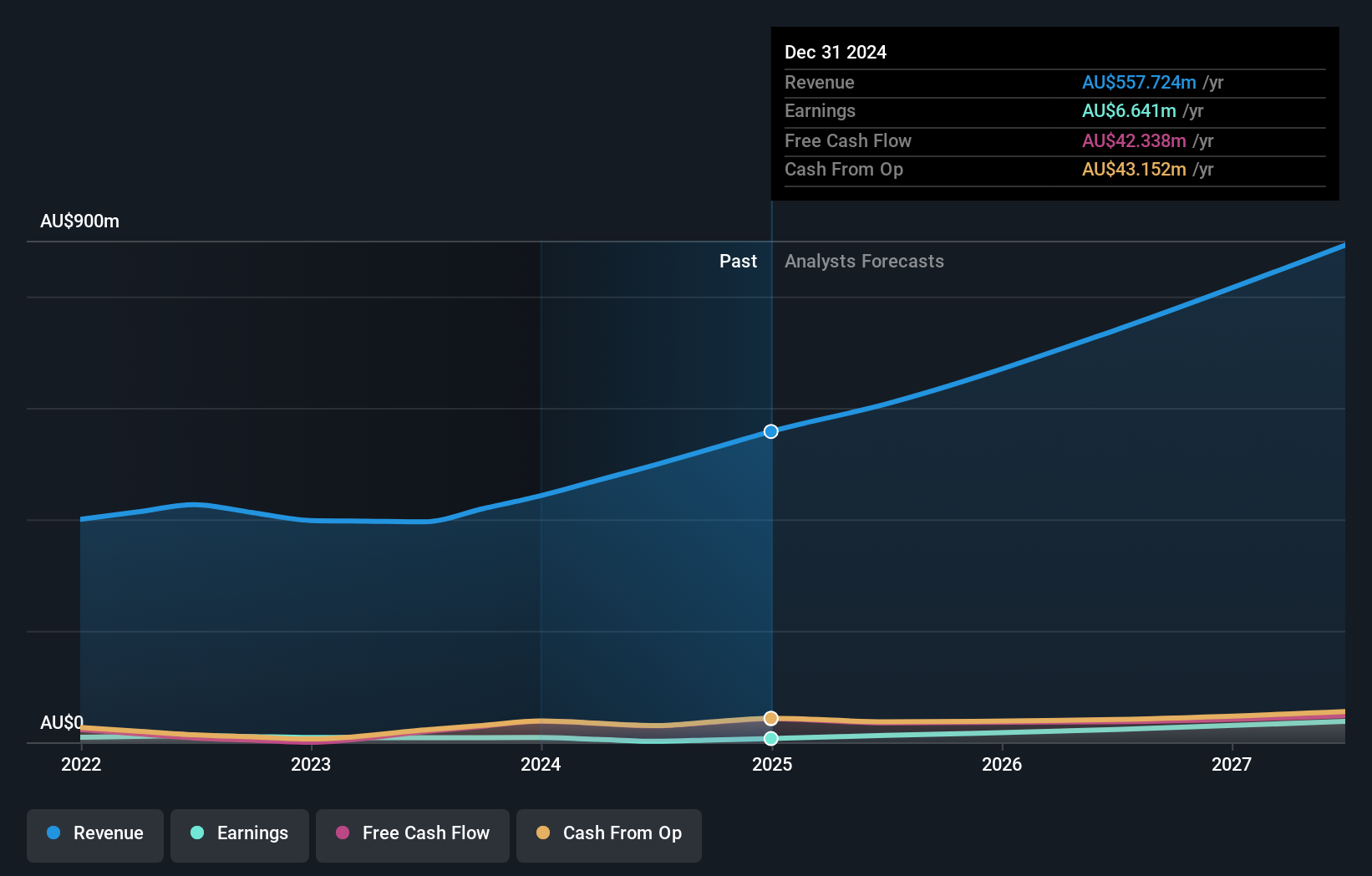

Temple & Webster Group (ASX:TPW)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Temple & Webster Group Ltd operates as an online retailer specializing in furniture, homewares, and home improvement products in Australia, with a market cap of A$2.28 billion.

Operations: The company's revenue is primarily generated from the sale of furniture, homewares, and home improvement products, amounting to A$557.72 million.

Insider Ownership: 12.3%

Temple & Webster Group's recent addition to the S&P/ASX 200 and Consumer Discretionary Sector Indexes highlights its growing market presence. With forecasted revenue growth of 16.4% annually, it surpasses the Australian market average. Earnings are expected to increase significantly at 39.41% per year, well above the market's 11.7%. Despite a slight drop in profit margins from last year, insider ownership remains strong, with no significant insider trading activity reported recently.

- Delve into the full analysis future growth report here for a deeper understanding of Temple & Webster Group.

- The valuation report we've compiled suggests that Temple & Webster Group's current price could be inflated.

Key Takeaways

- Access the full spectrum of 97 Fast Growing ASX Companies With High Insider Ownership by clicking on this link.

- Want To Explore Some Alternatives? The end of cancer? These 24 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Nanosonics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:NAN

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives