- Australia

- /

- Electrical

- /

- ASX:LIT

Investors Who Bought Lithium Australia (ASX:LIT) Shares Three Years Ago Are Now Down 61%

Lithium Australia NL (ASX:LIT) shareholders will doubtless be very grateful to see the share price up 38% in the last month. But over the last three years we've seen a quite serious decline. Regrettably, the share price slid 61% in that period. So the improvement may be a real relief to some. Perhaps the company has turned over a new leaf.

See our latest analysis for Lithium Australia

With just AU$306,862 worth of revenue in twelve months, we don't think the market considers Lithium Australia to have proven its business plan. We can't help wondering why it's publicly listed so early in its journey. Are venture capitalists not interested? So it seems that the investors focused more on what could be, than paying attention to the current revenues (or lack thereof). For example, investors may be hoping that Lithium Australia finds some valuable resources, before it runs out of money.

As a general rule, if a company doesn't have much revenue, and it loses money, then it is a high risk investment. There is usually a significant chance that they will need more money for business development, putting them at the mercy of capital markets to raise equity. So the share price itself impacts the value of the shares (as it determines the cost of capital). While some companies like this go on to deliver on their plan, making good money for shareholders, many end in painful losses and eventual de-listing. Lithium Australia has already given some investors a taste of the bitter losses that high risk investing can cause.

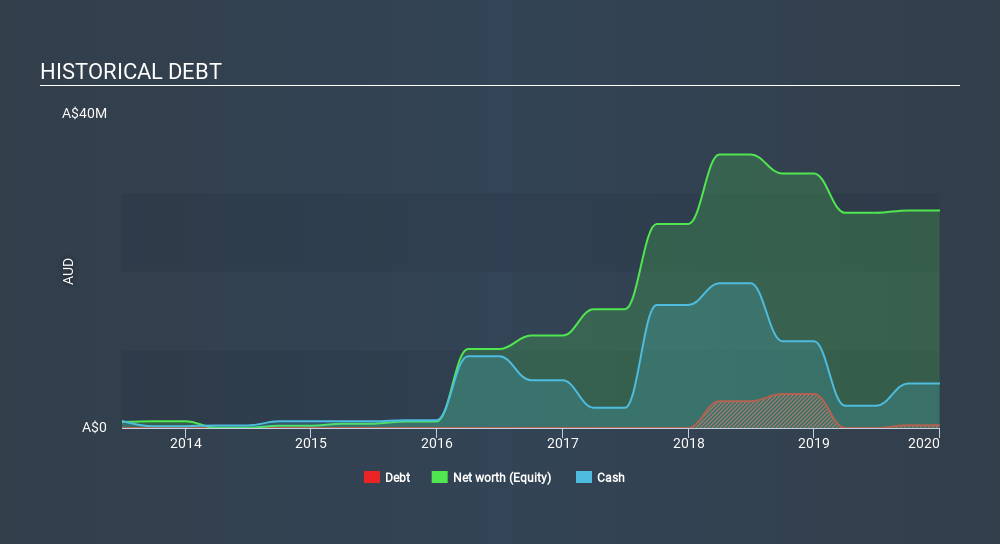

Lithium Australia had cash in excess of all liabilities of just AU$2.1m when it last reported (December 2019). So if it hasn't remedied the situation already, it will almost certainly have to raise more capital soon. That probably explains why the share price is down 27% per year, over 3 years. You can click on the image below to see (in greater detail) how Lithium Australia's cash levels have changed over time.

Of course, the truth is that it is hard to value companies without much revenue or profit. Would it bother you if insiders were selling the stock? I would feel more nervous about the company if that were so. You can click here to see if there are insiders selling.

A Different Perspective

While the broader market lost about 9.5% in the twelve months, Lithium Australia shareholders did even worse, losing 36%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 7.3% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Lithium Australia better, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 7 warning signs for Lithium Australia (of which 3 shouldn't be ignored!) you should know about.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ASX:LIT

Livium

Engages in mineral exploration and technology development activities.

Moderate risk with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives