- Australia

- /

- Metals and Mining

- /

- ASX:FAL

3 ASX Penny Stocks With Market Caps Over A$8M To Consider

Reviewed by Simply Wall St

As the Australian market experiences a slight uptick, diverging from recent U.S. trends amid ongoing reporting season, investors are keenly observing opportunities that might arise. Penny stocks, although an older term, continue to offer intriguing prospects for those willing to explore smaller or newer companies with strong financial foundations. This article highlights three such penny stocks on the ASX that combine robust balance sheets with potential growth opportunities, providing investors a chance to uncover hidden value in quality companies.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.79 | A$144.95M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.575 | A$67.47M | ★★★★★★ |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.83 | A$86.33M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.475 | A$294.57M | ★★★★★☆ |

| IVE Group (ASX:IGL) | A$2.21 | A$342.3M | ★★★★☆☆ |

| SHAPE Australia (ASX:SHA) | A$3.04 | A$252.05M | ★★★★★★ |

| Bisalloy Steel Group (ASX:BIS) | A$3.51 | A$168.14M | ★★★★★★ |

| Dusk Group (ASX:DSK) | A$1.05 | A$65.38M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.54 | A$106.04M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.86 | A$102.89M | ★★★★★★ |

Click here to see the full list of 1,030 stocks from our ASX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Australian Silica Quartz Group (ASX:ASQ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Australian Silica Quartz Group Ltd. focuses on acquiring, exploring, and developing hard rock quartz and high-grade silica sand properties in Australia, with a market cap of A$8.46 million.

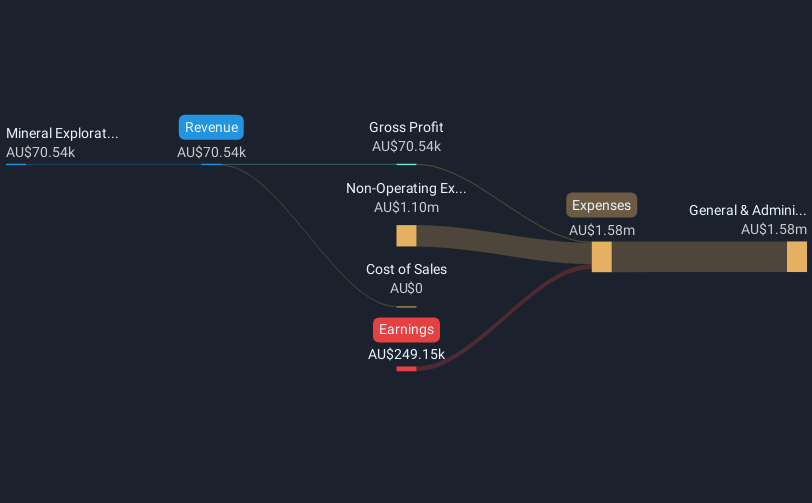

Operations: The company generates revenue from its mineral exploration activities, amounting to A$0.07 million.

Market Cap: A$8.46M

Australian Silica Quartz Group Ltd. is a pre-revenue company with a market cap of A$8.46 million, focusing on quartz and silica sand exploration in Australia. Despite its unprofitable status, the company benefits from having no debt and covering both short-term liabilities with assets of A$2.6 million and long-term liabilities with none existing. The management team is experienced, averaging 9.3 years in tenure, while the board averages 17.9 years, indicating stability at leadership levels. However, the company's stock has been highly volatile recently and it remains challenging to compare its growth against industry benchmarks due to ongoing losses.

- Navigate through the intricacies of Australian Silica Quartz Group with our comprehensive balance sheet health report here.

- Examine Australian Silica Quartz Group's past performance report to understand how it has performed in prior years.

Falcon Metals (ASX:FAL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Falcon Metals Limited focuses on the discovery, exploration, and development of mineral deposits in Australia with a market cap of A$24.78 million.

Operations: Falcon Metals Limited has not reported any revenue segments.

Market Cap: A$24.78M

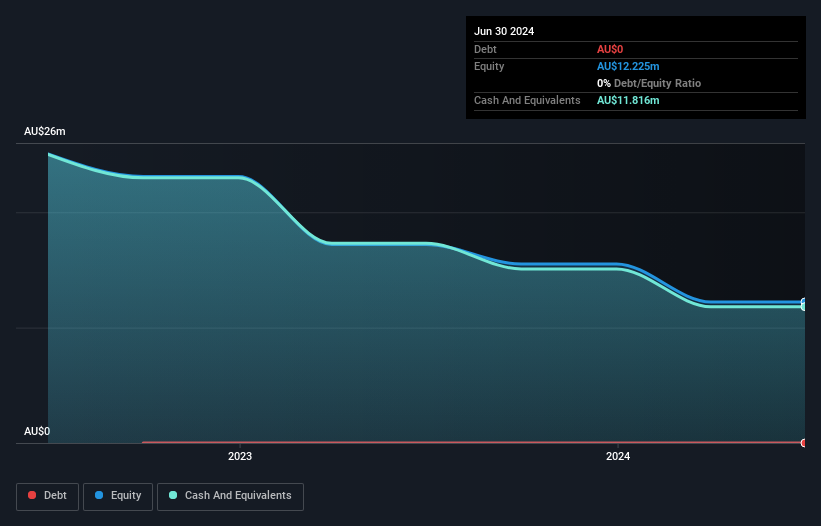

Falcon Metals Limited, with a market cap of A$24.78 million, is a pre-revenue company focused on mineral exploration in Australia. Despite its unprofitable status, Falcon benefits from being debt-free for the past five years and having short-term assets of A$12.3 million that cover both short and long-term liabilities comfortably. The management and board are experienced with an average tenure of 3.2 years, contributing to stable governance. Shareholders have not been significantly diluted recently, while the company's cash runway extends over two years if free cash flow continues to decrease at historical rates.

- Click to explore a detailed breakdown of our findings in Falcon Metals' financial health report.

- Learn about Falcon Metals' historical performance here.

Kingsrose Mining (ASX:KRM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Kingsrose Mining Limited, along with its subsidiaries, is a mineral exploration company operating in Norway and Finland with a market capitalization of A$27.13 million.

Operations: Kingsrose Mining Limited does not report any specific revenue segments.

Market Cap: A$27.13M

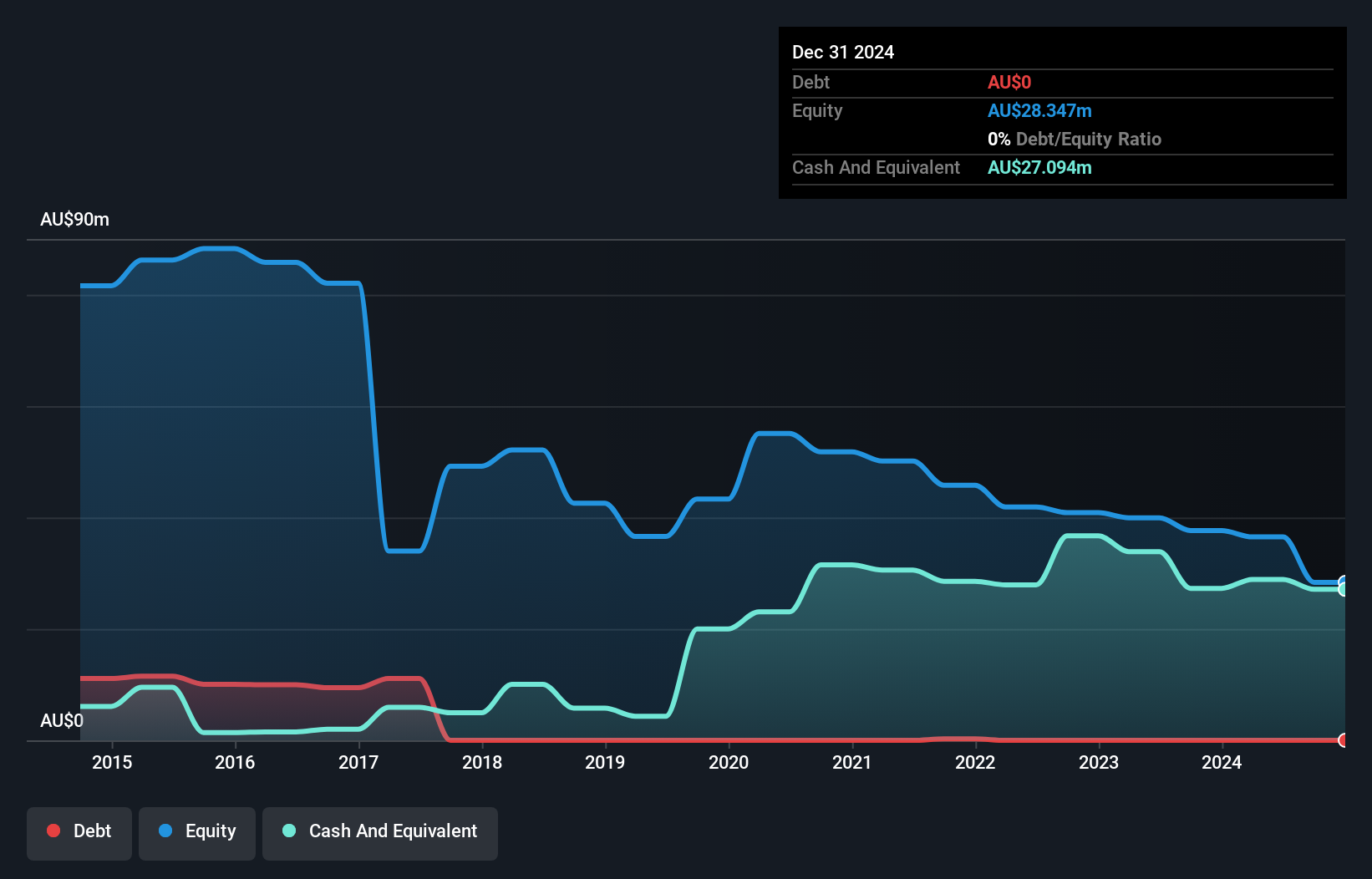

Kingsrose Mining Limited, with a market cap of A$27.13 million, operates in Norway and Finland as a pre-revenue mineral exploration company. Despite its unprofitable status and volatile share price, it maintains financial stability with short-term assets of A$29.0 million exceeding liabilities of A$4.0 million and no long-term debt. The company benefits from an experienced board with an average tenure of 4.3 years, although the management team is relatively new with only 1.9 years on average. Kingsrose's cash runway extends beyond three years if current free cash flow trends persist without significant shareholder dilution recently observed.

- Click here and access our complete financial health analysis report to understand the dynamics of Kingsrose Mining.

- Assess Kingsrose Mining's previous results with our detailed historical performance reports.

Where To Now?

- Reveal the 1,030 hidden gems among our ASX Penny Stocks screener with a single click here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:FAL

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion