- Australia

- /

- Capital Markets

- /

- ASX:HM1

Top ASX Penny Stocks To Watch In February 2025

Reviewed by Simply Wall St

The Australian market is showing resilience amid global trade tensions, with local indices experiencing modest gains despite ongoing tariff exchanges between the U.S. and China. In such a climate, investors often turn their attention to smaller or newer companies for potential opportunities. Penny stocks, though an older term, continue to capture interest as they represent these emerging entities that can offer both affordability and growth potential when backed by strong financials.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.79 | A$141.28M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.575 | A$66.82M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.50 | A$310.07M | ★★★★★☆ |

| MaxiPARTS (ASX:MXI) | A$1.90 | A$106.21M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.535 | A$105.06M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.94 | A$322.38M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$3.00 | A$247.9M | ★★★★★★ |

| IVE Group (ASX:IGL) | A$2.20 | A$334.56M | ★★★★☆☆ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$235.35M | ★★★★★★ |

| Nickel Industries (ASX:NIC) | A$0.745 | A$3.2B | ★★★★★☆ |

Click here to see the full list of 1,032 stocks from our ASX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Emerald Resources (ASX:EMR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Emerald Resources NL is involved in the exploration and development of mineral reserves in Cambodia and Australia, with a market cap of A$2.81 billion.

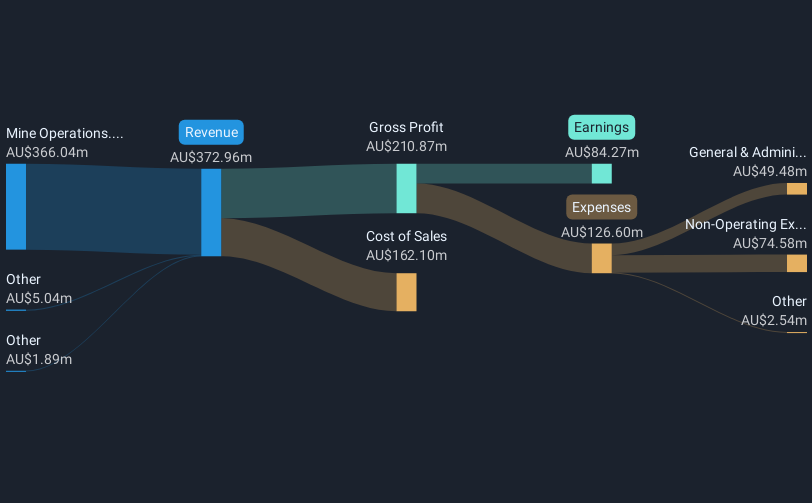

Operations: The company generates revenue primarily from its mine operations, amounting to A$366.04 million.

Market Cap: A$2.81B

Emerald Resources NL has demonstrated robust financial and operational performance, with a market cap of A$2.81 billion and significant revenue from its Okvau Gold Mine operations in Cambodia. The company reported record quarterly production, exceeding guidance with 31,888 ounces of gold produced. Improvements in plant throughput and process flow optimization have enhanced gold recovery rates to 85.4% for the quarter. Financially, Emerald's debt is well-covered by operating cash flow, interest payments are comfortably managed by EBIT, and the company holds more cash than total debt. Despite these strengths, Return on Equity remains low at 14.5%.

- Dive into the specifics of Emerald Resources here with our thorough balance sheet health report.

- Gain insights into Emerald Resources' future direction by reviewing our growth report.

Hearts and Minds Investments (ASX:HM1)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Hearts and Minds Investments (ASX:HM1) is an Australian investment company with a market cap of A$773.96 million, focusing on generating long-term capital growth by investing in high-conviction ideas from leading fund managers and supporting medical research.

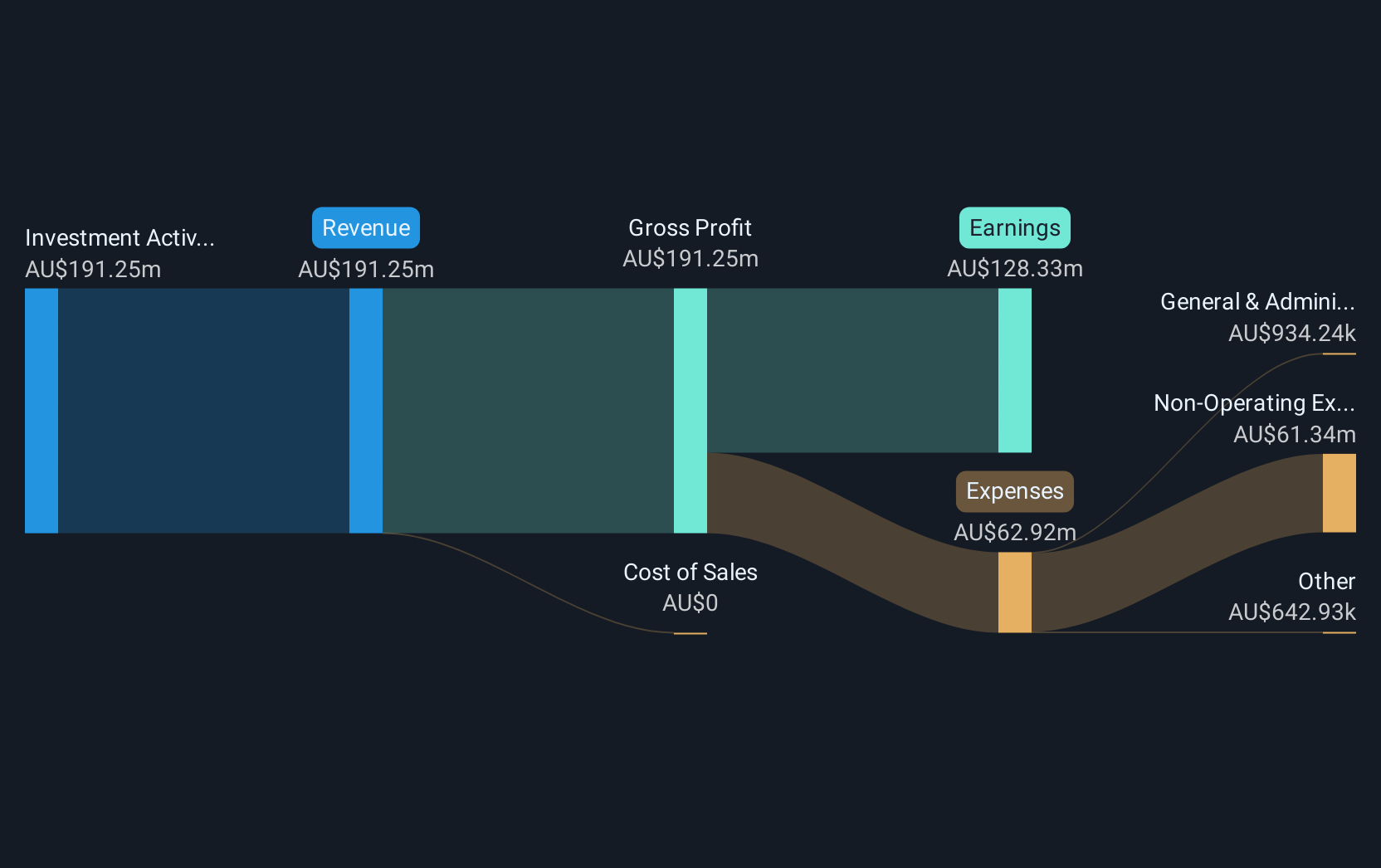

Operations: The company's revenue segment is derived entirely from investment activities, amounting to A$84.39 million.

Market Cap: A$773.96M

Hearts and Minds Investments, with a market cap of A$773.96 million, focuses on long-term capital growth through high-conviction investments. The company has shown strong earnings growth of 55.6% over the past year, surpassing its five-year average and the broader Capital Markets industry rate. While it holds more cash than total debt, operating cash flow remains negative, indicating potential challenges in covering debt obligations. Its short-term assets significantly exceed both short and long-term liabilities, providing financial stability. However, the dividend yield of 4.29% is not well-supported by free cash flows, suggesting caution for income-focused investors.

- Get an in-depth perspective on Hearts and Minds Investments' performance by reading our balance sheet health report here.

- Review our historical performance report to gain insights into Hearts and Minds Investments' track record.

Kairos Minerals (ASX:KAI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Kairos Minerals Limited is a resource exploration company operating in Australia, with a market cap of A$39.46 million.

Operations: Currently, there are no reported revenue segments for this resource exploration company operating in Australia.

Market Cap: A$39.46M

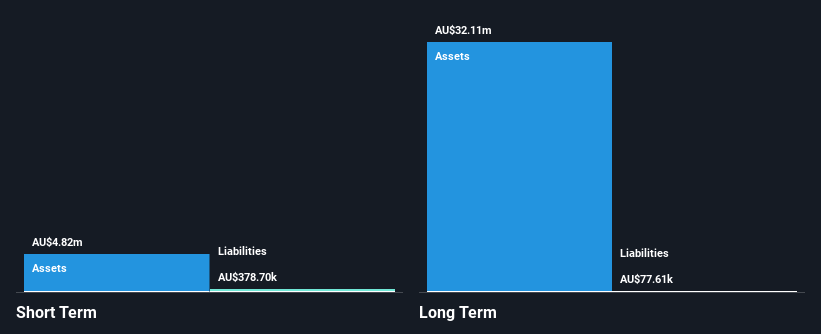

Kairos Minerals, with a market cap of A$39.46 million, is pre-revenue and currently unprofitable, though it has reduced losses by 36% annually over the past five years. The company holds A$4.8 million in short-term assets, comfortably covering its short and long-term liabilities. Despite being debt-free for five years, Kairos faces financial constraints with less than a year of cash runway based on current free cash flow trends. The management team is relatively new but experienced by industry standards. However, the stock exhibits high volatility compared to most Australian stocks, posing potential risks for investors seeking stability.

- Jump into the full analysis health report here for a deeper understanding of Kairos Minerals.

- Gain insights into Kairos Minerals' historical outcomes by reviewing our past performance report.

Make It Happen

- Access the full spectrum of 1,032 ASX Penny Stocks by clicking on this link.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hearts and Minds Investments might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:HM1

Hearts and Minds Investments

Proven track record with adequate balance sheet.

Market Insights

Community Narratives