ASX Penny Stocks Spotlight: EcoGraf And Two Other Promising Picks

Reviewed by Simply Wall St

The Australian market has shown resilience, with the ASX200 closing up 0.22% at 8,297 points, driven by gains in the IT and Financial sectors. While penny stocks may seem like a relic of past trading days, they still offer unique opportunities for growth in smaller or newer companies. When these stocks are backed by strong financials and solid fundamentals, they can present a chance for significant returns without many of the typical risks associated with this segment of the market.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Lindsay Australia (ASX:LAU) | A$0.705 | A$223.61M | ✅ 4 ⚠️ 2 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.83 | A$147.4M | ✅ 4 ⚠️ 2 View Analysis > |

| Accent Group (ASX:AX1) | A$1.95 | A$1.17B | ✅ 4 ⚠️ 2 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.60 | A$75.48M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.68 | A$413.21M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.615 | A$117.51M | ✅ 3 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$2.20 | A$2.51B | ✅ 4 ⚠️ 1 View Analysis > |

| GR Engineering Services (ASX:GNG) | A$2.76 | A$461.9M | ✅ 2 ⚠️ 1 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.30 | A$156.59M | ✅ 3 ⚠️ 1 View Analysis > |

| Regal Partners (ASX:RPL) | A$2.20 | A$739.56M | ✅ 4 ⚠️ 4 View Analysis > |

Click here to see the full list of 997 stocks from our ASX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

EcoGraf (ASX:EGR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: EcoGraf Limited focuses on the exploration and production of graphite products for lithium-ion batteries and advanced manufacturing markets in Tanzania and Australia, with a market cap of A$136.24 million.

Operations: The company generates its revenue primarily from Australia, amounting to A$3.94 million.

Market Cap: A$136.24M

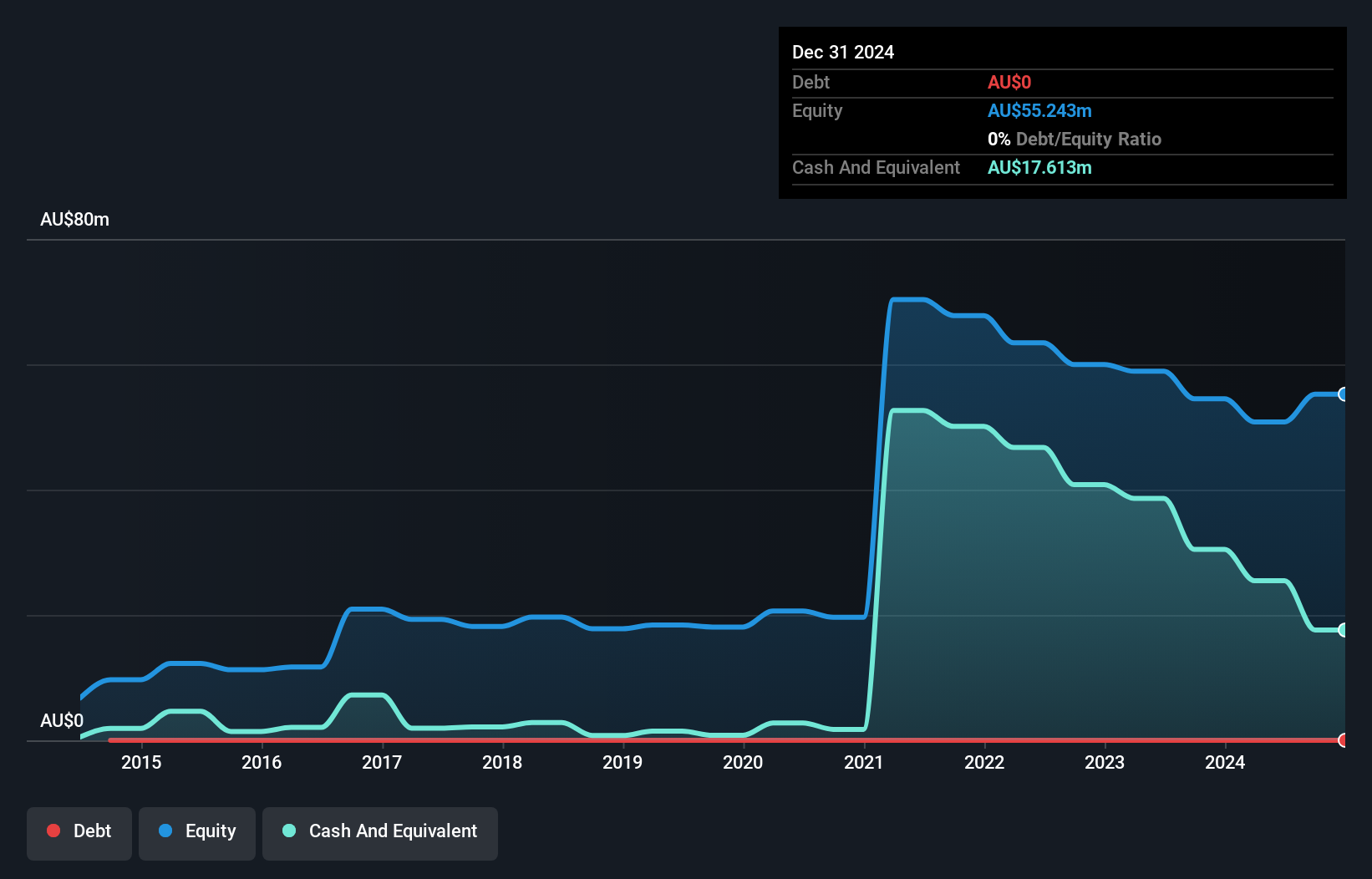

EcoGraf Limited, with a market cap of A$136.24 million, is pre-revenue and focuses on developing environmentally sustainable graphite products for battery anode materials. Recent milestones include the granting of a second HFfree® purification patent in Australia and successful product qualification results meeting high customer specifications for spherical graphite. The company has no debt and maintains sufficient cash runway exceeding one year based on current free cash flow. Despite its unprofitability, EcoGraf's strategic advancements in technology and partnerships position it to potentially benefit from increasing global demand driven by legislative incentives in the EU and US markets.

- Click here and access our complete financial health analysis report to understand the dynamics of EcoGraf.

- Evaluate EcoGraf's historical performance by accessing our past performance report.

Kairos Minerals (ASX:KAI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Kairos Minerals Limited, with a market cap of A$68.40 million, is a resource exploration company operating in Australia through its subsidiaries.

Operations: Kairos Minerals Limited does not report any revenue segments.

Market Cap: A$68.4M

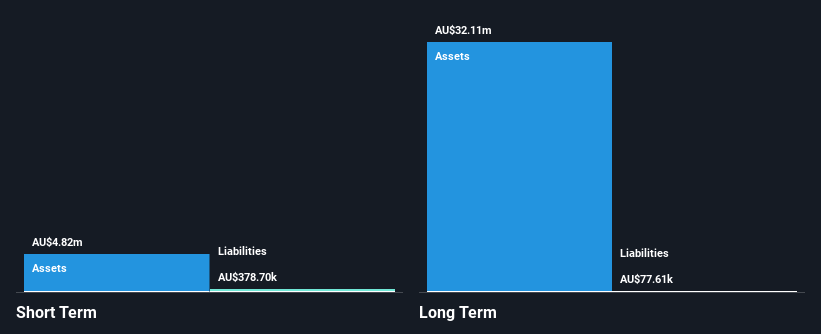

Kairos Minerals Limited, with a market cap of A$68.40 million, remains pre-revenue, reporting only A$0.35 million in revenue for the half year ending December 31, 2024. The company is debt-free and holds sufficient short-term assets (A$12.7M) to cover both its short-term and long-term liabilities comfortably. Despite a net loss of A$1.72 million for the period, Kairos has managed to reduce its losses over five years by approximately 24.9% annually and maintains a cash runway exceeding three years at current free cash flow levels, indicating financial stability amidst ongoing exploration activities.

- Navigate through the intricacies of Kairos Minerals with our comprehensive balance sheet health report here.

- Gain insights into Kairos Minerals' historical outcomes by reviewing our past performance report.

ReadyTech Holdings (ASX:RDY)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: ReadyTech Holdings Limited offers technology-based solutions in Australia and has a market cap of A$288.25 million.

Operations: The company generates revenue through three primary segments: Workforce Solutions (A$32.30 million), Government and Justice (A$43.21 million), and Education and Work Pathways (A$41.90 million).

Market Cap: A$288.25M

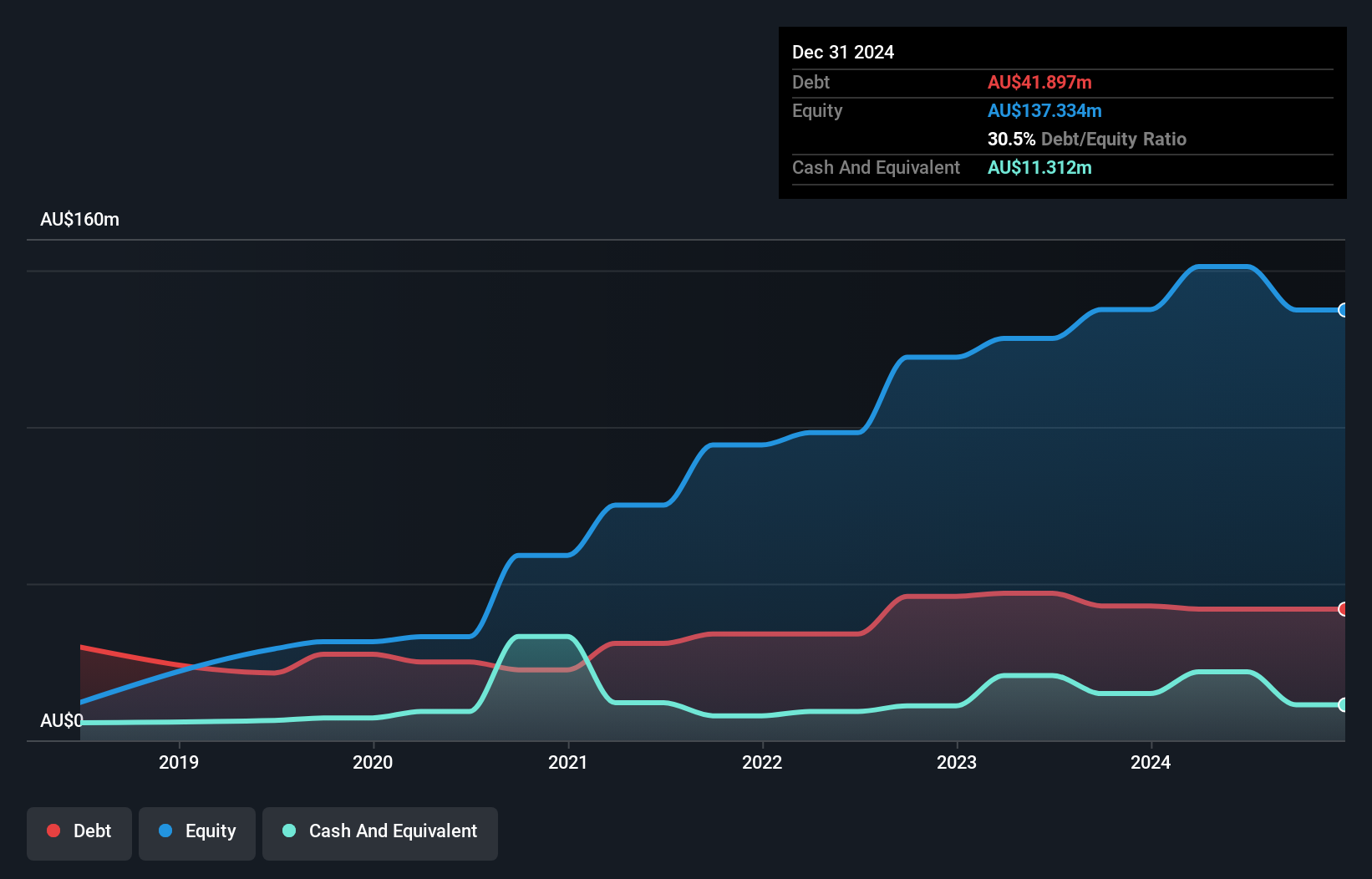

ReadyTech Holdings Limited, with a market cap of A$288.25 million, operates through three revenue-generating segments: Workforce Solutions (A$32.30 million), Government and Justice (A$43.21 million), and Education and Work Pathways (A$41.90 million). Despite its revenue streams, the company is currently unprofitable, reporting a net loss of A$18.72 million for the half year ending December 31, 2024. Its debt levels are well managed with a net debt to equity ratio of 22.3%, though short-term assets do not cover liabilities fully. Analysts forecast significant earnings growth at 60.98% per year amidst stable weekly volatility at 6%.

- Dive into the specifics of ReadyTech Holdings here with our thorough balance sheet health report.

- Review our growth performance report to gain insights into ReadyTech Holdings' future.

Turning Ideas Into Actions

- Jump into our full catalog of 997 ASX Penny Stocks here.

- Want To Explore Some Alternatives? AI is about to change healthcare. These 22 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:RDY

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives