As the Australian market holds steady with investors keenly awaiting key inflation data, the ASX 200 is set to open nearly unchanged, reflecting a cautious sentiment. In such a landscape, identifying strong investment opportunities requires careful consideration of financial health and growth potential. While penny stocks are often associated with smaller or emerging companies, they can still offer significant value when backed by robust fundamentals. This article will explore three promising penny stocks that stand out for their financial strength and potential for growth in today’s market conditions.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| LaserBond (ASX:LBL) | A$0.62 | A$72.68M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$127.64M | ★★★★☆☆ |

| Helloworld Travel (ASX:HLO) | A$1.78 | A$286.72M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.895 | A$104.82M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.57 | A$353.48M | ★★★★★☆ |

| Navigator Global Investments (ASX:NGI) | A$1.685 | A$825.78M | ★★★★★☆ |

| GTN (ASX:GTN) | A$0.47 | A$92.11M | ★★★★★★ |

| Joyce (ASX:JYC) | A$3.98 | A$117.4M | ★★★★★★ |

| EZZ Life Science Holdings (ASX:EZZ) | A$3.40 | A$151.04M | ★★★★★★ |

| Atlas Pearls (ASX:ATP) | A$0.13 | A$56.64M | ★★★★★★ |

Click here to see the full list of 1,028 stocks from our ASX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

COSOL (ASX:COS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: COSOL Limited, along with its subsidiaries, offers information technology services across the Asia Pacific, North America, Europe, the Middle East, Africa, and globally; it has a market cap of A$172.13 million.

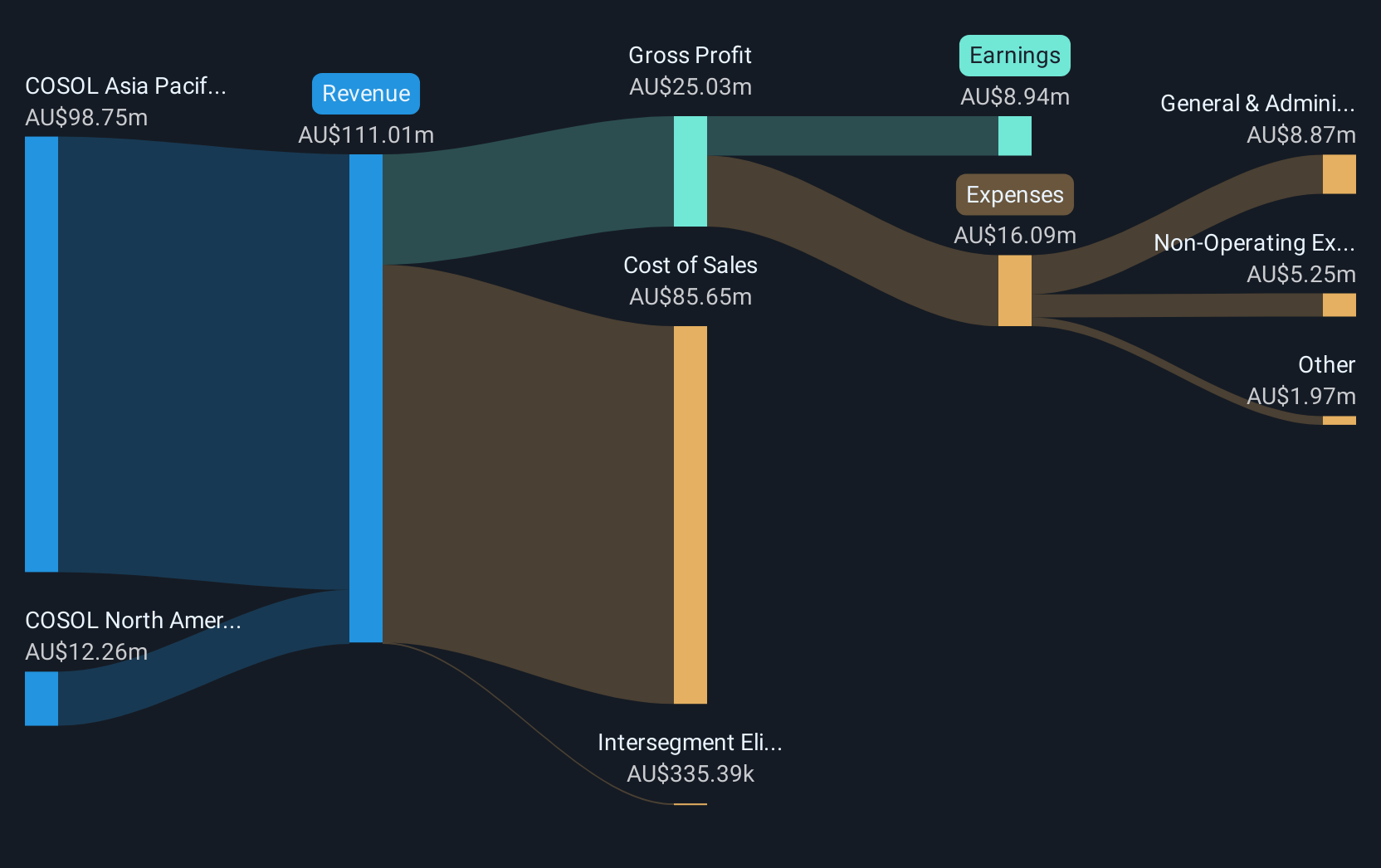

Operations: The company's revenue is primarily generated from the Asia Pacific region with A$88.99 million, complemented by A$13.88 million from North America.

Market Cap: A$172.13M

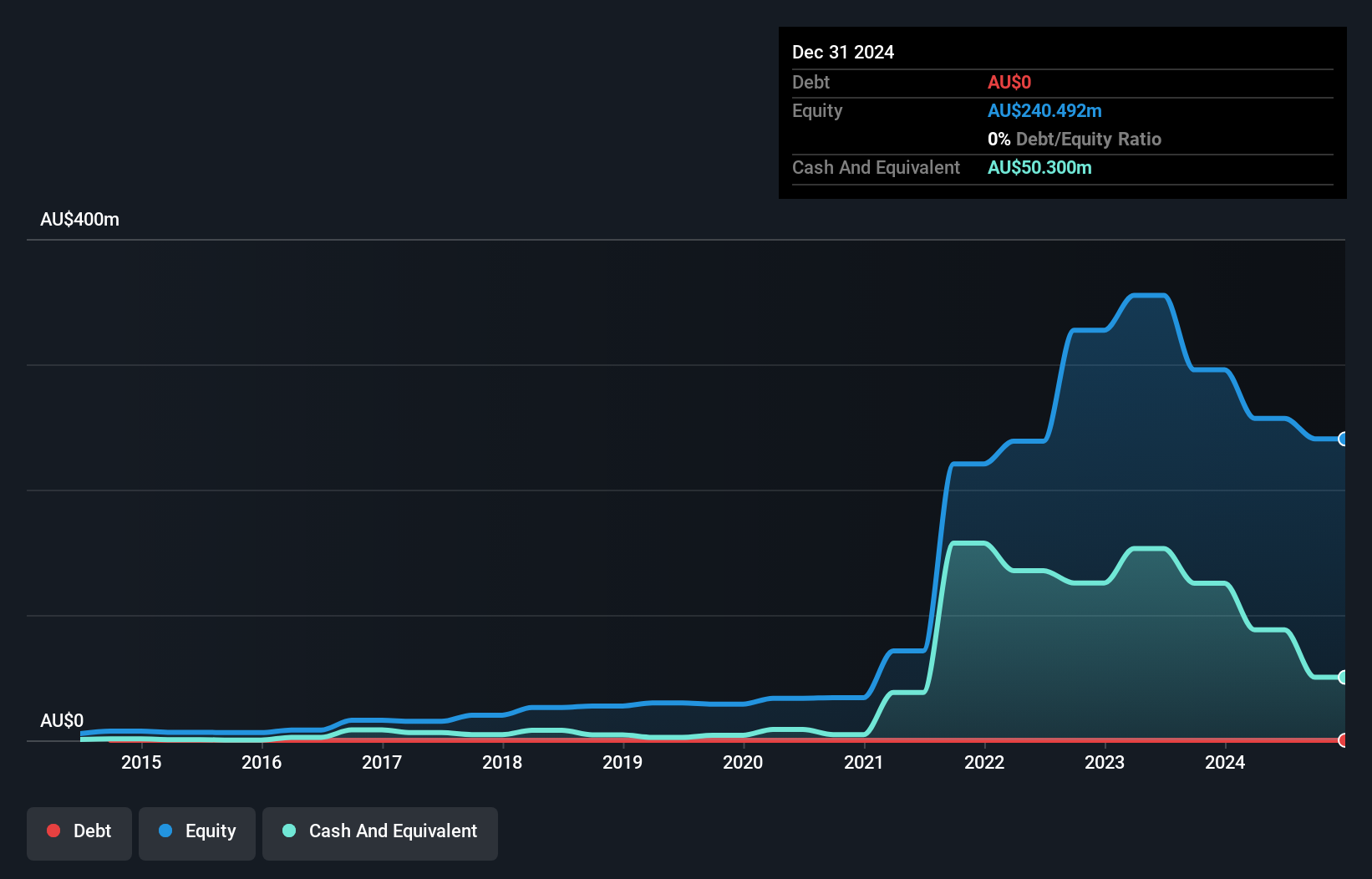

COSOL Limited, with a market cap of A$172.13 million, has shown consistent revenue growth, reporting A$101.93 million in sales for the year ended June 2024, up from A$75.1 million previously. Despite a slight decline in net profit margins from 10.6% to 8.4%, earnings have grown at an average annual rate of 27.5% over five years and are forecasted to grow by 20% annually moving forward. The company maintains a satisfactory net debt to equity ratio of 17.3%, with interest well covered by EBIT at 9.6x and operating cash flow covering debt adequately at 39%.

- Click to explore a detailed breakdown of our findings in COSOL's financial health report.

- Gain insights into COSOL's future direction by reviewing our growth report.

Core Lithium (ASX:CXO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Core Lithium Ltd focuses on developing lithium and various metal deposits in Northern Territory and South Australia, with a market cap of A$235.73 million.

Operations: The company's revenue is primarily generated from the Finniss Lithium Project, amounting to A$189.49 million.

Market Cap: A$235.73M

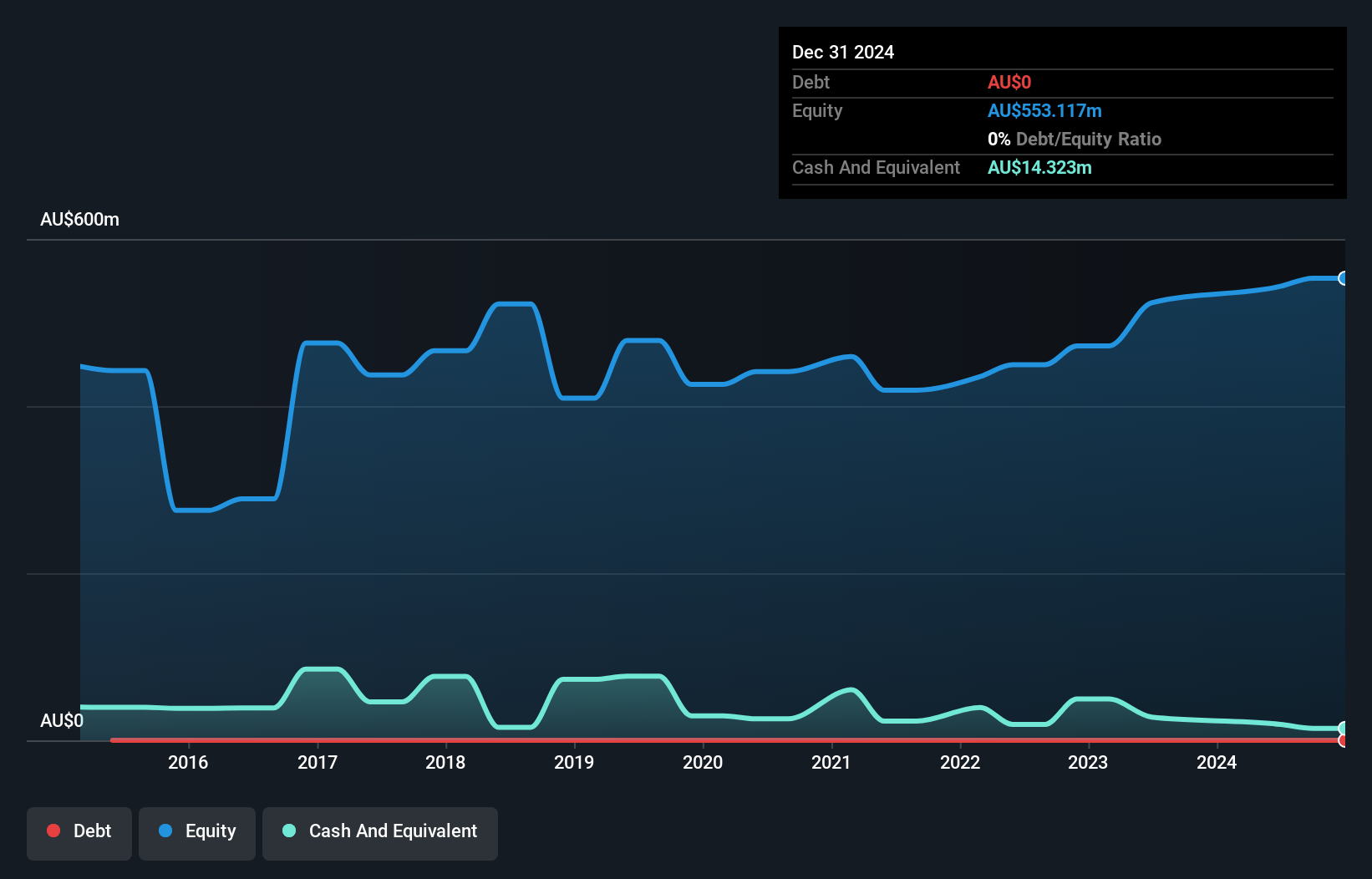

Core Lithium Ltd, with a market cap of A$235.73 million, is focused on developing lithium projects in Australia. Despite its significant revenue from the Finniss Lithium Project at A$189.49 million for the year ending June 2024, the company reported a net loss of A$207.01 million compared to a net income last year. The management team is relatively new with an average tenure of 0.6 years and faces challenges such as high share price volatility and ongoing unprofitability without expected profitability in the near term. However, it remains debt-free with sufficient short-term assets covering liabilities and has been added to the S&P/ASX Emerging Companies Index recently.

- Click here and access our complete financial health analysis report to understand the dynamics of Core Lithium.

- Examine Core Lithium's earnings growth report to understand how analysts expect it to perform.

Jupiter Mines (ASX:JMS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Jupiter Mines Limited is an independent mining company based in Australia with a market capitalization of A$342.99 million.

Operations: The company generates revenue primarily from its manganese operations in South Africa, totaling A$8.07 million.

Market Cap: A$343M

Jupiter Mines Limited, with a market cap of A$342.99 million, primarily generates revenue from its manganese operations in South Africa, reporting A$8.07 million in sales for the year ending June 2024. Despite being debt-free and having sufficient short-term assets to cover liabilities, the company faces challenges such as declining earnings over the past five years and low return on equity at 7.2%. Recent board changes include Sally Langer's appointment as an Independent Non-Executive Director following Patrick Murphy's retirement. Additionally, Jupiter Mines was added to the S&P Global BMI Index in September 2024.

- Jump into the full analysis health report here for a deeper understanding of Jupiter Mines.

- Assess Jupiter Mines' previous results with our detailed historical performance reports.

Summing It All Up

- Unlock more gems! Our ASX Penny Stocks screener has unearthed 1,025 more companies for you to explore.Click here to unveil our expertly curated list of 1,028 ASX Penny Stocks.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:COS

COSOL

Provides information technology services in the Asia Pacific, North America, Europe, the Middle East, Africa, and internationally.

Undervalued with excellent balance sheet.