- Australia

- /

- Consumer Finance

- /

- ASX:CCP

Asian Undervalued Small Caps With Insider Action In July 2025

Reviewed by Simply Wall St

In recent months, Asian markets have shown resilience amid global economic shifts, with key indices like Japan's Nikkei 225 and China's CSI 300 posting gains as trade tensions ease and investor sentiment improves. As small-cap stocks in Asia continue to navigate these dynamic conditions, identifying opportunities often involves looking for companies with strong fundamentals that can capitalize on favorable macroeconomic trends.

Top 10 Undervalued Small Caps With Insider Buying In Asia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| East West Banking | 3.2x | 0.7x | 31.26% | ★★★★★☆ |

| Atturra | 26.5x | 1.1x | 40.78% | ★★★★★☆ |

| Daiwa House Logistics Trust | 11.4x | 6.9x | 26.98% | ★★★★★☆ |

| Growthpoint Properties Australia | NA | 5.6x | 21.03% | ★★★★★☆ |

| Lion Rock Group | 5.0x | 0.4x | 49.81% | ★★★★☆☆ |

| Dicker Data | 18.7x | 0.6x | -12.40% | ★★★★☆☆ |

| Sing Investments & Finance | 7.5x | 3.8x | 36.99% | ★★★★☆☆ |

| AInnovation Technology Group | NA | 2.4x | 48.16% | ★★★★☆☆ |

| China XLX Fertiliser | 5.1x | 0.3x | -10.67% | ★★★☆☆☆ |

| Charter Hall Long WALE REIT | NA | 12.2x | 20.79% | ★★★☆☆☆ |

We'll examine a selection from our screener results.

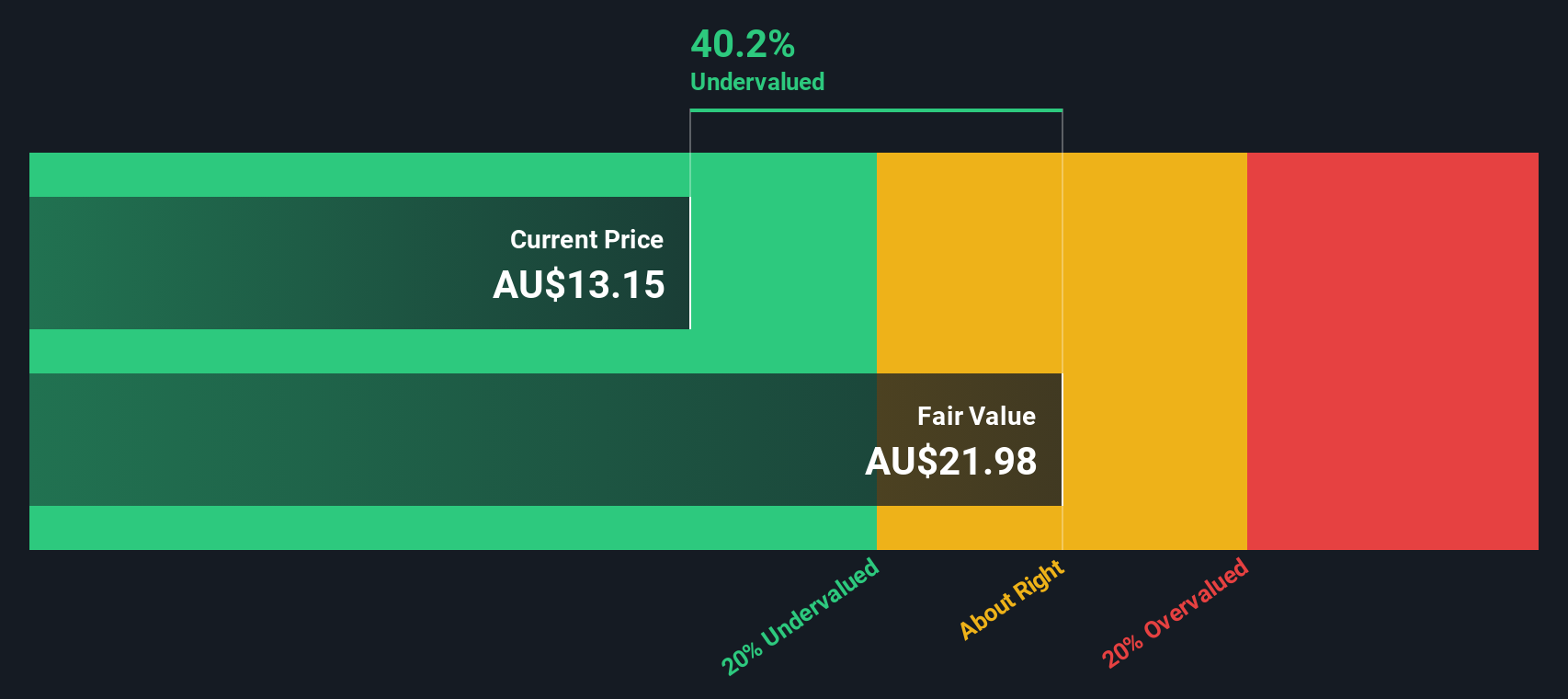

Credit Corp Group (ASX:CCP)

Simply Wall St Value Rating: ★★★★★★

Overview: Credit Corp Group operates in debt ledger purchasing across the United States, Australia, and New Zealand, as well as providing consumer lending services in these regions, with a market capitalization of A$1.83 billion.

Operations: The company generates revenue primarily from Debt Ledger Purchasing in the United States and Australia/New Zealand, as well as consumer lending across these regions. Over recent periods, the net income margin has shown variability, peaking at 27.61% in December 2021 and experiencing fluctuations thereafter. Operating expenses are significant, with General & Administrative Expenses being a major component.

PE: 8.8x

Credit Corp Group, a small company in Asia, recently presented at the Macquarie Emerging Leaders Conference on June 18, 2025. Despite its size and potential for growth, earnings are expected to decline by an average of 0.7% annually over the next three years. The company relies entirely on external borrowing for funding, which is considered riskier than customer deposits. However, insider confidence is evident with recent share purchases by insiders in the past six months.

- Get an in-depth perspective on Credit Corp Group's performance by reading our valuation report here.

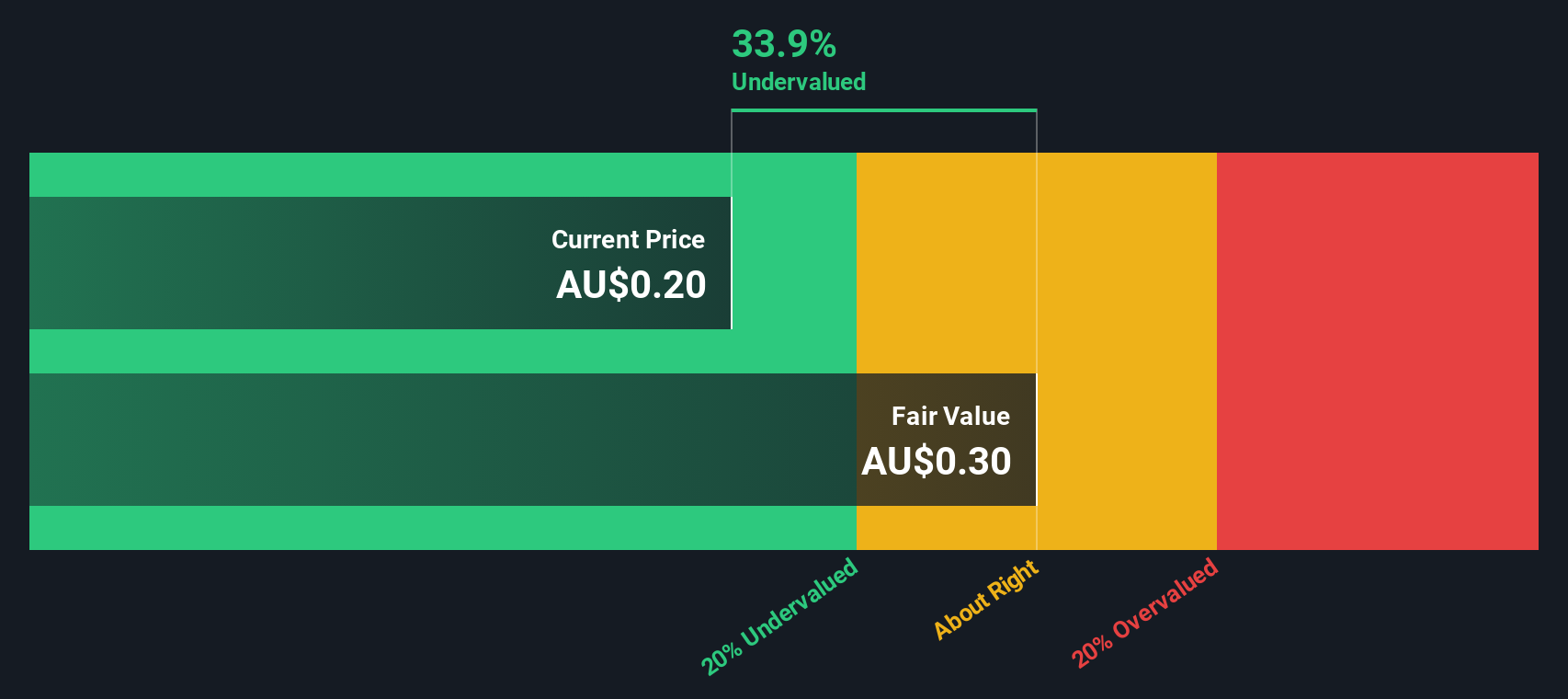

Jupiter Mines (ASX:JMS)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Jupiter Mines is a mining company that focuses on manganese production in South Africa, with a market cap of A$ 408.56 million.

Operations: The company's primary revenue stream is from its manganese operations in South Africa, with recent quarterly revenue of A$9.49 million. Despite consistent gross profit margins at 1.0%, net income margin has shown variability, most recently recorded at 4.06%.

PE: 10.2x

Jupiter Mines, a smaller player in the mining industry, has seen insider confidence with Peter North acquiring 520,000 shares valued at A$88,399 in May 2025. Despite a challenging backdrop of declining earnings by 11.6% annually over five years and lower profit margins compared to last year, this activity suggests potential optimism from within. The company relies entirely on external borrowing for funding, adding risk but also indicating room for strategic financial maneuvers.

- Click here and access our complete valuation analysis report to understand the dynamics of Jupiter Mines.

Understand Jupiter Mines' track record by examining our Past report.

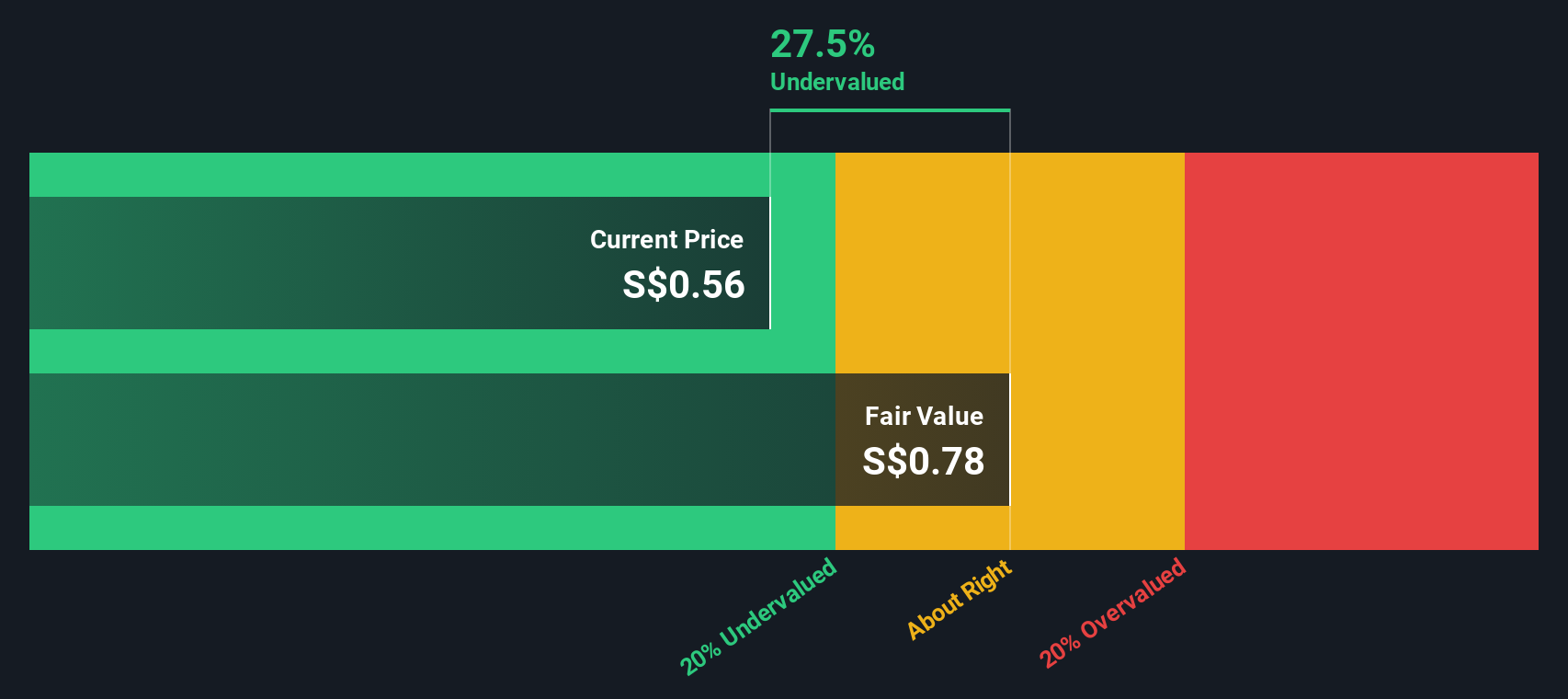

Daiwa House Logistics Trust (SGX:DHLU)

Simply Wall St Value Rating: ★★★★★☆

Overview: Daiwa House Logistics Trust focuses on investing in logistics and industrial properties, with a market cap of approximately SGD 0.55 billion.

Operations: Daiwa House Logistics Trust primarily generates revenue through its investments in logistics and industrial properties. Over recent periods, the company has experienced fluctuations in net income margin, with a notable peak of 2.06% in 2022 before settling at 0.61% by the end of 2024. The gross profit margin has shown relative stability, hovering around 76%, indicating efficient management of direct costs associated with property investments.

PE: 11.4x

Daiwa House Logistics Trust, a smaller player in the Asian market, is attracting attention due to insider confidence as insiders have increased their share purchases over the past few months. Despite its financial position being strained by debt not fully covered by operating cash flow and earnings impacted by large one-off items, the trust continues to draw interest. However, with earnings projected to decline 4.9% annually over three years and reliance on external borrowing for funding, potential investors should weigh these risks carefully against any perceived value.

Turning Ideas Into Actions

- Discover the full array of 53 Undervalued Asian Small Caps With Insider Buying right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CCP

Credit Corp Group

Engages in the provision of debt ledger purchase and collection, and consumer lending services in Australia, New Zealand, and the United States.

Very undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives