- Australia

- /

- Consumer Finance

- /

- ASX:CCP

Asian Undervalued Small Caps With Insider Action

Reviewed by Simply Wall St

As global markets navigate the complexities of trade policies and economic indicators, small-cap stocks in Asia present intriguing opportunities amid fluctuating market sentiments. With inflation trends and economic growth projections influencing investor decisions, identifying promising small-cap companies requires a keen understanding of their potential to thrive in these dynamic conditions.

Top 10 Undervalued Small Caps With Insider Buying In Asia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Security Bank | 4.3x | 1.0x | 37.76% | ★★★★★★ |

| East West Banking | 3.1x | 0.7x | 33.40% | ★★★★★☆ |

| ReadyTech Holdings | NA | 2.5x | 49.73% | ★★★★★☆ |

| Lion Rock Group | 5.0x | 0.4x | 49.92% | ★★★★☆☆ |

| Puregold Price Club | 8.4x | 0.4x | 43.10% | ★★★★☆☆ |

| Atturra | 29.0x | 1.2x | 31.41% | ★★★★☆☆ |

| Sing Investments & Finance | 7.2x | 3.7x | 39.67% | ★★★★☆☆ |

| PWR Holdings | 35.2x | 4.9x | 23.47% | ★★★☆☆☆ |

| Dicker Data | 18.6x | 0.6x | -14.11% | ★★★☆☆☆ |

| Integral Diagnostics | 159.1x | 1.8x | 43.36% | ★★★☆☆☆ |

Let's uncover some gems from our specialized screener.

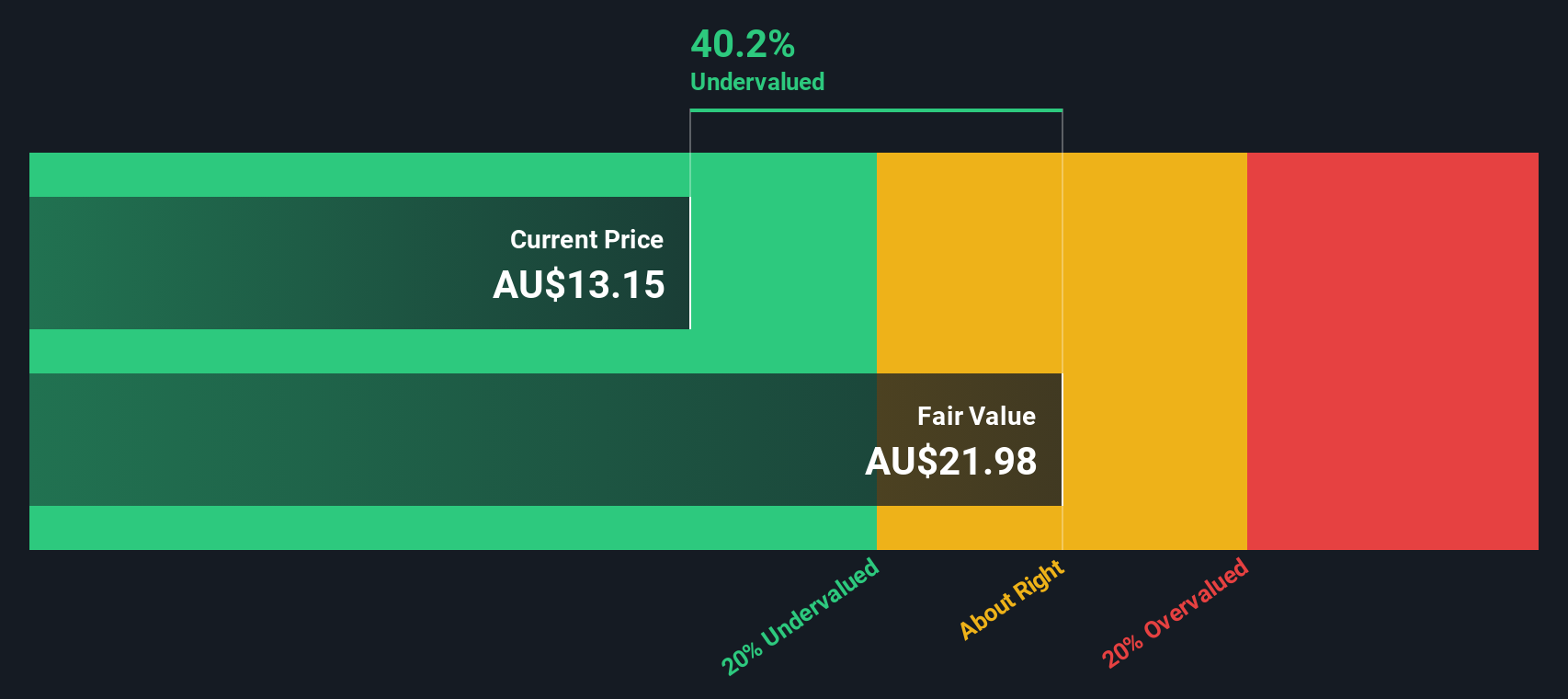

Credit Corp Group (ASX:CCP)

Simply Wall St Value Rating: ★★★★★★

Overview: Credit Corp Group operates in debt ledger purchasing across the United States, Australia, and New Zealand, as well as consumer lending in these regions, with a market cap of A$2.17 billion.

Operations: The company's revenue streams include Debt Ledger Purchasing in the United States and Australia/New Zealand, along with consumer lending across these regions. Operating expenses are significant, with General & Administrative Expenses being a major component. The net income margin has shown variability, reaching 26.28% at its peak and declining to 13.36% more recently.

PE: 8.6x

Credit Corp Group, a small cap in Asia, is catching attention for its potential value. Despite relying entirely on external borrowing for funding, which adds risk compared to customer deposits, insider confidence is evident with share purchases over the past six months. However, earnings are expected to decline by an average of 0.7% annually over the next three years. This dynamic presents both challenges and opportunities for investors considering its future trajectory in a competitive market environment.

- Get an in-depth perspective on Credit Corp Group's performance by reading our valuation report here.

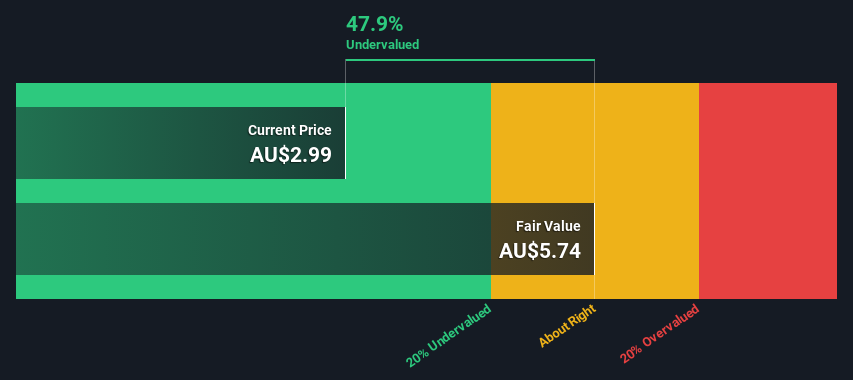

Integral Diagnostics (ASX:IDX)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Integral Diagnostics operates diagnostic imaging facilities and has a market capitalization of A$1.06 billion.

Operations: The company generates revenue primarily from operating diagnostic imaging facilities, with recent figures showing A$491.32 million in revenue. The cost of goods sold (COGS) was A$335.79 million, leading to a gross profit of A$155.53 million and a gross profit margin of 31.66%. Operating expenses totaled A$112.35 million, while non-operating expenses amounted to A$37.52 million, impacting the net income margin which stood at 1.15%.

PE: 159.1x

Integral Diagnostics, with a market value of A$837 million, presents an intriguing opportunity in the healthcare sector. Despite recent share price declines, insider confidence is evident as James Hall purchased 36,000 shares for A$78,840 between March and June 2025. The company faces challenges with high-risk external borrowing and past shareholder dilution but remains attractive to private equity firms following M&A rumors. Future earnings growth is forecasted at 40% annually, suggesting potential for recovery and expansion.

- Take a closer look at Integral Diagnostics' potential here in our valuation report.

Gain insights into Integral Diagnostics' past trends and performance with our Past report.

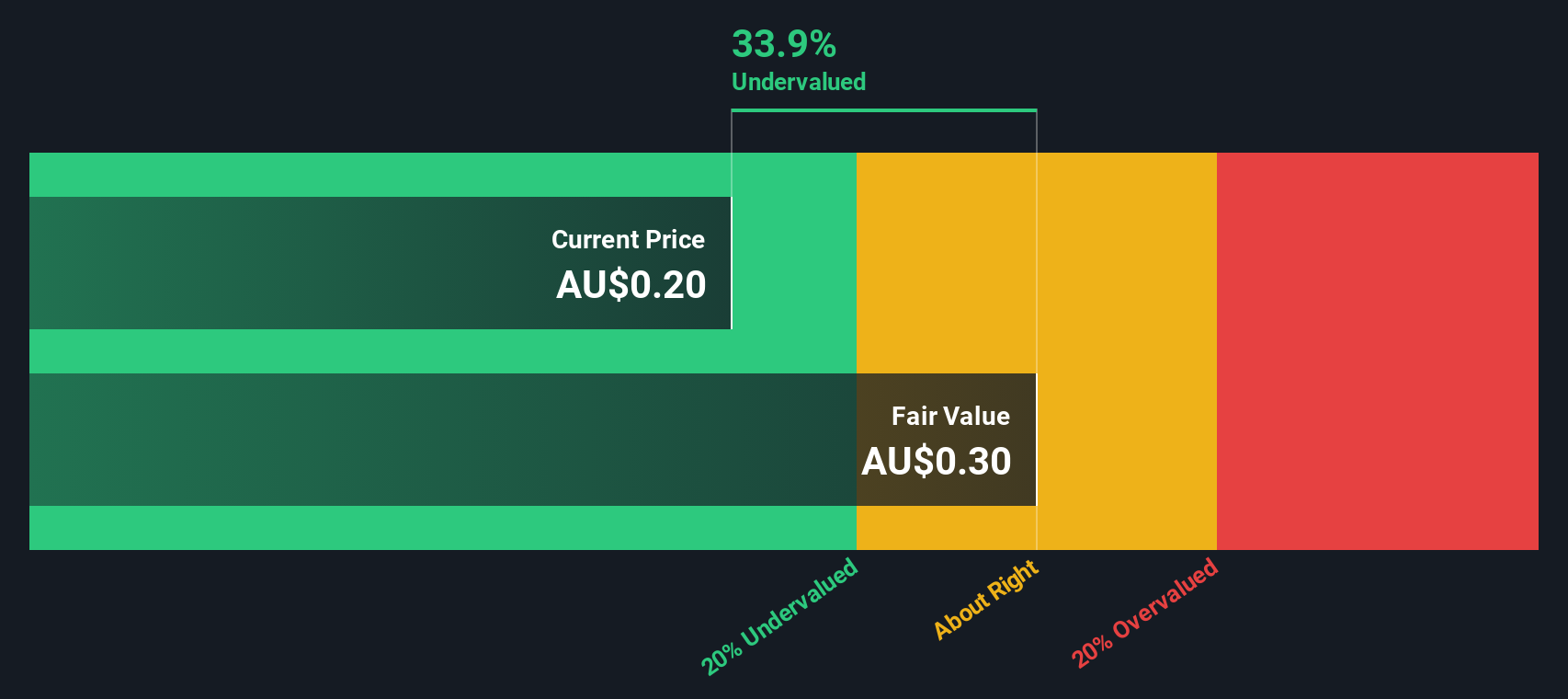

Jupiter Mines (ASX:JMS)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Jupiter Mines is involved in manganese mining operations primarily in South Africa and has a market capitalization of approximately A$1.05 billion.

Operations: The primary revenue stream is derived from manganese sales in South Africa, with recent figures showing A$9.49 million. Operating expenses have been significant, with the latest recorded at A$7.61 million, impacting net income margins which were last noted at 4.06%. The gross profit margin consistently stands at 1.00%, indicating a stable relationship between revenue and cost of goods sold over time.

PE: 10.7x

Jupiter Mines, a smaller player in Asia's mining sector, has seen insider confidence with Peter North purchasing 520,000 shares worth A$88,399 between April and May 2025. Despite facing an 11.6% annual decline in earnings over the past five years and relying entirely on external borrowing for funding, the company remains intriguing due to these insider activities. Recent leadership changes with Kiho Han joining as Director may signal strategic shifts aimed at enhancing future prospects.

- Unlock comprehensive insights into our analysis of Jupiter Mines stock in this valuation report.

Assess Jupiter Mines' past performance with our detailed historical performance reports.

Make It Happen

- Click this link to deep-dive into the 64 companies within our Undervalued Asian Small Caps With Insider Buying screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CCP

Credit Corp Group

Engages in the provision of debt ledger purchase and collection, and consumer lending services in Australia, New Zealand, and the United States.

Very undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives