Insiders who bought AU$101.6k worth of IRIS Metals Limited (ASX:IR1) stock in the last year recovered part of their losses as the stock rose by 15% last week. However, the purchase is proving to be a costly gamble, since losses made by insiders have totalled AU$49k since the time of purchase.

Although we don't think shareholders should simply follow insider transactions, we do think it is perfectly logical to keep tabs on what insiders are doing.

View our latest analysis for IRIS Metals

The Last 12 Months Of Insider Transactions At IRIS Metals

The insider Simon Lill made the biggest insider purchase in the last 12 months. That single transaction was for AU$102k worth of shares at a price of AU$0.69 each. That means that even when the share price was higher than AU$0.35 (the recent price), an insider wanted to purchase shares. Their view may have changed since then, but at least it shows they felt optimistic at the time. To us, it's very important to consider the price insiders pay for shares. Generally speaking, it catches our eye when an insider has purchased shares at above current prices, as it suggests they believed the shares were worth buying, even at a higher price. Simon Lill was the only individual insider to buy during the last year.

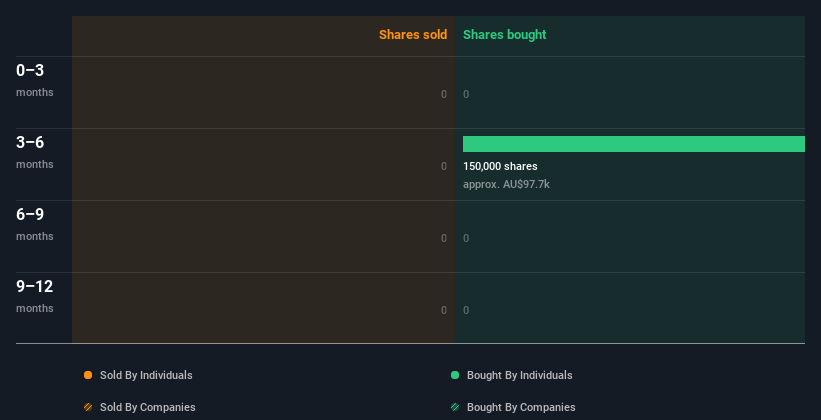

The chart below shows insider transactions (by companies and individuals) over the last year. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

IRIS Metals is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Does IRIS Metals Boast High Insider Ownership?

For a common shareholder, it is worth checking how many shares are held by company insiders. A high insider ownership often makes company leadership more mindful of shareholder interests. IRIS Metals insiders own 43% of the company, currently worth about AU$19m based on the recent share price. This kind of significant ownership by insiders does generally increase the chance that the company is run in the interest of all shareholders.

So What Does This Data Suggest About IRIS Metals Insiders?

It doesn't really mean much that no insider has traded IRIS Metals shares in the last quarter. On a brighter note, the transactions over the last year are encouraging. It would be great to see more insider buying, but overall it seems like IRIS Metals insiders are reasonably well aligned (owning significant chunk of the company's shares) and optimistic for the future. So while it's helpful to know what insiders are doing in terms of buying or selling, it's also helpful to know the risks that a particular company is facing. When we did our research, we found 4 warning signs for IRIS Metals (2 are concerning!) that we believe deserve your full attention.

Of course IRIS Metals may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:IR1

IRIS Metals

Engages in exploration, evaluation, and acquisition of mining tenements in South Dakota, the United States.

High growth potential with moderate risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion