Three ASX Growth Companies With High Insider Ownership And Earnings Growth Of At Least 14%

Reviewed by Simply Wall St

Recent data indicating a rise in Australia's CPI inflation has led to significant sell-offs on the ASX200, reflecting heightened market sensitivity and volatility. Amidst these challenging conditions, investors may find reassurance in growth companies with high insider ownership, as such stakes can signal confidence from those who know the company best.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Hartshead Resources (ASX:HHR) | 13.9% | 86.3% |

| Cettire (ASX:CTT) | 28.7% | 29.9% |

| Gratifii (ASX:GTI) | 15.6% | 112.4% |

| Acrux (ASX:ACR) | 14.6% | 115.3% |

| Doctor Care Anywhere Group (ASX:DOC) | 28.4% | 96.4% |

| Alpha HPA (ASX:A4N) | 26.3% | 95.9% |

| Plenti Group (ASX:PLT) | 12.6% | 106.4% |

| Botanix Pharmaceuticals (ASX:BOT) | 11.4% | 120.9% |

| Hillgrove Resources (ASX:HGO) | 10.4% | 45.4% |

| Liontown Resources (ASX:LTR) | 16.4% | 63.9% |

We're going to check out a few of the best picks from our screener tool.

IperionX (ASX:IPX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: IperionX Limited is a company focused on the exploration and development of mineral properties in the United States, with a market capitalization of approximately A$554.22 million.

Operations: The firm is primarily involved in the exploration and development of mineral properties in the United States.

Insider Ownership: 15.2%

Earnings Growth Forecast: 47.4% p.a.

IperionX, an Australian growth company with high insider ownership, recently raised A$50 million through a follow-on equity offering priced at A$1.91 per share. This capital infusion is poised to support its partnership with Vegas Fastener Manufacturing to supply advanced titanium products for the U.S. Army and other critical sectors. Despite a challenging financial performance with a net loss of US$10.5 million in the last half-year, IperionX is expected to see substantial revenue growth (76.4% annually) and become profitable within three years, underpinned by innovative technologies in titanium processing which promise significant sustainability and cost advantages over traditional methods.

- Delve into the full analysis future growth report here for a deeper understanding of IperionX.

- Insights from our recent valuation report point to the potential overvaluation of IperionX shares in the market.

Mesoblast (ASX:MSB)

Simply Wall St Growth Rating: ★★★★★☆

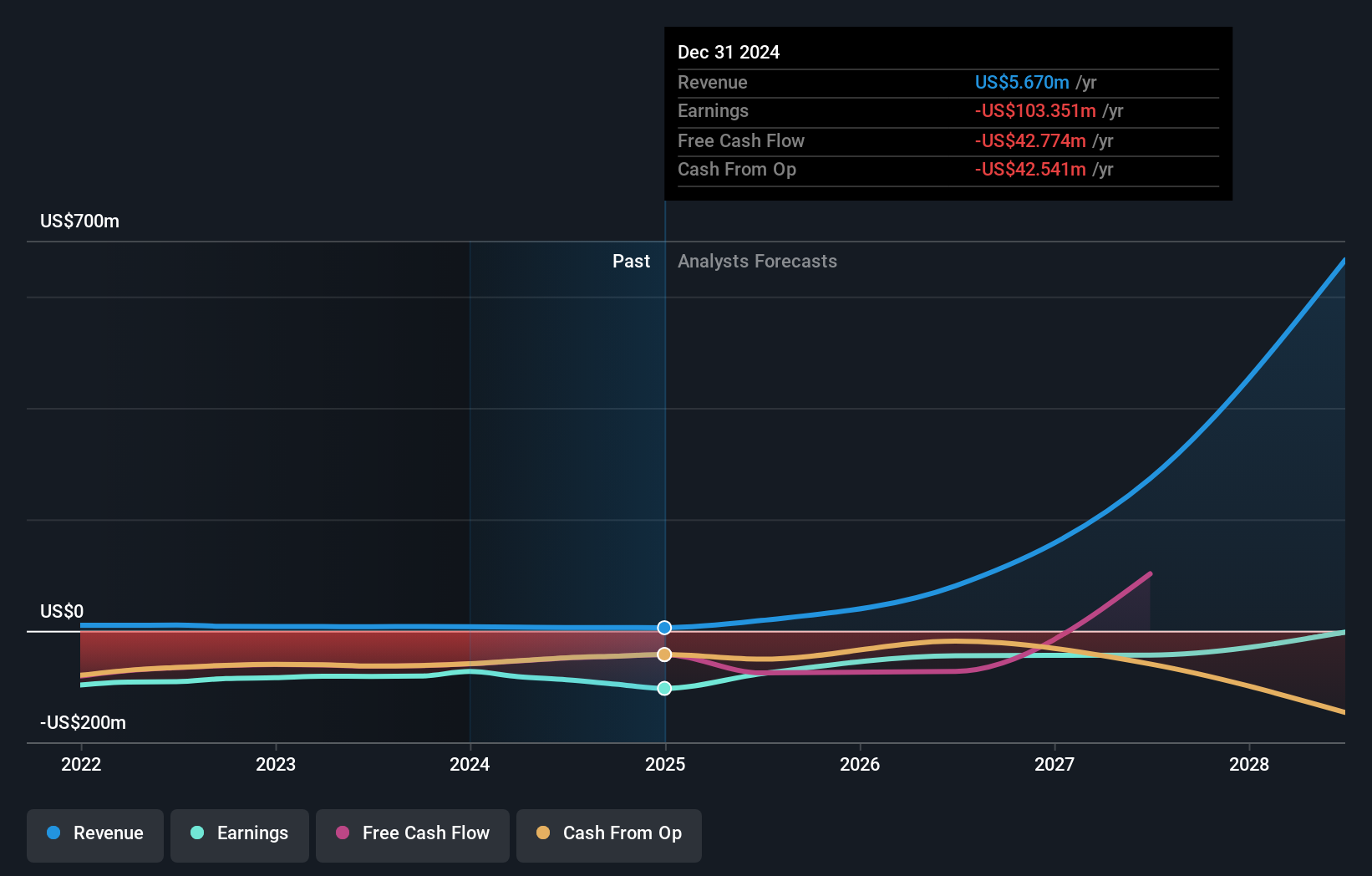

Overview: Mesoblast Limited is a biopharmaceutical company focused on developing regenerative medicine products, with operations in Australia, the United States, Singapore, and Switzerland, and a market capitalization of approximately A$1.32 billion.

Operations: The company generates revenue primarily from its development of adult stem cell technology, totaling A$7.47 million.

Insider Ownership: 22.2%

Earnings Growth Forecast: 56.8% p.a.

Mesoblast Limited, an Australian growth company with high insider ownership, is poised for substantial growth with a forecasted annual revenue increase of 55.3%. Despite recent share dilution, insider buying activity has been robust over the past three months. The company's valuation stands significantly below its estimated fair value, reflecting potential upside. However, its share price has shown high volatility recently. Leadership changes include appointing Jane Bell as non-executive Chair, enhancing governance with her extensive finance and healthcare experience.

- Click here and access our complete growth analysis report to understand the dynamics of Mesoblast.

- Our valuation report here indicates Mesoblast may be undervalued.

Technology One (ASX:TNE)

Simply Wall St Growth Rating: ★★★★☆☆

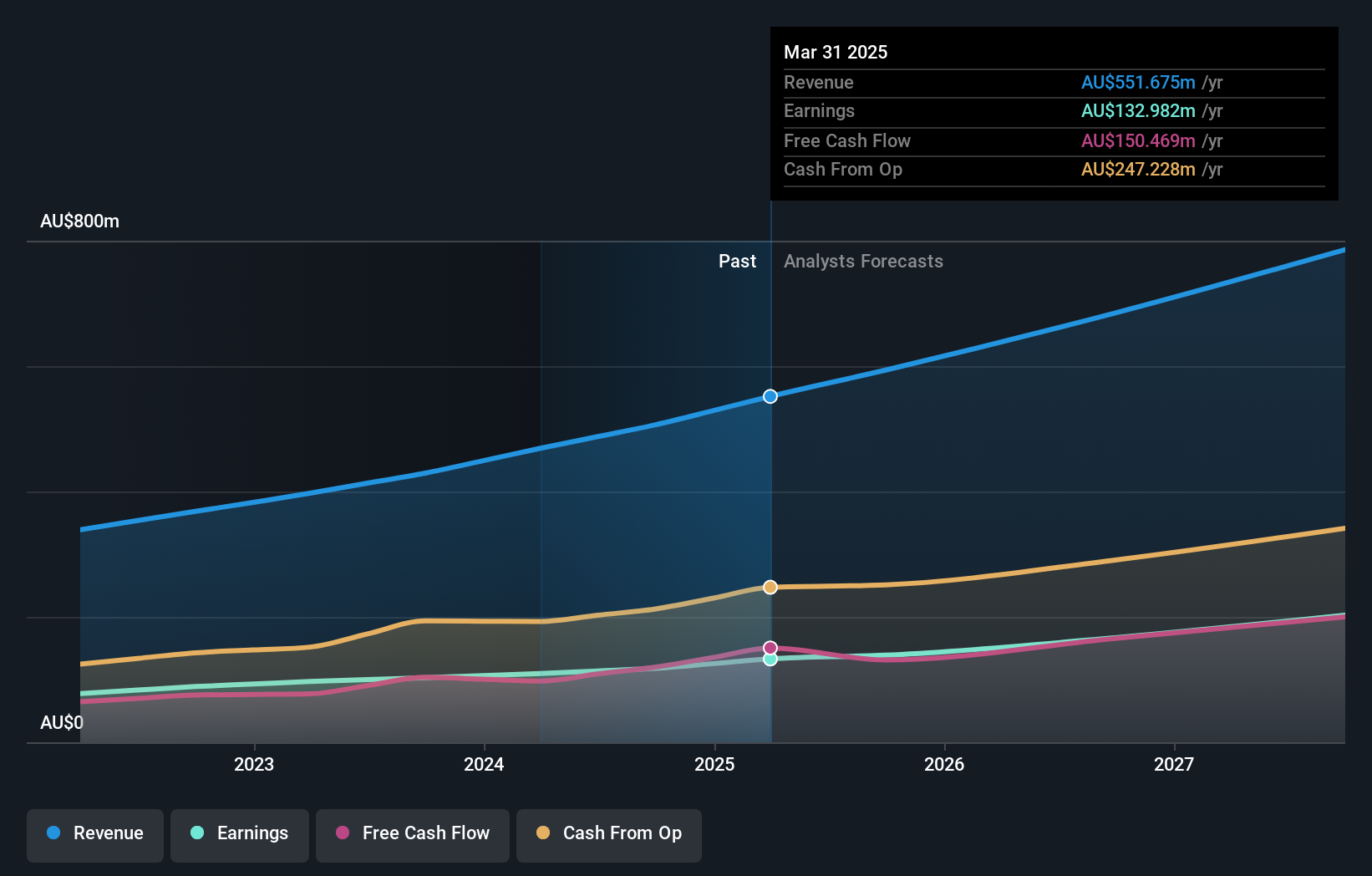

Overview: Technology One Limited is a company that develops, markets, sells, implements, and supports integrated enterprise business software solutions in Australia and internationally, with a market capitalization of approximately A$5.80 billion.

Operations: The company generates revenue through three primary segments: software sales contributing A$317.24 million, corporate services adding A$83.83 million, and consulting services at A$68.13 million.

Insider Ownership: 12.3%

Earnings Growth Forecast: 14.2% p.a.

Technology One Limited, an Australian growth firm with high insider ownership, reported a robust half-year performance with revenue rising to A$240.83 million and net income increasing to A$48 million. The company's earnings have grown by 13.1% over the past year and are expected to outpace the Australian market with a forecasted annual growth rate of 14.2%. Despite this, its revenue growth forecast of 11.1% per year trails behind significant benchmarks but still exceeds average market projections. With a Price-To-Earnings ratio lower than the industry average, it presents as reasonably valued amidst its growth trajectory.

- Unlock comprehensive insights into our analysis of Technology One stock in this growth report.

- Upon reviewing our latest valuation report, Technology One's share price might be too optimistic.

Make It Happen

- Click through to start exploring the rest of the 88 Fast Growing ASX Companies With High Insider Ownership now.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Technology One might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:TNE

Technology One

Develops, markets, sells, implements, and supports integrated enterprise business software solutions in Australia and internationally.

Flawless balance sheet with reasonable growth potential.