- Australia

- /

- Metals and Mining

- /

- ASX:IPT

Discovering ASX Penny Stocks To Watch In October 2024

Reviewed by Simply Wall St

The Australian market has shown a modest uptick with the ASX200 rising by 0.31%, buoyed by strong performances in the Health Care and Financial sectors, while Information Technology lagged behind. In such a varied market landscape, identifying stocks with solid fundamentals becomes crucial for investors seeking potential growth opportunities. Although 'penny stocks' might seem like an outdated term, they still offer intriguing prospects when these smaller or newer companies demonstrate financial strength and growth potential.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| LaserBond (ASX:LBL) | A$0.61 | A$71.5M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$127.64M | ★★★★☆☆ |

| MaxiPARTS (ASX:MXI) | A$1.87 | A$103.44M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.55 | A$341.08M | ★★★★★☆ |

| Helloworld Travel (ASX:HLO) | A$1.845 | A$297.19M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.72 | A$842.94M | ★★★★★☆ |

| Perenti (ASX:PRN) | A$1.19 | A$1.1B | ★★★★★★ |

| Atlas Pearls (ASX:ATP) | A$0.135 | A$58.82M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.47 | A$92.11M | ★★★★★★ |

| Joyce (ASX:JYC) | A$3.915 | A$115.48M | ★★★★★★ |

Click here to see the full list of 1,032 stocks from our ASX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Freehill Mining (ASX:FHS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Freehill Mining Limited is involved in the mining and exploration of mineral resources in Chile, with a market capitalization of A$18.47 million.

Operations: The company's revenue is derived from its mining operations in Chile, generating A$0.69 million.

Market Cap: A$18.47M

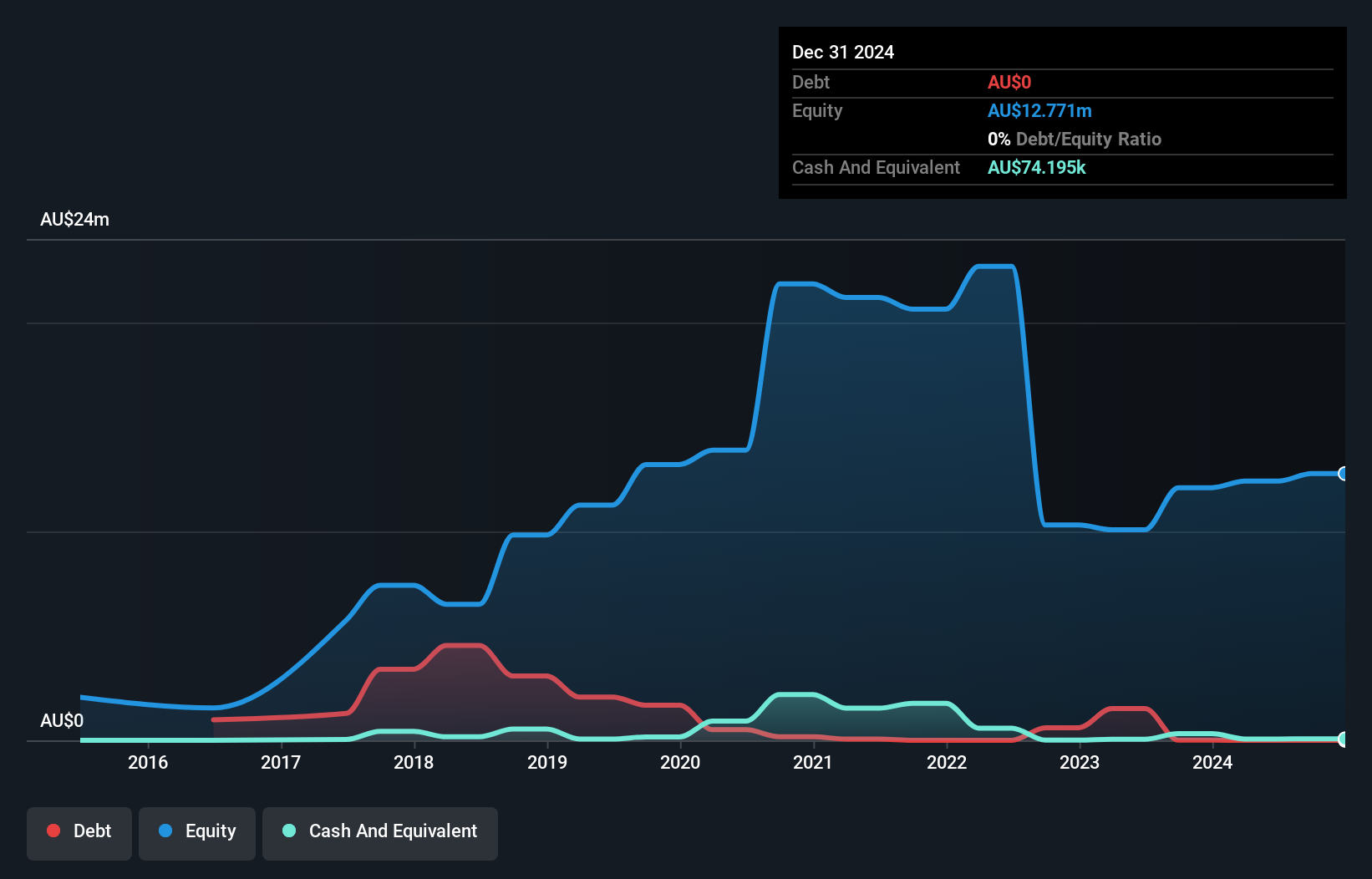

Freehill Mining Limited, with a market capitalization of A$18.47 million, remains pre-revenue despite generating A$0.69 million from its Chilean operations. The company's board is relatively new, with an average tenure of 1.5 years, indicating potential inexperience. Although the company has no debt and its short-term assets cover both short and long-term liabilities, it faces challenges such as high share price volatility and recent shareholder dilution by 8.2%. Freehill Mining's net loss improved significantly over the past year but remains unprofitable, highlighting ongoing financial hurdles for investors to consider in this penny stock environment.

- Unlock comprehensive insights into our analysis of Freehill Mining stock in this financial health report.

- Learn about Freehill Mining's historical performance here.

Impact Minerals (ASX:IPT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Impact Minerals Limited is an exploration company in Australia with a market cap of A$39.77 million.

Operations: The company's revenue primarily comes from its mineral exploration segment, which generated A$0.12 million.

Market Cap: A$39.77M

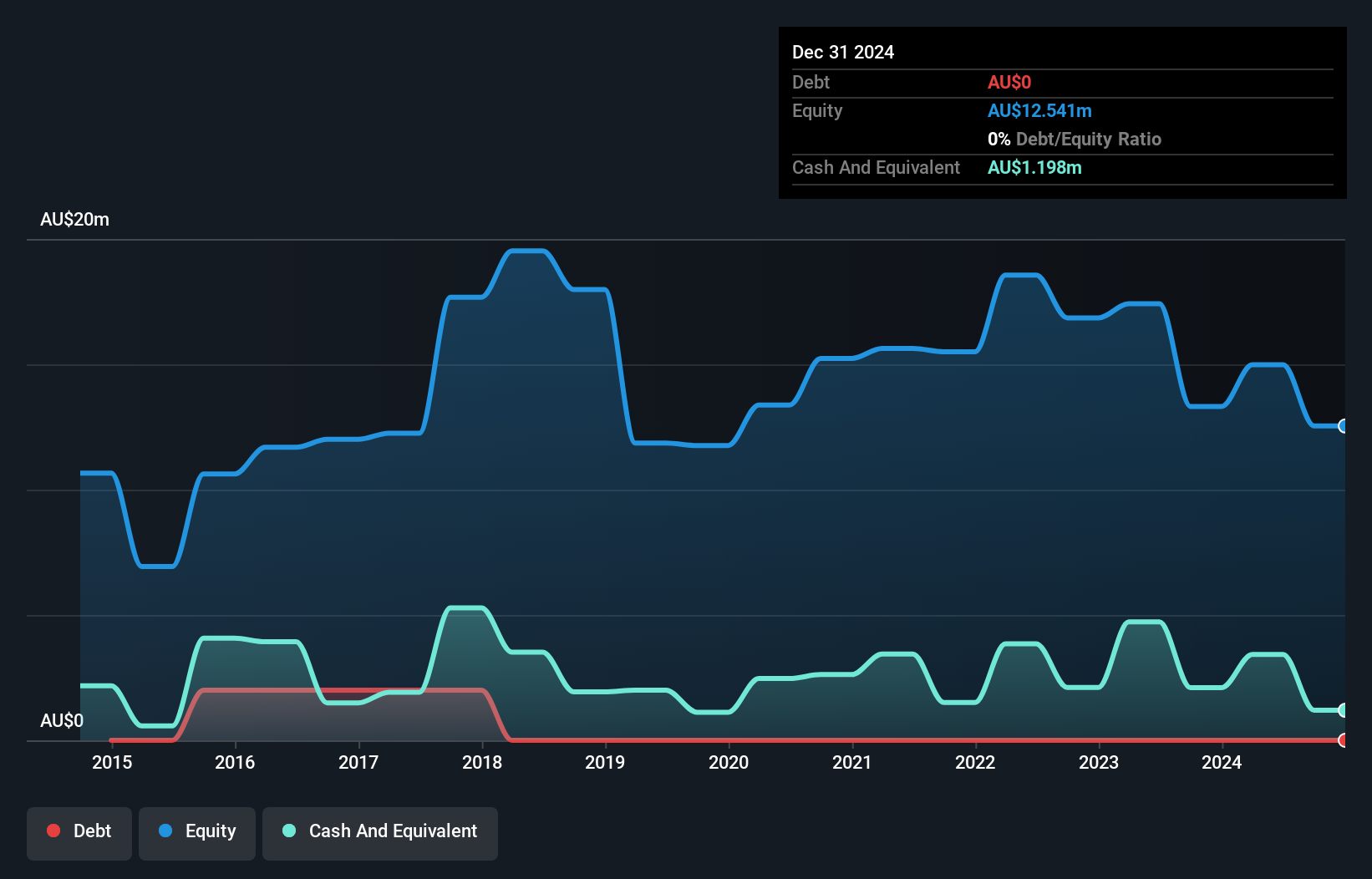

Impact Minerals Limited, with a market cap of A$39.77 million, remains pre-revenue, generating only A$0.12 million from its exploration activities. The company reported a net loss of A$6.75 million for the year ended June 2024, widening from the previous year. Despite being debt-free and having short-term assets exceeding liabilities, Impact faces challenges such as shareholder dilution and limited cash runway projected at four months without additional capital raises. While its board is experienced with an average tenure of 16.8 years, ongoing unprofitability and increased losses over five years present significant risks in this investment landscape.

- Get an in-depth perspective on Impact Minerals' performance by reading our balance sheet health report here.

- Gain insights into Impact Minerals' historical outcomes by reviewing our past performance report.

Marmota (ASX:MEU)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Marmota Limited is an Australian company focused on the exploration of mineral properties, with a market capitalization of A$43.46 million.

Operations: Currently, there are no reported revenue segments for this Australian exploration-focused company.

Market Cap: A$43.46M

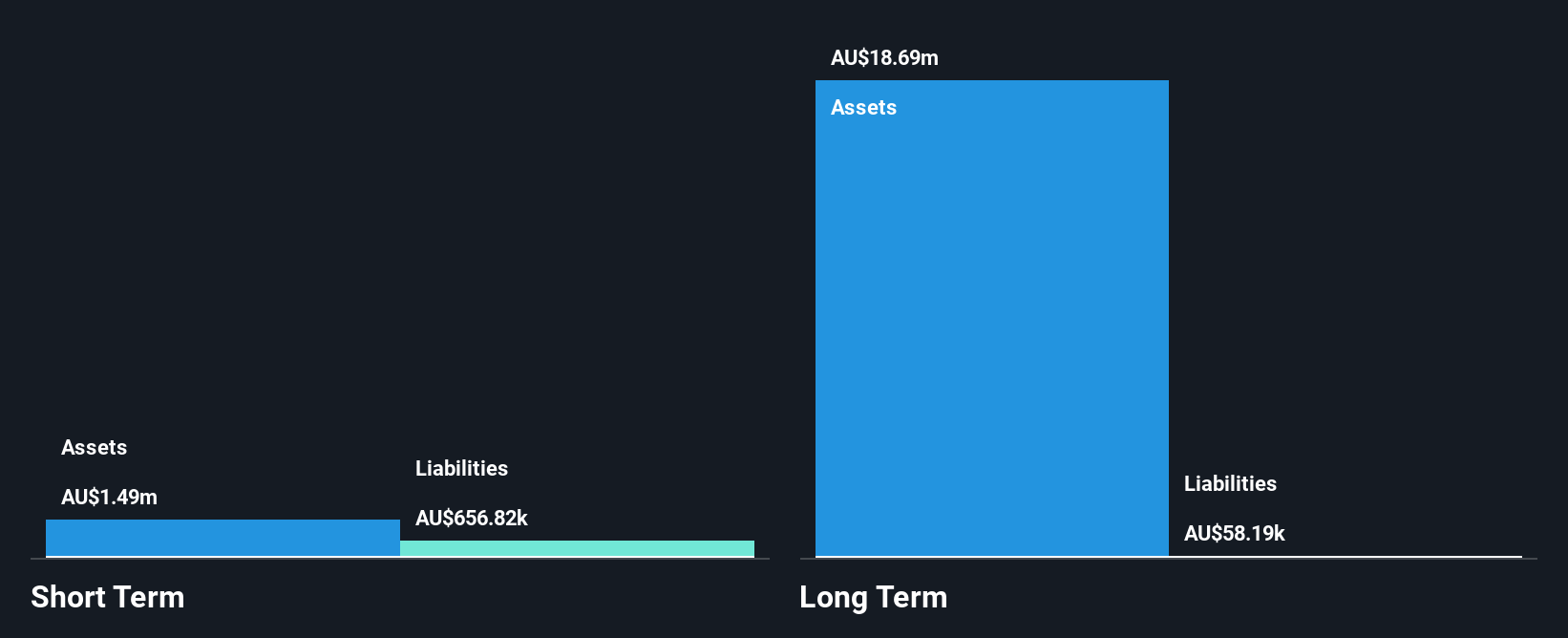

Marmota Limited, with a market cap of A$43.46 million, is pre-revenue, reporting only A$0.14 million in revenue for the year ending June 2024 and a net loss of A$0.40 million. The company benefits from an experienced management team and board, with average tenures of 5.1 and 3.4 years respectively. Despite being unprofitable, Marmota has reduced losses over five years by a significant rate annually and remains debt-free with short-term assets exceeding both short-term and long-term liabilities. However, shareholder dilution occurred last year as shares outstanding increased by 2.6%.

- Click here to discover the nuances of Marmota with our detailed analytical financial health report.

- Gain insights into Marmota's past trends and performance with our report on the company's historical track record.

Key Takeaways

- Discover the full array of 1,032 ASX Penny Stocks right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:IPT

Flawless balance sheet moderate.

Similar Companies

Market Insights

Community Narratives