- Australia

- /

- Metals and Mining

- /

- ASX:ILU

Why Iluka Resources (ASX:ILU) Is Up 7.6% After Surging Demand Fuels Rare Earths Supply Chain Partnerships

Reviewed by Sasha Jovanovic

- Global rare earth producers, including Iluka Resources, have attracted increased attention as demand for neodymium-iron-boron magnets is projected to more than double by 2035 due to growth in electric vehicles, robotics, and advanced air mobility.

- Iluka's position in Western supply chains is further highlighted by growing government backing and partnerships aimed at securing critical materials outside traditional sources.

- We'll explore how renewed government and industry focus on rare earth supply chains could influence Iluka's longer-term investment outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Iluka Resources Investment Narrative Recap

To see Iluka Resources as a good opportunity, you’ll likely need to believe in the persistent growth of rare earth demand, especially for neodymium-iron-boron magnets, and Iluka’s strategic advantage in Western supply chains. The recent news highlighting surging demand and increased government support for non-Chinese rare earth supply is important, but does not immediately reduce the short-term risks of rising Australian operating costs and the heavy capital requirements of the company’s refinery projects.

The recent board leadership change, with James Mactier’s appointment as Chair in May 2025, stands out. While not directly tied to the rare earth supply chain headlines, stable governance is crucial as Iluka manages the challenges and costs associated with scaling its refinery business, which remains a central catalyst for future growth.

But investors also need to be mindful that despite increased attention on rare earths, Iluka’s refinery project still requires substantial ongoing capital contributions and ...

Read the full narrative on Iluka Resources (it's free!)

Iluka Resources is projected to reach A$1.8 billion in revenue and A$192.4 million in earnings by 2028. This outlook is based on an annual revenue growth rate of 16.9%, representing a modest A$2.8 million increase in earnings from the current A$189.6 million.

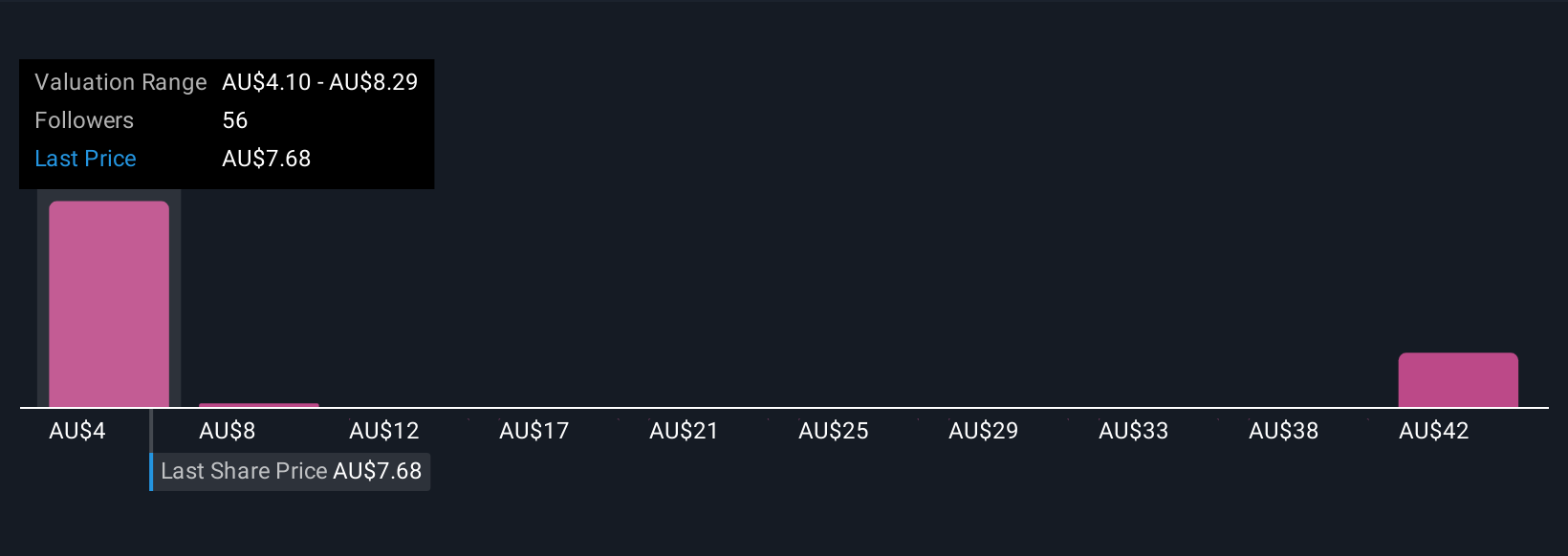

Uncover how Iluka Resources' forecasts yield a A$6.67 fair value, a 6% downside to its current price.

Exploring Other Perspectives

Nine separate fair value estimates from the Simply Wall St Community range from A$2.14 to A$9.20 per share. Against this backdrop of varied perspectives, keep in mind how capital strain from the Eneabba refinery build remains a central issue for future performance and explore several viewpoints for a fuller picture.

Explore 9 other fair value estimates on Iluka Resources - why the stock might be worth as much as 30% more than the current price!

Build Your Own Iluka Resources Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Iluka Resources research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Iluka Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Iluka Resources' overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are the new gold rush. Find out which 32 stocks are leading the charge.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ILU

Iluka Resources

Engages in the exploration, project development, mining, processing, marketing, and rehabilitation of mineral sands in Australia, China, rest of Asia, Europe, the Americas, and internationally.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives