- Australia

- /

- Metals and Mining

- /

- ASX:ILU

Iluka Resources (ASX:ILU) Valuation in Focus Following Geopolitical Shifts in Rare Earths Policy

Reviewed by Kshitija Bhandaru

See our latest analysis for Iluka Resources.

Iluka Resources has surged as investors respond to geopolitics and renewed focus on rare earths, with a standout 73.97% share price return year to date and a one-year total shareholder return of almost 40%. This recent momentum signals growing optimism around both sector demand and Iluka’s positioning in the supply chain.

Curious what other companies are seeing big moves right now? Take the next step and uncover fast growing stocks with high insider ownership.

With strong returns grabbing attention and geopolitical dynamics driving rare earths higher, the question is whether Iluka’s share price has run ahead of its fundamentals or if the current valuation still leaves room for investors to benefit from future growth.

Most Popular Narrative: 33.2% Overvalued

With Iluka Resources closing at A$8.89, the most widely followed narrative assigns a fair value of just A$6.67. This gap raises tough questions for investors about whether the current excitement is running ahead of fundamentals, given analyst consensus models and financial projections.

The development of the Eneabba rare earths refinery, with secured funding and progress in construction, positions Iluka for significant growth in the high-demand rare earth market. This could potentially boost future revenue streams. The anticipated commencement of the Balranald project will increase the supply of natural rutile and high-quality zircon, addressing existing supply constraints. The project is expected to contribute positively to revenue and earnings once production begins.

Want a shot at understanding what drives this surprising valuation gap? One catalyst behind the number involves ambitious project ramps and bold projections for sector demand and margins. Unlock the full model and get the analyst assumptions that could rewrite Iluka’s fate.

Result: Fair Value of $6.67 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising Australian operating costs and the possibility of rare earth market oversupply could pressure Iluka’s future margins and present challenges to the bullish outlook.

Find out about the key risks to this Iluka Resources narrative.

Another View: Are the Numbers Really Stretched?

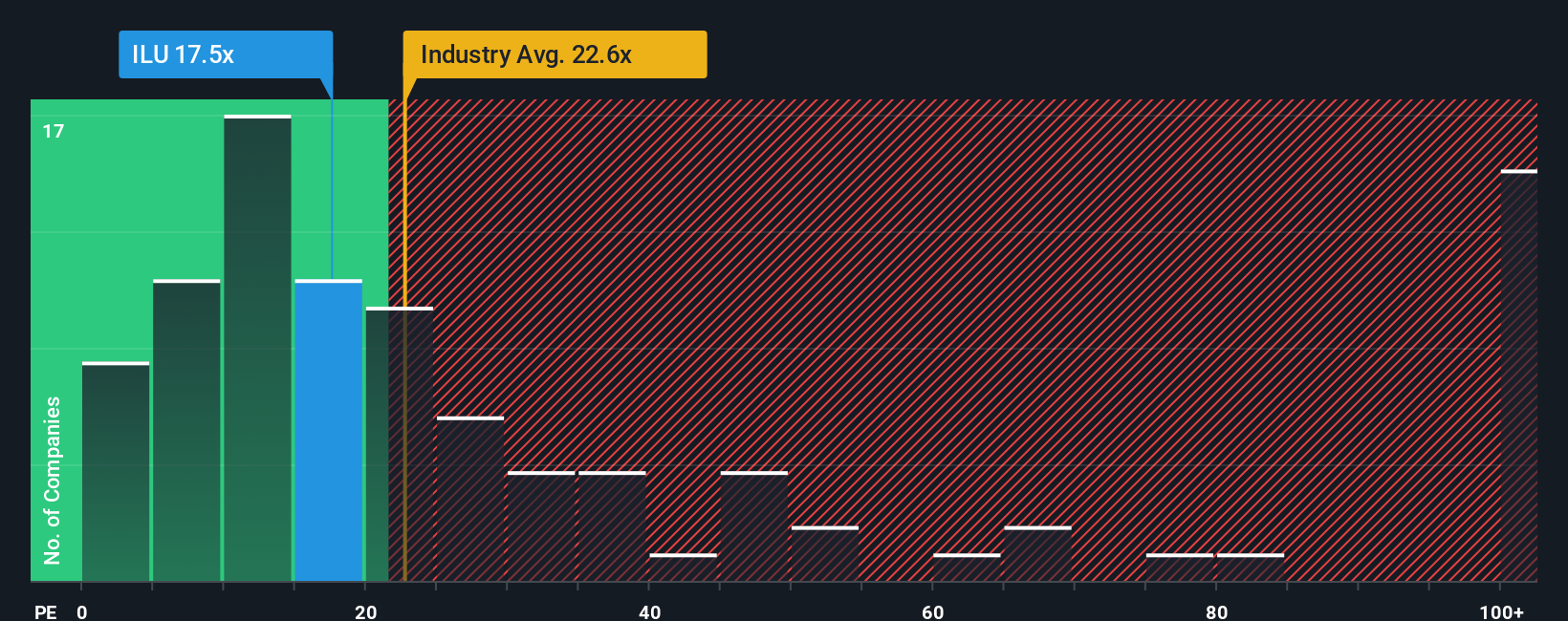

Looking at the price-to-earnings ratio instead of fair value estimates, Iluka is trading at 20.1x, slightly below both the industry average of 21.6x and the peer average of 26x. However, this is higher than the fair ratio suggested by the market, which is 18.4x. This gap signals valuation risk, as current optimism may not justify the premium. Could the market be overestimating Iluka's prospects, or is there real upside?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Iluka Resources Narrative

Not seeing things the same way as the consensus narrative, or want to dive deeper into the data yourself? Craft your own perspective on Iluka Resources in just minutes. Do it your way.

A great starting point for your Iluka Resources research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Seize this moment to uncover fresh possibilities with a quick scan of targeted stock ideas. With markets moving fast, you can’t afford to wait and get left behind.

- Boost your returns by focusing on growth potential in these 25 AI penny stocks at the forefront of technological innovation.

- Find steady income streams by searching for these 18 dividend stocks with yields > 3% offering reliable yields above 3%.

- Take part in the disruption and explore these 79 cryptocurrency and blockchain stocks shaping the future of digital finance and blockchain solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ILU

Iluka Resources

Engages in the exploration, project development, mining, processing, marketing, and rehabilitation of mineral sands in Australia, China, rest of Asia, Europe, the Americas, and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.