- Australia

- /

- Professional Services

- /

- ASX:RTH

Cadoux Among 3 Promising Penny Stocks On The ASX

Reviewed by Simply Wall St

As Christmas approaches, the Australian Securities Exchange has shown resilience, bouncing back with a 0.67% increase to 8,305 points, driven by gains in sectors like Telecommunication and Real Estate. For investors looking beyond the major players, penny stocks—though an older term—continue to offer intriguing opportunities within the market landscape. This article explores three such stocks on the ASX that combine financial stability with potential for growth, providing a chance to uncover hidden value in quality companies.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.755 | A$138.53M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.55 | A$64.47M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.51 | A$316.27M | ★★★★★☆ |

| SHAPE Australia (ASX:SHA) | A$2.84 | A$235.47M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.925 | A$313.42M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.75 | A$96.8M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.61 | A$789.03M | ★★★★★☆ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$219.66M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$1.84 | A$103.2M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.97 | A$490.37M | ★★★★☆☆ |

Click here to see the full list of 1,050 stocks from our ASX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Cadoux (ASX:CCM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Cadoux Limited focuses on the exploration, evaluation, and development of mineral properties in Australia and Southeast Asia, with a market cap of A$20.77 million.

Operations: Cadoux Limited has not reported any specific revenue segments.

Market Cap: A$20.77M

Cadoux Limited, with a market cap of A$20.77 million, is a pre-revenue company involved in mineral exploration and development. Despite being debt-free and having seasoned management and board members, the company faces significant challenges. It reported a net loss of A$3.74 million for the year ended June 30, 2024, with auditors expressing doubts about its ability to continue as a going concern. While earnings are forecast to grow significantly at over 100% annually, Cadoux's high share price volatility and limited cash runway underscore the risks associated with investing in such early-stage ventures.

- Unlock comprehensive insights into our analysis of Cadoux stock in this financial health report.

- Explore Cadoux's analyst forecasts in our growth report.

Iltani Resources (ASX:ILT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Iltani Resources Limited focuses on the exploration and development of metal projects in Australia, with a market cap of A$10.36 million.

Operations: Iltani Resources Limited has not reported any specific revenue segments.

Market Cap: A$10.36M

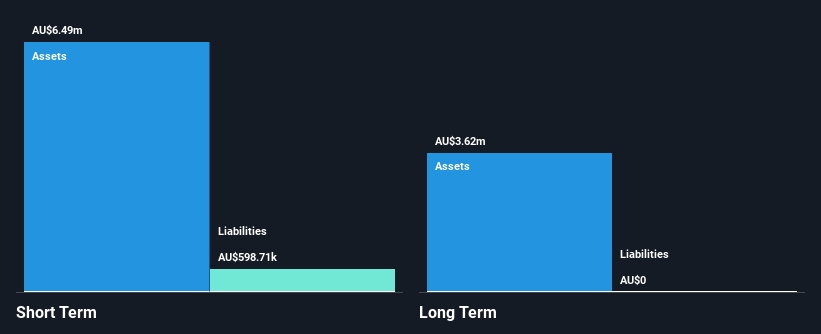

Iltani Resources Limited, with a market cap of A$10.36 million, is pre-revenue and focused on metal exploration in Australia. The company recently reported a reduced net loss of A$0.59 million for the year ended June 30, 2024. Despite being debt-free and having sufficient cash runway for over a year due to recent capital raising efforts amounting to A$2.18 million, Iltani faces challenges such as high share price volatility and shareholder dilution over the past year. Its board is considered experienced with an average tenure of 3.3 years, providing some stability amid its speculative nature as an investment.

- Take a closer look at Iltani Resources' potential here in our financial health report.

- Examine Iltani Resources' past performance report to understand how it has performed in prior years.

RAS Technology Holdings (ASX:RTH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: RAS Technology Holdings Limited offers data, content, SaaS solutions, and digital media services to the racing and wagering industries across Australia, the UK, the US, and other international markets with a market cap of A$42.02 million.

Operations: The company generates revenue from its Entertainment Software segment, which amounts to A$16.18 million.

Market Cap: A$42.02M

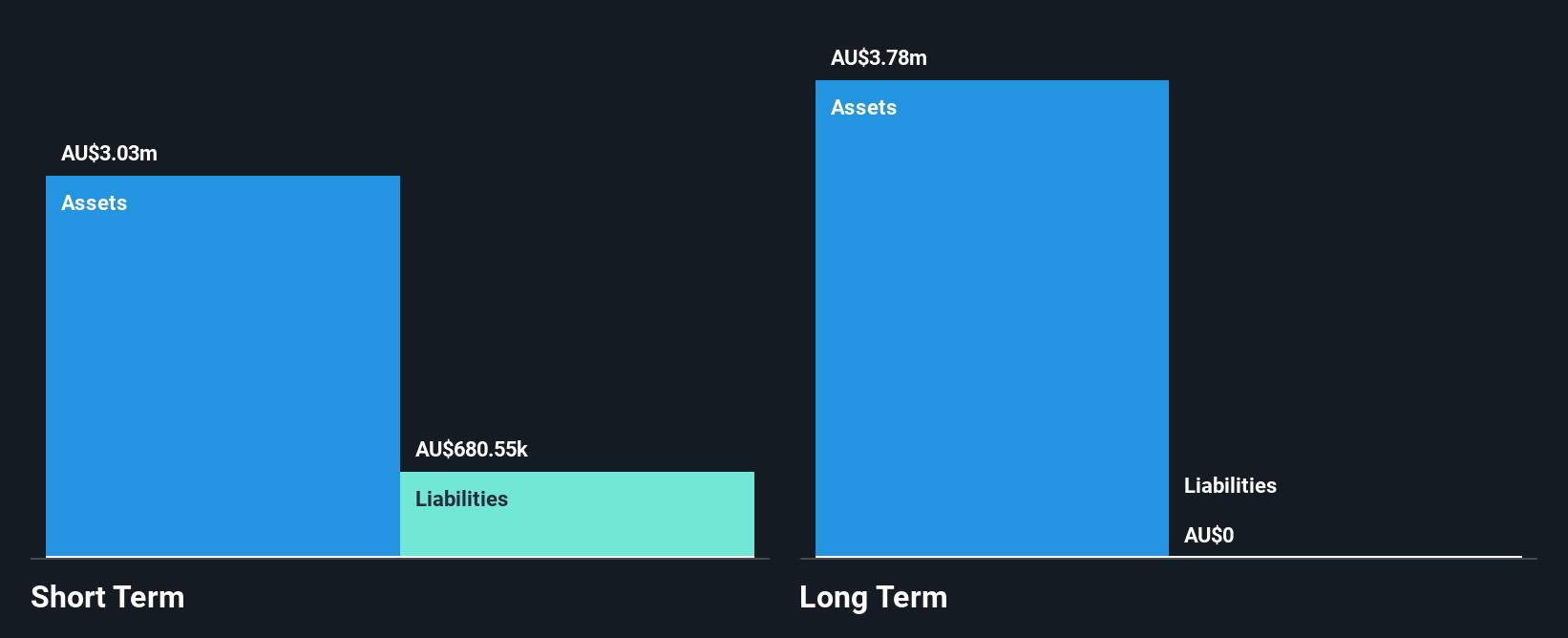

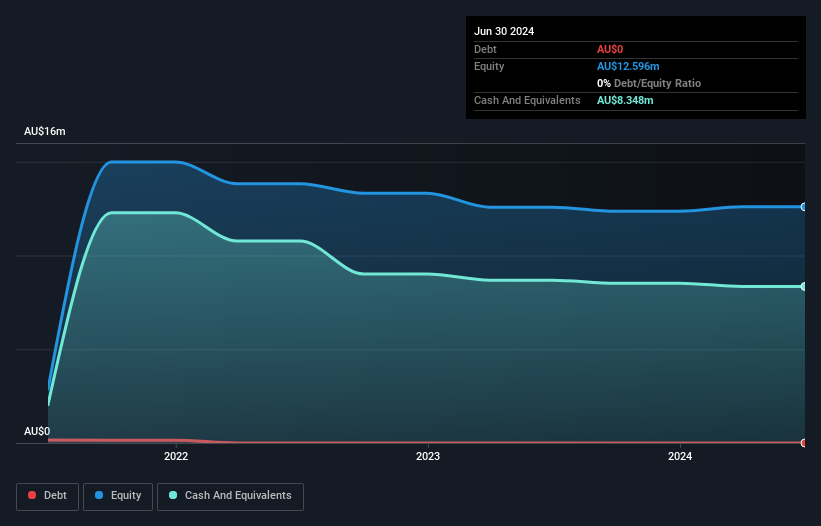

RAS Technology Holdings, with a market cap of A$42.02 million, is unprofitable but generates A$16.18 million in revenue from its Entertainment Software segment. The company benefits from an experienced board and management team, providing stability amid its speculative nature as a penny stock investment. RAS is debt-free and has sufficient cash runway for over three years based on current free cash flow trends. However, shareholders have experienced dilution recently, and the company's negative return on equity highlights ongoing profitability challenges despite forecasts of significant earnings growth at 65.46% per year.

- Jump into the full analysis health report here for a deeper understanding of RAS Technology Holdings.

- Learn about RAS Technology Holdings' future growth trajectory here.

Key Takeaways

- Investigate our full lineup of 1,050 ASX Penny Stocks right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:RTH

RAS Technology Holdings

Provides data, content, software as a service (SaaS) solution, and digital and media services to the racing and wagering industries in Australia, the United Kingdom, the United States, and internationally.

Flawless balance sheet with reasonable growth potential.