- Australia

- /

- Metals and Mining

- /

- ASX:IGO

Will IGO's (ASX:IGO) Bridgetown-Greenbushes Deal Redefine Its Lithium Growth Story?

Reviewed by Sasha Jovanovic

- Venus Metals Corporation announced that IGO Limited has secured a 51% controlling stake and entered into a joint venture for the Bridgetown-Greenbushes lithium project, unlocking further exploration options in Australia’s key lithium district.

- This agreement follows IGO’s completion of a A$3 million exploration milestone, giving it operational control and the possibility of increasing its stake to 70% by investing an additional A$3 million.

- We’ll explore how IGO’s expanded control in a premier lithium region enhances its investment narrative, particularly with recent exploration milestones.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

What Is IGO's Investment Narrative?

To hold IGO stock, an investor needs to believe in the company's ability to bounce back from recent operational and financial challenges by capitalizing on emerging lithium opportunities. The new joint venture with Venus Metals, which gives IGO a controlling stake in a prominent lithium region, could inject new momentum into its exploration pipeline and shift the short-term narrative. While earlier assessments focused on unprofitability, seasoned board shifts, and significant revenue declines, this fresh lithium exposure adds a timely catalyst just ahead of Q1 2026 results. However, the effect on short-term valuation is still uncertain, as price moves in recent weeks show some renewed optimism, but risks remain tied to execution, leadership turnover, and sector volatility. The coming quarters will reveal whether this strategic move is enough to offset headwinds in other parts of the business. But with a new management team and ongoing legal disputes, execution risk can’t be ignored.

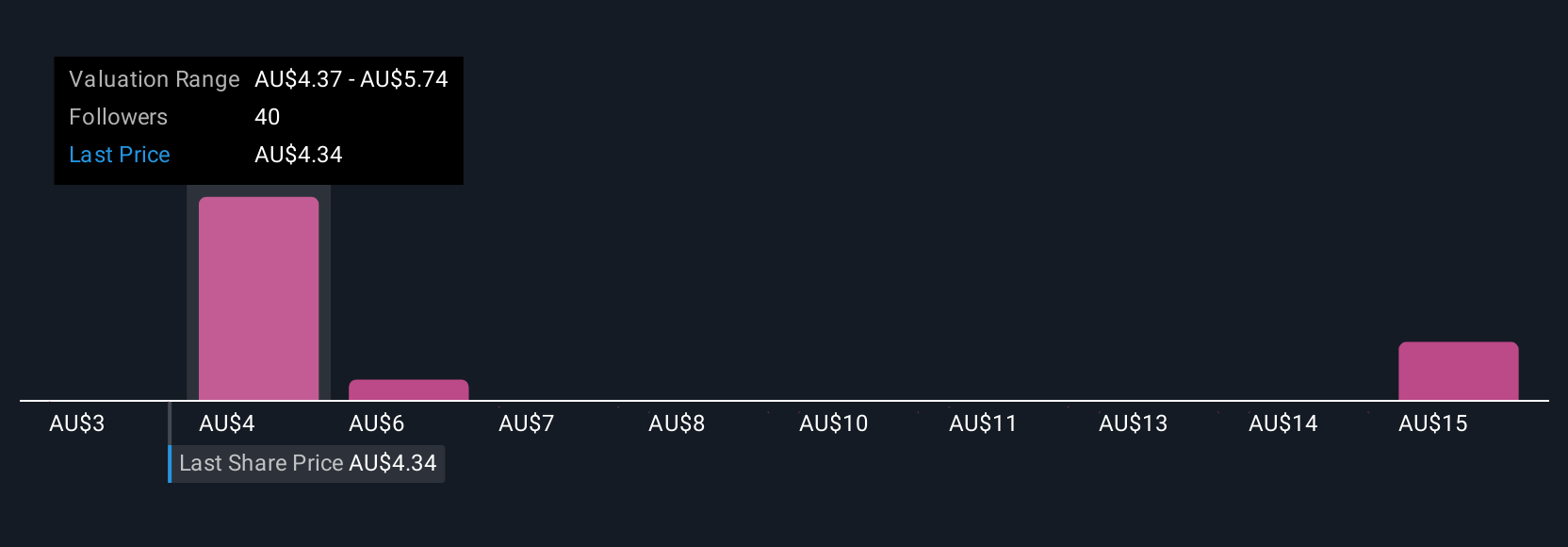

IGO's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 12 other fair value estimates on IGO - why the stock might be worth 45% less than the current price!

Build Your Own IGO Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your IGO research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free IGO research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate IGO's overall financial health at a glance.

Searching For A Fresh Perspective?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:IGO

IGO

IGO Limited, together with its subsidiaries, discovers, develops, and delivers battery minerals in Australia.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives