- Australia

- /

- Renewable Energy

- /

- ASX:FHE

ASX Penny Stocks Spotlight: Botanix Pharmaceuticals And Two More

Reviewed by Simply Wall St

The Australian market is currently experiencing some nervousness, aligning with trends seen in other Asian markets as investors await the Federal Reserve's rate cut decision. Despite the cautious sentiment, opportunities still exist for those willing to explore beyond the major players. Penny stocks—though an outdated term—remain a relevant investment area, especially when these smaller or younger companies are backed by strong financials and potential for growth. In this article, we examine three such stocks that stand out for their resilience and promise in today's market conditions.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.52 | A$149.03M | ✅ 4 ⚠️ 3 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.815 | A$50.75M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.65 | A$409.76M | ✅ 4 ⚠️ 3 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.50 | A$258.32M | ✅ 4 ⚠️ 2 View Analysis > |

| Pureprofile (ASX:PPL) | A$0.041 | A$47.96M | ✅ 3 ⚠️ 1 View Analysis > |

| Veris (ASX:VRS) | A$0.075 | A$38.83M | ✅ 4 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$3.04 | A$3.47B | ✅ 4 ⚠️ 1 View Analysis > |

| Praemium (ASX:PPS) | A$0.785 | A$375.39M | ✅ 5 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.34 | A$1.43B | ✅ 3 ⚠️ 1 View Analysis > |

| MaxiPARTS (ASX:MXI) | A$2.50 | A$138.61M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 434 stocks from our ASX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Botanix Pharmaceuticals (ASX:BOT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Botanix Pharmaceuticals Limited is a commercial dermatology company operating in Australia and the United States, with a market cap of A$254.97 million.

Operations: The company's revenue is derived from its Research and Development Dermatology and Antimicrobial Products segment, totaling A$5.79 million.

Market Cap: A$254.97M

Botanix Pharmaceuticals, with a market cap of A$254.97 million, operates in dermatology and antimicrobial products but remains pre-revenue with sales of A$5.79 million. The company is debt-free but faces challenges with increased volatility and significant annual losses of A$86.4 million as reported for the year ending June 2025. Recent leadership changes include Dr Patricia Walker joining the board, bringing extensive dermatology expertise which may bolster strategic direction for its lead product SofdraTM. Despite these hurdles, Botanix's short-term assets cover liabilities, providing a buffer as it navigates towards profitability amidst volatile stock performance.

- Click here and access our complete financial health analysis report to understand the dynamics of Botanix Pharmaceuticals.

- Explore Botanix Pharmaceuticals' analyst forecasts in our growth report.

Frontier Energy (ASX:FHE)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Frontier Energy Limited is a renewable energy company focused on developing an integrated renewable energy facility in Australia, with a market cap of A$146.84 million.

Operations: No revenue segments have been reported.

Market Cap: A$146.84M

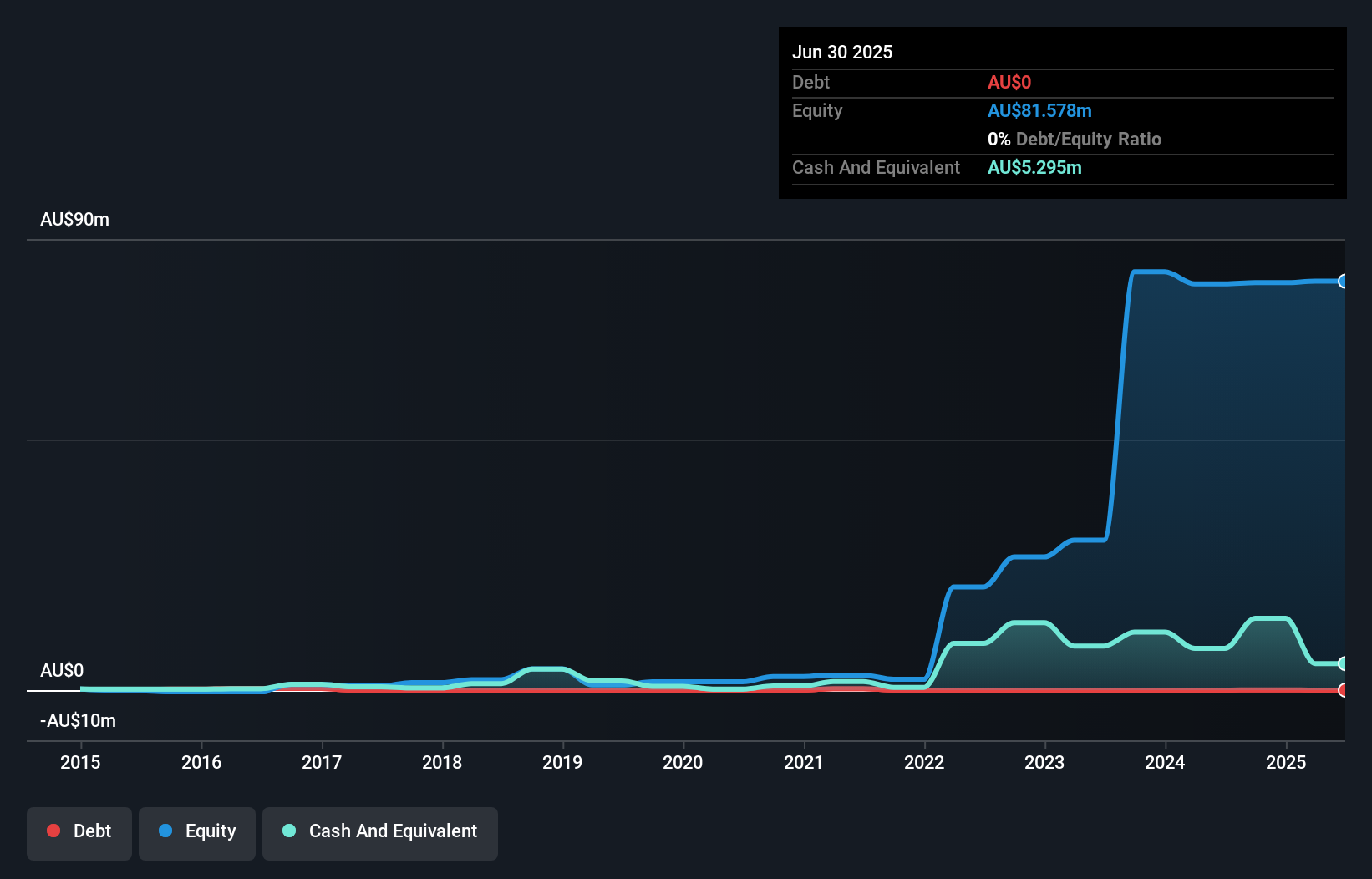

Frontier Energy Limited, with a market cap of A$146.84 million, is pre-revenue and remains unprofitable, reporting a net loss of A$0.21 million for the half-year ending June 2025. Despite this, the company maintains financial stability with short-term assets of A$8.3 million exceeding liabilities of A$855.4K and no long-term debt or liabilities. However, its cash runway is less than one year if current free cash flow trends persist. While its board has an average tenure of 3.4 years indicating experience, the management team is relatively new with an average tenure of 1.8 years.

- Unlock comprehensive insights into our analysis of Frontier Energy stock in this financial health report.

- Evaluate Frontier Energy's historical performance by accessing our past performance report.

IGO (ASX:IGO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: IGO Limited, along with its subsidiaries, is involved in the discovery, development, and delivery of battery minerals in Australia and has a market capitalization of A$3.62 billion.

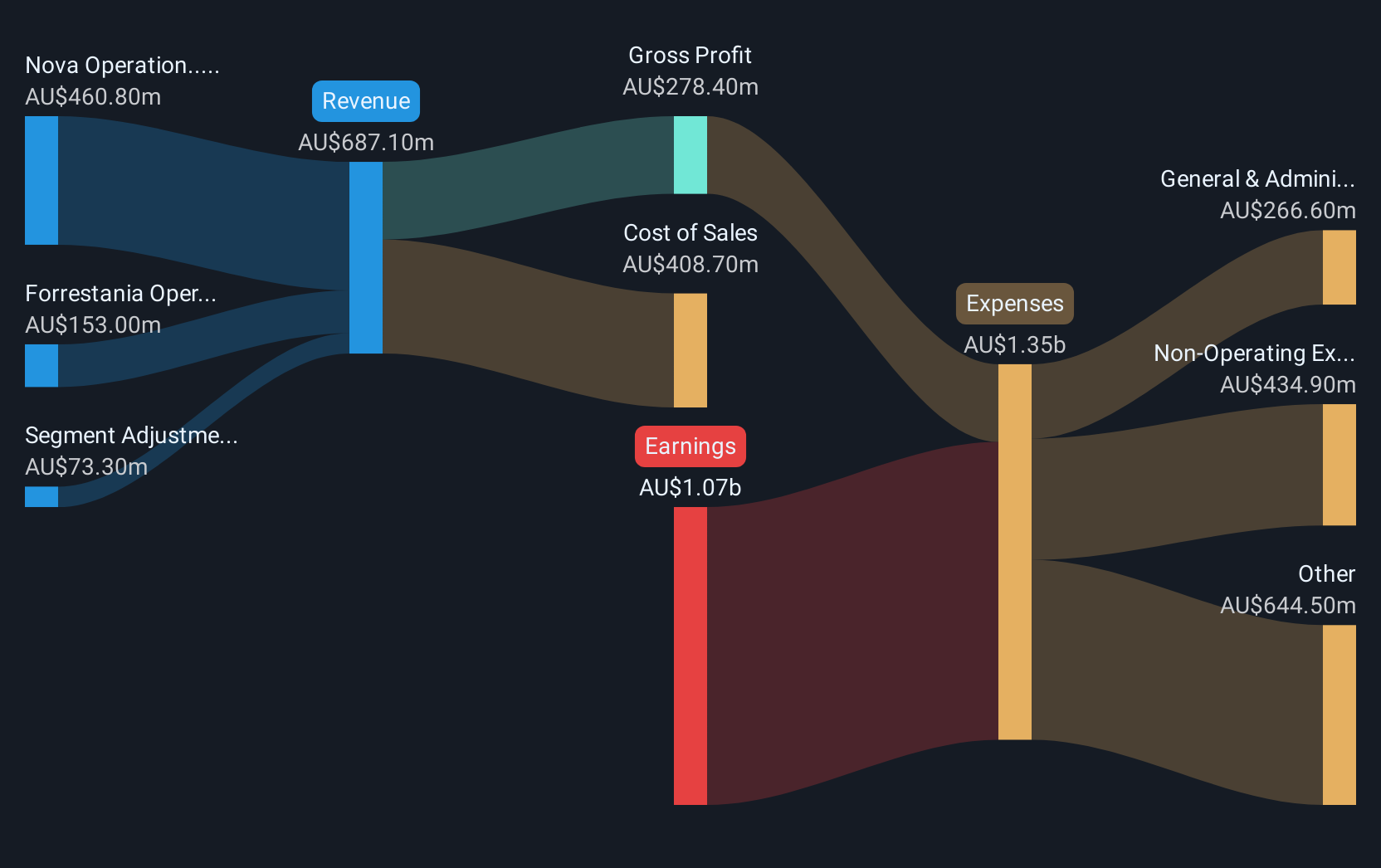

Operations: The company's revenue is primarily derived from its Nova Operation, which generated A$439 million, followed by the Forrestania Operation with A$65.5 million, the Cosmos Project contributing A$8 million, and Interest Revenue amounting to A$15.3 million.

Market Cap: A$3.62B

IGO Limited, with a market capitalization of A$3.62 billion, is not pre-revenue and derives significant income from its Nova and Forrestania operations. Despite this, the company reported a net loss of A$954.6 million for the year ending June 2025, highlighting ongoing profitability challenges. The recent strategic decision to transfer its interest in the Big Bullocks exploration license indicates a shift in focus or strategy within its exploration portfolio. Financially stable with short-term assets exceeding liabilities and no debt burden, IGO's management team is relatively new but guided by an experienced board averaging 3.9 years in tenure.

- Navigate through the intricacies of IGO with our comprehensive balance sheet health report here.

- Examine IGO's earnings growth report to understand how analysts expect it to perform.

Where To Now?

- Investigate our full lineup of 434 ASX Penny Stocks right here.

- Want To Explore Some Alternatives? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:FHE

Frontier Energy

A renewable energy company, engages in the development of an integrated renewable energy facility in Australia.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives