- Australia

- /

- Metals and Mining

- /

- ASX:SMR

3 ASX Penny Stocks With Market Caps Under A$4B

Reviewed by Simply Wall St

As the Australian market faces a challenging day with ASX 200 futures indicating a slight decline, investors are keeping a close eye on global economic developments, particularly the impact of U.S. tariffs. In this climate, penny stocks—though an old-fashioned term—still capture attention as they represent smaller or newer companies that can offer intriguing opportunities. By focusing on those with strong financial foundations and potential for growth, investors might uncover hidden value in these lesser-known stocks.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.385 | A$110.34M | ✅ 3 ⚠️ 3 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.35 | A$110.86M | ✅ 4 ⚠️ 3 View Analysis > |

| GTN (ASX:GTN) | A$0.38 | A$72.45M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.94 | A$453.29M | ✅ 4 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$2.66 | A$3.03B | ✅ 5 ⚠️ 1 View Analysis > |

| Southern Cross Electrical Engineering (ASX:SXE) | A$1.855 | A$490.48M | ✅ 4 ⚠️ 1 View Analysis > |

| Regal Partners (ASX:RPL) | A$3.08 | A$1.04B | ✅ 4 ⚠️ 2 View Analysis > |

| Austco Healthcare (ASX:AHC) | A$0.385 | A$140.72M | ✅ 4 ⚠️ 1 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.825 | A$146.99M | ✅ 4 ⚠️ 2 View Analysis > |

| Reckon (ASX:RKN) | A$0.63 | A$71.38M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 457 stocks from our ASX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

IGO (ASX:IGO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: IGO Limited is an Australian exploration and mining company focused on discovering, developing, and operating assets for clean energy metals, with a market cap of A$3.57 billion.

Operations: The company's revenue is derived from its Nova Operation, which generated A$460.8 million, and the Forrestania Operation, contributing A$153 million.

Market Cap: A$3.57B

IGO Limited, with a market cap of A$3.57 billion, remains unprofitable despite significant revenue from its Nova and Forrestania operations. The company is debt-free, with short-term assets exceeding both short and long-term liabilities, providing financial stability. Trading significantly below estimated fair value suggests potential for price appreciation if profitability improves. Recent executive changes include the appointment of Suzy Retallack as Chief People and Sustainability Officer, enhancing leadership expertise in sustainability within the mining sector. However, IGO's management team lacks seasoned experience with an average tenure of 1.1 years compared to its more experienced board members at 3 years tenure on average.

- Unlock comprehensive insights into our analysis of IGO stock in this financial health report.

- Assess IGO's future earnings estimates with our detailed growth reports.

Metals X (ASX:MLX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Metals X Limited is an Australian company focused on tin production, with a market capitalization of A$536.27 million.

Operations: The company's revenue is primarily derived from its 50% stake in the Renison Tin Operation, generating A$218.82 million.

Market Cap: A$536.27M

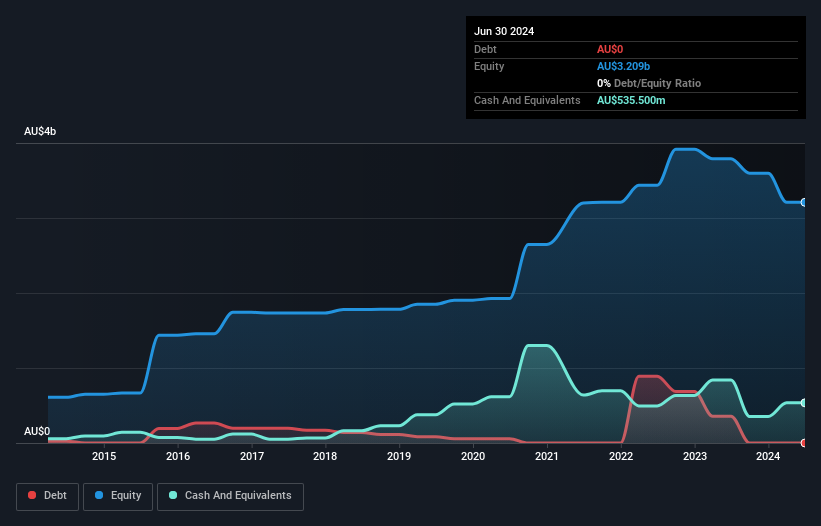

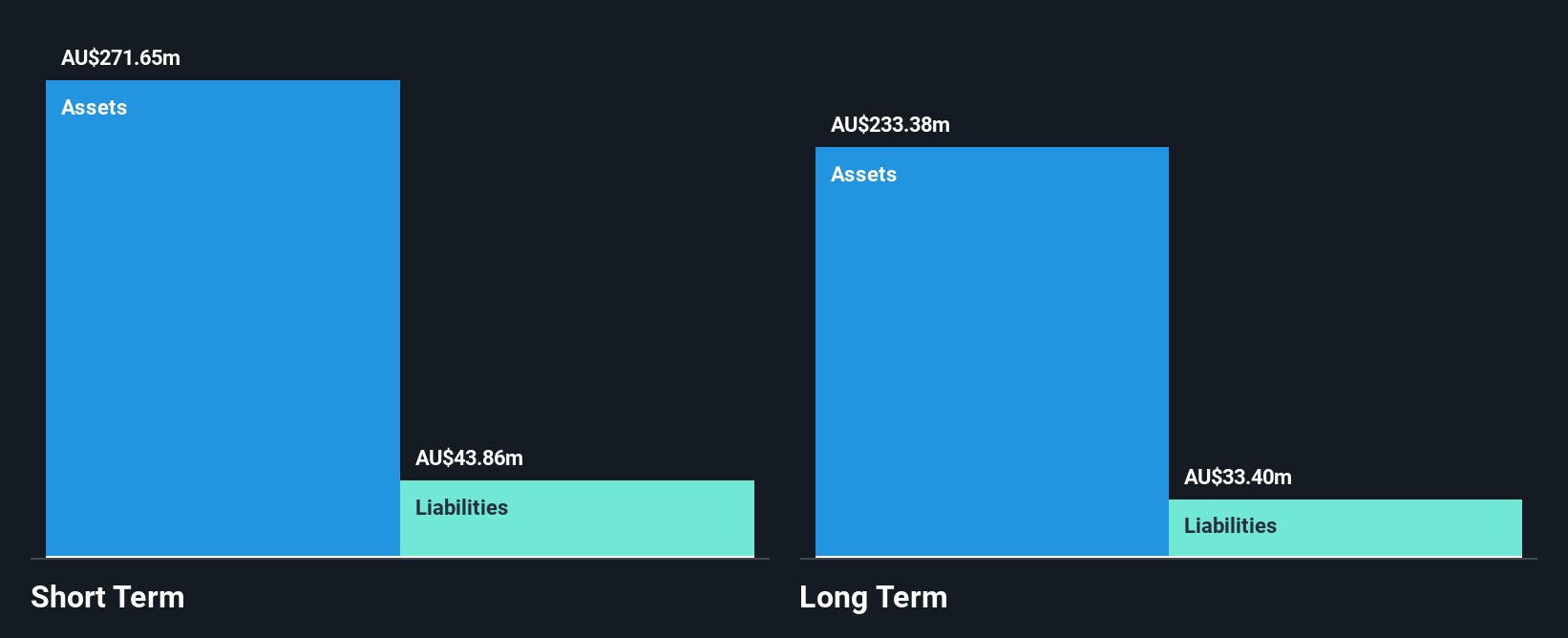

Metals X Limited, with a market cap of A$536.27 million, has demonstrated significant financial improvements and stability. The company's debt to equity ratio has impressively decreased from 47.7% to 0.1% over five years, while its short-term assets of A$271.6 million comfortably cover both short-term and long-term liabilities totaling A$77.3 million combined. Despite a large one-off gain impacting recent earnings, the company achieved an extraordinary earnings growth of 601.7% last year, far surpassing industry averages and reflecting high-quality returns with a return on equity at 23.9%. Trading below fair value indicates potential investment appeal amidst forecasted challenges in earnings growth.

- Get an in-depth perspective on Metals X's performance by reading our balance sheet health report here.

- Examine Metals X's earnings growth report to understand how analysts expect it to perform.

Stanmore Resources (ASX:SMR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Stanmore Resources Limited is involved in the exploration, development, production, and sale of metallurgical coal in Australia with a market cap of A$2.09 billion.

Operations: The company's revenue is primarily derived from its Metals & Mining - Coal segment, which generated $2.40 billion.

Market Cap: A$2.09B

Stanmore Resources Limited, with a market cap of A$2.09 billion, faces mixed financial prospects. The company's short-term assets of A$644.5 million exceed its short-term liabilities but fall short of covering long-term liabilities of A$806.2 million. Despite high-quality earnings and satisfactory net debt to equity ratio at 1%, the company experienced negative earnings growth last year and a decline in profit margins from 16.8% to 8%. Recent board changes include the appointment of Mr. Ben Gargett as alternate director, while its removal from key indices like S&P/ASX 200 signals potential volatility concerns for investors.

- Click here and access our complete financial health analysis report to understand the dynamics of Stanmore Resources.

- Review our growth performance report to gain insights into Stanmore Resources' future.

Taking Advantage

- Get an in-depth perspective on all 457 ASX Penny Stocks by using our screener here.

- Looking For Alternative Opportunities? Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SMR

Stanmore Resources

Engages in the exploration, development, production, and sale of metallurgical coal in Australia.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives