- Australia

- /

- Metals and Mining

- /

- ASX:GSM

Do Insiders Own Lots Of Shares In Golden State Mining Limited (ASX:GSM)?

A look at the shareholders of Golden State Mining Limited (ASX:GSM) can tell us which group is most powerful. Institutions will often hold stock in bigger companies, and we expect to see insiders owning a noticeable percentage of the smaller ones. I generally like to see some degree of insider ownership, even if only a little. As Nassim Nicholas Taleb said, 'Don’t tell me what you think, tell me what you have in your portfolio.

Golden State Mining is not a large company by global standards. It has a market capitalization of AU$2.0m, which means it wouldn't have the attention of many institutional investors. In the chart below, we can see that institutions don't own many shares in the company. Let's delve deeper into each type of owner, to discover more about Golden State Mining.

View our latest analysis for Golden State Mining

What Does The Institutional Ownership Tell Us About Golden State Mining?

Institutional investors commonly compare their own returns to the returns of a commonly followed index. So they generally do consider buying larger companies that are included in the relevant benchmark index.

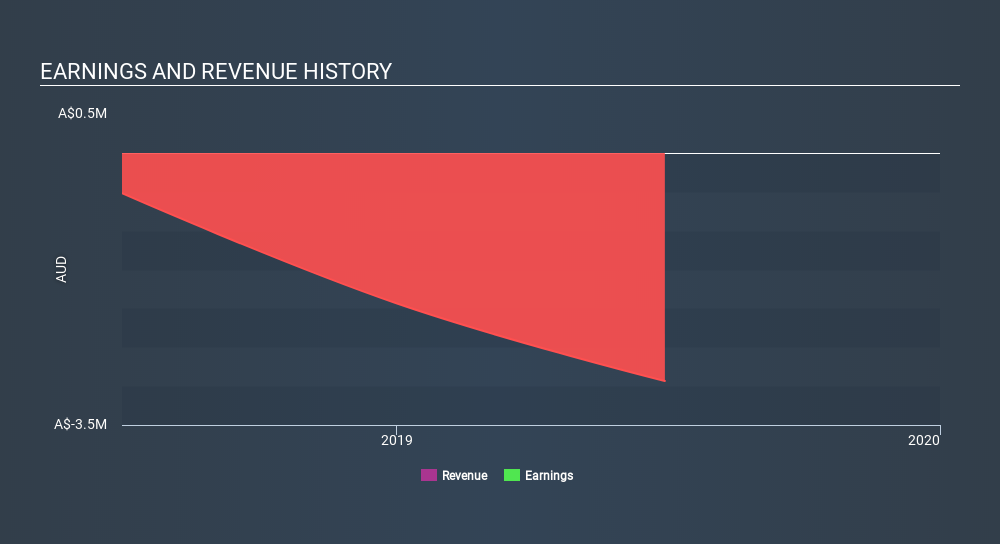

Institutions own less than 5% of Golden State Mining. That indicates that the company is on the radar of some funds, but it isn't particularly popular with professional investors at the moment. So if the company itself can improve over time, we may well see more institutional buyers in the future. We sometimes see a rising share price when a few big institutions want to buy a certain stock at the same time. The history of earnings and revenue, which you can see below, could be helpful in considering if more institutional investors will want the stock. Of course, there are plenty of other factors to consider, too.

We note that hedge funds don't have a meaningful investment in Golden State Mining. Janet Wicks is currently the largest shareholder, with 7.6% of shares outstanding. The second and third largest shareholders are Lefroy Exploration Limited and Michael Moore, holding 4.6% and 4.4%, respectively. Michael Moore also happens to hold the title of Member of the Board of Directors.

On studying our ownership data, we found that 20 of the top shareholders collectively own less than 50% of the share register, implying that no single individual has a majority interest.

Researching institutional ownership is a good way to gauge and filter a stock's expected performance. The same can be achieved by studying analyst sentiments. Our information suggests that there isn't any analyst coverage of the stock, so it is probably little known.

Insider Ownership Of Golden State Mining

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. Company management run the business, but the CEO will answer to the board, even if he or she is a member of it.

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, on some occasions too much power is concentrated within this group.

It seems insiders own a significant proportion of Golden State Mining Limited. Insiders have a AU$504k stake in this AU$2.0m business. It is great to see insiders so invested in the business. It might be worth checking if those insiders have been buying recently.

General Public Ownership

The general public -- mostly retail investors -- own 54% of Golden State Mining. This level of ownership gives retail investors the power to sway key policy decisions such as board composition, executive compensation, and the dividend payout ratio.

Private Company Ownership

Our data indicates that Private Companies hold 15%, of the company's shares. It's hard to draw any conclusions from this fact alone, so its worth looking into who owns those private companies. Sometimes insiders or other related parties have an interest in shares in a public company through a separate private company.

Public Company Ownership

Public companies currently own 4.6% of GSM stock. It's hard to say for sure, but this suggests they have entwined business interests. This might be a strategic stake, so it's worth watching this space for changes in ownership.

Next Steps:

It's always worth thinking about the different groups who own shares in a company. But to understand Golden State Mining better, we need to consider many other factors. For instance, we've identified 6 warning signs for Golden State Mining (3 are a bit unpleasant) that you should be aware of.

Of course this may not be the best stock to buy. Therefore, you may wish to see our free collection of interesting prospects boasting favorable financials.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ASX:GSM

Golden State Mining

Through its subsidiaries, engages in the acquisition, exploration, evaluation, and investment of mineral properties in Australia.

Flawless balance sheet with slight risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026