- Australia

- /

- Real Estate

- /

- ASX:SRV

3 Top ASX Dividend Stocks Yielding Up To 8.3%

Reviewed by Simply Wall St

The Australian market has climbed 1.4% in the last 7 days and is up 15% over the last 12 months, with earnings expected to grow by 12% per annum over the next few years. In this favorable economic climate, identifying strong dividend stocks can be a smart strategy for investors seeking reliable income and potential growth.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Perenti (ASX:PRN) | 7.48% | ★★★★★☆ |

| Super Retail Group (ASX:SUL) | 6.65% | ★★★★★☆ |

| Nick Scali (ASX:NCK) | 4.07% | ★★★★★☆ |

| Collins Foods (ASX:CKF) | 3.39% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.53% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.48% | ★★★★★☆ |

| GrainCorp (ASX:GNC) | 6.05% | ★★★★★☆ |

| National Storage REIT (ASX:NSR) | 4.33% | ★★★★★☆ |

| Premier Investments (ASX:PMV) | 4.02% | ★★★★★☆ |

| Sugar Terminals (NSX:SUG) | 7.56% | ★★★★☆☆ |

Click here to see the full list of 36 stocks from our Top ASX Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

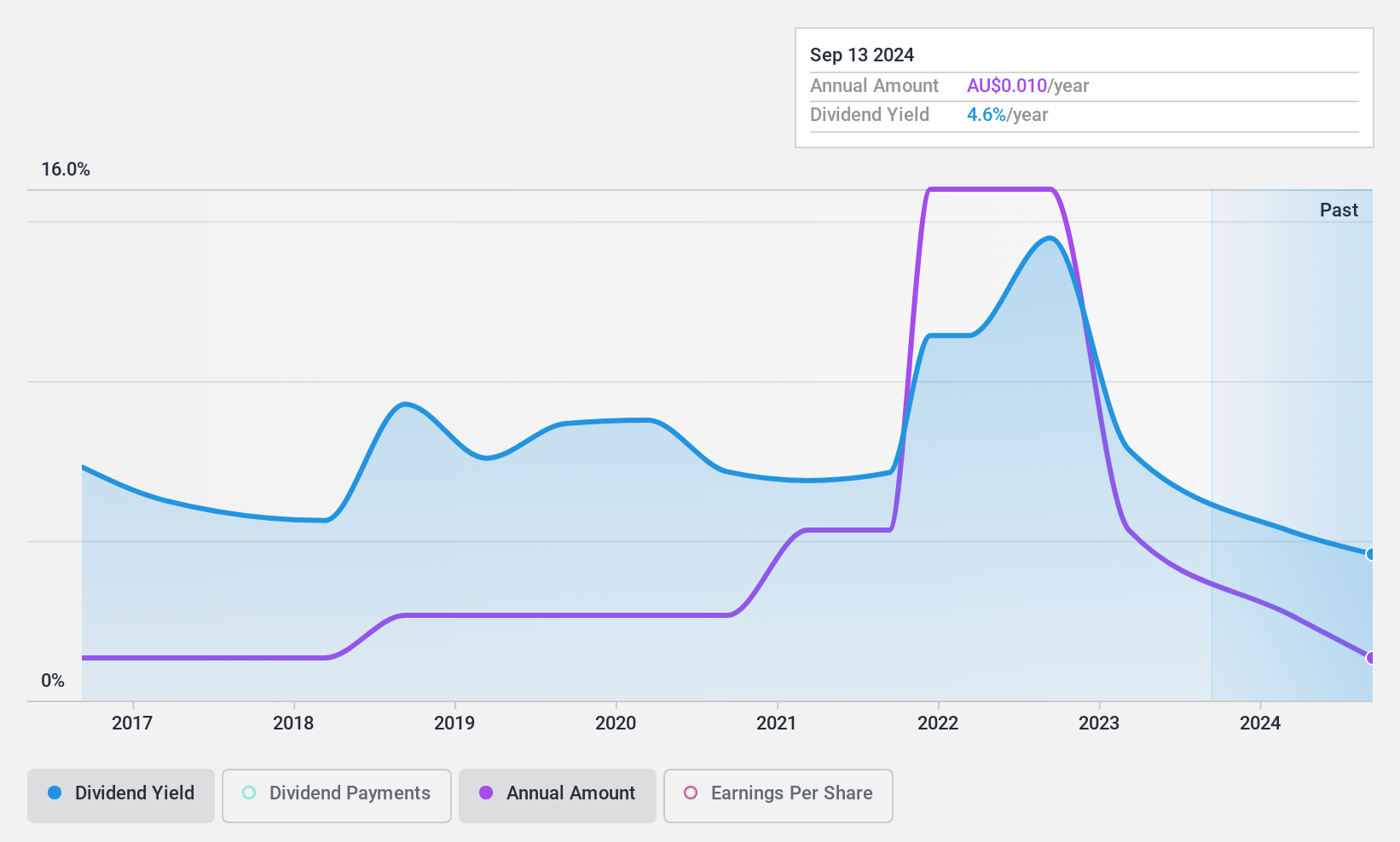

Grange Resources (ASX:GRR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Grange Resources Limited operates an integrated iron ore mining and pellet production business in Australia and internationally, with a market cap of A$277.76 million.

Operations: Grange Resources Limited generates revenue primarily from its ore mining segment, amounting to A$570.41 million.

Dividend Yield: 8.3%

Grange Resources recently announced a fully franked dividend of A$0.005 per security, payable on September 30, 2024. Despite its removal from the S&P/ASX indices, the company's dividends are well-covered by earnings and cash flows with payout ratios of 21.8% and 11.6%, respectively. However, Grange's dividend payments have been volatile and unreliable over the past decade, lacking consistent growth. The stock trades significantly below its estimated fair value but offers a high yield in the Australian market.

- Dive into the specifics of Grange Resources here with our thorough dividend report.

- The analysis detailed in our Grange Resources valuation report hints at an deflated share price compared to its estimated value.

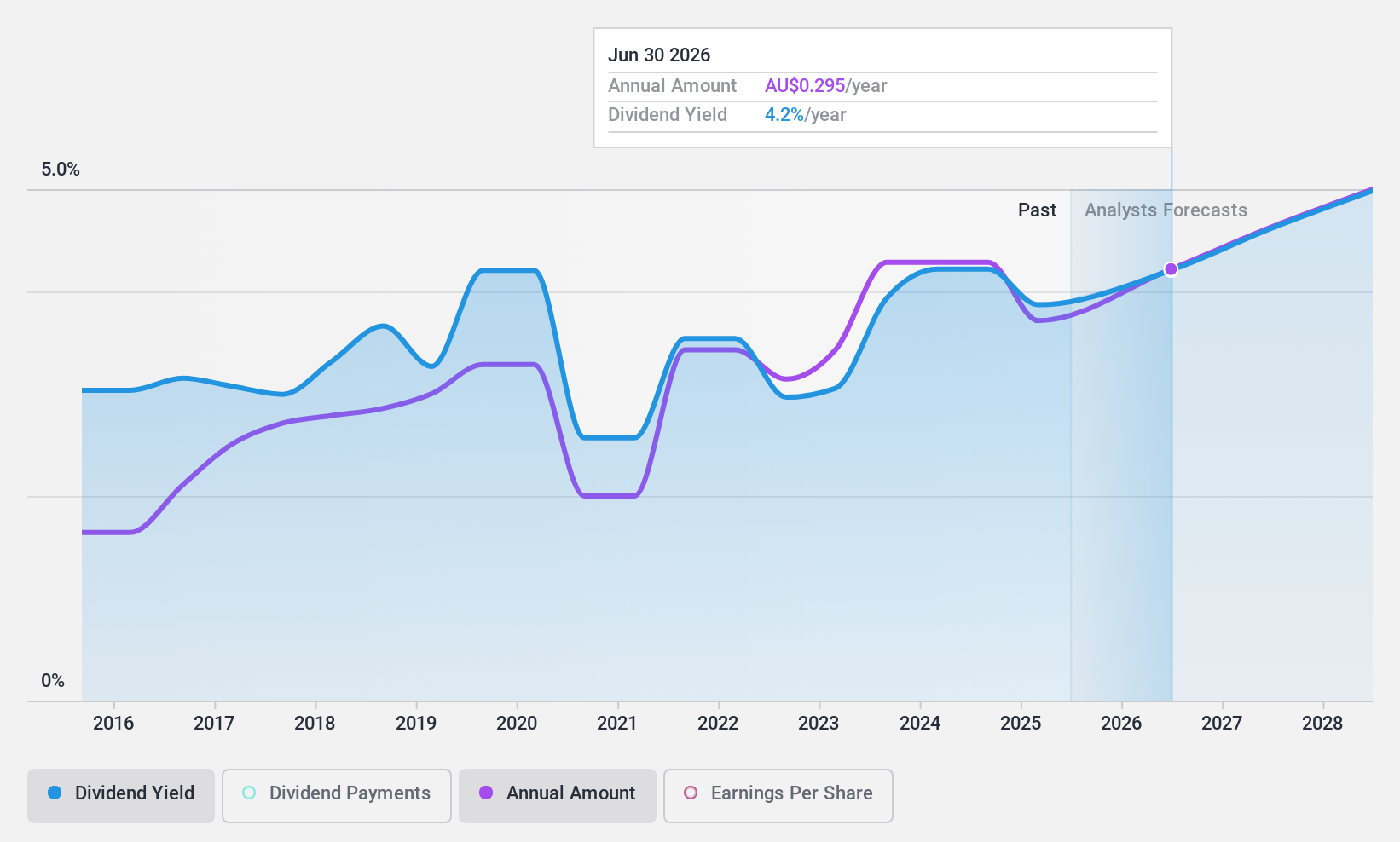

nib holdings (ASX:NHF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: nib holdings limited (ASX:NHF) operates in the underwriting and distribution of private health, life, and living insurance for residents, international students, and visitors in Australia and New Zealand with a market cap of A$2.78 billion.

Operations: nib holdings limited generates revenue through various segments, including Australian Residents Health Insurance (A$2.65 billion), New Zealand Insurance (A$373.10 million), International (Inbound) Health Insurance (A$203.50 million), NIB Travel (A$96.80 million), and Nib Thrive (A$51.30 million).

Dividend Yield: 5.1%

nib holdings declared a fully franked second half dividend of A$0.14 per share, culminating in a full year dividend of A$0.29 per share, with a payout ratio of 75.7% of FY24 NPAT. Despite earnings growth to A$185.6 million from A$114.4 million, dividends have been volatile historically and yield is lower than top-tier payers in Australia at 5.05%. The stock trades significantly below its fair value estimate and dividends are covered by both earnings and cash flows.

- Click here and access our complete dividend analysis report to understand the dynamics of nib holdings.

- Our valuation report unveils the possibility nib holdings' shares may be trading at a discount.

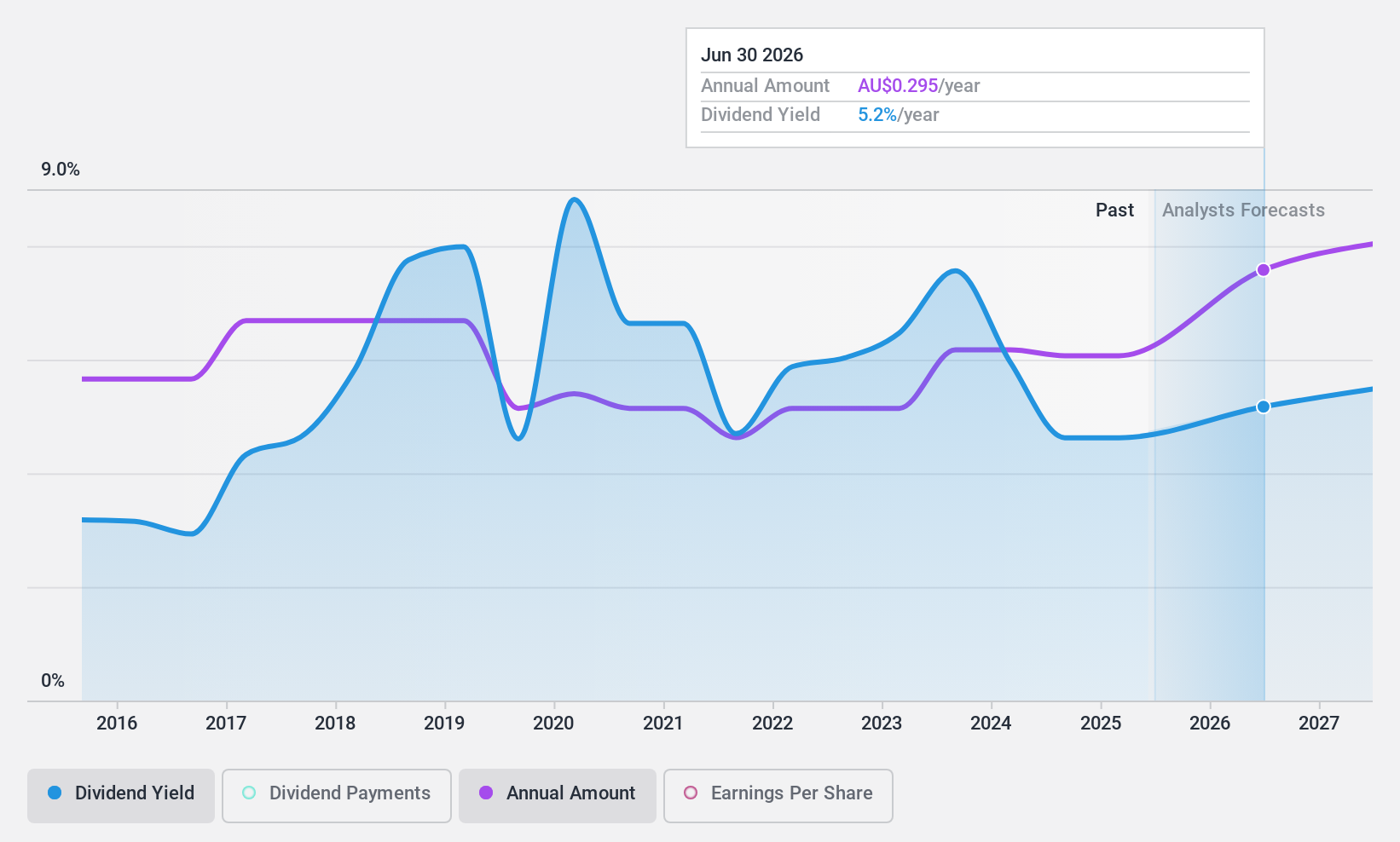

Servcorp (ASX:SRV)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Servcorp Limited offers executive serviced and virtual offices, coworking spaces, IT, communications, and secretarial services with a market cap of A$490.13 million.

Operations: Servcorp Limited generates revenue primarily from its real estate rental segment, which amounts to A$314.89 million.

Dividend Yield: 4.7%

Servcorp declared a final dividend of A$0.13 per share, increasing total FY24 dividends to A$0.25 per share, up 14% from FY23. Earnings surged to A$39.04 million from A$11.07 million, with dividends well-covered by earnings (59.7% payout ratio) and cash flows (14.1% cash payout ratio). Despite recent growth, the dividend yield is lower than top-tier Australian payers and has been volatile over the past decade. The stock trades significantly below its fair value estimate.

- Delve into the full analysis dividend report here for a deeper understanding of Servcorp.

- Insights from our recent valuation report point to the potential undervaluation of Servcorp shares in the market.

Seize The Opportunity

- Reveal the 36 hidden gems among our Top ASX Dividend Stocks screener with a single click here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SRV

Servcorp

Provides executive serviced and virtual offices, coworking and IT, communications, and secretarial services.

Outstanding track record, undervalued and pays a dividend.