- Australia

- /

- Metals and Mining

- /

- ASX:GML

Executive MD & Director Peter Langworthy Just Bought Shares In Gateway Mining Limited (ASX:GML)

Potential Gateway Mining Limited (ASX:GML) shareholders may wish to note that the Executive MD & Director, Peter Langworthy, recently bought AU$200k worth of stock, paying AU$0.015 for each share. That's a very decent purchase to our minds and it grew their holding by a solid 21%.

View our latest analysis for Gateway Mining

Gateway Mining Insider Transactions Over The Last Year

In fact, the recent purchase by Executive MD & Director Peter Langworthy was not their only acquisition of Gateway Mining shares this year. Earlier in the year, they paid AU$0.015 per share in a AU$215k purchase. Although we like to see insider buying, we note that this large purchase was at significantly below the recent price of AU$0.019. Because it occurred at a lower valuation, it doesn't tell us much about whether insiders might find today's price attractive.

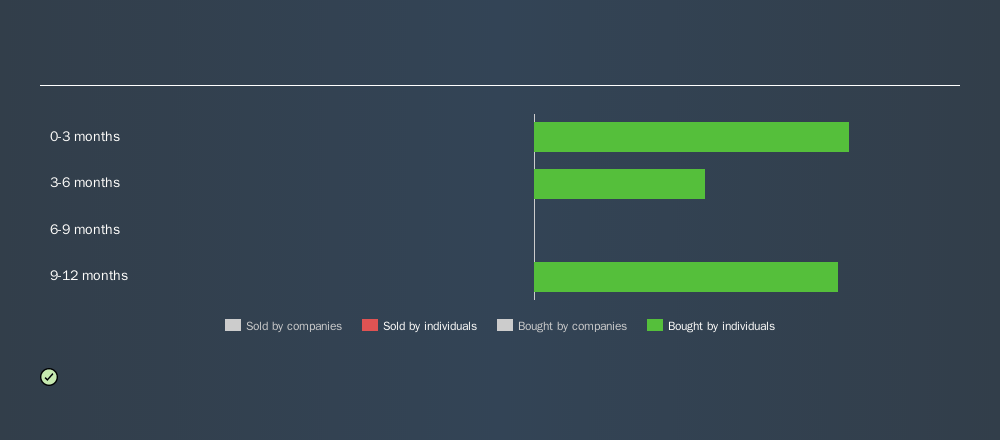

Gateway Mining insiders may have bought shares in the last year, but they didn't sell any. You can see a visual depiction of insider transactions (by individuals) over the last 12 months, below. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

There are always plenty of stocks that insiders are buying. So if that suits your style you could check each stock one by one or you could take a look at this free list of companies. (Hint: insiders have been buying them).

Insider Ownership of Gateway Mining

Another way to test the alignment between the leaders of a company and other shareholders is to look at how many shares they own. I reckon it's a good sign if insiders own a significant number of shares in the company. Gateway Mining insiders own about AU$4.1m worth of shares. That equates to 16% of the company. While this is a strong but not outstanding level of insider ownership, it's enough to indicate some alignment between management and smaller shareholders.

What Might The Insider Transactions At Gateway Mining Tell Us?

It's certainly positive to see the recent insider purchases. We also take confidence from the longer term picture of insider transactions. But we don't feel the same about the fact the company is making losses. Insiders likely see value in Gateway Mining shares, given these transactions (along with notable insider ownership of the company). Along with insider transactions, I recommend checking if Gateway Mining is growing revenue. This free chart of historic revenue and earnings should make that easy.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ASX:GML

Gateway Mining

Acquires, explores, and develops mineral resource properties in Western Australia.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026