- Australia

- /

- Metals and Mining

- /

- ASX:GGP

Greatland Resources (ASX:GGP): Valuation Snapshot Following Strong September Quarter Production Update and Guidance Confirmation

Reviewed by Kshitija Bhandaru

Greatland Resources (ASX:GGP) delivered its preliminary September quarter update, highlighting both steady gold and copper output as well as reaffirmed guidance for the coming year. Management noted its all-in-sustaining costs remain at the lower end of expectations.

See our latest analysis for Greatland Resources.

Greatland Resources’ momentum has been hard to miss lately, with a 33% 1-month share price return and a 25.9% gain over the past quarter. The shares have traded higher following robust production numbers, a strategic acquisition that cemented its status as a key gold-copper producer, and a dual listing on the ASX. All the while, its fundamentals remain solid. This combination of operational progress and improving confidence suggests that market sentiment may be on the upswing.

If you’re interested in uncovering what else is capturing investor attention, now’s a great moment to broaden your perspective and discover fast growing stocks with high insider ownership

With shares rallying and fundamentals looking sound, the question now is whether Greatland Resources is still trading at a discount, or if the recent run-up already reflects expectations for future growth. Could there be more value ahead for investors?

Price-to-Earnings of 16.5x: Is it justified?

Greatland Resources is trading at a price-to-earnings (P/E) ratio of 16.5x, well below both its peer group average of 27.1x and the broader Australian Metals and Mining industry average of 22.6x. This valuation signals that the market is pricing Greatland Resources at a discount compared to similar companies and sector averages.

The price-to-earnings multiple reflects how much investors are willing to pay now for each dollar of future earnings. In the resource sector, this multiple often depends on prospects of stable production, revenue visibility, and consistent profit margins. Greatland Resources has only recently become profitable, so its P/E ratio could be especially attractive if earnings durability is maintained as the company grows.

Compared to its industry peers, the current P/E ratio places Greatland Resources among the most attractively valued within the sector. If the market starts to recognize the company’s improved profitability and stable output, this gap could narrow, which may lead to multiple expansion.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 16.5x (UNDERVALUED)

However, slower net income growth and future commodity price volatility remain risks that could temper expectations around Greatland Resources’ current valuation and future performance.

Find out about the key risks to this Greatland Resources narrative.

Another View: Discounted Cash Flow Tells a Different Story

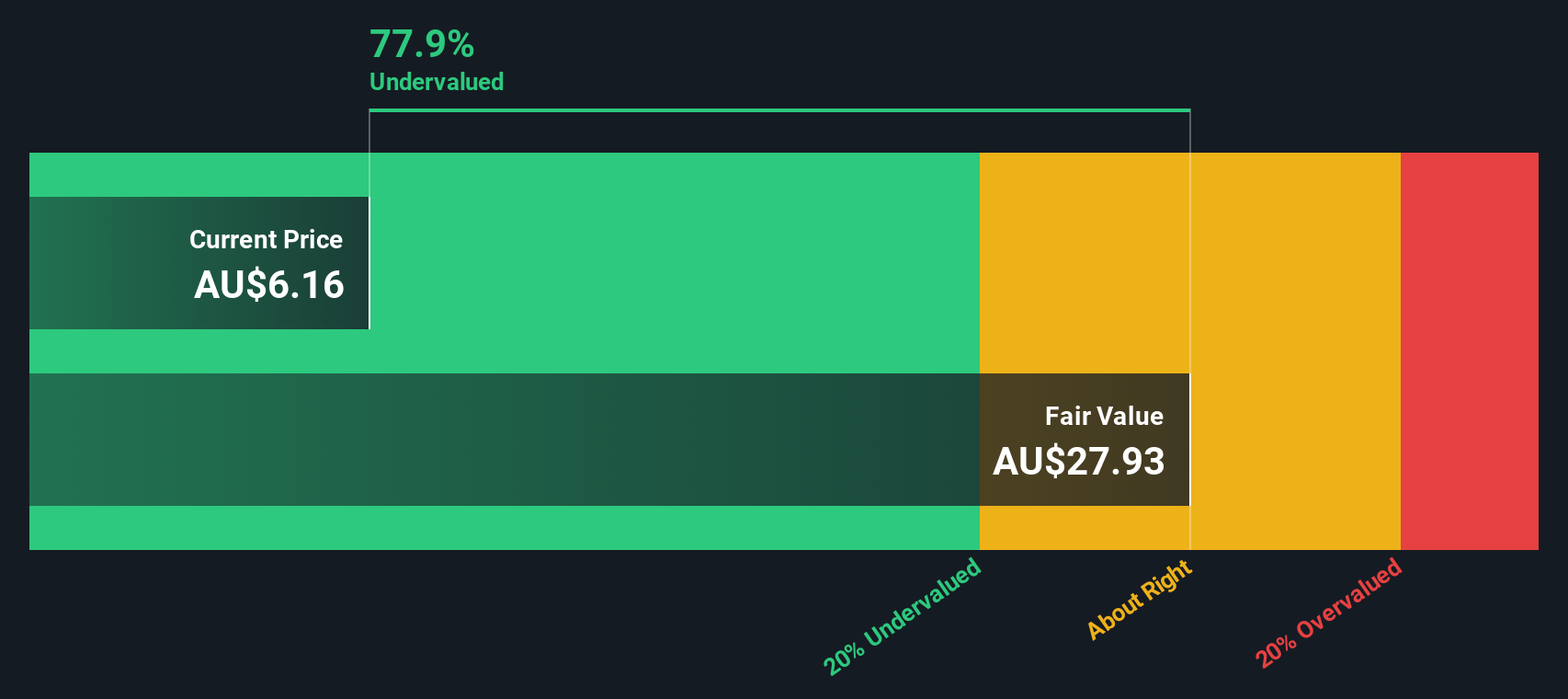

While Greatland Resources looks undervalued using earnings multiples, our DCF model offers a more optimistic outlook. The SWS DCF model suggests that the stock could be trading at a significant discount to its intrinsic value, which points to deeper potential. But does this paint too rosy a picture, or is there more upside than the market expects?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Greatland Resources for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Greatland Resources Narrative

If you have your own perspective or want to dig deeper into the numbers, you can easily build your personal view of the company’s outlook in just a few minutes, and Do it your way.

A great starting point for your Greatland Resources research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t miss your chance to get ahead of the market by spotting tomorrow’s winners today. Use powerful investment screeners that surface unique opportunities you might have overlooked.

- Unlock new growth potential when you jump into these 26 quantum computing stocks for companies pioneering advancements in quantum computing and technological disruption.

- Boost your passive income with confidence by reviewing these 19 dividend stocks with yields > 3% offering yields above 3% and dependable payout histories.

- Capitalize on tech breakthroughs and future innovation by scanning these 26 AI penny stocks that are setting the pace in artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:GGP

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives