- Australia

- /

- Metals and Mining

- /

- ASX:GBE

Companies Like Globe Metals & Mining (ASX:GBE) Are In A Position To Invest In Growth

There's no doubt that money can be made by owning shares of unprofitable businesses. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. But while the successes are well known, investors should not ignore the very many unprofitable companies that simply burn through all their cash and collapse.

Given this risk, we thought we'd take a look at whether Globe Metals & Mining (ASX:GBE) shareholders should be worried about its cash burn. In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. We'll start by comparing its cash burn with its cash reserves in order to calculate its cash runway.

Check out our latest analysis for Globe Metals & Mining

When Might Globe Metals & Mining Run Out Of Money?

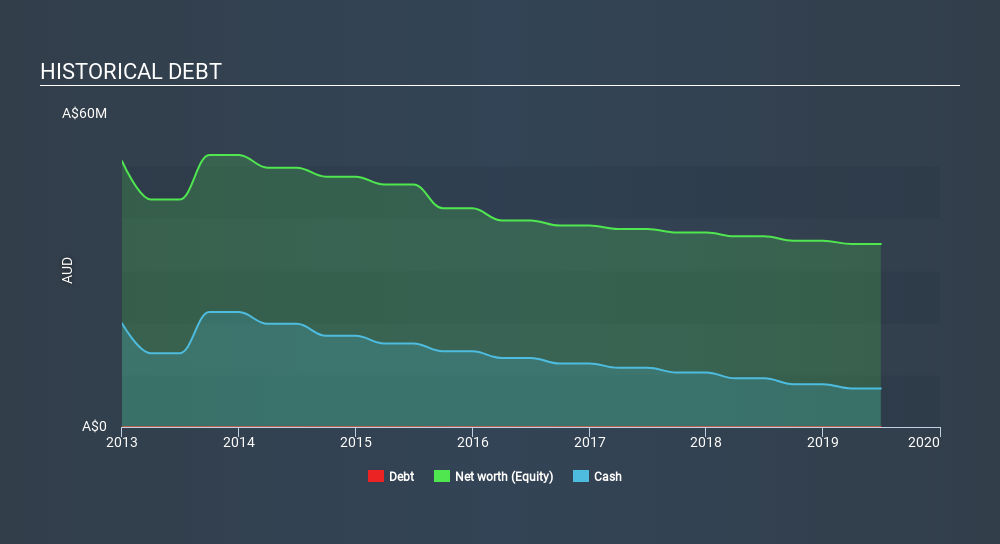

A company's cash runway is calculated by dividing its cash hoard by its cash burn. When Globe Metals & Mining last reported its balance sheet in June 2019, it had zero debt and cash worth AU$7.4m. Looking at the last year, the company burnt through AU$1.9m. That means it had a cash runway of about 3.8 years as of June 2019. There's no doubt that this is a reassuringly long runway. Depicted below, you can see how its cash holdings have changed over time.

How Is Globe Metals & Mining's Cash Burn Changing Over Time?

Globe Metals & Mining didn't record any revenue over the last year, indicating that it's an early stage company still developing its business. So while we can't look to sales to understand growth, we can look at how the cash burn is changing to understand how expenditure is trending over time. Cash burn was pretty flat over the last year, which suggests that management are holding spending steady while the business advances its strategy. Globe Metals & Mining makes us a little nervous due to its lack of substantial operating revenue. So we'd generally prefer stocks from this list of stocks that have analysts forecasting growth.

Can Globe Metals & Mining Raise More Cash Easily?

While its cash burn is only increasing slightly, Globe Metals & Mining shareholders should still consider the potential need for further cash, down the track. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. Commonly, a business will sell new shares in itself to raise cash to drive growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Since it has a market capitalisation of AU$7.5m, Globe Metals & Mining's AU$1.9m in cash burn equates to about 26% of its market value. That's fairly notable cash burn, so if the company had to sell shares to cover the cost of another year's operations, shareholders would suffer some costly dilution.

How Risky Is Globe Metals & Mining's Cash Burn Situation?

Even though its cash burn relative to its market cap makes us a little nervous, we are compelled to mention that we thought Globe Metals & Mining's cash runway was relatively promising. Based on the factors mentioned in this article, we think its cash burn situation warrants some attention from shareholders, but we don't think they should be worried. When you don't have traditional metrics like earnings per share and free cash flow to value a company, many are extra motivated to consider qualitative factors such as whether insiders are buying or selling shares. Please Note: Globe Metals & Mining insiders have been trading shares, according to our data. Click here to check whether insiders have been buying or selling.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies insiders are buying, and this list of stocks growth stocks (according to analyst forecasts)

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ASX:GBE

Globe Metals & Mining

Engages in the exploration, development, and investment of mineral resource properties in Australia and Africa.

Moderate risk with adequate balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026