- Australia

- /

- Metals and Mining

- /

- ASX:FMG

Fortescue (ASX:FMG) Valuation in Focus as Renewables Strategy Accelerates

Reviewed by Kshitija Bhandaru

Fortescue (ASX:FMG) is drawing attention as it accelerates its shift toward renewables, unveiling a series of large-scale supply deals for wind turbines, solar panels, and battery-electric haul truck fleets. This signals a fundamental change in the company’s approach to sustainability and operations.

See our latest analysis for Fortescue.

Fortescue’s recent deals for renewables, new clean energy partnerships, and the Nabrawind wind tech acquisition are adding to a sense of momentum for the miner. That said, while broader market enthusiasm around energy transition has been rising, Fortescue’s one-year total shareholder return stands at just 3.6%. Its five-year figure of over 92% highlights the company’s long-term transformative growth story.

If you’re looking to expand your watchlist beyond mining and renewables, now’s a great moment to discover fast growing stocks with high insider ownership.

With Fortescue shares up just 3.6 percent over the past year but having outperformed significantly in the long term, the real question is whether the market has already priced in the company’s green ambitions or if a buying opportunity remains.

Most Popular Narrative: 9.7% Overvalued

At A$19.29 per share, Fortescue's recent close is nearly 10% above the consensus fair value estimated by the most popular market narrative, hinting at expectations that may already be ambitious. The underlying projections and assumptions driving this view set up important questions about the company’s earnings power and long-term profit margins.

The market appears to be pricing in continued robust iron ore demand from China, driven by a belief in ongoing mega-infrastructure projects and resilient steel consumption. This assumes that elevated Chinese demand can offset global industry headwinds. Should this prove optimistic, Fortescue's future revenue could disappoint.

Curious about which forecasts are fueling that price target? The core of this narrative is built on some bold assumptions about falling profit margins and a profit multiple most miners rarely achieve. Wondering what analysts expect for Fortescue’s future earnings, revenues, and profit outlook? Click through to uncover the precise metrics shaping this valuation debate.

Result: Fair Value of $17.59 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Fortescue's record shipments and advancing green projects could help offset margin pressures more quickly than expected, which challenges the current outlook.

Find out about the key risks to this Fortescue narrative.

Another View: Different Model, Opposite Conclusion

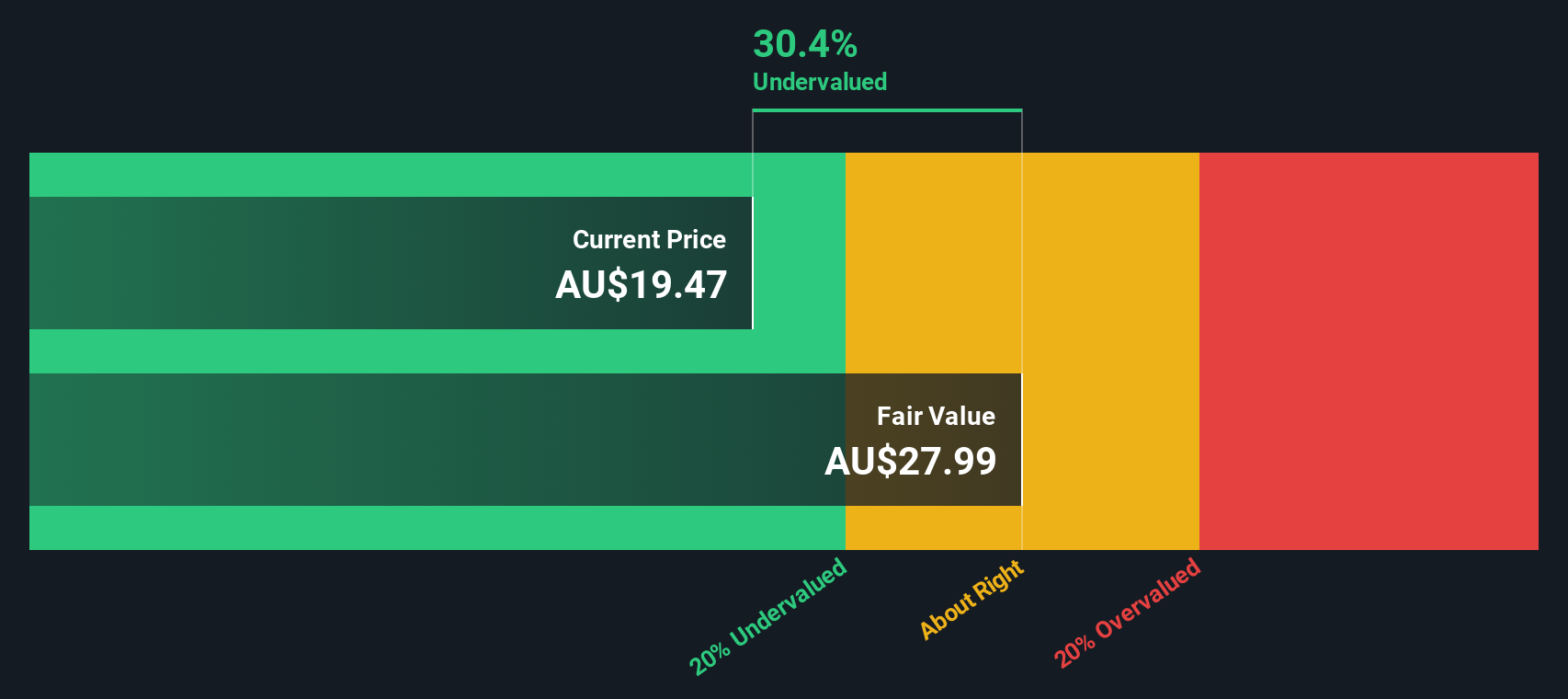

While the popular narrative suggests Fortescue is overvalued based on analyst earnings forecasts, our SWS DCF model presents a very different picture. This long-term cash flow-based approach indicates the shares are actually undervalued by more than 30%. So, which yardstick ultimately tells the sharper story?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Fortescue Narrative

If you see things differently or want to dig into the numbers yourself, it's simple to build your own perspective in just a few minutes. Do it your way.

A great starting point for your Fortescue research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Unlock new opportunities by stepping beyond the obvious and staying ahead of the curve by targeting sectors others might overlook. You owe it to your future returns.

- Spot tomorrow’s winners first by reviewing these 910 undervalued stocks based on cash flows that could be flying under the radar with remarkable cash flow potential.

- Supercharge your portfolio’s growth with these 24 AI penny stocks leading the charge in artificial intelligence innovation and next-generation computing trends.

- Secure steady income streams with these 19 dividend stocks with yields > 3% offering reliable yields above 3 percent to strengthen your investment foundation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:FMG

Fortescue

Engages in the exploration, development, production, processing, and sale of iron ore in Australia, China, and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives