- Australia

- /

- Metals and Mining

- /

- ASX:AGY

Argosy Minerals Leads The Charge With 2 Other ASX Penny Stocks

Reviewed by Simply Wall St

The Australian market is experiencing a downturn, with the ASX expected to extend its losses this week due to disappointment over unlikely rate cuts and recent inflation data. In such conditions, investors often turn their attention to penny stocks, which despite their outdated name, can still present valuable opportunities when backed by strong financials. These smaller or newer companies can offer a unique blend of value and growth potential that larger firms might miss, making them intriguing options for those seeking under-the-radar investments with long-term promise.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| LaserBond (ASX:LBL) | A$0.615 | A$72.09M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.785 | A$144.03M | ★★★★☆☆ |

| MaxiPARTS (ASX:MXI) | A$1.895 | A$104.82M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.745 | A$281.08M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.52 | A$322.48M | ★★★★★☆ |

| Navigator Global Investments (ASX:NGI) | A$1.69 | A$828.23M | ★★★★★☆ |

| Perenti (ASX:PRN) | A$1.17 | A$1.08B | ★★★★★★ |

| Atlas Pearls (ASX:ATP) | A$0.145 | A$63.17M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.465 | A$91.13M | ★★★★★★ |

| Joyce (ASX:JYC) | A$4.22 | A$124.48M | ★★★★★★ |

Click here to see the full list of 1,033 stocks from our ASX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Argosy Minerals (ASX:AGY)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Argosy Minerals Limited focuses on the exploration and development of lithium projects in Argentina and the United States, with a market cap of A$61.15 million.

Operations: No revenue segments are reported.

Market Cap: A$61.15M

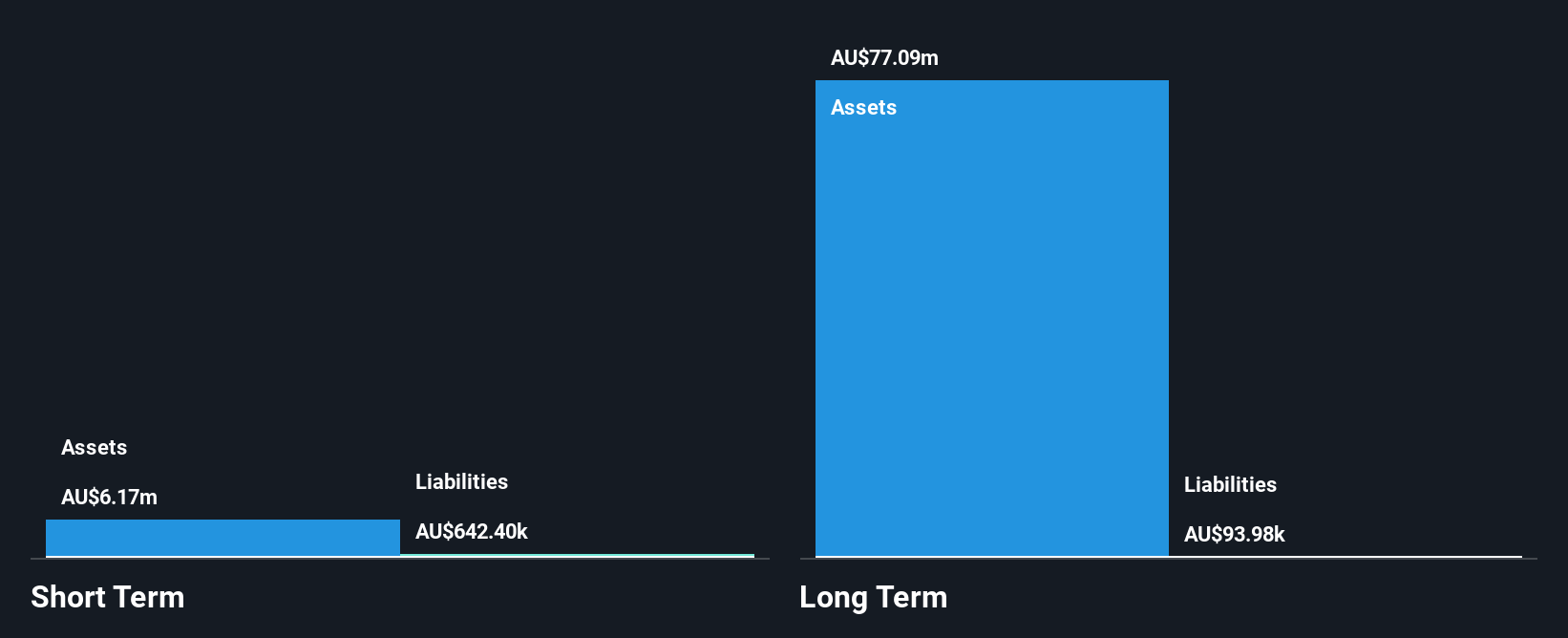

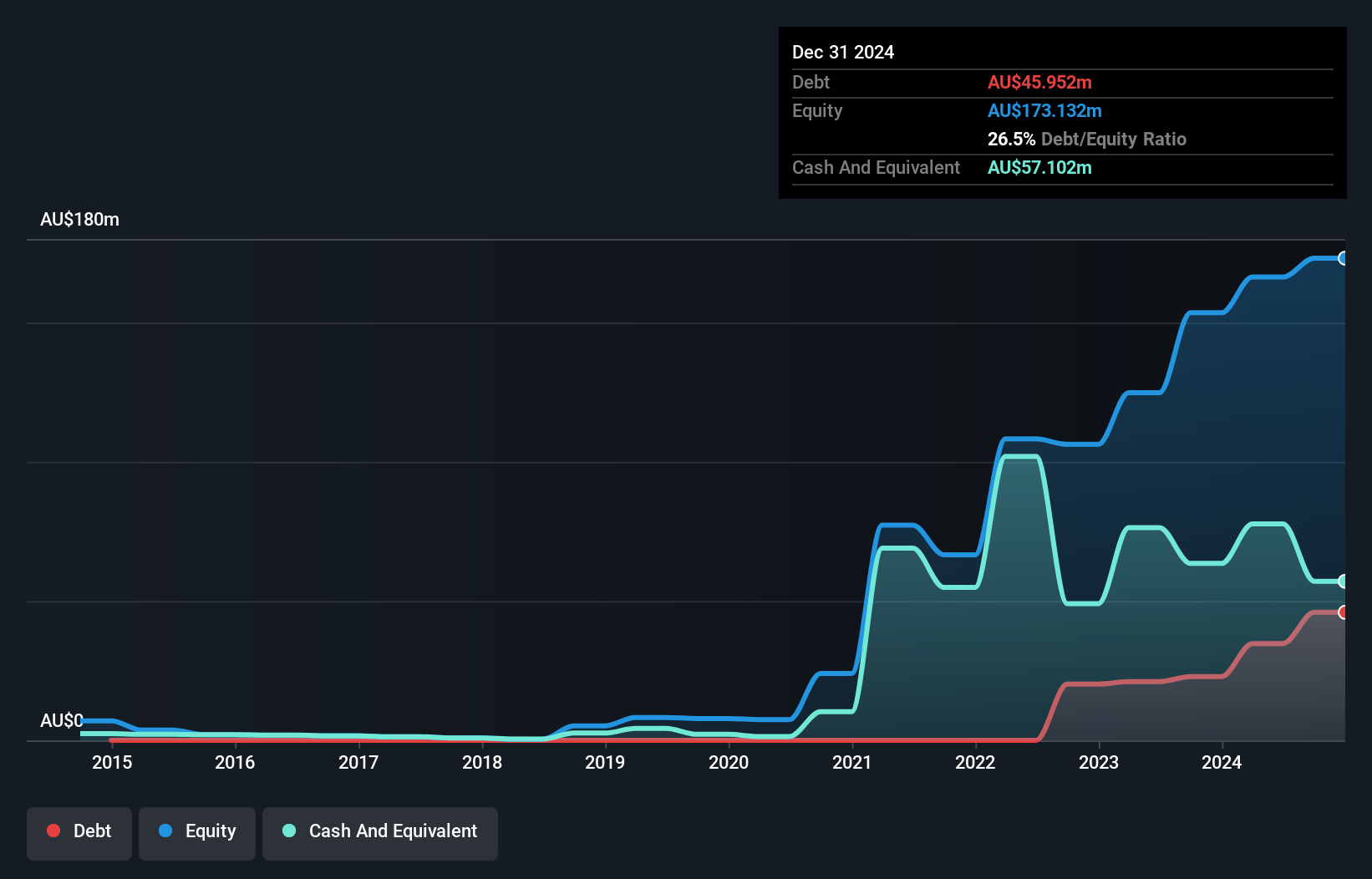

Argosy Minerals Limited, with a market cap of A$61.15 million, is pre-revenue and currently unprofitable, having reported a net loss of A$70.91 million for the half year ended June 30, 2024. Despite being debt-free and possessing short-term assets that cover both its short- and long-term liabilities, Argosy's earnings have declined significantly over the past five years. The company has sufficient cash runway for nearly two years but faces challenges such as recent index exclusion and shareholder dilution over the past year. Its management team is experienced; however, its board lacks tenure depth.

- Click here to discover the nuances of Argosy Minerals with our detailed analytical financial health report.

- Review our historical performance report to gain insights into Argosy Minerals' track record.

Fenix Resources (ASX:FEX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Fenix Resources Limited is involved in the exploration, development, and mining of mineral tenements in Western Australia, with a market cap of A$194.57 million.

Operations: Fenix Resources generates revenue from three primary segments: Mining (A$240.18 million), Logistics (A$72.48 million), and Port Services (A$34.07 million).

Market Cap: A$194.57M

Fenix Resources, with a market cap of A$194.57 million, has shown solid financial performance in the past year. The company reported sales of A$259.2 million for the full year ended June 30, 2024, up from A$196.85 million the previous year, and net income increased to A$33.64 million from A$29.25 million. Despite shareholder dilution over the past year and slightly declining profit margins, Fenix maintains high-quality earnings and strong cash flow coverage for its debt obligations. Its return on equity is robust at 20.2%, indicating efficient use of equity capital compared to industry peers.

- Unlock comprehensive insights into our analysis of Fenix Resources stock in this financial health report.

- Understand Fenix Resources' earnings outlook by examining our growth report.

Southern Cross Media Group (ASX:SXL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Southern Cross Media Group Limited, with a market cap of A$121.15 million, creates audio content for distribution across broadcast and digital networks in Australia.

Operations: The company's revenue is primarily derived from Broadcast Radio (A$366.62 million), followed by Television (A$97.49 million) and Digital Audio (A$35.03 million).

Market Cap: A$121.15M

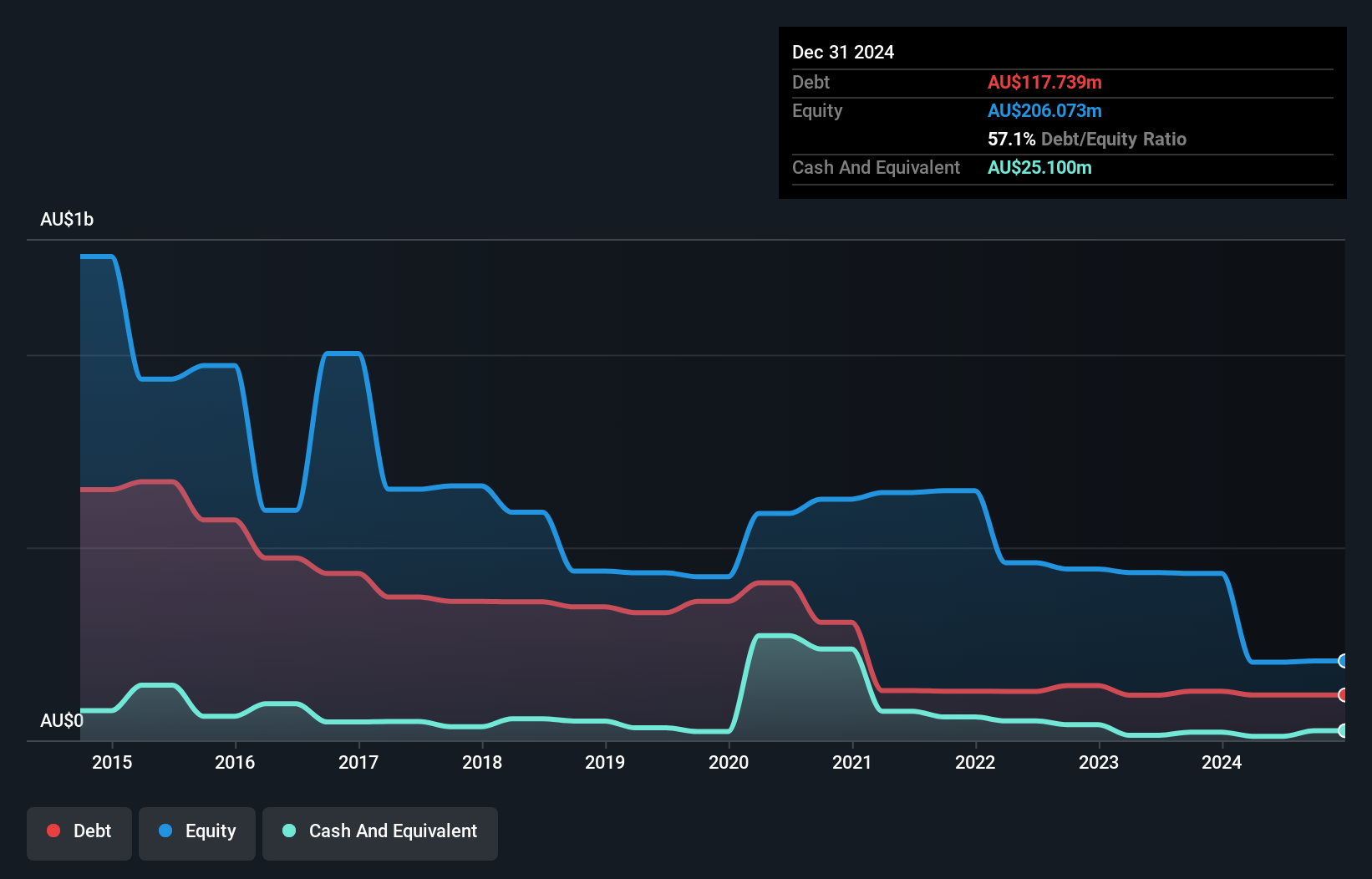

Southern Cross Media Group, with a market cap of A$121.15 million, faces challenges as it navigates unprofitability and a recent net loss of A$224.6 million for the year ending June 30, 2024. Despite this, the company maintains a positive cash runway exceeding three years and has not significantly diluted shareholders recently. Its short-term assets cover liabilities effectively, but long-term liabilities remain uncovered by current assets. The company's debt to equity ratio is high at 52.8%, though it has improved over five years from 76.2%. Recent executive changes include Marina Go's appointment as Director in October 2024.

- Get an in-depth perspective on Southern Cross Media Group's performance by reading our balance sheet health report here.

- Examine Southern Cross Media Group's earnings growth report to understand how analysts expect it to perform.

Next Steps

- Dive into all 1,033 of the ASX Penny Stocks we have identified here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:AGY

Argosy Minerals

Engages in the exploration and development of lithium properties in Argentina and the United States.

Flawless balance sheet slight.

Similar Companies

Market Insights

Community Narratives