As Australian shares are poised for a modest rise, all eyes are on the Reserve Bank of Australia's upcoming decision amidst fluctuating economic indicators like core inflation and unemployment rates. For investors seeking opportunities beyond the mainstream, penny stocks—though an old-fashioned term—continue to hold relevance as they often represent smaller or newer companies with promising potential. These stocks can offer a blend of affordability and growth prospects, especially when backed by robust financials, making them an intriguing area to explore in today's market landscape.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.40 | A$114.64M | ✅ 3 ⚠️ 3 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.15 | A$101.42M | ✅ 4 ⚠️ 3 View Analysis > |

| GTN (ASX:GTN) | A$0.395 | A$75.31M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.97 | A$457.92M | ✅ 4 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$2.67 | A$3.04B | ✅ 5 ⚠️ 1 View Analysis > |

| Regal Partners (ASX:RPL) | A$3.05 | A$1.03B | ✅ 4 ⚠️ 2 View Analysis > |

| Austco Healthcare (ASX:AHC) | A$0.375 | A$137.06M | ✅ 4 ⚠️ 1 View Analysis > |

| Austin Engineering (ASX:ANG) | A$0.305 | A$189.26M | ✅ 4 ⚠️ 1 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.825 | A$146.99M | ✅ 4 ⚠️ 2 View Analysis > |

| Reckon (ASX:RKN) | A$0.645 | A$73.08M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 457 stocks from our ASX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Falcon Metals (ASX:FAL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Falcon Metals Limited focuses on the discovery, exploration, and development of mineral deposits in Australia with a market cap of A$111.86 million.

Operations: Falcon Metals Limited has not reported any distinct revenue segments.

Market Cap: A$111.86M

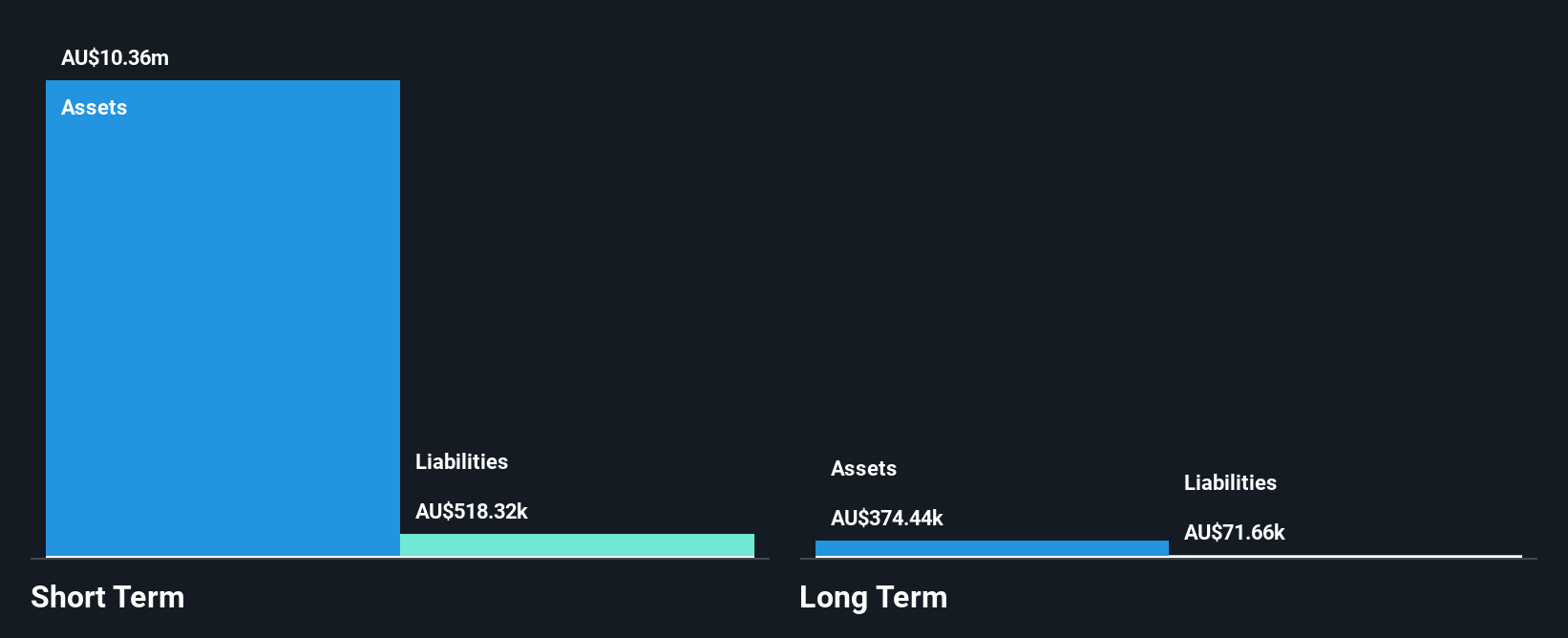

Falcon Metals Limited, with a market cap of A$111.86 million, is pre-revenue and currently unprofitable. Despite this, the company maintains a debt-free status and has sufficient cash runway for 1.8 years if free cash flow continues to decrease at historical rates. Its short-term assets of A$10.4 million exceed both short-term liabilities (A$518.3K) and long-term liabilities (A$71.7K), indicating solid financial management in covering obligations without leveraging debt. However, investors should be aware of its high share price volatility over the past three months and increased weekly volatility from 21% to 34% over the past year.

- Navigate through the intricacies of Falcon Metals with our comprehensive balance sheet health report here.

- Explore historical data to track Falcon Metals' performance over time in our past results report.

NRW Holdings (ASX:NWH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: NRW Holdings Limited, with a market cap of A$1.54 billion, offers diversified contract services to the resources and infrastructure sectors in Australia through its subsidiaries.

Operations: The company's revenue is generated from three main segments: Mining (A$1.56 billion), MET (A$853.22 million), and Civil (A$776.06 million).

Market Cap: A$1.54B

NRW Holdings Limited, with a market cap of A$1.54 billion, generates substantial revenue across its Mining (A$1.56 billion), MET (A$853.22 million), and Civil (A$776.06 million) segments, demonstrating robust operational capabilities in Australia's resources and infrastructure sectors. The company exhibits strong financial health, with short-term assets exceeding both short-term and long-term liabilities, and interest payments well-covered by EBIT at 7.5 times coverage. Despite an unstable dividend track record, earnings have grown significantly by 29.9% over the past year—surpassing industry growth—and are forecasted to continue expanding annually at 8%.

- Click here and access our complete financial health analysis report to understand the dynamics of NRW Holdings.

- Examine NRW Holdings' earnings growth report to understand how analysts expect it to perform.

ReadyTech Holdings (ASX:RDY)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: ReadyTech Holdings Limited offers technology-based solutions in Australia and has a market cap of A$296.55 million.

Operations: The company's revenue is derived from three main segments: Workforce Solutions (A$32.30 million), Government and Justice (A$43.21 million), and Education and Work Pathways (A$41.90 million).

Market Cap: A$296.55M

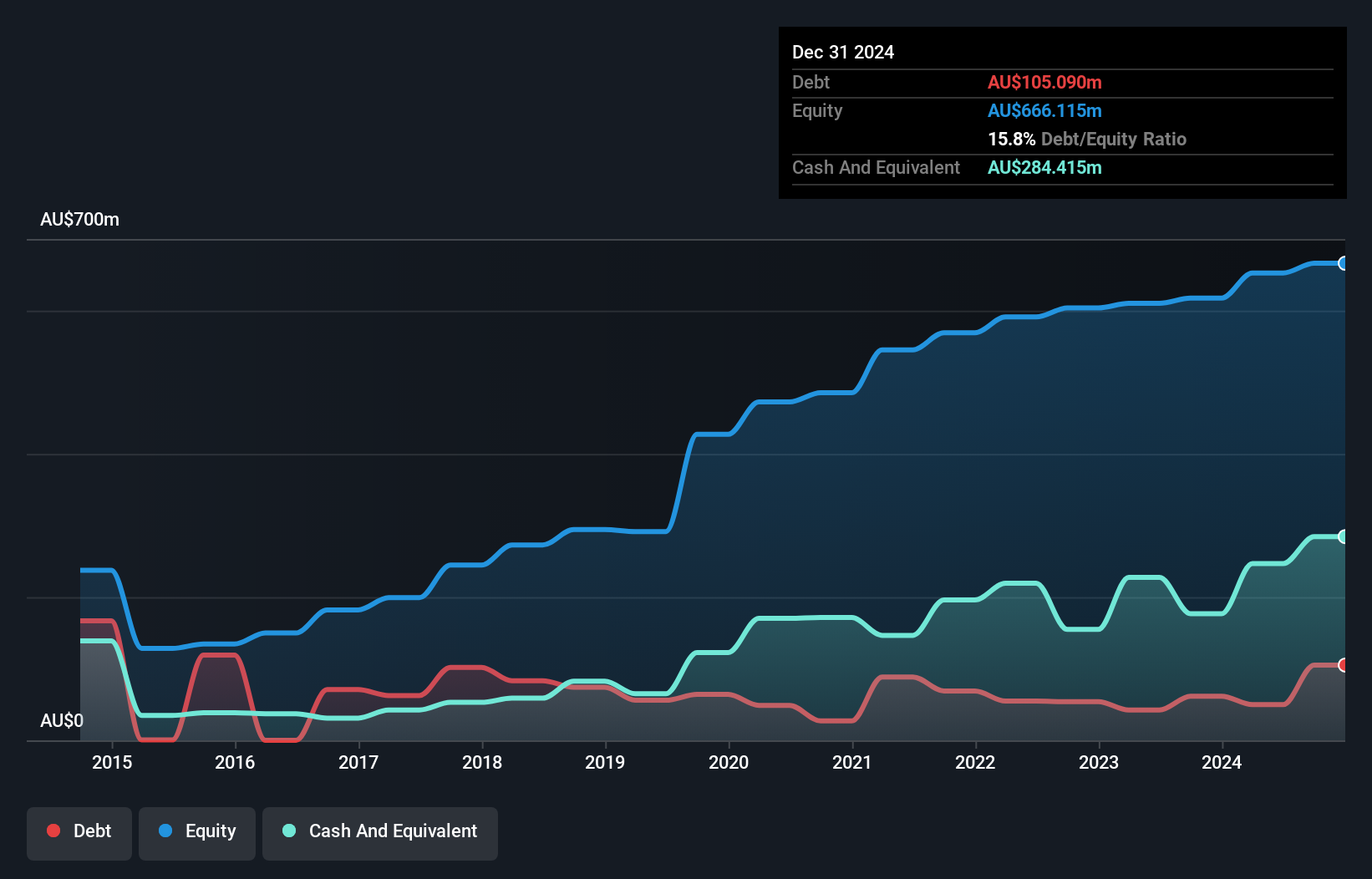

ReadyTech Holdings Limited, with a market cap of A$296.55 million, derives revenue from Workforce Solutions (A$32.30 million), Government and Justice (A$43.21 million), and Education and Work Pathways (A$41.90 million). Despite being unprofitable with a negative Return on Equity (-11.19%), the company has reduced its debt to equity ratio significantly over five years to 30.5%. Debt is well covered by operating cash flow at 66.7%, though short-term assets fall short of covering both short-term and long-term liabilities. Analysts anticipate earnings growth of 50.81% annually, suggesting potential future improvement in financial performance.

- Get an in-depth perspective on ReadyTech Holdings' performance by reading our balance sheet health report here.

- Evaluate ReadyTech Holdings' prospects by accessing our earnings growth report.

Turning Ideas Into Actions

- Click here to access our complete index of 457 ASX Penny Stocks.

- Searching for a Fresh Perspective? The end of cancer? These 26 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:RDY

ReadyTech Holdings

Provides technology-based solutions in Australia and New Zealand, the United Kingdom, and the United States of America.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives