- Australia

- /

- Metals and Mining

- /

- ASX:EUR

European Lithium (ASX:EUR) Sells Critical Metals Stake and Lands Battery Deal—What Does This Signal?

Reviewed by Sasha Jovanovic

- European Lithium recently announced a share repurchase program and revealed the sale of 3.85 million shares in Nasdaq-listed Critical Metals Corp, generating US$50 million in proceeds.

- The company’s major offtake agreement with a leading global battery manufacturer and its significant holding in Critical Metals Corp reinforce its emerging role in Europe’s electric vehicle supply chain.

- We’ll explore how these developments, especially the landmark battery offtake deal, influence European Lithium’s current investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is European Lithium's Investment Narrative?

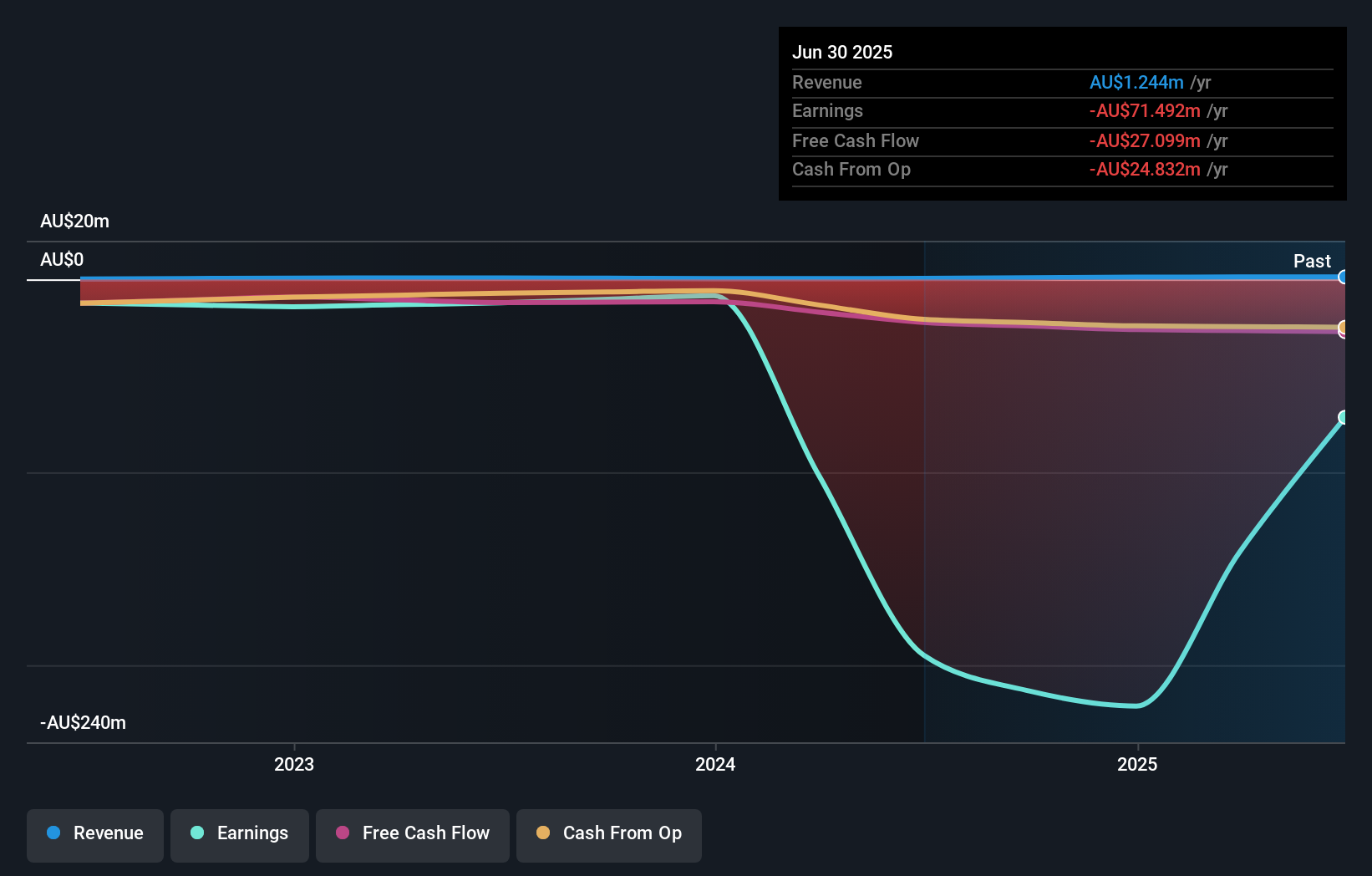

To be a European Lithium shareholder right now, you need to believe in the accelerating demand for European-sourced lithium and the company’s ability to convert its project pipeline and high-profile partnerships into meaningful revenues. The recent battery offtake deal stands out as a potential short-term catalyst, having driven a sharp rally in the stock and positioning European Lithium as a serious contender in the electric vehicle supply chain. Alongside the share buyback, the US$50 million sale of Critical Metals shares has boosted the company’s liquidity and underlined the value locked in its stakes. These moves offer a degree of financial flexibility not reflected in earlier company analysis, although structural risks remain. Chief among them are continued operating losses, auditor doubts about going concern status, a limited cash runway, and volatility amplified by rapid share price fluctuations. The latest developments do shift the narrative, making the investment story more about capital strength and market relevance, but questions about profitability and sustainability linger.

But with auditor concerns still in play, there’s a key risk detail investors should not overlook.

Exploring Other Perspectives

Explore 3 other fair value estimates on European Lithium - why the stock might be worth less than half the current price!

Build Your Own European Lithium Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your European Lithium research is our analysis highlighting 4 important warning signs that could impact your investment decision.

- Our free European Lithium research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate European Lithium's overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if European Lithium might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:EUR

European Lithium

Engages in the exploration and development of lithium deposits in Australia and Austria.

Slight risk with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives