- Australia

- /

- Metals and Mining

- /

- ASX:EUR

European Lithium (ASX:EUR) Launches Major Buyback Is Management Signaling Stronger Confidence in Growth?

Reviewed by Sasha Jovanovic

- European Lithium Limited recently announced a major share repurchase program, authorizing the buyback of up to 135,000,000 shares, approximately 10% of its issued share capital, valid through March 31, 2026.

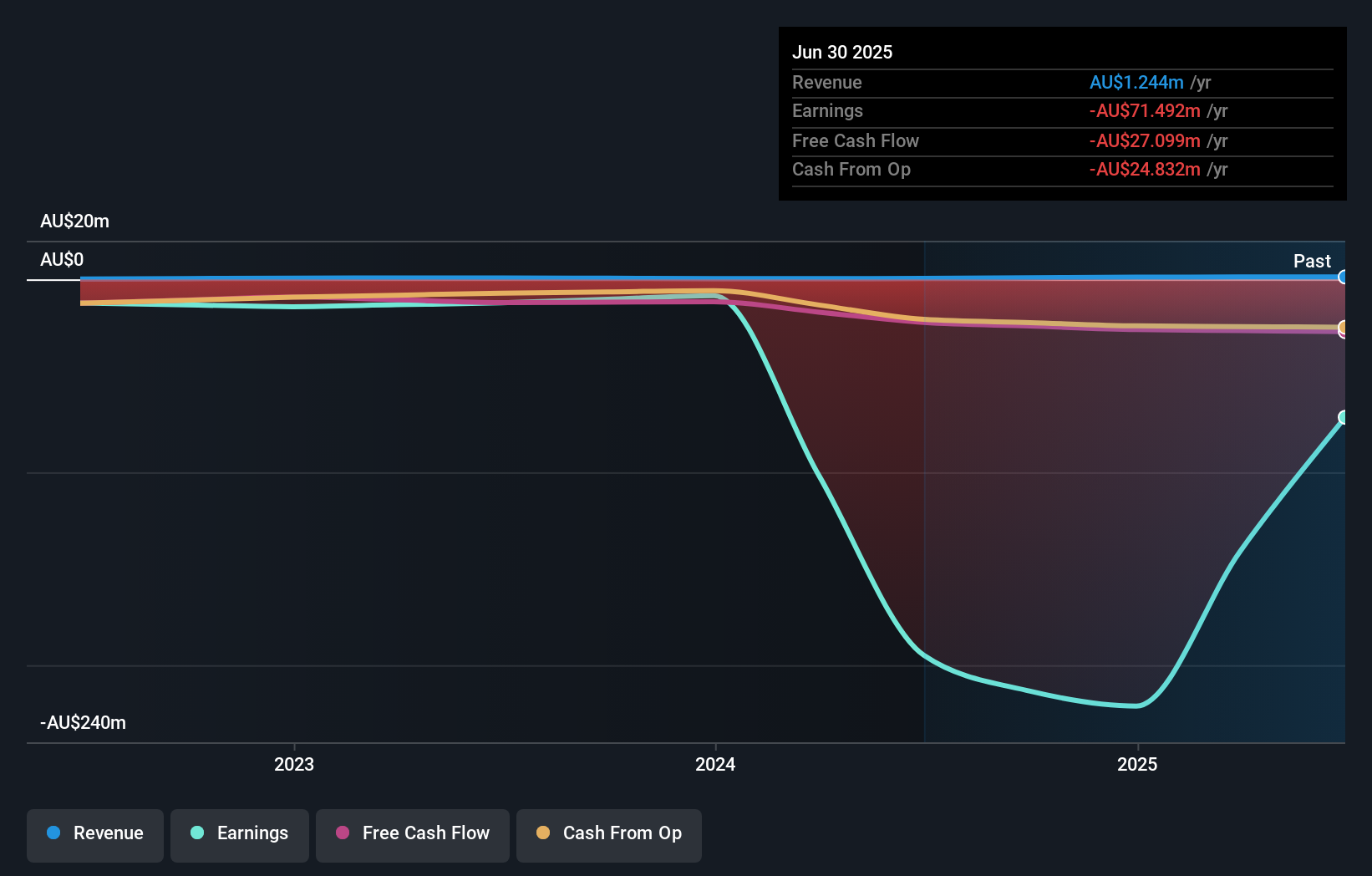

- This announcement follows improved full-year earnings, with sales rising to A$1.24 million and the company's net loss shrinking compared to the previous year, signaling greater operational momentum.

- With management committing to a sizable buyback, we'll explore how this move reinforces confidence in European Lithium's growth efforts.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is European Lithium's Investment Narrative?

Being a shareholder in European Lithium means believing in the company's ambition to supply lithium for the rapidly expanding electric vehicle and battery industries, driven by ongoing developments at its Wolfsberg Project. The recent share buyback announcement, sized at 10% of total issued shares through early 2026, could support the share price and potentially improve market sentiment in the short term. This move follows a period where losses have narrowed and revenues have increased, albeit from a low base, suggesting incremental operational improvements. However, the business remains unprofitable and has less than one year's cash runway, signaling that access to new financing or further equity raises may become a pressing issue. The board's sizeable buyback commitment offers a show of confidence, but it also sharpens focus on the company's persistent reliance on external funding as a central ongoing risk.

But despite recent momentum, cash runway concerns still hang over the company, something investors should keep in mind. Our comprehensive valuation report raises the possibility that European Lithium is priced higher than what may be justified by its financials.Exploring Other Perspectives

Explore 3 other fair value estimates on European Lithium - why the stock might be worth less than half the current price!

Build Your Own European Lithium Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your European Lithium research is our analysis highlighting 4 important warning signs that could impact your investment decision.

- Our free European Lithium research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate European Lithium's overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if European Lithium might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:EUR

European Lithium

Engages in the exploration and development of lithium deposits in Australia and Austria.

Slight risk with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives