- Australia

- /

- Metals and Mining

- /

- ASX:ESS

Here's Why I Think Essential Metals (ASX:ESS) Might Deserve Your Attention Today

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Essential Metals (ASX:ESS). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

View our latest analysis for Essential Metals

Essential Metals's Improving Profits

In a capitalist society capital chases profits, and that means share prices tend rise with earnings per share (EPS). So like a ray of sunshine through a gap in the clouds, improving EPS is considered a good sign. You can imagine, then, that it almost knocked my socks off when I realized that Essential Metals grew its EPS from AU$0.0019 to AU$0.009, in one short year. Even though that growth rate is unlikely to be repeated, that looks like a breakout improvement.

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). Essential Metals's EBIT margins have actually improved by 12.3 percentage points in the last year, to reach 12%, but, on the flip side, revenue was down 14%. That's not ideal.

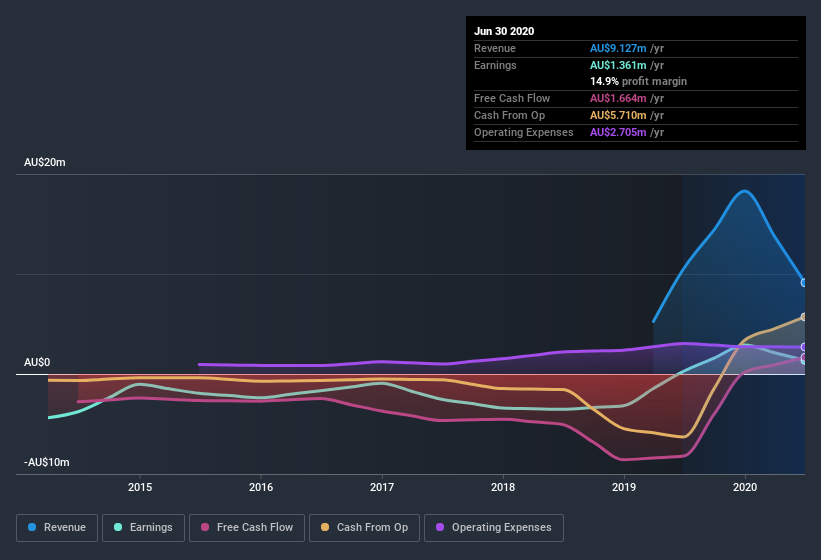

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Essential Metals isn't a huge company, given its market capitalization of AU$29m. That makes it extra important to check on its balance sheet strength.

Are Essential Metals Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

The good news for Essential Metals shareholders is that no insiders reported selling shares in the last year. With that in mind, it's heartening that Paul Payne, the Independent Non-Executive Director of the company, paid AU$18k for shares at around AU$0.09 each.

Is Essential Metals Worth Keeping An Eye On?

Essential Metals's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. If you're like me, you'll find it hard to ignore that sort of explosive EPS growth. And indeed, it could be a sign that the business is at an inflection point. If that's the case, you may regret neglecting to put Essential Metals on your watchlist. Still, you should learn about the 3 warning signs we've spotted with Essential Metals .

As a growth investor I do like to see insider buying. But Essential Metals isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you’re looking to trade Essential Metals, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Essential Metals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:ESS

Essential Metals

Essential Metals Limited explores for and develops mineral properties in Australia.

Flawless balance sheet low.

Market Insights

Community Narratives