- Australia

- /

- Capital Markets

- /

- ASX:NGI

Undiscovered Gems in Australia to Watch This September 2024

Reviewed by Simply Wall St

As the Australian market navigates a dynamic landscape, the ASX200 closed up 0.1% at 8,212 points, driven by gains in the Materials sector following China's latest stimulus announcement. With economic indicators favoring commodity-driven sectors and small-cap companies showing resilience, discerning investors are on the lookout for promising yet undervalued stocks that can thrive in these conditions. In this context, identifying undiscovered gems becomes crucial for those looking to capitalize on current market trends and economic shifts.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Fiducian Group | NA | 9.94% | 6.48% | ★★★★★★ |

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Bisalloy Steel Group | 0.95% | 10.27% | 24.14% | ★★★★★★ |

| Lycopodium | NA | 17.22% | 33.85% | ★★★★★★ |

| SKS Technologies Group | NA | 34.65% | 47.39% | ★★★★★★ |

| Red Hill Minerals | NA | 75.05% | 36.74% | ★★★★★★ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| AMCIL | NA | 5.16% | 5.31% | ★★★★★☆ |

| Hearts and Minds Investments | 1.00% | 18.81% | 20.95% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Emerald Resources (ASX:EMR)

Simply Wall St Value Rating: ★★★★★☆

Overview: Emerald Resources NL focuses on the exploration and development of mineral reserves in Cambodia and Australia, with a market cap of A$2.63 billion.

Operations: Emerald Resources NL generates revenue primarily from its mine operations, totaling A$366.04 million. The company has a market cap of A$2.63 billion.

Emerald Resources has shown impressive growth, with earnings increasing by 41.9% over the past year, outpacing the Metals and Mining industry’s 0.7%. The company reported A$371.07 million in sales for the year ending June 30, 2024, up from A$299.48 million a year ago, while net income rose to A$84.27 million from A$59.36 million. Trading at 57.5% below its estimated fair value and having more cash than total debt highlights its strong financial position and potential for future growth.

Navigator Global Investments (ASX:NGI)

Simply Wall St Value Rating: ★★★★★☆

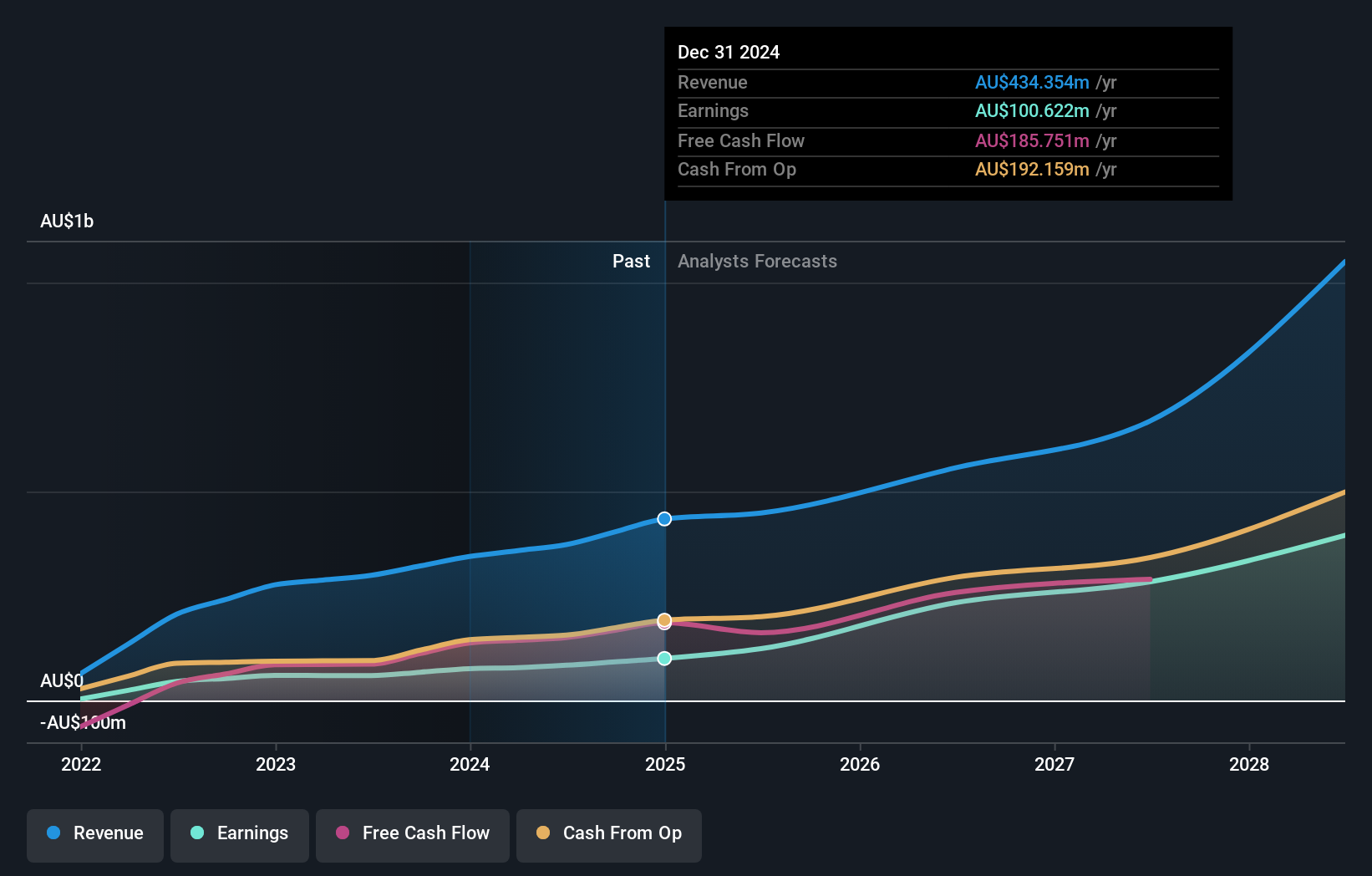

Overview: Navigator Global Investments (ticker: ASX:NGI) operates as a fund management company in Australia with a market cap of A$857.64 million.

Operations: Navigator Global Investments derives its revenue primarily from its Lighthouse segment, which generated A$95.93 million, with minimal contributions from other segments.

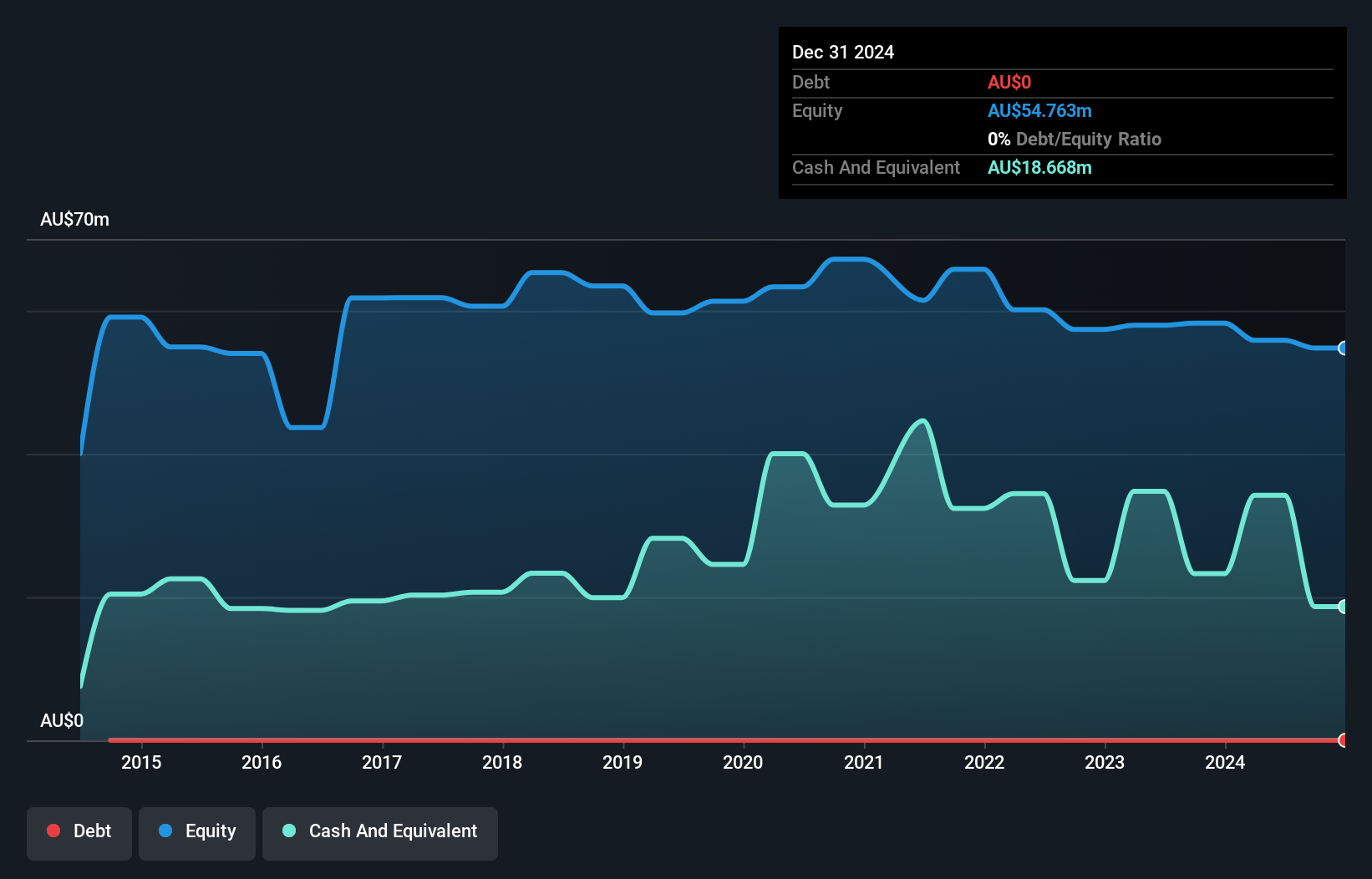

Navigator Global Investments, a notable player in the Australian market, reported significant earnings growth of 86.7% over the past year, outpacing the Capital Markets industry average of 17.2%. The company is trading at 44.5% below its estimated fair value and has no debt, making it an attractive proposition for investors seeking stability. A one-off gain of $17.7M impacted its financial results for the year ending June 30, 2024, contributing to net income of $66.31M from revenue of $276.28M compared to last year's $184.9M revenue and $35.51M net income.

RPMGlobal Holdings (ASX:RUL)

Simply Wall St Value Rating: ★★★★★★

Overview: RPMGlobal Holdings Limited develops and provides mining software solutions across Australia, Asia, the Americas, Africa, and Europe with a market cap of A$677.59 million.

Operations: RPMGlobal Holdings Limited generates revenue primarily from its Software segment, contributing A$72.67 million, and its Advisory segment, adding A$31.41 million.

RPMGlobal Holdings, a notable player in the software industry, has demonstrated impressive growth with earnings surging 134.6% over the past year, significantly outpacing the industry's 6.8%. The company reported A$104.19 million in revenue for FY2024, up from A$91.56 million last year, and net income increased to A$8.66 million from A$3.69 million previously. Recently added to both the S&P/ASX Small Ordinaries and S&P/ASX 300 indices, RPMGlobal is debt-free with high-quality earnings and promising annual growth forecasts of 22.62%.

- Click to explore a detailed breakdown of our findings in RPMGlobal Holdings' health report.

Examine RPMGlobal Holdings' past performance report to understand how it has performed in the past.

Turning Ideas Into Actions

- Click here to access our complete index of 57 ASX Undiscovered Gems With Strong Fundamentals.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Navigator Global Investments might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:NGI

Navigator Global Investments

HFA Holdings Limited operates as a fund management company in Australia.

Very undervalued with excellent balance sheet.