- Australia

- /

- Metals and Mining

- /

- ASX:EMR

Undiscovered Gems in Australia for August 2025

Reviewed by Simply Wall St

As the ASX 200 reaches a historic milestone by surpassing the 9,000 mark, driven primarily by robust performances in the Industrials and Consumer sectors, investors are eyeing opportunities within Australia's dynamic market landscape. In this environment of growth and optimism, identifying promising small-cap stocks that can capitalize on these trends is key to uncovering potential gems in the market.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.78% | 4.30% | ★★★★★★ |

| MFF Capital Investments | NA | 40.81% | 44.64% | ★★★★★★ |

| Hearts and Minds Investments | NA | 47.09% | 49.82% | ★★★★★★ |

| Tribune Resources | NA | -10.33% | -48.18% | ★★★★★★ |

| Red Hill Minerals | NA | 95.16% | 40.06% | ★★★★★★ |

| Djerriwarrh Investments | 2.39% | 8.18% | 7.91% | ★★★★★★ |

| Lycopodium | 0.97% | 16.20% | 28.63% | ★★★★★☆ |

| Carlton Investments | 0.02% | 9.10% | 8.68% | ★★★★★☆ |

| Fiducian Group | 3.81% | 10.00% | 9.57% | ★★★★☆☆ |

| K&S | 20.24% | 1.58% | 25.54% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Emerald Resources (ASX:EMR)

Simply Wall St Value Rating: ★★★★★☆

Overview: Emerald Resources NL focuses on the exploration and development of mineral reserves in Cambodia and Australia, with a market capitalization of A$2.41 billion.

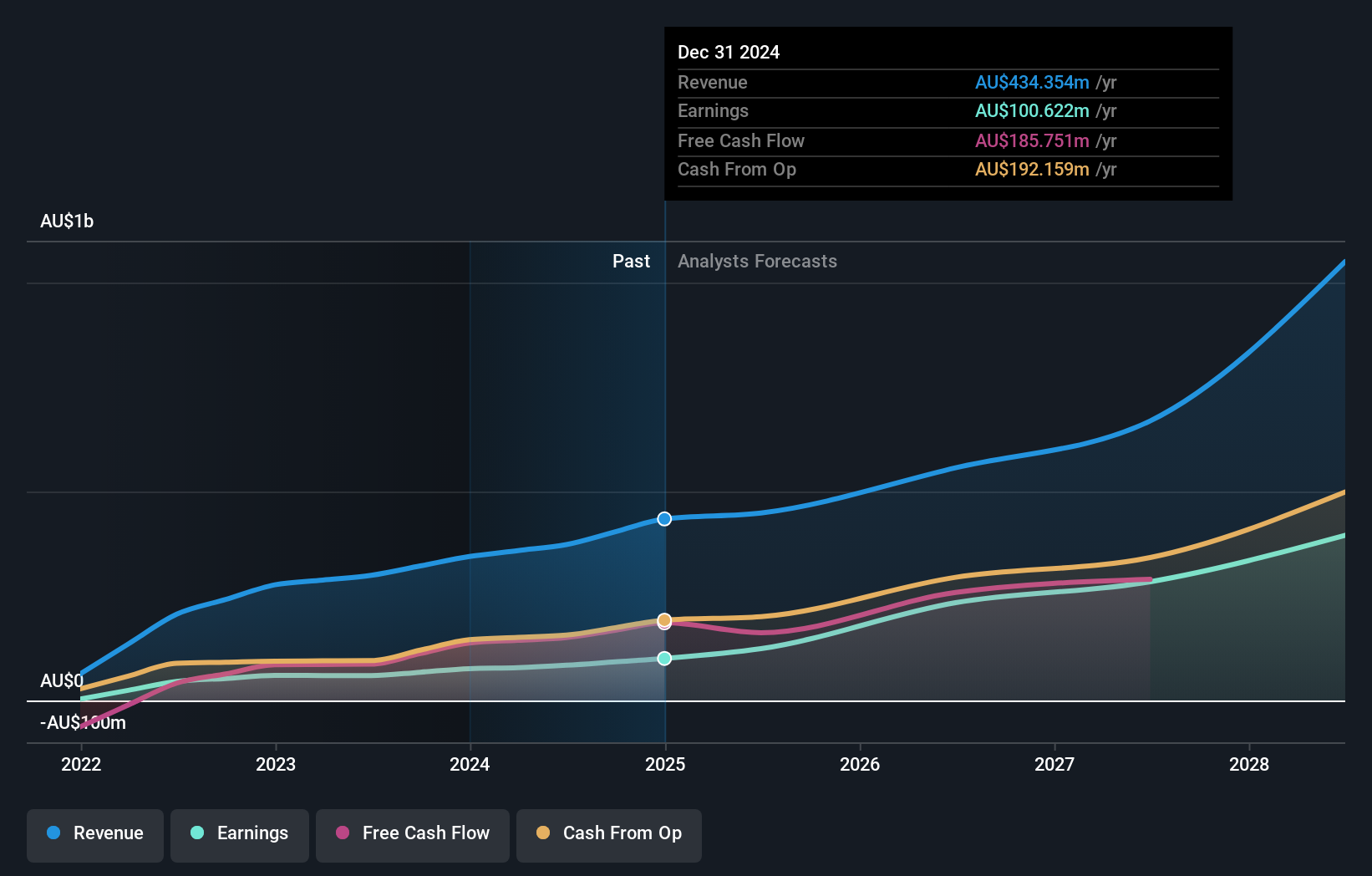

Operations: Emerald Resources generates revenue primarily from its mine operations, amounting to A$427.32 million.

Emerald Resources, a promising player in the metals and mining sector, has seen its debt to equity ratio rise from 0% to 3% over five years, yet it remains financially robust with more cash than total debt. The company's earnings have surged by 32.2% over the past year, outpacing the industry's growth of 14.2%, and it trades at approximately 8.7% below its estimated fair value. With high-quality earnings and free cash flow positivity, EMR’s interest payments are well covered by EBIT at a substantial 29.7x coverage ratio, indicating sound financial health amidst ongoing expansion efforts in gold production.

- Delve into the full analysis health report here for a deeper understanding of Emerald Resources.

Understand Emerald Resources' track record by examining our Past report.

Kingsgate Consolidated (ASX:KCN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Kingsgate Consolidated Limited focuses on the exploration, development, and mining of gold and silver mineral properties with a market capitalization of A$764.55 million.

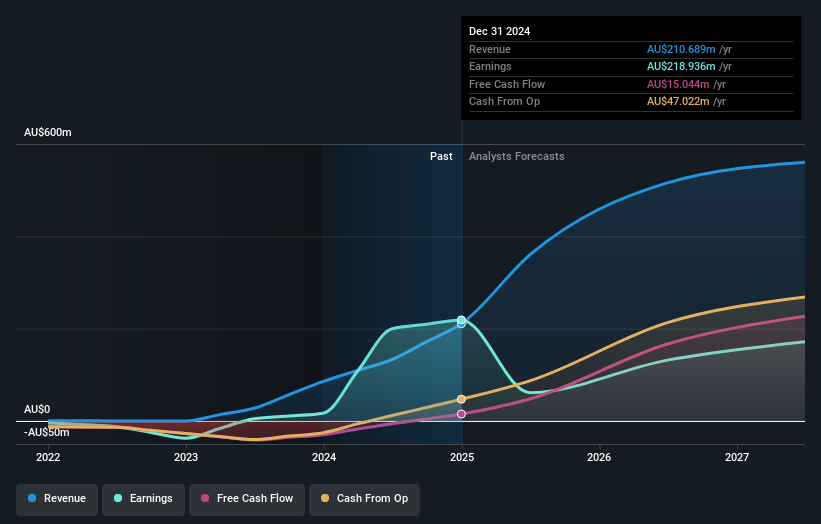

Operations: Kingsgate Consolidated generates revenue primarily from its Chatree segment, amounting to A$210.69 million. The company's financial performance is influenced by various operational costs and market conditions impacting its profitability.

Kingsgate Consolidated, a player in the mining sector, has seen its earnings skyrocket by 1203% over the past year, significantly outpacing the industry average of 14.2%. The company's net debt to equity ratio has impressively reduced from 52.5% to 23.2% over five years, indicating improved financial health. With interest payments well covered by EBIT at a ratio of 17.2 times and trading at a substantial discount of 91% below estimated fair value, Kingsgate seems positioned for potential growth. A recent executive change introduced Mischa Mutavdzic as CFO, bringing extensive experience in corporate finance within mining contexts.

- Click here and access our complete health analysis report to understand the dynamics of Kingsgate Consolidated.

Learn about Kingsgate Consolidated's historical performance.

MFF Capital Investments (ASX:MFF)

Simply Wall St Value Rating: ★★★★★★

Overview: MFF Capital Investments Limited is an investment firm manager with a market capitalization of A$2.73 billion.

Operations: MFF Capital Investments generates revenue primarily from equity investments, totaling A$631.43 million. The firm's financial performance is reflected in its market capitalization of A$2.73 billion.

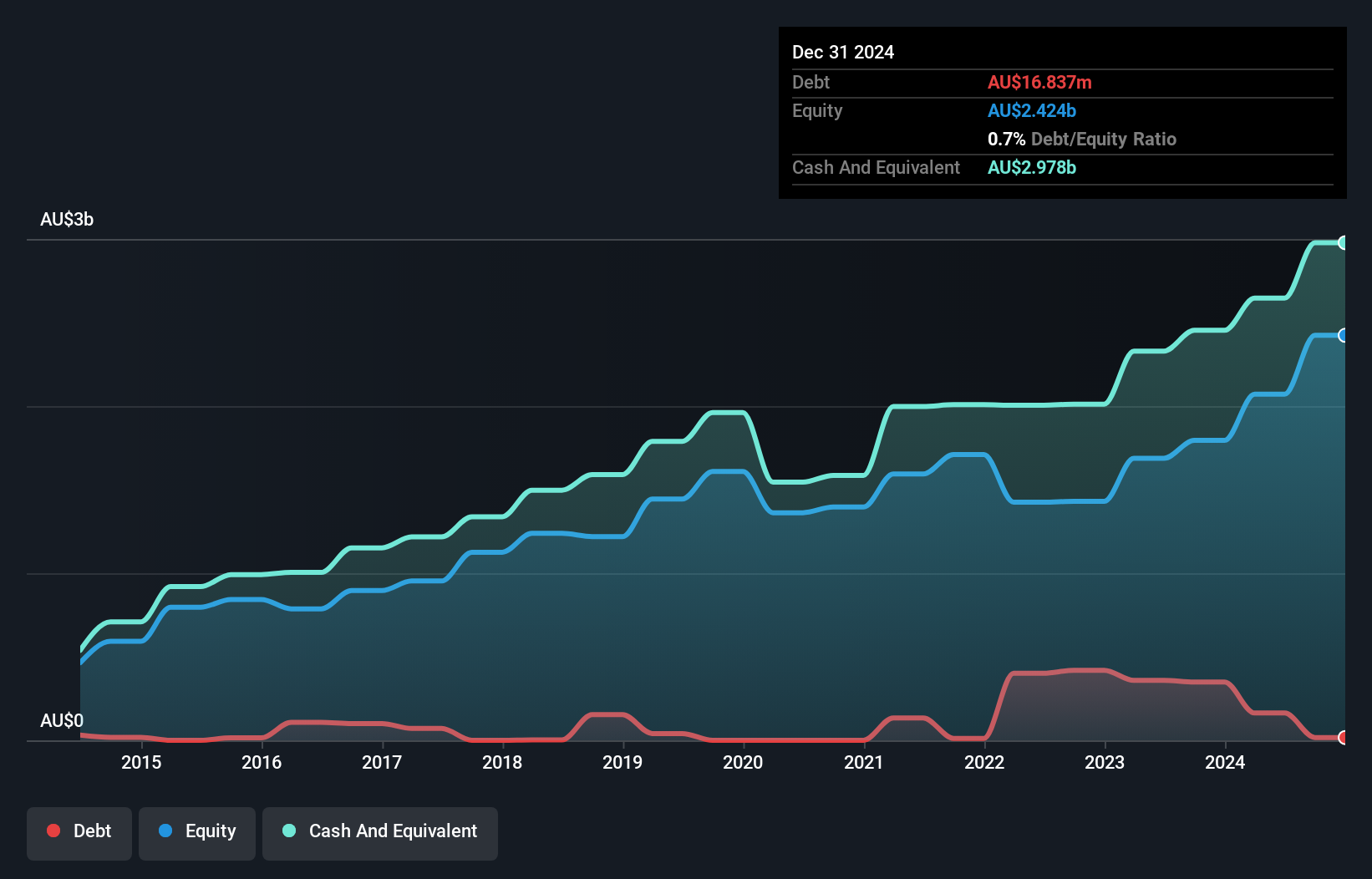

MFF Capital Investments, a nimble player in the market, recently reported earnings of A$431.97 million for the fiscal year ending June 2025, slightly down from A$447.36 million the previous year. Trading at a notable 68% below its estimated fair value, MFF remains an intriguing prospect despite negative earnings growth of -3.4% over the past year compared to the industry's robust 19.3%. The company is debt-free and boasts high-quality past earnings while maintaining positive free cash flow, which reached A$336.60 million as of June 2025. Recent leadership additions include Kirsten Morton as CFO and Matthew Githens as Chief Risk Officer, potentially strengthening future strategic directions.

Taking Advantage

- Take a closer look at our ASX Undiscovered Gems With Strong Fundamentals list of 46 companies by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Emerald Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:EMR

Emerald Resources

Engages in the exploration and development of mineral reserves in Cambodia and Australia.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives