- Australia

- /

- Construction

- /

- ASX:LYL

Uncovering 3 Undiscovered Gems in Australia's Stock Market

Reviewed by Simply Wall St

As the Australian stock market navigates a challenging landscape, with the ASX200 closing down 1.23% and notable declines in financial and IT sectors, investors are increasingly looking for opportunities beyond traditional heavyweights like banks and tech companies. In this environment, identifying stocks with strong fundamentals and growth potential can be particularly rewarding, especially those that remain under the radar yet demonstrate resilience or unique value propositions amidst broader market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Fiducian Group | NA | 9.94% | 6.48% | ★★★★★★ |

| Bisalloy Steel Group | 0.95% | 10.27% | 24.14% | ★★★★★★ |

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Lycopodium | NA | 17.22% | 33.85% | ★★★★★★ |

| Red Hill Minerals | NA | 75.05% | 36.74% | ★★★★★★ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| AMCIL | NA | 5.16% | 5.31% | ★★★★★☆ |

| Hearts and Minds Investments | 1.00% | 18.81% | 20.95% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Boart Longyear Group | 71.20% | 9.71% | 39.19% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Emerald Resources (ASX:EMR)

Simply Wall St Value Rating: ★★★★★☆

Overview: Emerald Resources NL is involved in the exploration and development of mineral reserves in Cambodia and Australia, with a market capitalization of A$2.23 billion.

Operations: Emerald Resources generates revenue primarily from mine operations, amounting to A$366.04 million.

Emerald Resources, a dynamic player in the mining sector, has showcased impressive financial and operational performance. Over the past year, earnings surged by 41.9%, outpacing the industry growth of 3.9%. The company’s debt to equity ratio has risen to 8.5% over five years, yet it remains comfortably covered with an EBIT interest coverage of 18.6 times. Recent achievements include record quarterly production at its Okvau Gold Mine in Cambodia, producing 31,888 ounces and surpassing guidance with an average gold sale price of US$2,669 per ounce. This robust output underscores Emerald's potential as a compelling investment opportunity in Australia.

- Click here and access our complete health analysis report to understand the dynamics of Emerald Resources.

Assess Emerald Resources' past performance with our detailed historical performance reports.

Lycopodium (ASX:LYL)

Simply Wall St Value Rating: ★★★★★★

Overview: Lycopodium Limited is an Australian company that offers engineering and project delivery services across the resources, rail infrastructure, and industrial processes sectors, with a market capitalization of A$417.08 million.

Operations: Lycopodium generates revenue primarily from the resources sector, contributing A$366.49 million, with additional income from process industries and rail infrastructure amounting to A$11.45 million and A$10.21 million respectively.

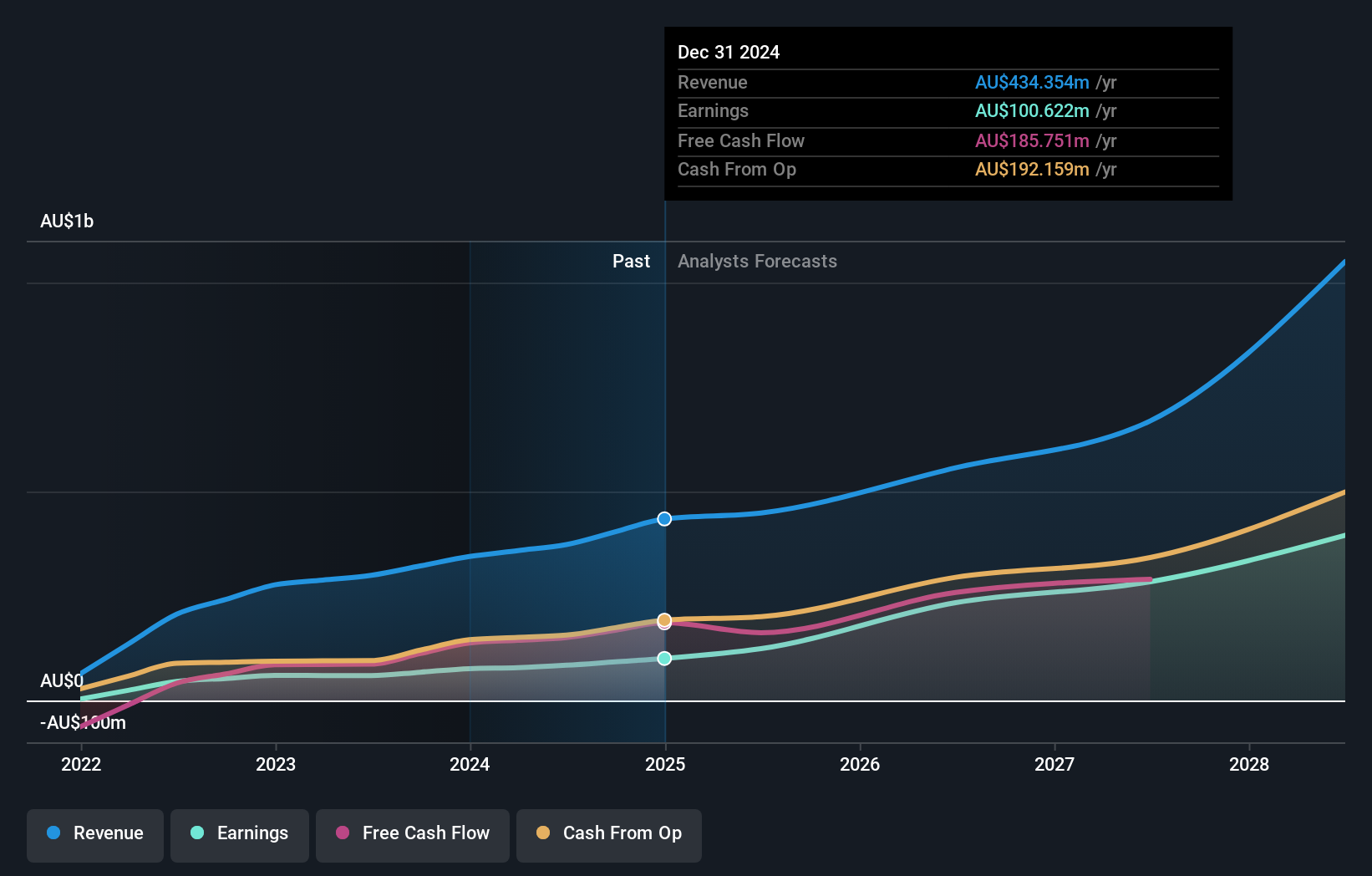

Lycopodium stands out with its debt-free status, which eliminates concerns over interest payments. Its price-to-earnings ratio of 8.2x is notably lower than the Australian market average of 19.7x, indicating potential value. Despite an impressive annual earnings growth rate of 33.8% over five years, recent insider selling may raise eyebrows among investors. The company has a high level of non-cash earnings and remains profitable with positive free cash flow, suggesting financial stability despite not matching the construction industry's growth pace last year (8.4% vs 24.3%). Upcoming dividends between A$0 and A$0.15 add to its appeal for income-focused investors.

- Click here to discover the nuances of Lycopodium with our detailed analytical health report.

Understand Lycopodium's track record by examining our Past report.

Tasmea (ASX:TEA)

Simply Wall St Value Rating: ★★★★★★

Overview: Tasmea Limited offers shutdown, maintenance, emergency breakdown, and capital upgrade services across various sectors in Australia with a market capitalization of approximately A$719.65 million.

Operations: Tasmea generates revenue from its diverse service offerings, with Mechanical Services contributing A$141.42 million and Electrical Services adding A$129.44 million to the total revenue. The company also derives income from Water & Fluid (A$73.55 million) and Civil Services (A$53.64 million), while Corporate Services provide a smaller portion of A$1.94 million.

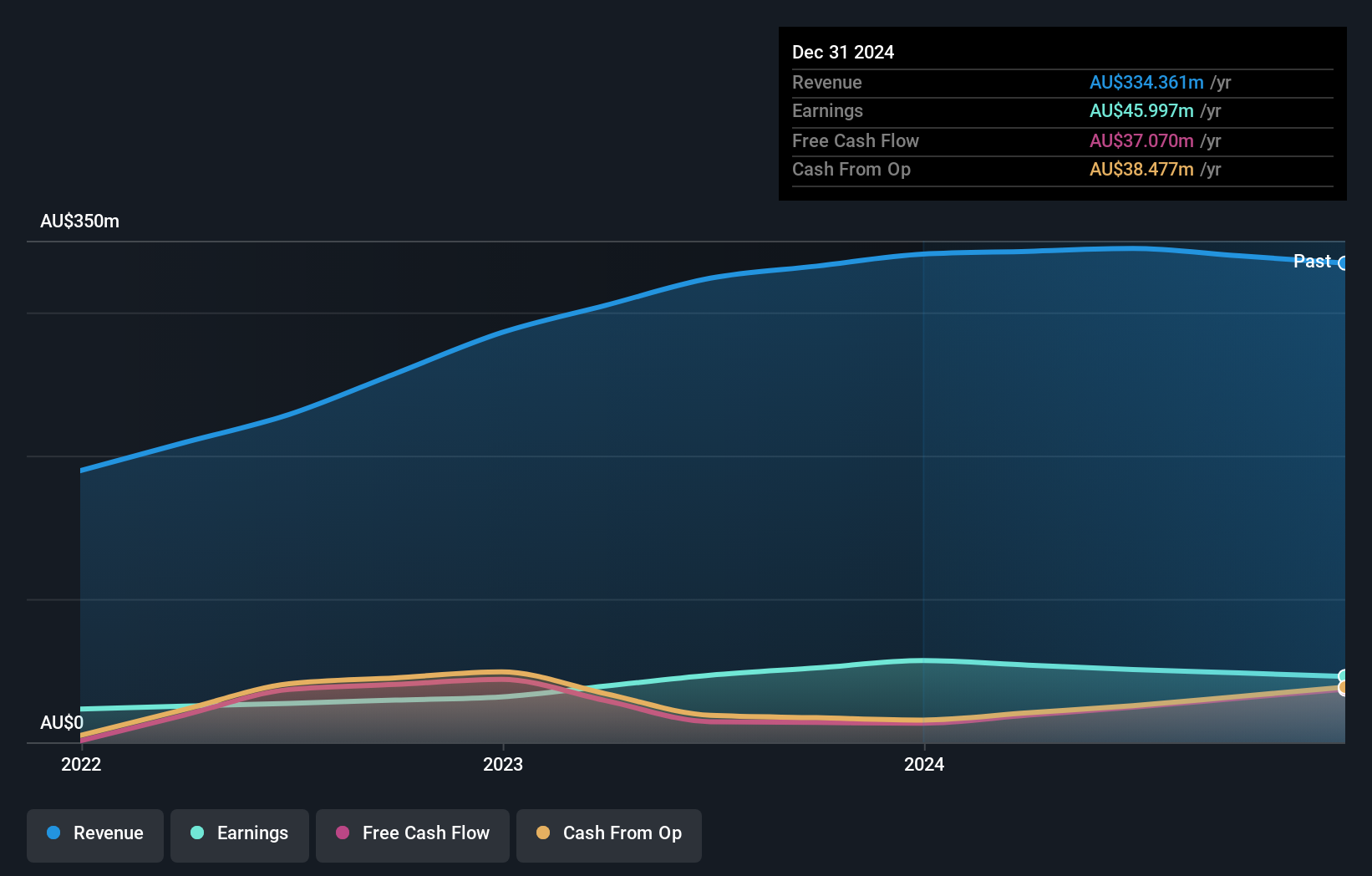

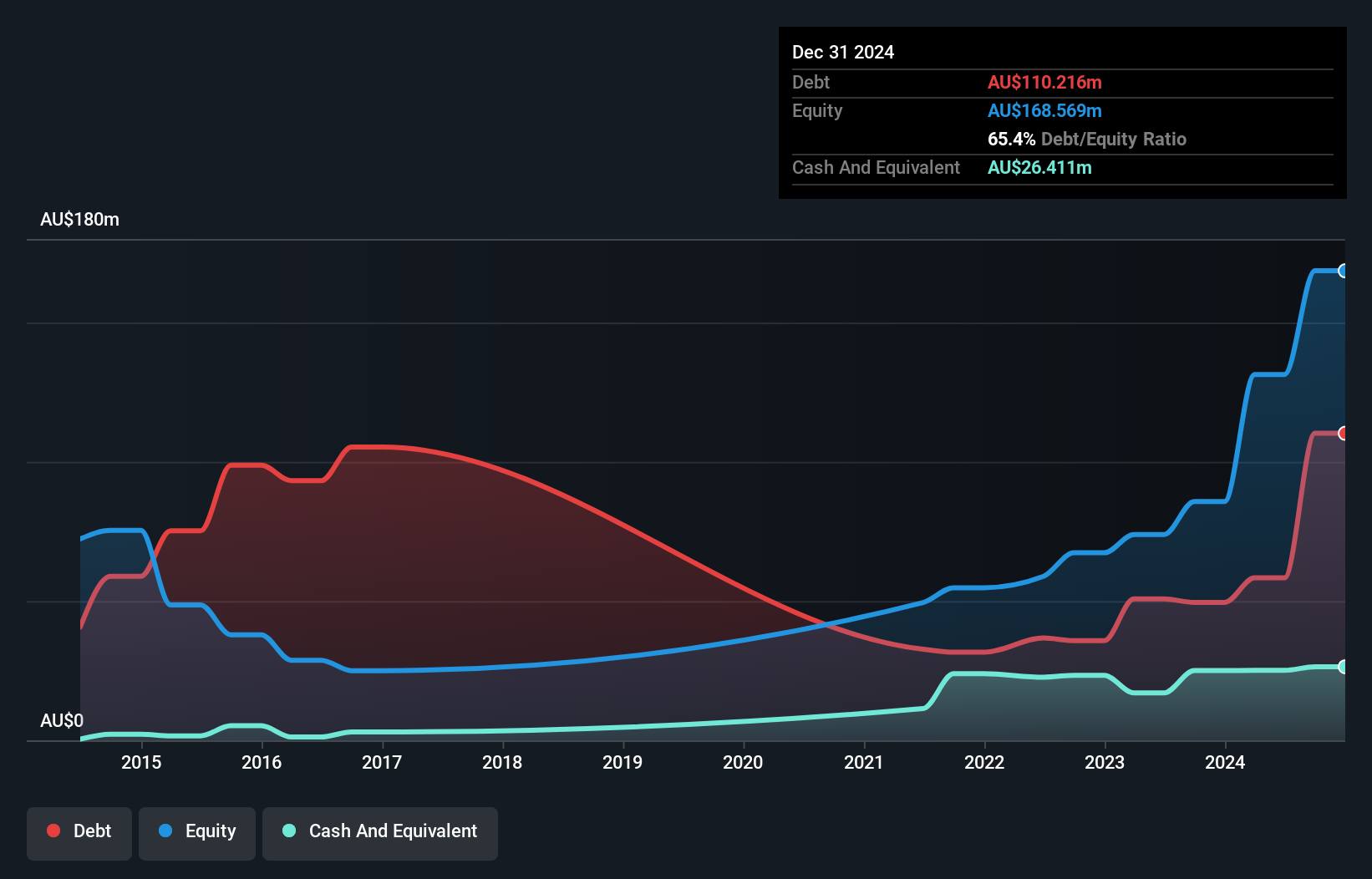

Tasmea shines with a robust financial profile, trading at 71.7% below its estimated fair value, suggesting potential for investors. Over the past year, earnings surged by 57.1%, outpacing the Construction industry's growth of 24.3%. The company's net debt to equity ratio stands at a satisfactory 25.3%, reflecting prudent financial management as it reduced from 168.5% over five years to 44.4%. With EBIT covering interest payments twelvefold, Tasmea's profitability is evident and free cash flow remains positive despite capital expenditures of A$22.18 million in June 2024 likely impacting short-term liquidity but supporting long-term growth prospects.

- Navigate through the intricacies of Tasmea with our comprehensive health report here.

Evaluate Tasmea's historical performance by accessing our past performance report.

Where To Now?

- Discover the full array of 55 ASX Undiscovered Gems With Strong Fundamentals right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:LYL

Lycopodium

Provides engineering and project delivery services in the resources, rail infrastructure, and industrial processes sectors in Australia.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives