The Australian market is poised for a cautious start, with shares expected to open slightly lower amid global uncertainties, particularly following a sell-off in the U.S. technology sector. Despite these broader market challenges, there remains potential for investors to find value in smaller or newer companies. Penny stocks, though often considered niche investments today, can still present intriguing opportunities when backed by strong financial health and growth prospects.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.775 | A$142.2M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.565 | A$66.23M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.86 | A$237.13M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.53 | A$328.68M | ★★★★★☆ |

| Vita Life Sciences (ASX:VLS) | A$1.90 | A$106.54M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$2.04 | A$332.15M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.90 | A$105.1M | ★★★★★★ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$228.62M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.99 | A$492.34M | ★★★★☆☆ |

| IVE Group (ASX:IGL) | A$2.08 | A$322.17M | ★★★★☆☆ |

Click here to see the full list of 1,051 stocks from our ASX Penny Stocks screener.

We'll examine a selection from our screener results.

Emerald Resources (ASX:EMR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Emerald Resources NL focuses on the exploration and development of mineral reserves in Cambodia and Australia, with a market cap of A$2.19 billion.

Operations: The company generates revenue primarily from its mine operations, which amounted to A$366.04 million.

Market Cap: A$2.19B

Emerald Resources has demonstrated strong financial performance, with recent record quarterly gold production exceeding guidance at its Okvau Gold Mine. The company reported A$366.04 million in revenue, supported by process improvements that increased plant throughput and gold recovery rates. Despite shareholder dilution over the past year, Emerald's earnings have grown significantly, surpassing industry averages with a 41.9% increase last year and a 66.6% annual growth over five years. The management team is experienced, and the company's debt is well-covered by operating cash flow. However, its return on equity remains relatively low at 14.5%.

- Click to explore a detailed breakdown of our findings in Emerald Resources' financial health report.

- Gain insights into Emerald Resources' future direction by reviewing our growth report.

Hearts and Minds Investments (ASX:HM1)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Hearts and Minds Investments (ASX:HM1) is an Australian-listed investment company with a market cap of A$721.29 million, focusing on generating long-term capital growth by investing in a concentrated portfolio of high-conviction stocks.

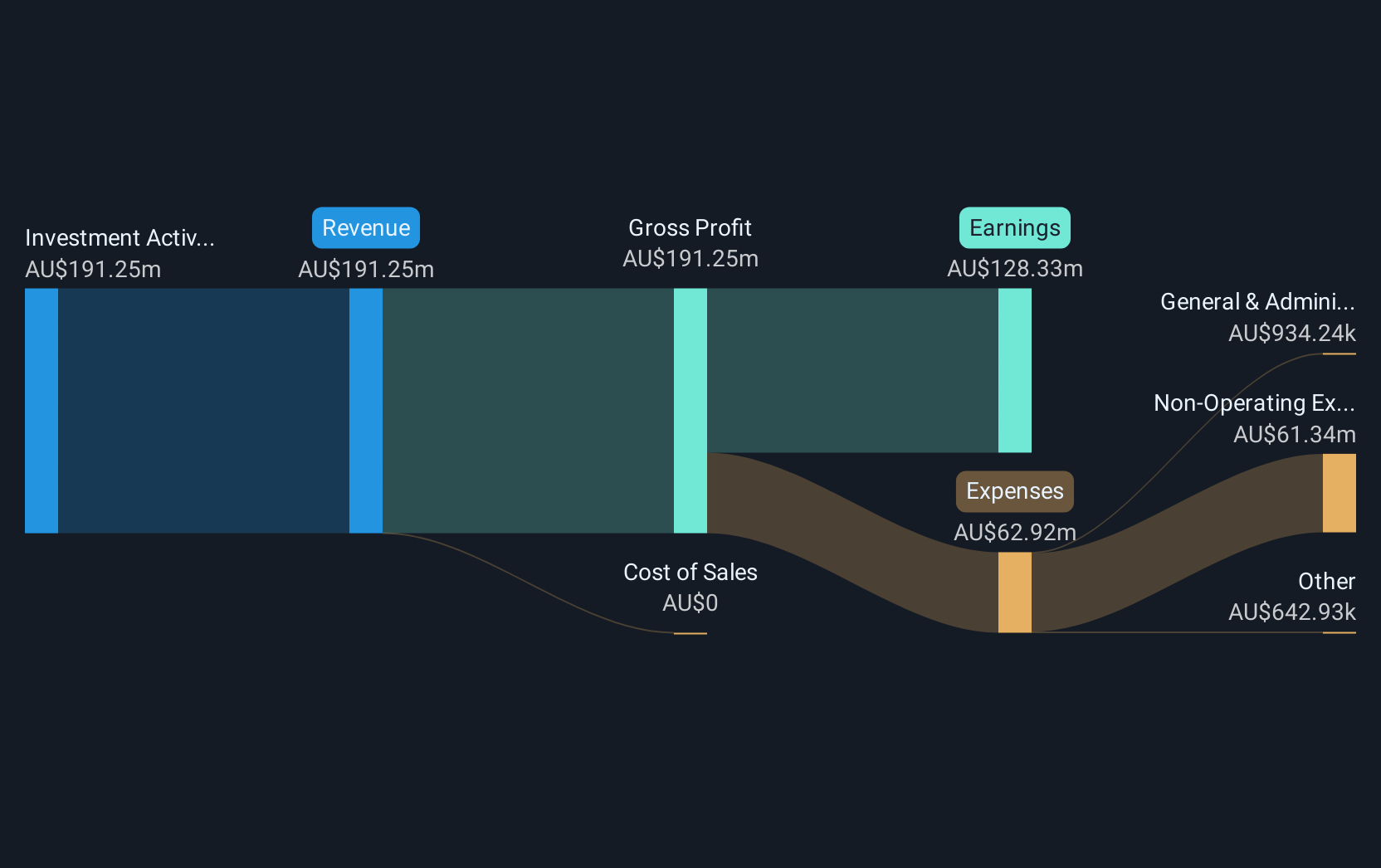

Operations: The company generates revenue of A$84.39 million from its investment activities.

Market Cap: A$721.29M

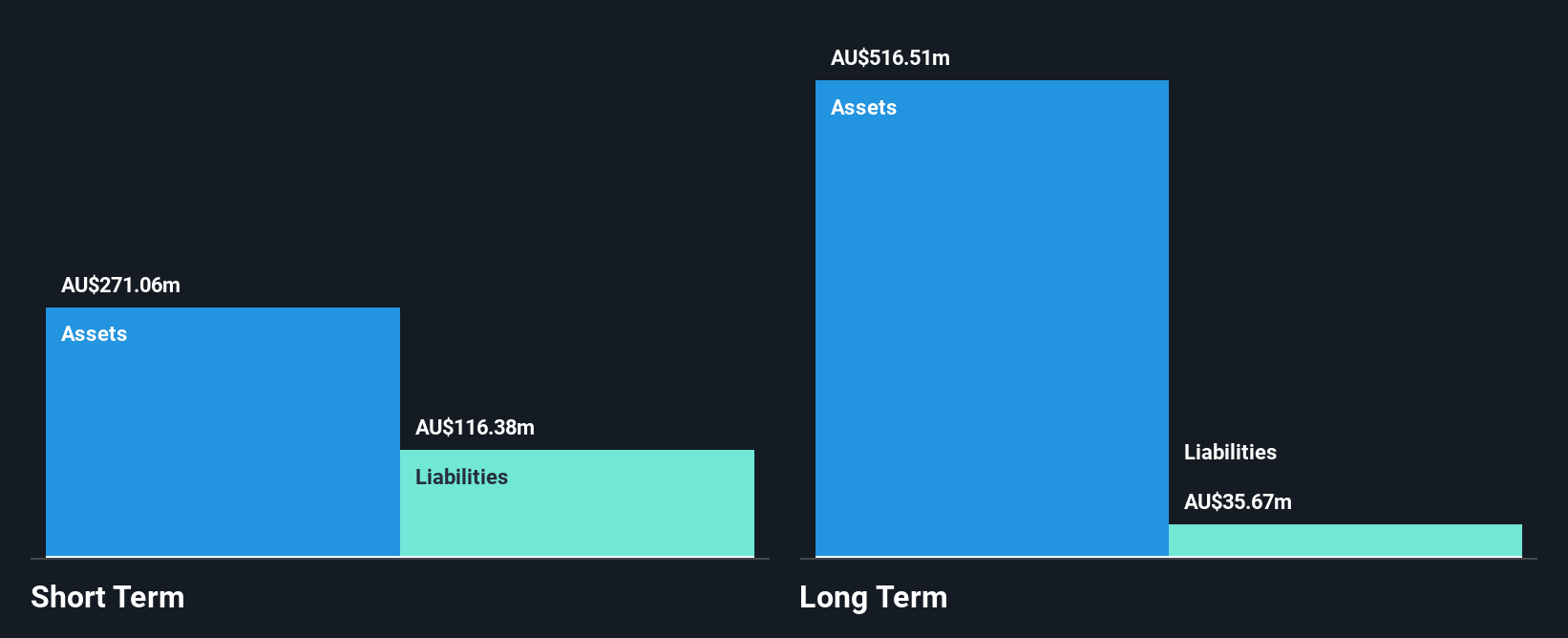

Hearts and Minds Investments exhibits a solid financial foundation, with short-term assets of A$626.7 million comfortably covering both short and long-term liabilities. The company has shown impressive earnings growth, increasing by 55.6% over the past year, outpacing the industry average. Despite a low return on equity at 7.3%, its net profit margin has improved to 60.3%. However, the dividend yield of 4.6% is not well covered by free cash flow, indicating potential sustainability concerns. The management team's inexperience contrasts with an experienced board, while negative operating cash flow suggests challenges in debt coverage despite having more cash than total debt.

- Click here and access our complete financial health analysis report to understand the dynamics of Hearts and Minds Investments.

- Evaluate Hearts and Minds Investments' historical performance by accessing our past performance report.

Harvey Norman Holdings (ASX:HVN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Harvey Norman Holdings Limited operates in the integrated retail, franchise, property, and digital system sectors with a market cap of A$5.84 billion.

Operations: The company's revenue segments include Retail in New Zealand (A$952.69 million), Slovenia & Croatia (A$215.44 million), Singapore & Malaysia (A$707.72 million), Non-Franchised Retail (A$242.39 million), and Ireland & Northern Ireland (A$693.42 million).

Market Cap: A$5.84B

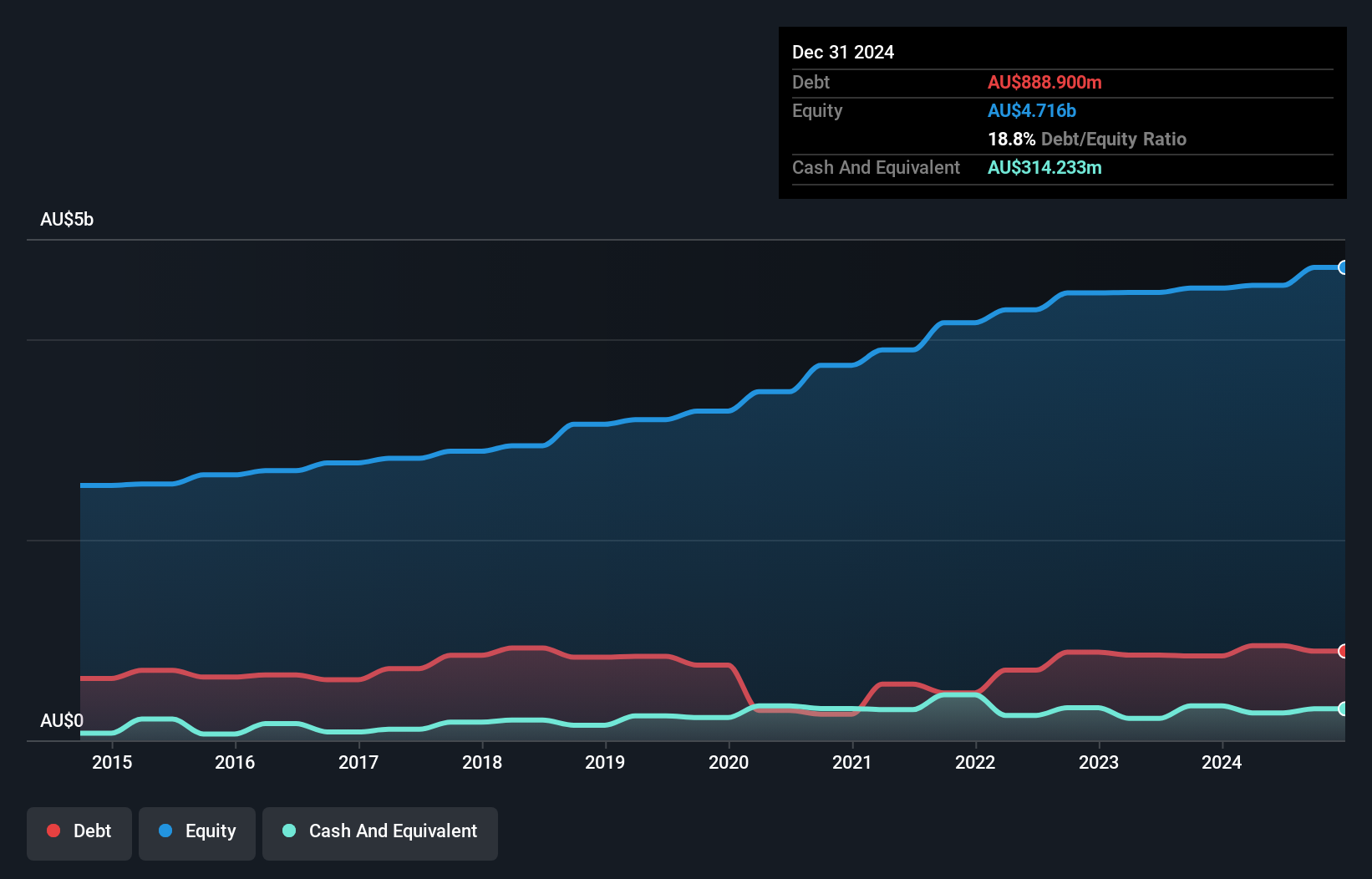

Harvey Norman Holdings faces challenges with declining profit margins, dropping from 19.4% to 12.6% over the past year, and negative earnings growth of -34.7%. Despite this, the company maintains a strong financial position with short-term assets of A$1.8 billion exceeding short-term liabilities of A$796.2 million, though long-term liabilities remain uncovered. The debt-to-equity ratio has improved to 20.8%, indicating prudent financial management, and interest payments are well-covered by EBIT at 11.1 times coverage. However, significant insider selling and an unstable dividend track record raise concerns about investor confidence and income reliability.

- Take a closer look at Harvey Norman Holdings' potential here in our financial health report.

- Examine Harvey Norman Holdings' earnings growth report to understand how analysts expect it to perform.

Make It Happen

- Jump into our full catalog of 1,051 ASX Penny Stocks here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Harvey Norman Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:HVN

Harvey Norman Holdings

Engages in the integrated retail, franchise, property, and digital system businesses.

Good value with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion