- Australia

- /

- Metals and Mining

- /

- ASX:EMR

Emerald Resources (ASX:EMR) Is Up 5.2% After Full-Year Earnings Beat - Has The Bull Case Changed?

Reviewed by Simply Wall St

- Emerald Resources NL recently announced its full-year earnings for the period ended June 30, 2025, reporting sales of A$437.79 million and net income of A$87.61 million, both up compared to the previous year.

- Despite higher sales and net income, the company saw a slight decrease in both basic and diluted earnings per share from continuing operations compared to the prior period.

- Given the increase in full-year net income, we’ll explore how this earnings report shapes Emerald Resources’ investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Emerald Resources' Investment Narrative?

To be a shareholder in Emerald Resources, you have to buy into a growth story that’s transformed the company from a smaller gold producer into a player capable of delivering substantial sales and net income expansion year over year. The recent full-year results strengthen this thesis, with sales climbing to A$437.79 million and net income at A$87.61 million. Yet, the drop in basic and diluted EPS, despite higher net profits, prompts some questions about cost structures or share dilution in the short term. Previously, one of the key catalysts for EMR was increasing output from the Okvau Gold Mine and any upgrades to their production guidance; that remains, but profitability metrics could move up the priority list for investors after this report. As for near-term risks, Emerald’s premium valuation versus the sector keeps price expectations sensitive to any operational hiccup or broader gold price weakness. This latest news doesn’t overhaul the big risks, but it does make margin and efficiency trends more important to watch.

Yet while production growth feels promising, the pressure is clearly on for EPS to catch up.

Exploring Other Perspectives

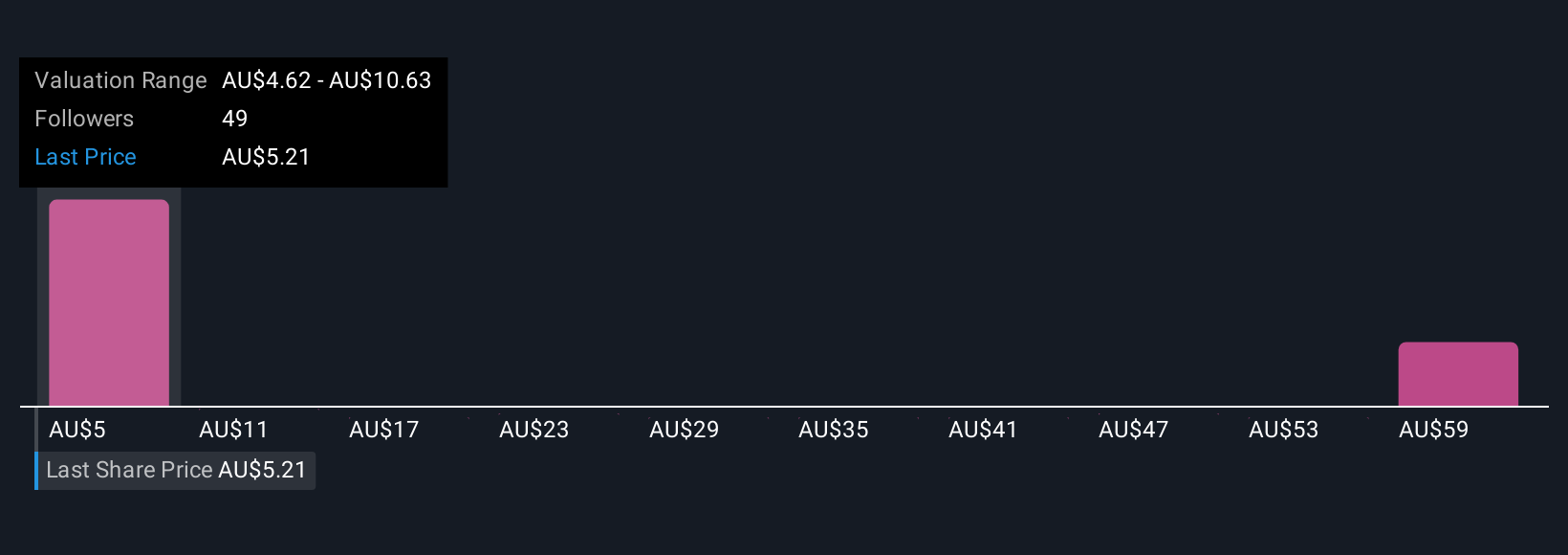

Explore 12 other fair value estimates on Emerald Resources - why the stock might be worth just A$4.62!

Build Your Own Emerald Resources Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Emerald Resources research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Emerald Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Emerald Resources' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Emerald Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:EMR

Emerald Resources

Engages in the exploration and development of mineral reserves in Cambodia and Australia.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives