- Australia

- /

- Metals and Mining

- /

- ASX:EMR

Emerald Resources (ASX:EMR): Assessing Valuation After Okvau’s Production Update and Reaffirmed FY26 Outlook

Reviewed by Kshitija Bhandaru

Emerald Resources (ASX:EMR) released updated guidance for the Okvau Gold Mine, reporting that September quarter production fell short due to heavy rainfall. The company reaffirmed its full-year 2026 production outlook and flagged upcoming expansion updates.

See our latest analysis for Emerald Resources.

Emerald’s recent production hiccup may have sparked some short-term volatility, but the bigger picture shows momentum is building. Its 30-day share price return of 24.26% and 53.05% year-to-date rally are hard to ignore, while the 1-year total shareholder return of 25.81% adds weight to the long-term growth story.

If this upward momentum has you interested in what other companies have outperformed expectations, now could be a smart time to broaden your search and discover fast growing stocks with high insider ownership

Given Emerald's strong longer-term returns and analyst price target nearly 20% above the last close, the question now is whether the market is undervaluing the stock or if future growth is already fully priced in.

Price-to-Earnings of 37.8x: Is it justified?

Emerald Resources trades at a price-to-earnings (P/E) ratio of 37.8x. This places it well above the industry average and signals that a premium is being paid for its future potential. At the last close price of A$5.02, investors are valuing Emerald at a markedly higher multiple than both its sector and its calculated fair value.

The P/E ratio compares a company's current share price to its per-share earnings and is a widely used indicator for assessing valuation in the mining sector. Companies with higher growth expectations often carry higher P/E ratios, but the market may be overestimating or underestimating future profitability.

Emerald’s P/E of 37.8x is considerably more expensive than the broader Australian Metals and Mining industry average of 21.8x. It also exceeds the estimated “fair” price-to-earnings ratio of 31.4x, suggesting investors are paying a rich premium that may not be fully supported by fundamentals. This highlights the risk of a valuation correction if company results do not keep up with high expectations. The market appears willing to pay up on the assumption of outsized earnings growth, but this position carries expectation risk if growth does not materialize.

Explore the SWS fair ratio for Emerald Resources

Result: Price-to-Earnings of 37.8x (OVERVALUED)

However, if gold prices decline or production challenges persist, Emerald's premium valuation could quickly come under pressure and shift sentiment more negatively.

Find out about the key risks to this Emerald Resources narrative.

Another View: Is Emerald Undervalued on Other Metrics?

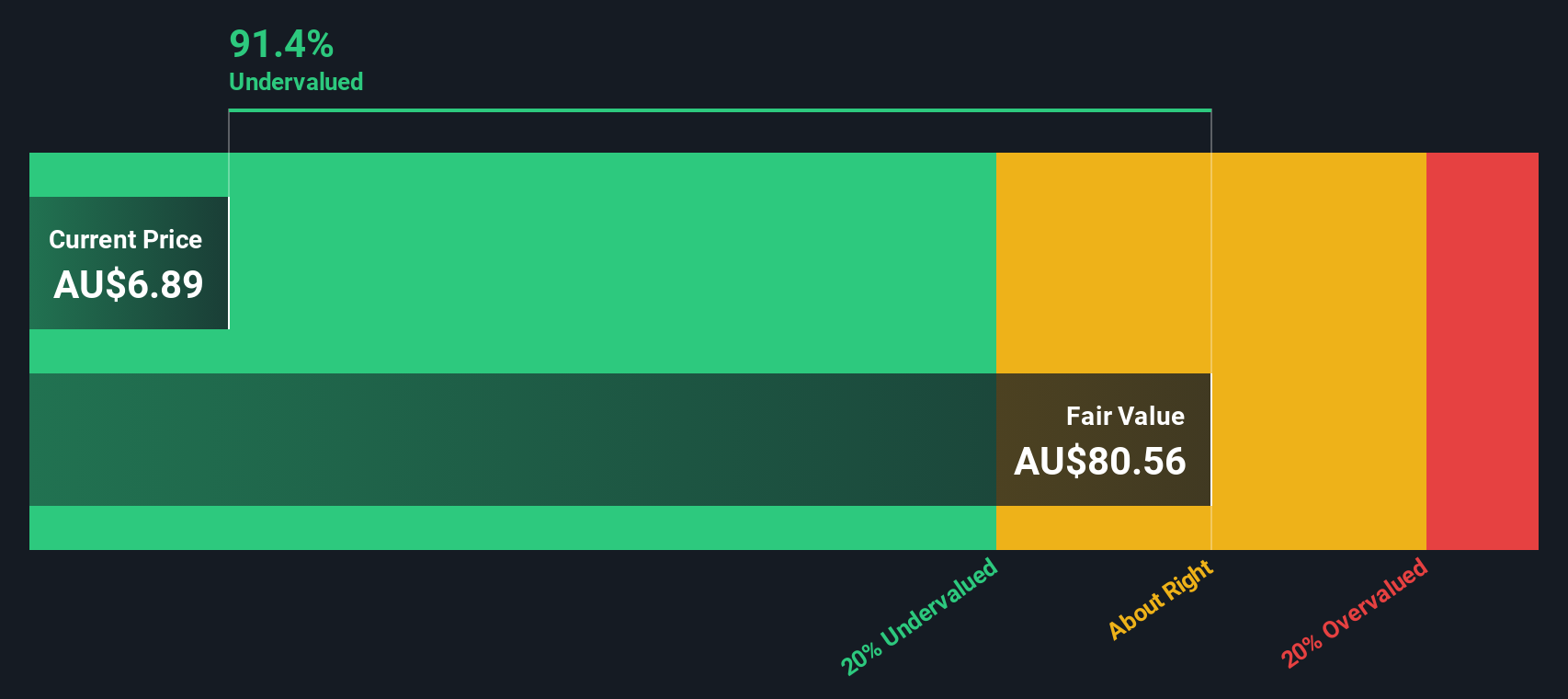

While Emerald appears expensive based on its P/E ratio, our DCF model paints a different picture. According to this method, the shares are trading at a substantial discount to their estimated fair value. Could the market be overlooking something? Or is the DCF too optimistic given sector risks?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Emerald Resources for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Emerald Resources Narrative

If you see the story differently, or want to dig deeper into Emerald’s numbers, you can easily build your own perspective in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Emerald Resources.

Ready to Uncover More High-Potential Opportunities?

Move quickly to spot the next big market winners, hidden values, and smart-yield investments before everyone else. Don’t miss your chance to get ahead now.

- Boost your portfolio’s passive income by targeting these 19 dividend stocks with yields > 3% with solid yields over 3% for consistent cash flow.

- Unlock new frontiers by tracking these 26 quantum computing stocks. This area is driving advancements in quantum computing and reshaping tomorrow's tech landscape.

- Capitalize on untapped bargains with these 898 undervalued stocks based on cash flows as they offer strong fundamentals and attractive valuations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Emerald Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:EMR

Emerald Resources

Engages in the exploration and development of mineral reserves in Cambodia and Australia.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives