ASX Penny Stocks Spotlight Featuring Emerald Resources And Two Others

Reviewed by Simply Wall St

As Australian shares experience a slight dip following recent bullish activity, the market remains a dynamic landscape influenced by global factors such as gold prices and geopolitical events. In this context, identifying promising stocks requires careful consideration of financial health and growth potential. Penny stocks, often associated with smaller or newer companies, continue to offer intriguing opportunities for investors seeking affordability combined with the possibility of significant returns.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.495 | A$141.86M | ✅ 4 ⚠️ 3 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.57 | A$121.24M | ✅ 2 ⚠️ 2 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.80 | A$49.81M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.75 | A$423.4M | ✅ 4 ⚠️ 3 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.22 | A$237.66M | ✅ 4 ⚠️ 2 View Analysis > |

| Pureprofile (ASX:PPL) | A$0.043 | A$50.3M | ✅ 3 ⚠️ 1 View Analysis > |

| Veris (ASX:VRS) | A$0.075 | A$38.83M | ✅ 4 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$3.04 | A$3.47B | ✅ 4 ⚠️ 1 View Analysis > |

| Praemium (ASX:PPS) | A$0.745 | A$355.9M | ✅ 5 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.24 | A$1.37B | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 424 stocks from our ASX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Emerald Resources (ASX:EMR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Emerald Resources NL is involved in the exploration and development of mineral reserves in Cambodia and Australia with a market cap of A$3.27 billion.

Operations: The company's revenue primarily comes from its mine operations, which generated A$430.41 million.

Market Cap: A$3.27B

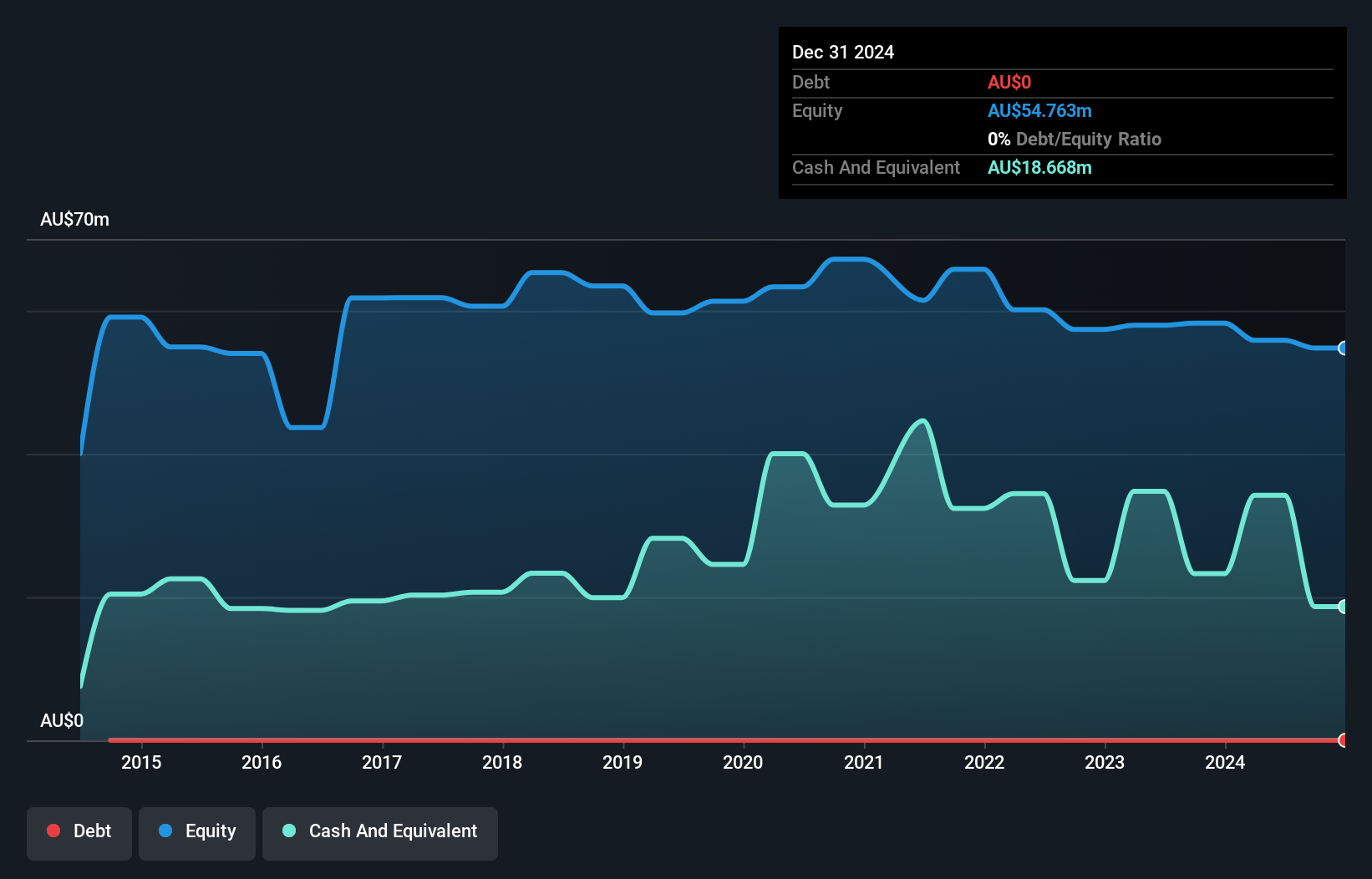

Emerald Resources has demonstrated strong financial health with no debt and a consistent growth in earnings, reporting A$437.79 million in sales for the year ending June 2025. Despite a slight slowdown in recent earnings growth to 4%, the company has maintained profitability over five years, with an average annual increase of 52.6%. The management and board are experienced, contributing to stable operations and minimal shareholder dilution. However, its return on equity remains low at 13.4%, and profit margins have slightly decreased from last year’s figures. Emerald's stock is currently trading significantly below its estimated fair value.

- Take a closer look at Emerald Resources' potential here in our financial health report.

- Review our growth performance report to gain insights into Emerald Resources' future.

Patronus Resources (ASX:PTN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Patronus Resources Limited is involved in the development and exploration of gold, base metal, and uranium properties in Australia with a market cap of A$144.97 million.

Operations: Patronus Resources Limited has not reported any revenue segments.

Market Cap: A$144.97M

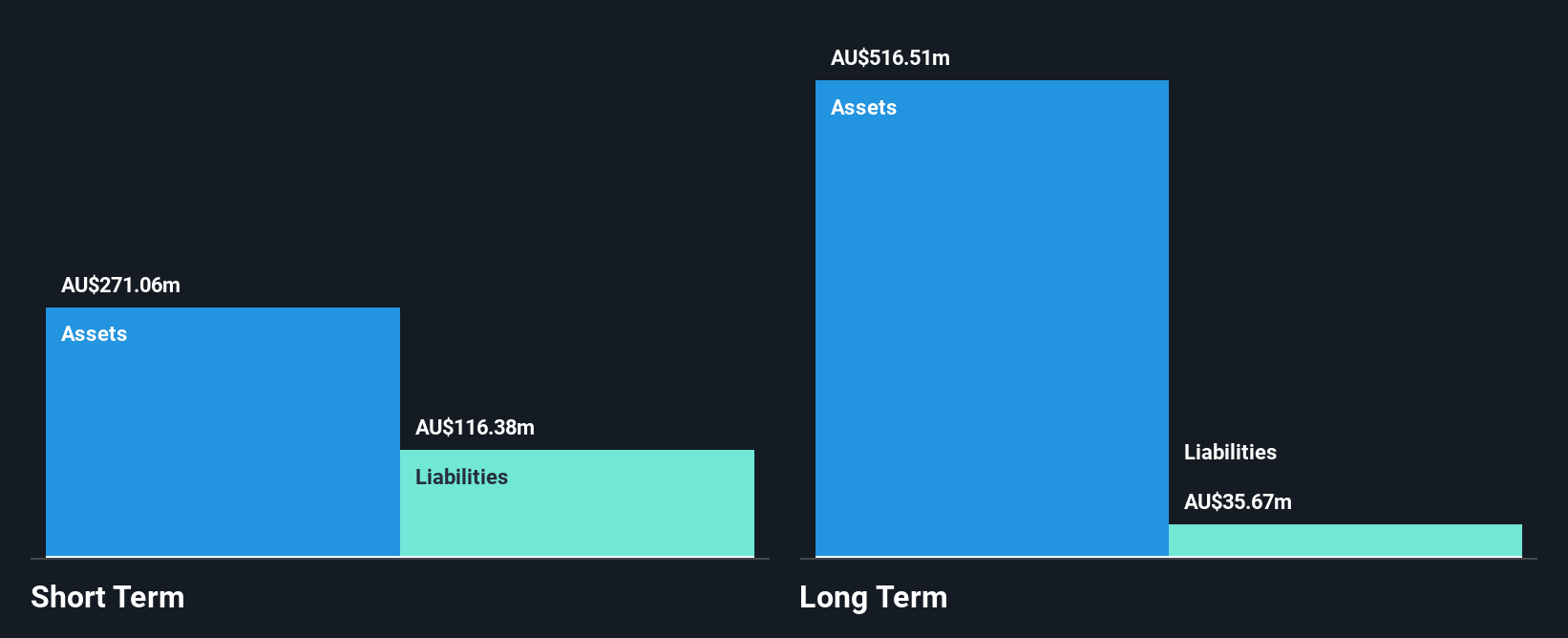

Patronus Resources Limited, with a market cap of A$144.97 million, is pre-revenue and currently unprofitable. Despite this, the company has reduced its losses by 27.7% annually over the past five years and maintains a strong financial position with no debt and sufficient cash runway for over three years. Its short-term assets of A$80.5 million comfortably cover both short-term (A$1.3 million) and long-term liabilities (A$2.6 million). Recent activities include completing a share buyback worth A$9.17 million, indicating efforts to enhance shareholder value amidst reporting a net loss of A$35.85 million for fiscal year 2025.

- Navigate through the intricacies of Patronus Resources with our comprehensive balance sheet health report here.

- Understand Patronus Resources' track record by examining our performance history report.

RPMGlobal Holdings (ASX:RUL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: RPMGlobal Holdings Limited develops and provides mining software solutions across Australia, Asia, the Americas, Africa, and Europe with a market cap of A$1.05 billion.

Operations: The company's revenue is generated from two main segments: Advisory, contributing A$24.77 million, and Software, which brings in A$73.96 million.

Market Cap: A$1.05B

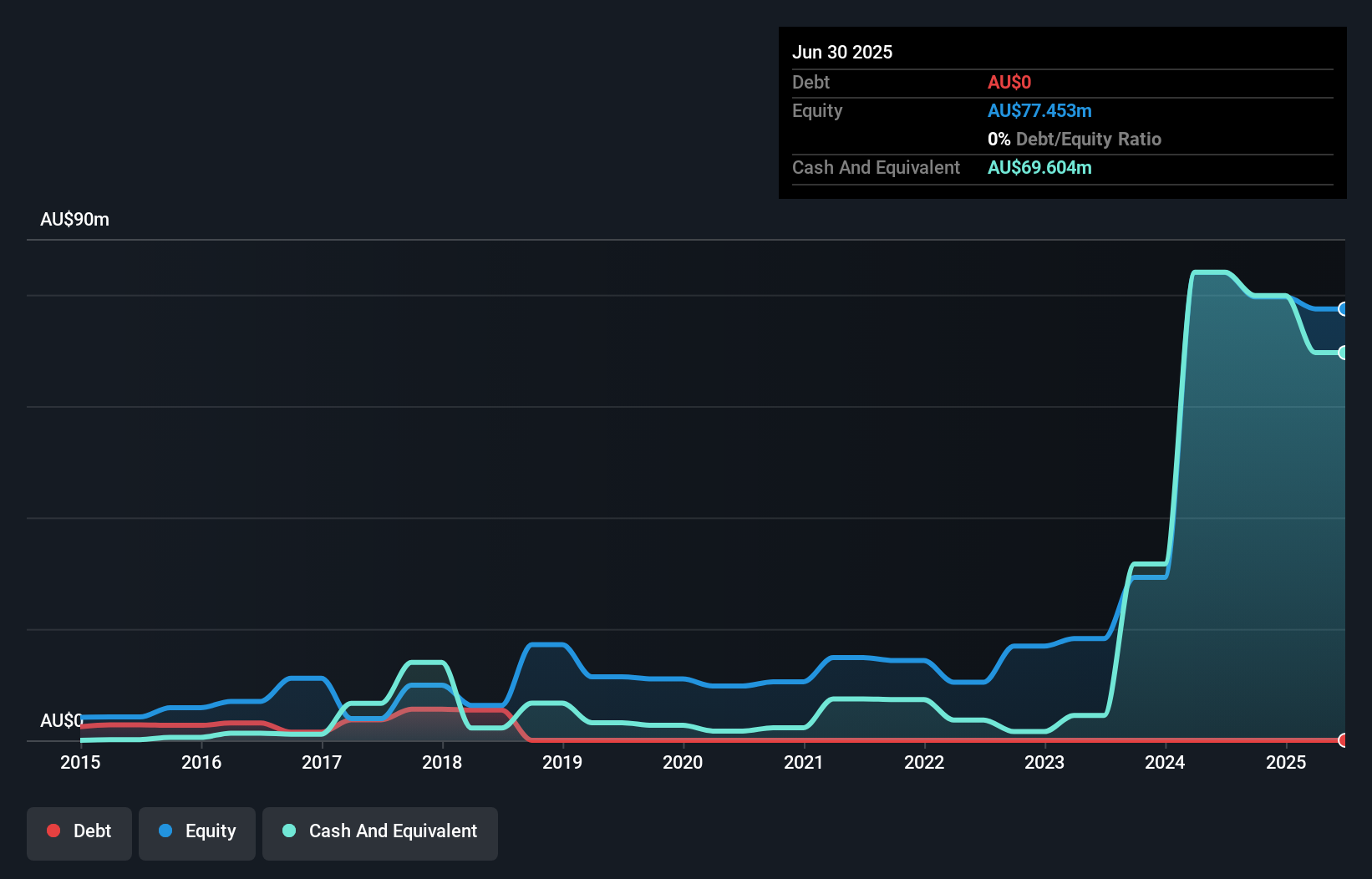

RPMGlobal Holdings Limited, with a market cap of A$1.05 billion, is currently under a non-binding acquisition proposal from Caterpillar Inc. for A$1.1 billion at A$5 per share, pending due diligence and agreement finalization. The company reported significant net income growth to A$47.46 million for the year ending June 30, 2025, despite facing challenges such as a large one-off loss of A$2.2 million and declining profit margins from last year’s 5.3% to 0.01%. RPMGlobal remains debt-free with strong asset coverage over liabilities and an experienced management team averaging 12.8 years in tenure.

- Click here and access our complete financial health analysis report to understand the dynamics of RPMGlobal Holdings.

- Examine RPMGlobal Holdings' earnings growth report to understand how analysts expect it to perform.

Make It Happen

- Explore the 424 names from our ASX Penny Stocks screener here.

- Seeking Other Investments? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:RUL

RPMGlobal Holdings

Develops and provides mining software solutions in Australia, Asia, the Americas, Africa, and Europe.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success