- Australia

- /

- Capital Markets

- /

- ASX:RPL

ASX Growth Companies With High Insider Ownership To Watch

Reviewed by Simply Wall St

As the Australian market kicks off November with a steady performance, buoyed by positive sentiment from recent international trade discussions, investors are closely watching various sectors for potential opportunities. In this environment, growth companies with high insider ownership can offer unique insights and potential resilience, making them intriguing prospects for those looking to navigate the current market landscape.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Wisr (ASX:WZR) | 12.6% | 90.7% |

| Titomic (ASX:TTT) | 11.2% | 74.9% |

| Pointerra (ASX:3DP) | 19% | 110.3% |

| Newfield Resources (ASX:NWF) | 31.5% | 72.1% |

| Lunnon Metals (ASX:LM8) | 10.8% | 31.4% |

| IRIS Metals (ASX:IR1) | 21.6% | 144.4% |

| IperionX (ASX:IPX) | 16.9% | 94.9% |

| Emerald Resources (ASX:EMR) | 18.4% | 57.6% |

| Echo IQ (ASX:EIQ) | 19.1% | 49.9% |

| Adveritas (ASX:AV1) | 17.3% | 96.8% |

We're going to check out a few of the best picks from our screener tool.

Australian Finance Group (ASX:AFG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Australian Finance Group Limited operates in the mortgage broking sector in Australia and has a market capitalization of approximately A$641.35 million.

Operations: The company's revenue segments consist of Distribution, generating A$934.50 million, and Manufacturing, contributing A$330.30 million.

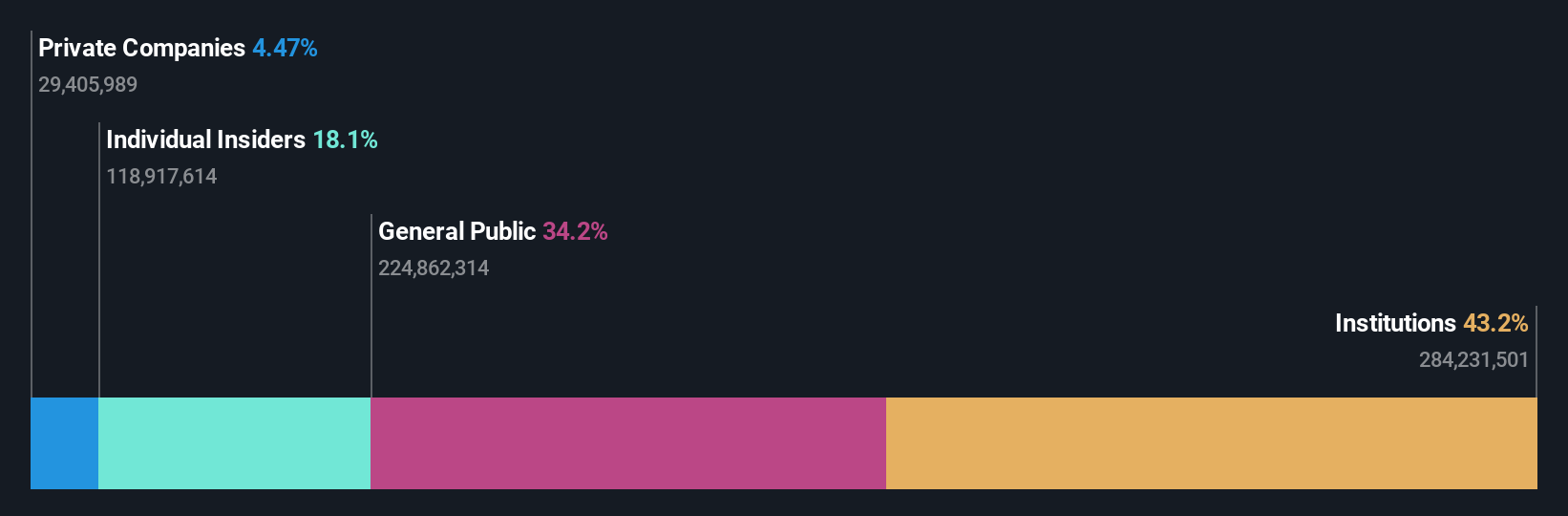

Insider Ownership: 20.1%

Earnings Growth Forecast: 18.1% p.a.

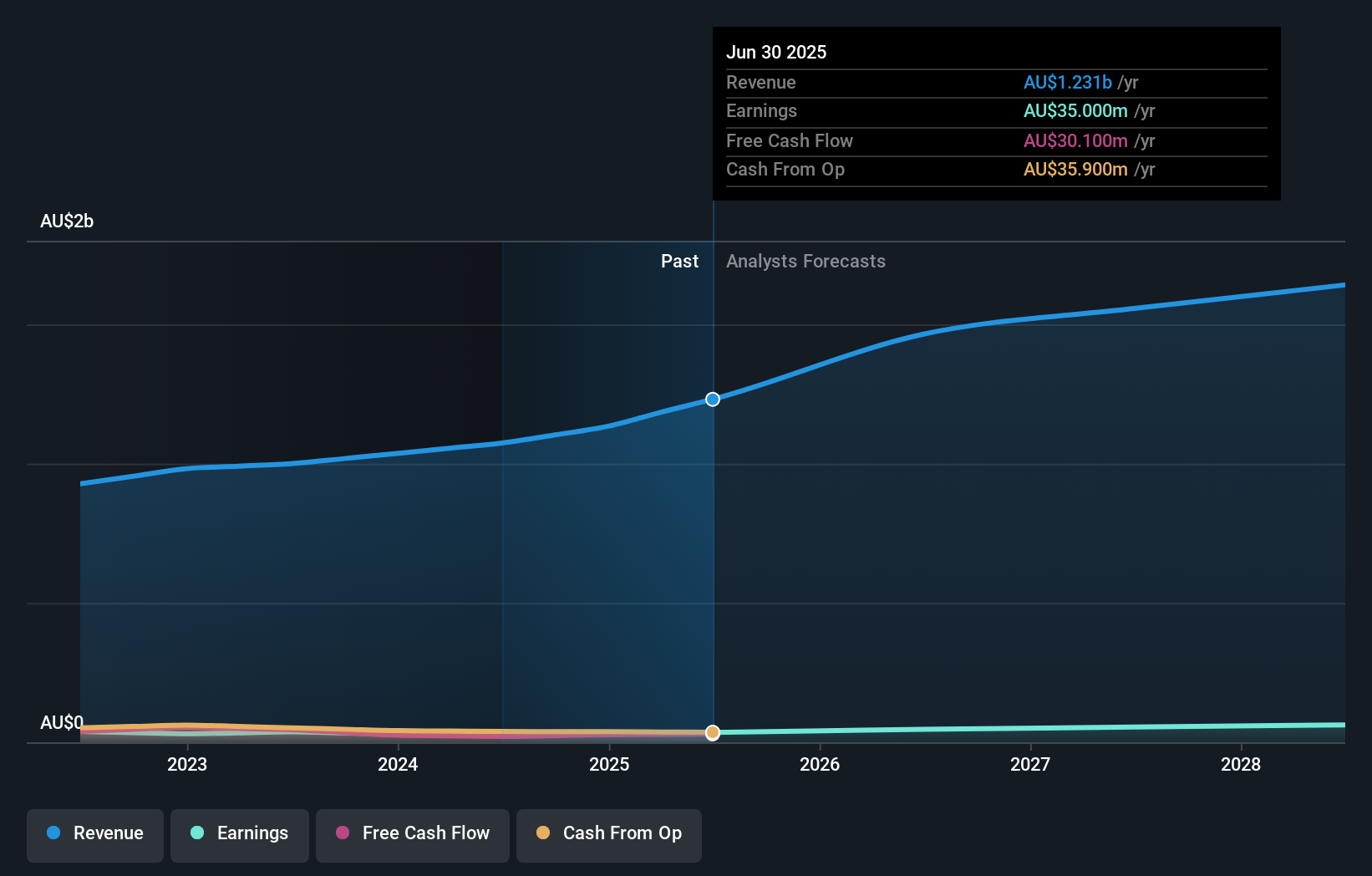

Australian Finance Group's earnings are forecast to grow at 18.1% annually, outpacing the Australian market. However, insider selling has been significant in recent months. The company's price-to-earnings ratio of 18.3x is attractive compared to the market average of 21.7x, yet its debt coverage by operating cash flow remains a concern. Recent financials show revenue growth from A$1.08 billion to A$1.24 billion and net income rising from A$29 million to A$35 million year-over-year.

- Click to explore a detailed breakdown of our findings in Australian Finance Group's earnings growth report.

- In light of our recent valuation report, it seems possible that Australian Finance Group is trading beyond its estimated value.

Emerald Resources (ASX:EMR)

Simply Wall St Growth Rating: ★★★★★★

Overview: Emerald Resources NL focuses on the exploration and development of mineral reserves in Cambodia and Australia, with a market cap of A$3.19 billion.

Operations: The company's revenue primarily comes from its mine operations, amounting to A$430.41 million.

Insider Ownership: 18.4%

Earnings Growth Forecast: 57.6% p.a.

Emerald Resources is poised for substantial growth, with earnings forecast to rise 57.6% annually, significantly outpacing the Australian market. The company trades at 87% below its estimated fair value and boasts a very high expected Return on Equity of 41.3%. Recent earnings showed sales increasing to A$437.79 million, though quarterly gold production was impacted by adverse weather conditions. Insider activity remains stable without significant buying or selling in recent months.

- Take a closer look at Emerald Resources' potential here in our earnings growth report.

- According our valuation report, there's an indication that Emerald Resources' share price might be on the cheaper side.

Regal Partners (ASX:RPL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Regal Partners Limited is a privately owned hedge fund sponsor with a market cap of A$1.04 billion.

Operations: The company's revenue primarily comes from the provision of investment management services, amounting to A$245.45 million.

Insider Ownership: 23.8%

Earnings Growth Forecast: 31.5% p.a.

Regal Partners demonstrates potential for growth, with earnings projected to rise 31.51% annually, surpassing the Australian market's growth rate. Despite trading at 41.9% below its estimated fair value, recent financials show a decline in revenue and net income compared to last year. Insider activity indicates more buying than selling recently, yet no substantial insider purchases occurred over the past quarter. The company's inclusion in key indices may enhance visibility among investors.

- Dive into the specifics of Regal Partners here with our thorough growth forecast report.

- The analysis detailed in our Regal Partners valuation report hints at an deflated share price compared to its estimated value.

Next Steps

- Investigate our full lineup of 109 Fast Growing ASX Companies With High Insider Ownership right here.

- Ready For A Different Approach? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:RPL

Good value with reasonable growth potential.

Market Insights

Community Narratives