- Australia

- /

- Metals and Mining

- /

- ASX:VSL

ASX Growth Companies With High Insider Ownership To Watch

Reviewed by Simply Wall St

As the Australian market experiences a tug-of-war between profit-taking in major financial stocks and renewed interest in the materials sector, investors are keenly observing how these shifts might influence broader indices. In such an environment, growth companies with high insider ownership can be particularly appealing as they often signal strong confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Titomic (ASX:TTT) | 11.2% | 77.2% |

| Newfield Resources (ASX:NWF) | 31.5% | 72.1% |

| Image Resources (ASX:IMA) | 22.3% | 79.9% |

| Fenix Resources (ASX:FEX) | 21.1% | 53.4% |

| Echo IQ (ASX:EIQ) | 18% | 51.4% |

| Cyclopharm (ASX:CYC) | 11.3% | 97.8% |

| Brightstar Resources (ASX:BTR) | 11.6% | 115.1% |

| AVA Risk Group (ASX:AVA) | 15.4% | 108.2% |

| Alfabs Australia (ASX:AAL) | 10.8% | 41.3% |

| Adveritas (ASX:AV1) | 18.1% | 88.8% |

Below we spotlight a couple of our favorites from our exclusive screener.

Australian Ethical Investment (ASX:AEF)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Australian Ethical Investment Ltd is a publicly owned investment manager with a market capitalization of A$680.52 million, focusing on ethical and sustainable investing practices.

Operations: The company's revenue is primarily derived from its Funds Management segment, which generated A$110.80 million.

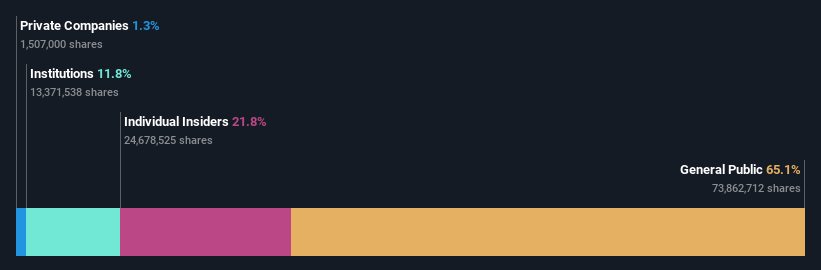

Insider Ownership: 21.8%

Earnings Growth Forecast: 24% p.a.

Australian Ethical Investment is poised for robust growth, with earnings forecast to increase by 24% annually, surpassing the Australian market's average. Revenue is expected to grow at 9.7% per year, outpacing the broader market but not reaching high-growth thresholds. Despite large one-off items affecting earnings quality, its projected return on equity remains very high at 56.6%. There has been no significant insider trading activity over the past three months.

- Click to explore a detailed breakdown of our findings in Australian Ethical Investment's earnings growth report.

- Our valuation report unveils the possibility Australian Ethical Investment's shares may be trading at a premium.

Emerald Resources (ASX:EMR)

Simply Wall St Growth Rating: ★★★★★★

Overview: Emerald Resources NL is involved in the exploration and development of mineral reserves in Cambodia and Australia, with a market cap of A$2.62 billion.

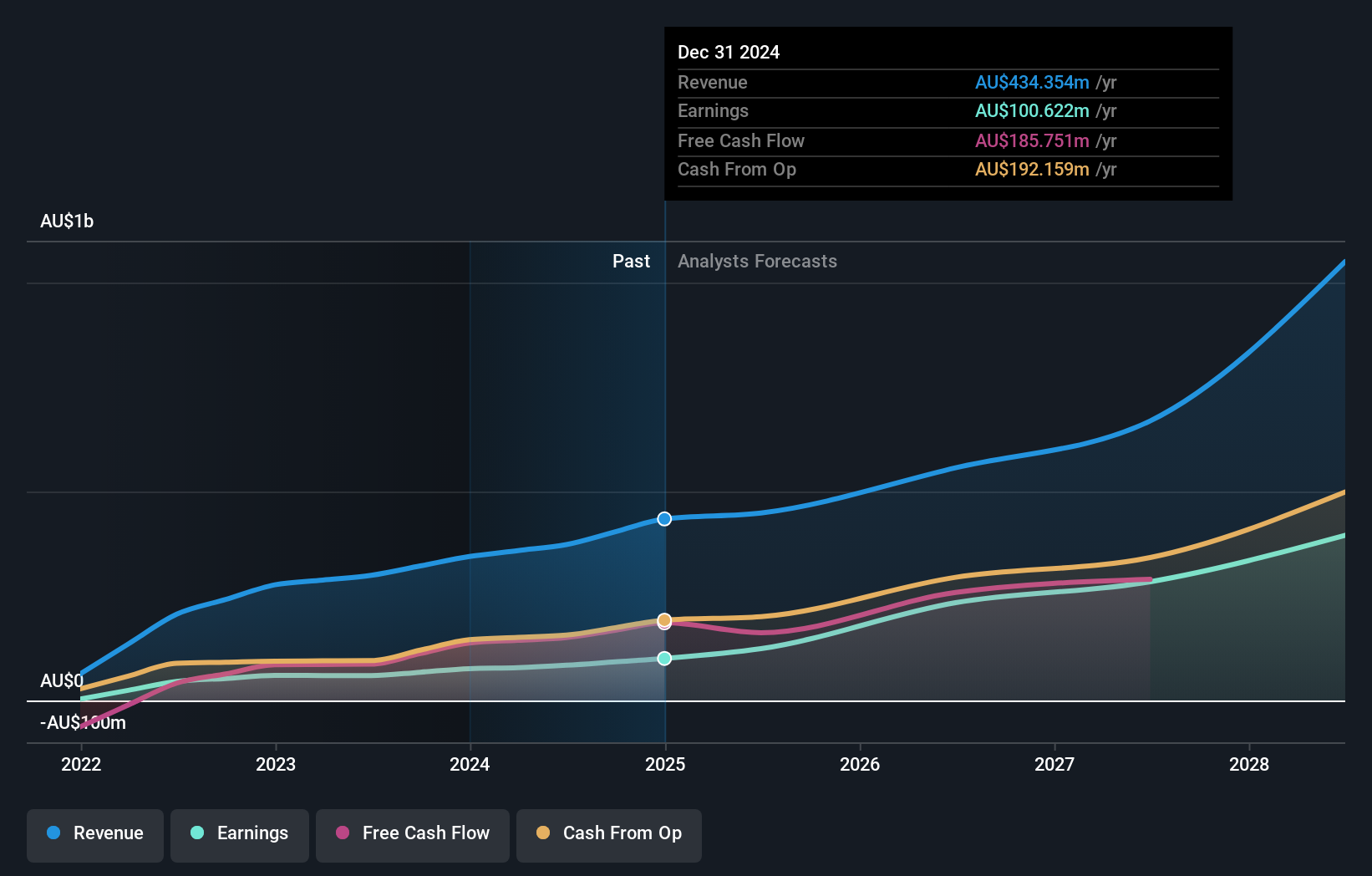

Operations: The company's revenue primarily comes from its mine operations, which generated A$427.32 million.

Insider Ownership: 18.1%

Earnings Growth Forecast: 36.2% p.a.

Emerald Resources is positioned for substantial growth, with earnings projected to rise by 36.2% annually, significantly outpacing the Australian market. Its revenue is expected to grow at 23.3% per year, exceeding the broader market's pace. The company recently updated its production guidance for Okvau Gold Mine, anticipating up to 125Koz in 2026. Trading well below estimated fair value and with no recent insider trading activity, it presents a compelling growth narrative.

- Dive into the specifics of Emerald Resources here with our thorough growth forecast report.

- According our valuation report, there's an indication that Emerald Resources' share price might be on the expensive side.

Vulcan Steel (ASX:VSL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Vulcan Steel Limited, with a market cap of A$747.22 million, operates in New Zealand and Australia focusing on the sale and distribution of steel and metal products.

Operations: The company's revenue segments consist of NZ$428.87 million from steel and NZ$564.44 million from metals.

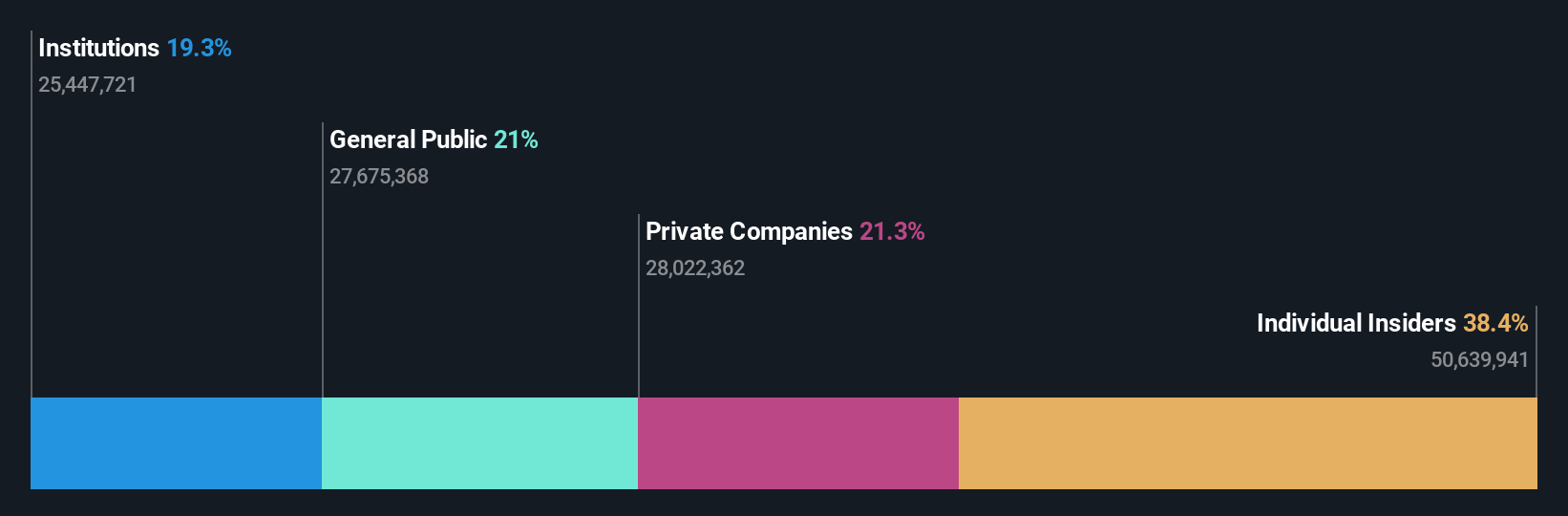

Insider Ownership: 38.4%

Earnings Growth Forecast: 29.9% p.a.

Vulcan Steel's earnings are forecast to grow significantly at 29.9% annually, surpassing the Australian market average of 10.9%. However, profit margins have decreased from last year, and interest payments aren't well covered by earnings. Despite these challenges, analysts expect a stock price increase of 26.9%. Leadership changes are underway with Gavin Street set to become CEO in January 2026, ensuring strategic continuity as Rhys Jones transitions to Board Chair.

- Delve into the full analysis future growth report here for a deeper understanding of Vulcan Steel.

- Our comprehensive valuation report raises the possibility that Vulcan Steel is priced higher than what may be justified by its financials.

Seize The Opportunity

- Click here to access our complete index of 94 Fast Growing ASX Companies With High Insider Ownership.

- Looking For Alternative Opportunities? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:VSL

Vulcan Steel

Engages in the sale and distribution of steel and metal products in New Zealand and Australia.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives