- Australia

- /

- Metals and Mining

- /

- ASX:EMR

ASX Growth Companies With High Insider Ownership For June 2025

Reviewed by Simply Wall St

As the Australian market flirts with record highs, investors are keenly observing sectors like energy and defense that have shown resilience amid fluctuating economic indicators, such as the recent low GDP growth rate of 0.2%. In this environment, companies with strong insider ownership can be particularly appealing, as they often signal confidence from those who know the business best and may provide a buffer against market volatility.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Alfabs Australia (ASX:AAL) | 10.8% | 41.3% |

| Brightstar Resources (ASX:BTR) | 11.6% | 106.7% |

| Fenix Resources (ASX:FEX) | 21.1% | 53.4% |

| Acrux (ASX:ACR) | 15.6% | 106.9% |

| Cyclopharm (ASX:CYC) | 11.3% | 97.8% |

| Newfield Resources (ASX:NWF) | 31.5% | 72.1% |

| AVA Risk Group (ASX:AVA) | 15.4% | 108.2% |

| Echo IQ (ASX:EIQ) | 19.8% | 65.9% |

| Image Resources (ASX:IMA) | 20.6% | 79.9% |

| Findi (ASX:FND) | 29.1% | 86.4% |

We'll examine a selection from our screener results.

Australian Ethical Investment (ASX:AEF)

Simply Wall St Growth Rating: ★★★★★☆

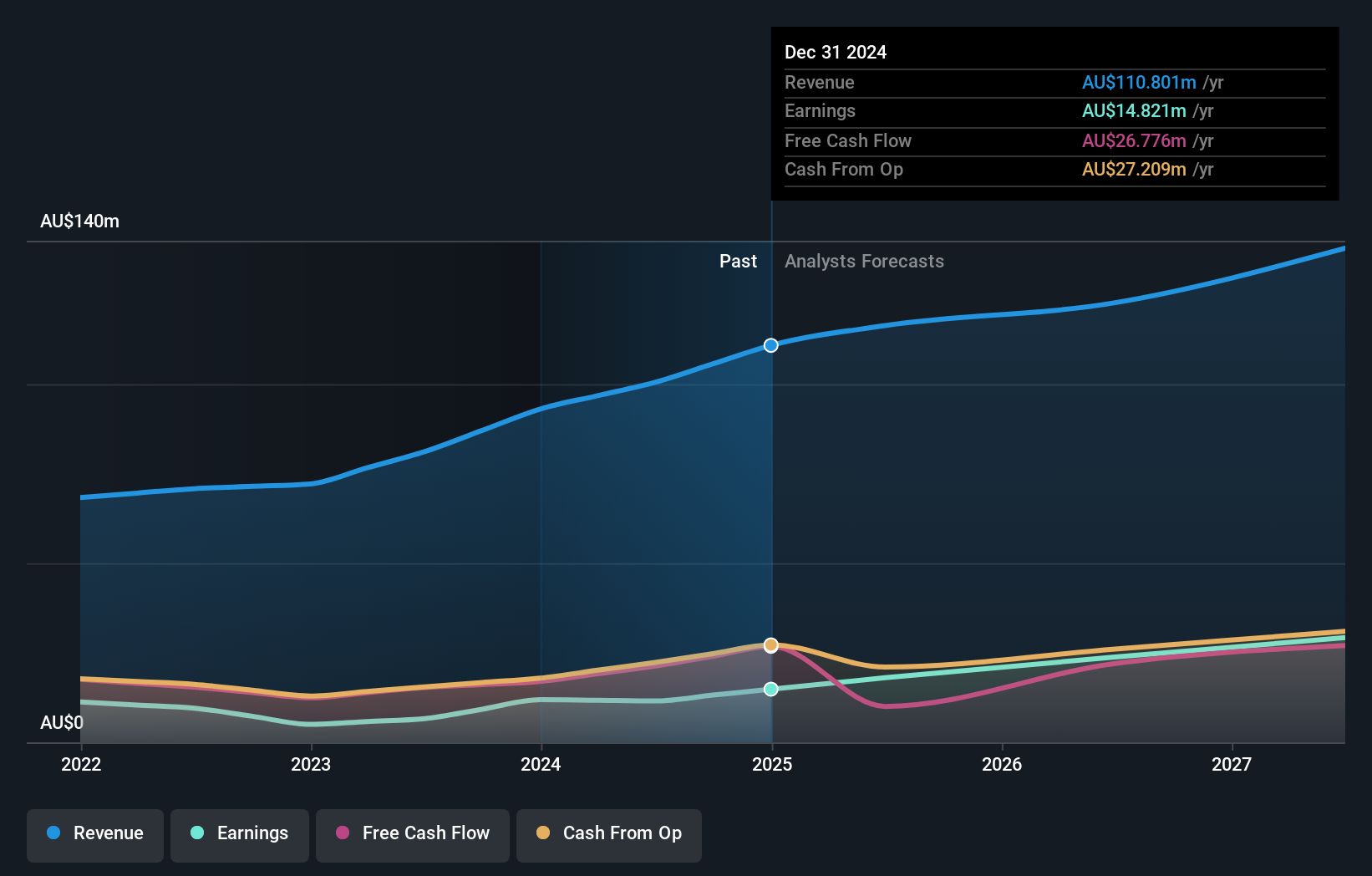

Overview: Australian Ethical Investment Ltd is a publicly owned investment manager with a market cap of A$705.47 million.

Operations: The company's revenue segment includes Funds Management, generating A$110.80 million.

Insider Ownership: 21.8%

Earnings Growth Forecast: 24% p.a.

Australian Ethical Investment exhibits strong growth potential with earnings forecasted to grow significantly at 24% annually, outpacing the Australian market. Despite a slower revenue growth rate of 9.7%, it remains above the market average. The company's Return on Equity is projected to be very high in three years, indicating efficient management and profitability prospects. While there are large one-off items affecting financial results, no substantial insider trading activity has been observed recently, suggesting stability in insider sentiment.

- Unlock comprehensive insights into our analysis of Australian Ethical Investment stock in this growth report.

- Our valuation report here indicates Australian Ethical Investment may be overvalued.

Emerald Resources (ASX:EMR)

Simply Wall St Growth Rating: ★★★★★★

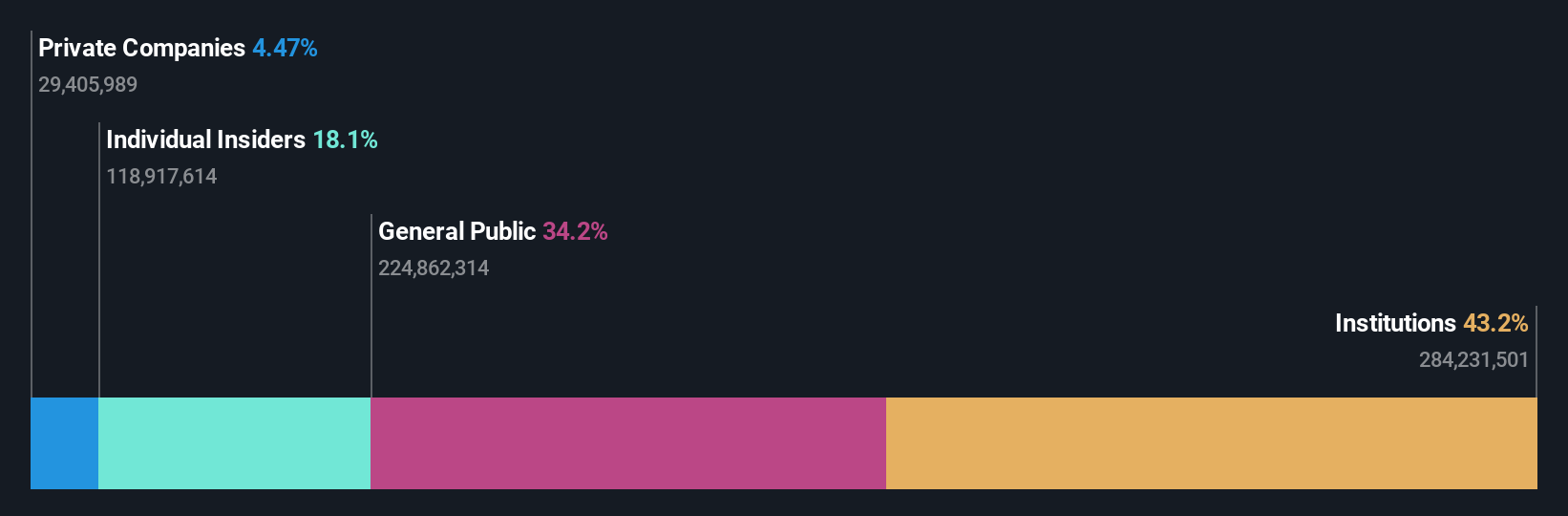

Overview: Emerald Resources NL is involved in the exploration and development of mineral reserves in Cambodia and Australia, with a market cap of A$3.21 billion.

Operations: The company's revenue primarily comes from its mine operations, which generated A$427.32 million.

Insider Ownership: 18.1%

Earnings Growth Forecast: 65.6% p.a.

Emerald Resources demonstrates robust growth prospects with earnings set to grow significantly at 65.6% annually, surpassing the Australian market. Revenue is also expected to increase rapidly at 42.3% per year, indicating strong operational momentum. The company trades at a substantial discount of 90.2% below its estimated fair value, suggesting potential undervaluation opportunities for investors. With no recent insider trading activity and high forecasted Return on Equity of 31.6%, Emerald Resources shows promising management efficiency and profitability potential.

- Get an in-depth perspective on Emerald Resources' performance by reading our analyst estimates report here.

- Our valuation report unveils the possibility Emerald Resources' shares may be trading at a discount.

Vulcan Steel (ASX:VSL)

Simply Wall St Growth Rating: ★★★★★☆

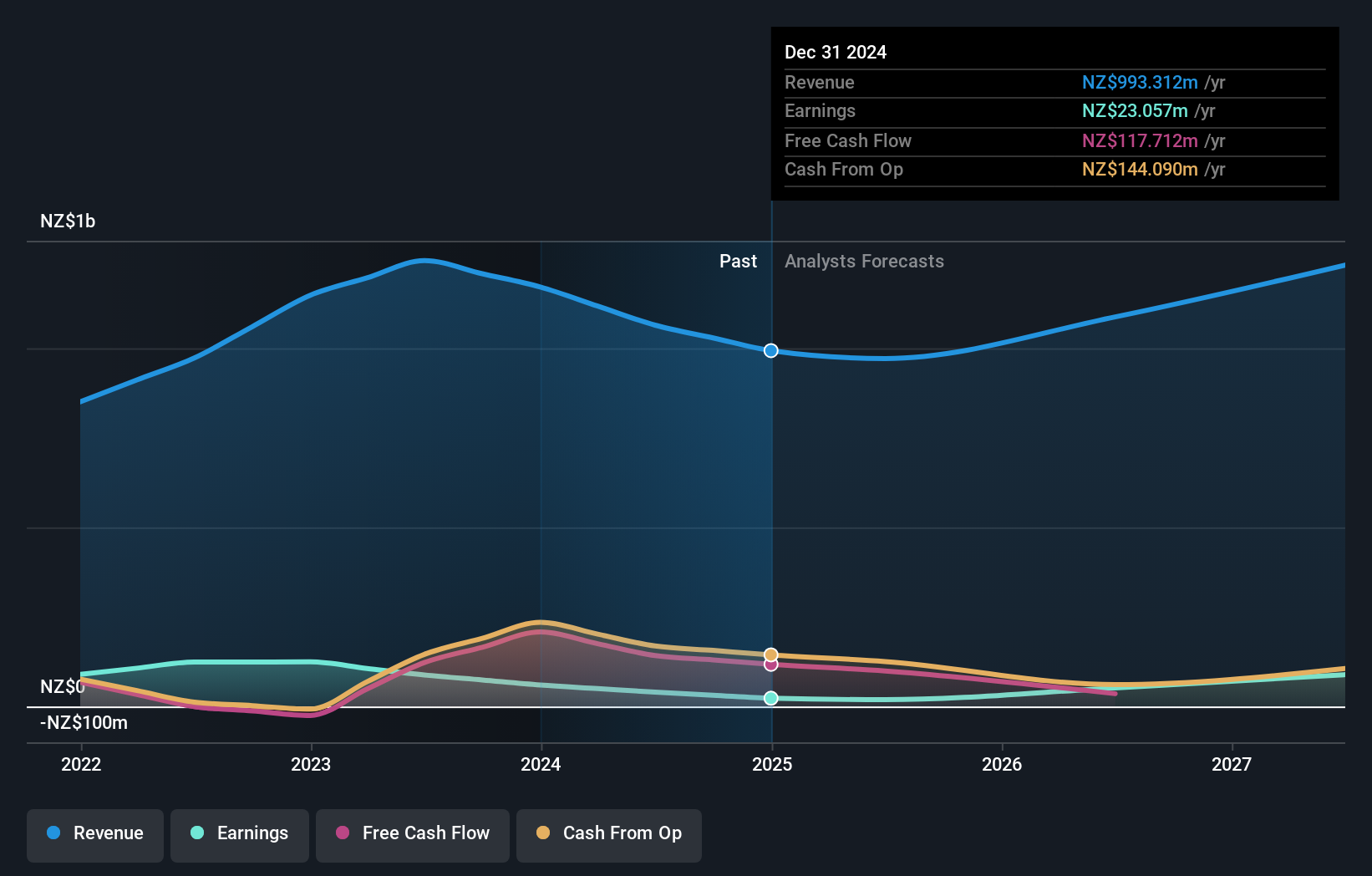

Overview: Vulcan Steel Limited, with a market cap of A$890.87 million, operates in New Zealand and Australia, focusing on the sale and distribution of steel and metal products through its subsidiaries.

Operations: The company's revenue segments consist of NZ$428.87 million from steel and NZ$564.44 million from metals, reflecting its core operations in New Zealand and Australia.

Insider Ownership: 38.4%

Earnings Growth Forecast: 37.8% p.a.

Vulcan Steel is positioned for strong growth, with earnings projected to increase significantly at 37.8% annually, outpacing the broader Australian market. Revenue is expected to grow at 8.7% per year, faster than the market average but below high-growth thresholds. Despite lower profit margins compared to last year and an unstable dividend history, Vulcan's forecasted Return on Equity of 33.4% indicates efficient management and profitability potential amidst interest in its distribution assets from prospective buyers like BlueScope Steel Limited.

- Click here and access our complete growth analysis report to understand the dynamics of Vulcan Steel.

- In light of our recent valuation report, it seems possible that Vulcan Steel is trading beyond its estimated value.

Key Takeaways

- Navigate through the entire inventory of 96 Fast Growing ASX Companies With High Insider Ownership here.

- Interested In Other Possibilities? Explore 22 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Emerald Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:EMR

Emerald Resources

Engages in the exploration and development of mineral reserves in Cambodia and Australia.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives