- Australia

- /

- Capital Markets

- /

- ASX:AEF

ASX Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

The Australian market recently experienced a slight dip, with the ASX200 closing down by 0.08% at 8,151 points, while sectors like Energy and Real Estate showed resilience with notable gains. In this fluctuating environment, growth companies with high insider ownership can be particularly appealing to investors seeking alignment of interests between management and shareholders, potentially offering stability amid market volatility.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Alfabs Australia (ASX:AAL) | 10.8% | 41.3% |

| Fenix Resources (ASX:FEX) | 21.1% | 53.4% |

| Cyclopharm (ASX:CYC) | 11.3% | 97.8% |

| Newfield Resources (ASX:NWF) | 31.5% | 72.1% |

| AVA Risk Group (ASX:AVA) | 15.4% | 108.2% |

| Brightstar Resources (ASX:BTR) | 11.6% | 105.2% |

| Echo IQ (ASX:EIQ) | 19.8% | 87.1% |

| Plenti Group (ASX:PLT) | 12.7% | 89.6% |

| Image Resources (ASX:IMA) | 16.1% | 79.9% |

| BETR Entertainment (ASX:BBT) | 38.6% | 121.8% |

Let's uncover some gems from our specialized screener.

Australian Ethical Investment (ASX:AEF)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Australian Ethical Investment Ltd is a publicly owned investment manager with a market cap of A$593.19 million.

Operations: The company generates revenue primarily from its Funds Management segment, amounting to A$110.80 million.

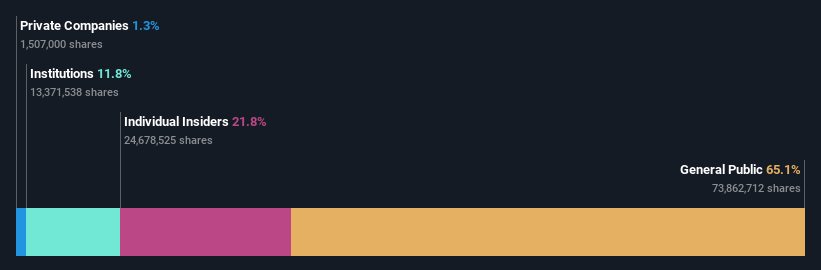

Insider Ownership: 21.8%

Australian Ethical Investment demonstrates strong growth potential with earnings projected to grow significantly at 24% annually, outpacing the broader Australian market. Its recent half-year results showed a substantial increase in net income to A$9.61 million from A$6.32 million year-on-year, despite revenue growth being moderate at 9.7% annually. The company's high forecasted return on equity of 56.6% further underscores its robust financial health, although insider trading activity remains limited over the past three months.

- Click here to discover the nuances of Australian Ethical Investment with our detailed analytical future growth report.

- According our valuation report, there's an indication that Australian Ethical Investment's share price might be on the expensive side.

Emerald Resources (ASX:EMR)

Simply Wall St Growth Rating: ★★★★★★

Overview: Emerald Resources NL focuses on the exploration and development of mineral reserves in Cambodia and Australia, with a market cap of A$2.86 billion.

Operations: The company's revenue primarily comes from Mine Operations, totaling A$427.32 million.

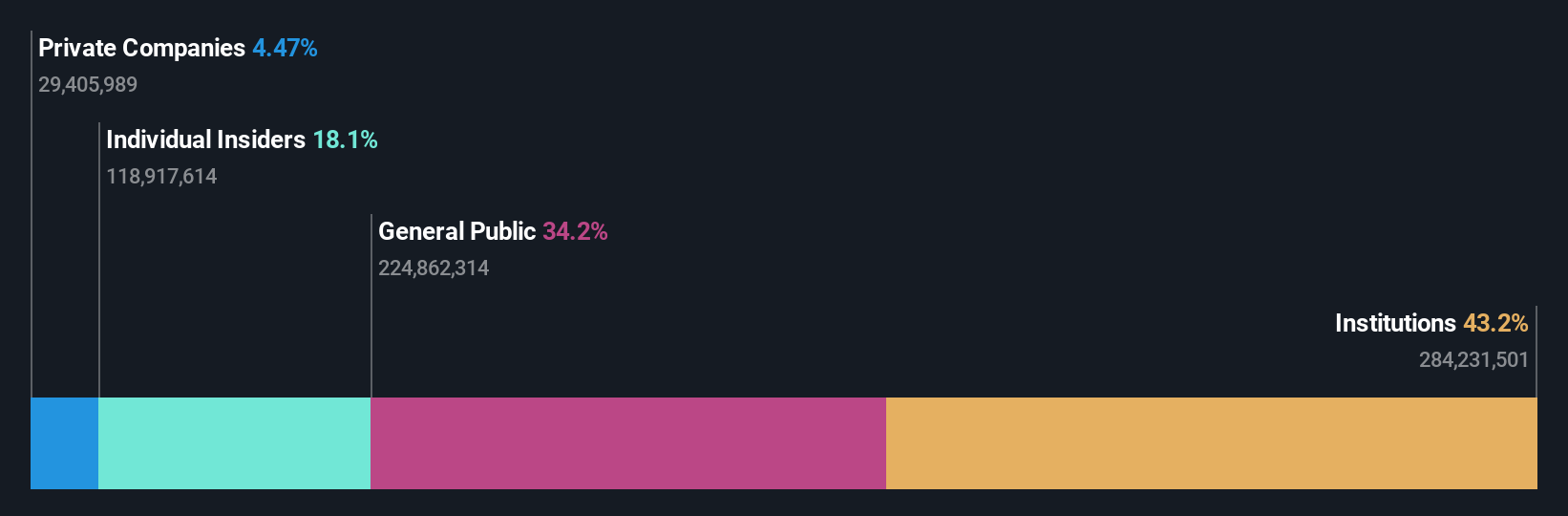

Insider Ownership: 18.1%

Emerald Resources shows strong growth potential, with earnings projected to grow significantly at 65.6% annually, surpassing the Australian market average. Recent half-year results highlight a notable increase in net income to A$59.67 million from A$43.31 million year-on-year, driven by sales growth to A$239.73 million from A$176.75 million a year ago. The company trades at 91% below its estimated fair value and boasts high forecasted return on equity of 31.6%.

- Navigate through the intricacies of Emerald Resources with our comprehensive analyst estimates report here.

- Upon reviewing our latest valuation report, Emerald Resources' share price might be too pessimistic.

Vulcan Steel (ASX:VSL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Vulcan Steel Limited, with a market cap of A$985.75 million, operates in New Zealand and Australia, focusing on the sale and distribution of steel and metal products through its subsidiaries.

Operations: The company's revenue segments consist of NZ$428.87 million from steel and NZ$564.44 million from metals.

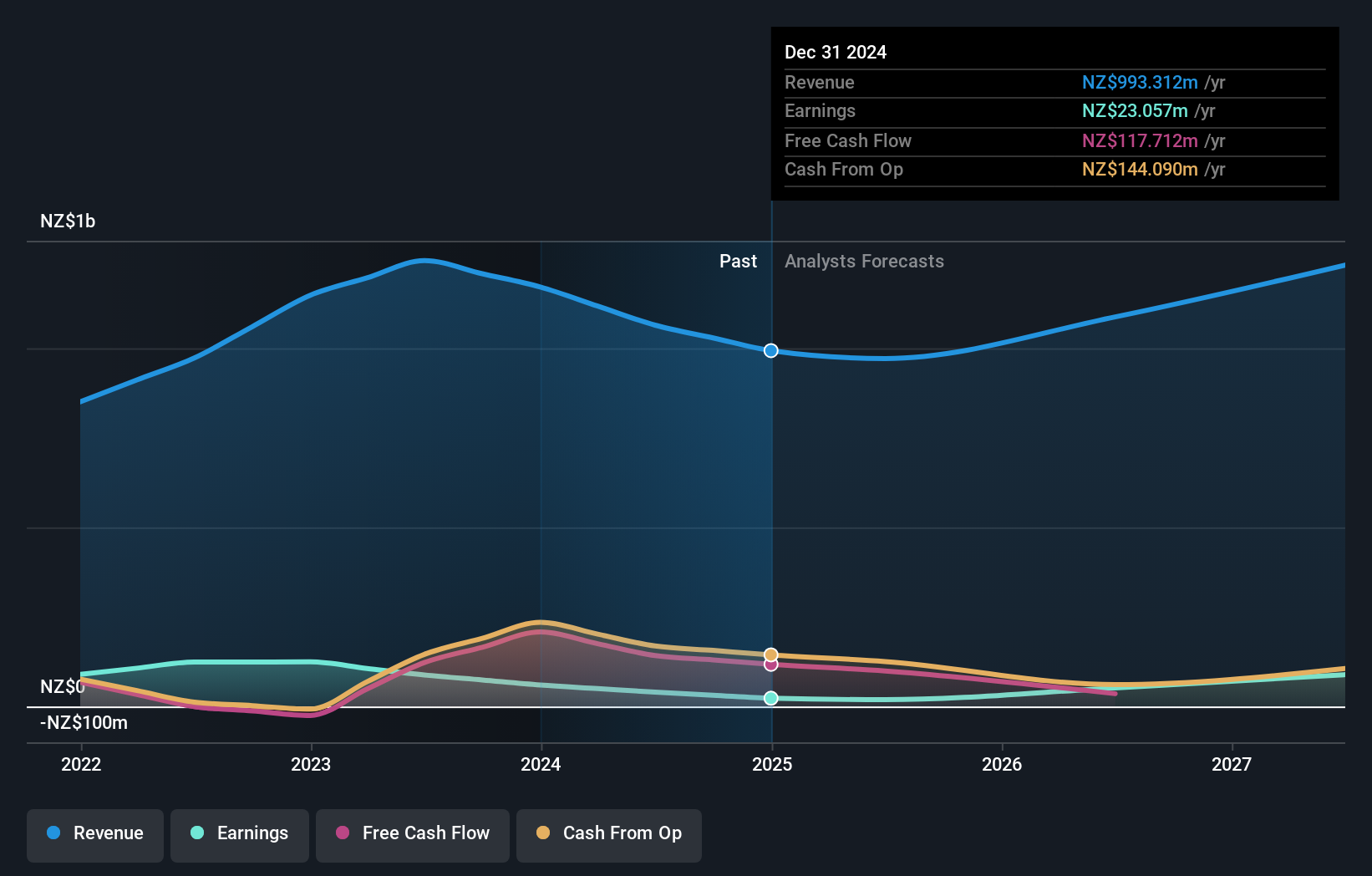

Insider Ownership: 38.4%

Vulcan Steel, with a substantial insider ownership, is poised for growth despite recent earnings declines. The company reported a decrease in net income to NZ$9.18 million from NZ$26.11 million year-on-year, but forecasts suggest significant annual profit growth of 37.8%, outpacing the Australian market average. While revenue growth is slower than desired at 8.7% annually, the company's strategic interest in acquisitions like InfraBuild's assets could enhance its distribution footprint and market position in Australia.

- Click here and access our complete growth analysis report to understand the dynamics of Vulcan Steel.

- The analysis detailed in our Vulcan Steel valuation report hints at an inflated share price compared to its estimated value.

Make It Happen

- Dive into all 95 of the Fast Growing ASX Companies With High Insider Ownership we have identified here.

- Interested In Other Possibilities? Outshine the giants: these 28 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:AEF

Australian Ethical Investment

Australian Ethical Investment Ltd is a publicly owned investment manager.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives