We can readily understand why investors are attracted to unprofitable companies. For example, EcoGraf (ASX:EGR) shareholders have done very well over the last year, with the share price soaring by 937%. But while the successes are well known, investors should not ignore the very many unprofitable companies that simply burn through all their cash and collapse.

So notwithstanding the buoyant share price, we think it's well worth asking whether EcoGraf's cash burn is too risky. In this article, we define cash burn as its annual (negative) free cash flow, which is the amount of money a company spends each year to fund its growth. First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

Check out our latest analysis for EcoGraf

Does EcoGraf Have A Long Cash Runway?

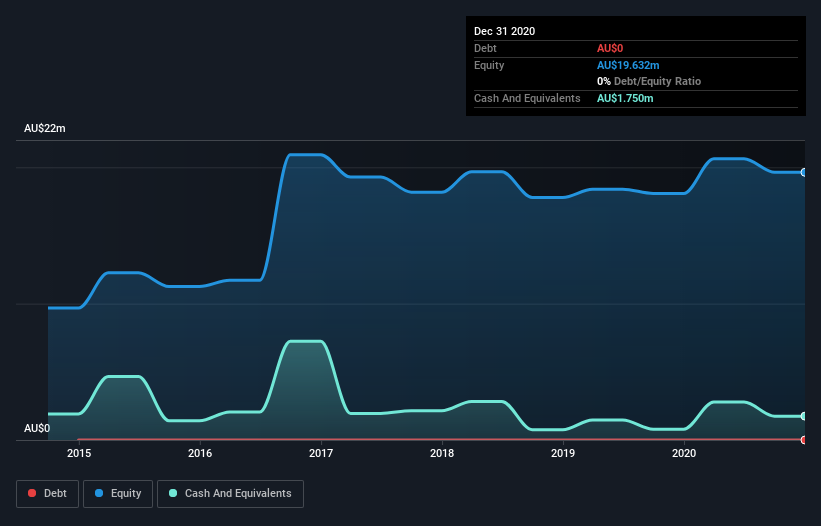

A company's cash runway is calculated by dividing its cash hoard by its cash burn. When EcoGraf last reported its balance sheet in December 2020, it had zero debt and cash worth AU$1.8m. In the last year, its cash burn was AU$2.7m. So it had a cash runway of approximately 8 months from December 2020. That's quite a short cash runway, indicating the company must either reduce its annual cash burn or replenish its cash. Depicted below, you can see how its cash holdings have changed over time.

How Is EcoGraf's Cash Burn Changing Over Time?

EcoGraf didn't record any revenue over the last year, indicating that it's an early stage company still developing its business. Nonetheless, we can still examine its cash burn trajectory as part of our assessment of its cash burn situation. As it happens, the company's cash burn reduced by 20% over the last year, which suggests that management may be mindful of the risks of their depleting cash reserves. Admittedly, we're a bit cautious of EcoGraf due to its lack of significant operating revenues. We prefer most of the stocks on this list of stocks that analysts expect to grow.

How Hard Would It Be For EcoGraf To Raise More Cash For Growth?

Even though it has reduced its cash burn recently, shareholders should still consider how easy it would be for EcoGraf to raise more cash in the future. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. Many companies end up issuing new shares to fund future growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

EcoGraf's cash burn of AU$2.7m is about 0.7% of its AU$382m market capitalisation. That means it could easily issue a few shares to fund more growth, and might well be in a position to borrow cheaply.

Is EcoGraf's Cash Burn A Worry?

On this analysis of EcoGraf's cash burn, we think its cash burn relative to its market cap was reassuring, while its cash runway has us a bit worried. Even though we don't think it has a problem with its cash burn, the analysis we've done in this article does suggest that shareholders should give some careful thought to the potential cost of raising more money in the future. An in-depth examination of risks revealed 4 warning signs for EcoGraf that readers should think about before committing capital to this stock.

Of course EcoGraf may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you decide to trade EcoGraf, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if EcoGraf might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:EGR

EcoGraf

Engages in the exploration and production of graphite products for the lithium-ion battery and advanced manufacturing markets in Tanzania and Australia.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026